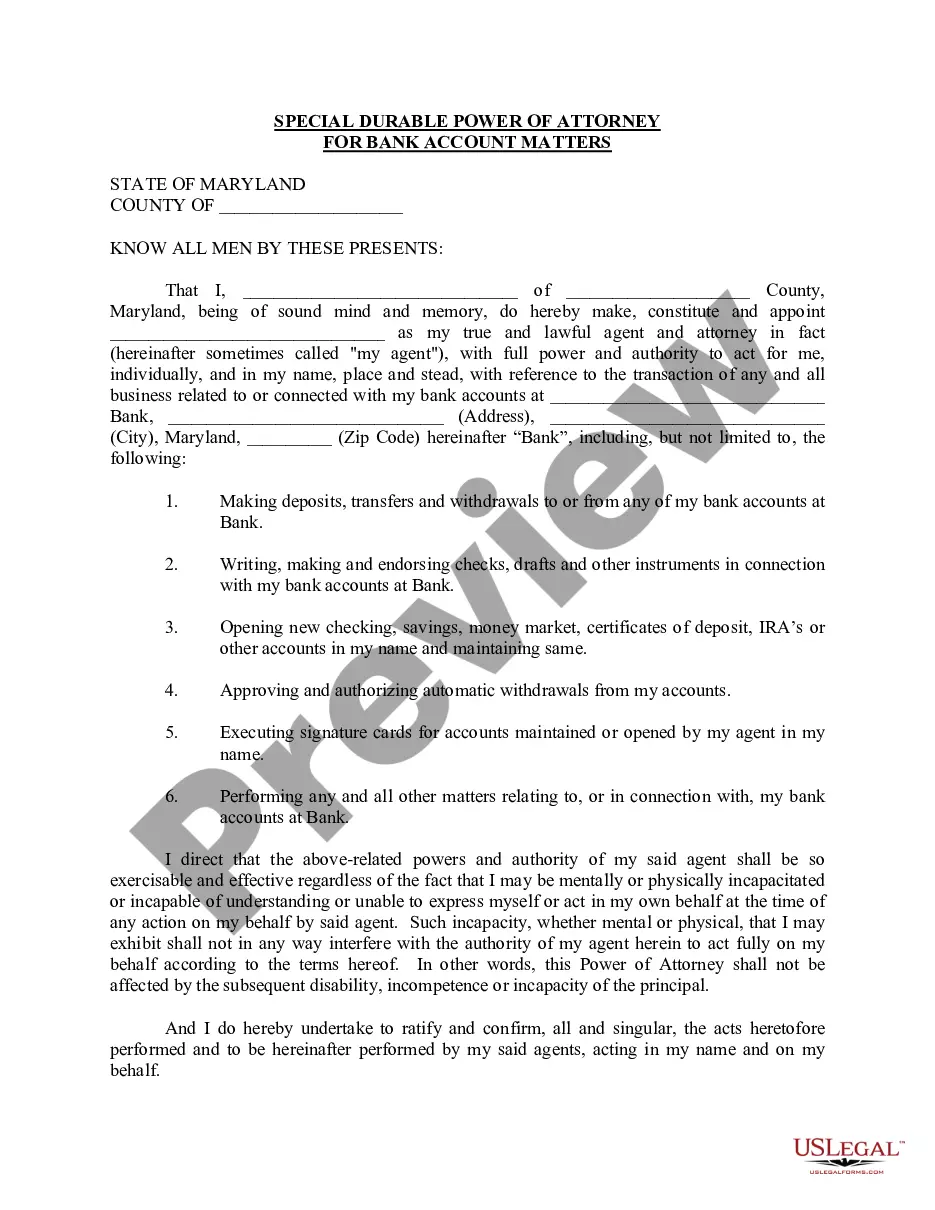

Maryland Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Maryland Special Durable Power Of Attorney For Bank Account Matters?

Greetings to the largest repository of legal documents, US Legal Forms. Here, you can locate any template, such as the Maryland Special Durable Power of Attorney for Bank Account Matters forms and download as many as you require.

Prepare legal documents in just a few hours, instead of days or weeks, without incurring exorbitant fees with a lawyer. Obtain the state-specific template in a few clicks and rest assured that it was prepared by our experienced attorneys.

If you’re already a registered user, simply Log In to your account and click Download beside the Maryland Special Durable Power of Attorney for Bank Account Matters you need. Since US Legal Forms is a web-based service, you’ll always be able to access your saved documents, regardless of the device you are using. Locate them in the My documents section.

Once you've finalized the Maryland Special Durable Power of Attorney for Bank Account Matters, submit it to your attorney for review. This is an additional step but an essential one to ensure you’re fully protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- If you do not yet possess an account, what are you waiting for? Check out our guidelines below to get started.

