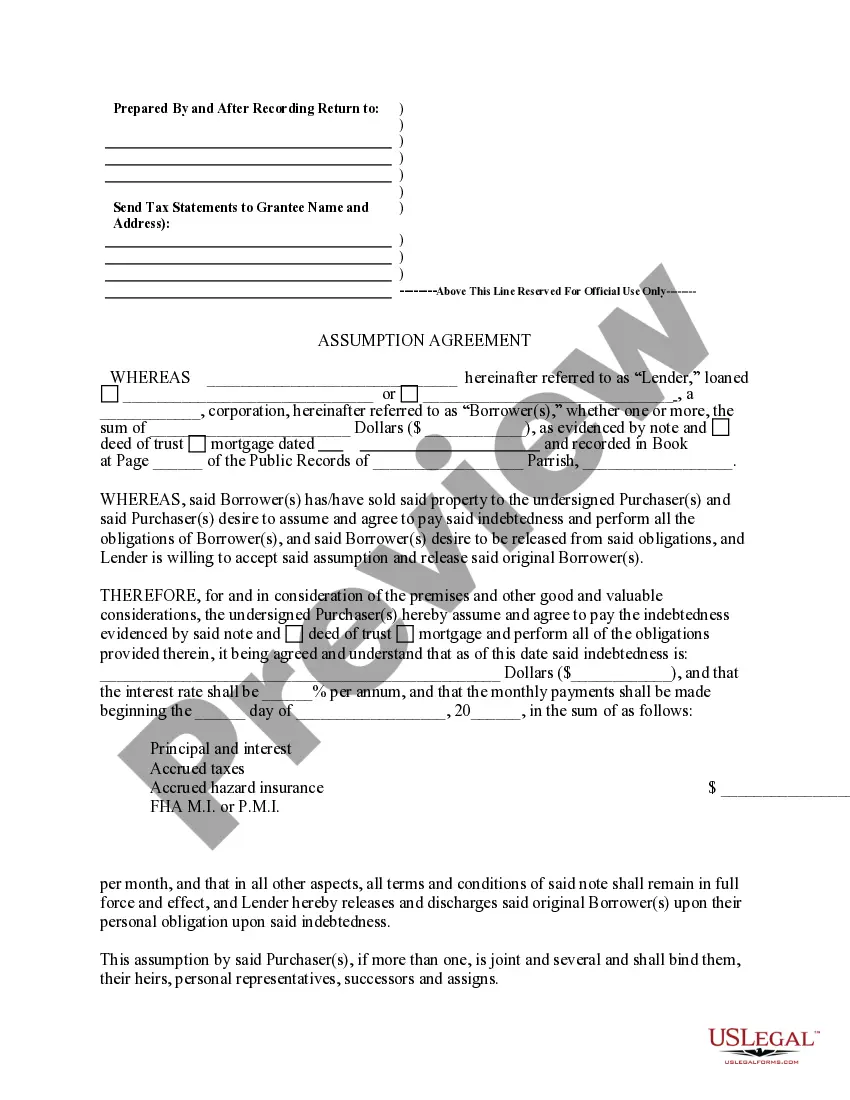

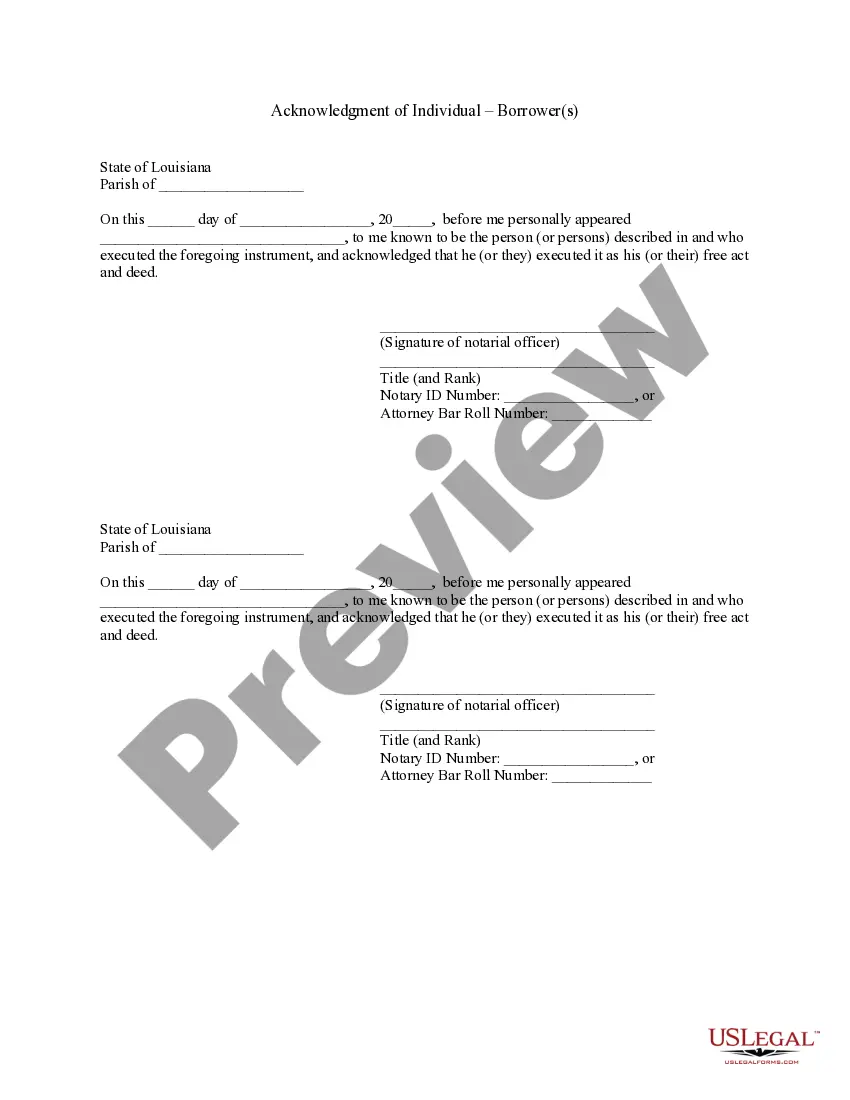

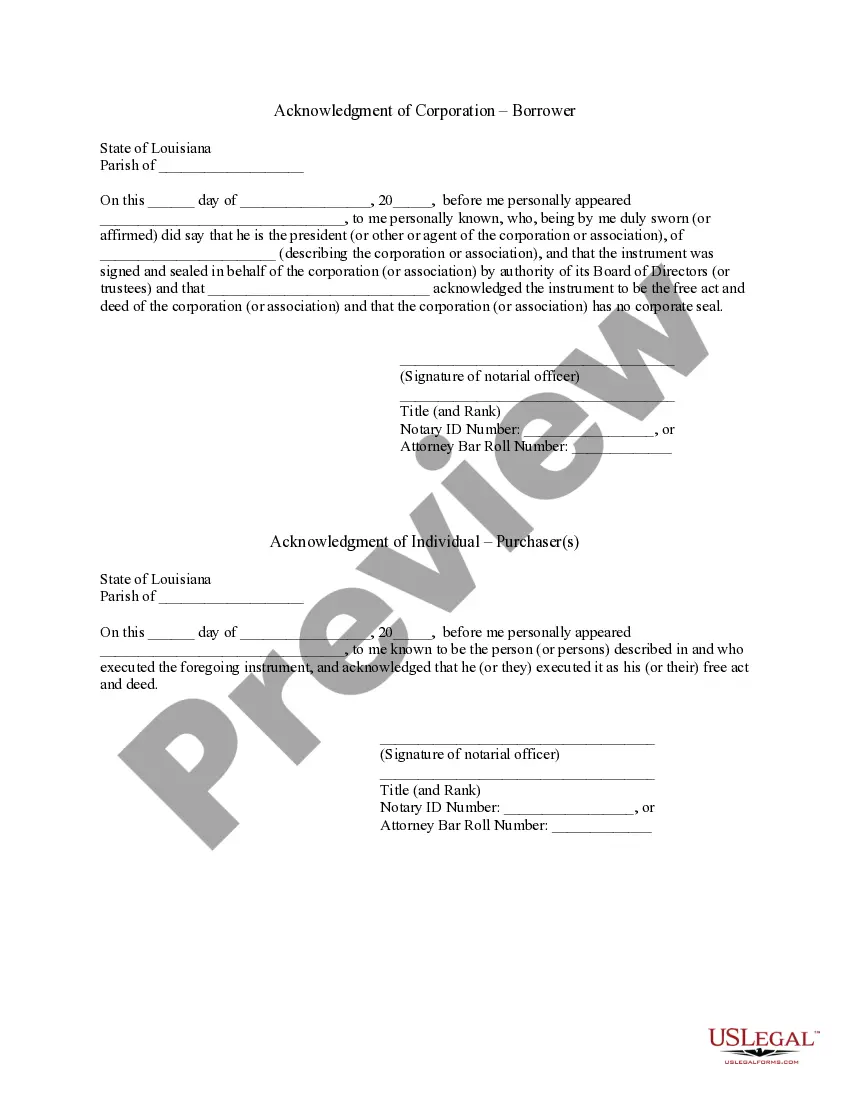

Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

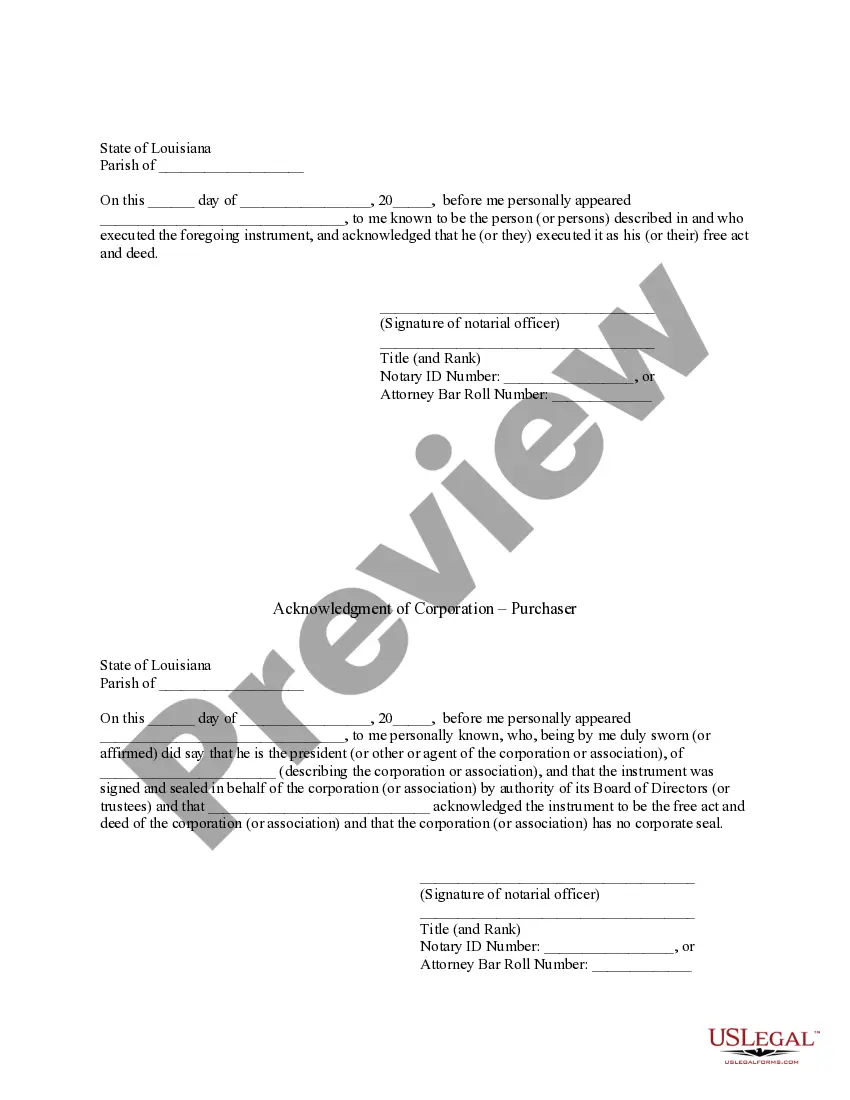

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Greetings to the finest repository of legal documents, US Legal Forms.

Here, you can obtain any template such as the Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors forms and preserve them (as many as you desire/require). Produce official documents in a few hours, instead of days or weeks, without expending a fortune on a lawyer or legal advisor.

Acquire your state-specific model with just a few clicks and be assured with the understanding that it was crafted by our experienced attorneys.

To create an account, choose a pricing plan. Use a credit card or PayPal account for registration. Save the template in your desired format (Word or PDF). Print the document and fill it in with your/your company’s information. Once you’ve finalized the Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors, forward it to your attorney for confirmation. It’s an extra step, but a crucial one to ensure you’re completely protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If you are already a subscribed client, just Log In to your profile and then hit Download next to the Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors you need.

- Given that US Legal Forms is an online service, you will always have access to your saved templates, regardless of the device you are using.

- Find them under the My documents section.

- If you do not have an account yet, what are you waiting for.

- Review our guidelines below to get started.

- If this is a jurisdiction-specific form, verify its validity in your state.

- Examine the description (if available) to ascertain if it’s the appropriate template.

- Explore additional content using the Preview feature.

- If the sample meets your requirements, simply select Buy Now.

Form popularity