- If this is a specific state form, verify its relevance in your residing state.

- Review the description (if available) to ensure it’s the correct template.

- Explore additional content using the Preview feature.

- If the template meets your requirements, click Buy Now.

- To create an account, select a payment plan.

- Utilize a credit card or PayPal account for registration.

- Download the document in your desired format (Word or PDF).

- Print the document and complete it with your or your business's information.

Form popularity

FAQ

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

The Achilles heel of powers of attorney is that banks and other financial institutions sometimes refuse to honor them.When the power of attorney becomes necessary, it's often because the principal has become incapacitated.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

A power of attorney, or POA, is one of the most commonly used legal documents because of the numerous purposes a POA can serve.Banks, for example, are notorious for refusing to honor, or at least questioning, the authority of an Agent when presented with a power of attorney.

Choose an agent. Before you begin to fill out the form, you have some decisions to make. Decide on the type of authority. You can choose whether you want your POA to be broad or narrow. Identify the length of time the POA will be in effect. Fill out the form. Execute the document.

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.

Determine if one is needed. Under a few circumstances, a power of attorney isn't necessary. Identify an agent. Take a look at the standard forms. Notarize the written POA, keep it stored safely, and provide copies to important people. Review the POA periodically.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

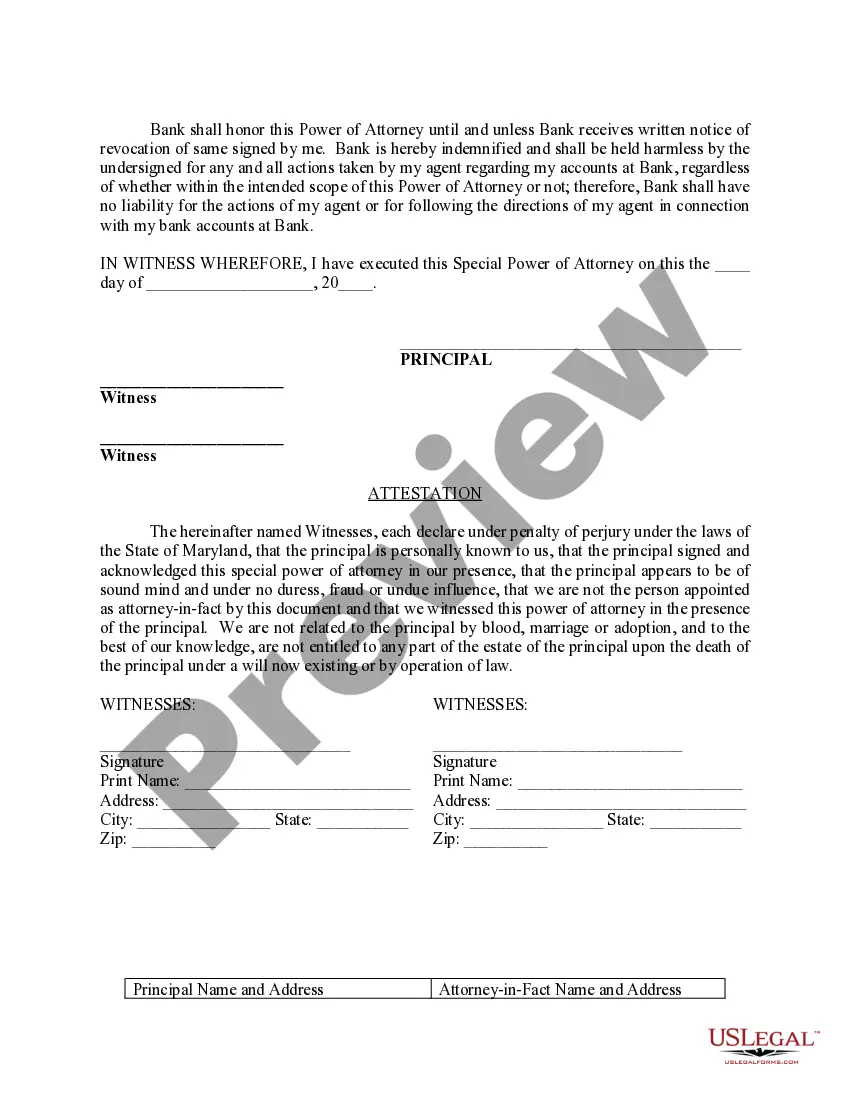

Contact the bank before having a financial power of attorney drafted by a lawyer. Send or deliver your previously drafted financial power of attorney document to the bank. Provide identification and a copy of the financial power of attorney to the bank teller when you ready to complete a transaction.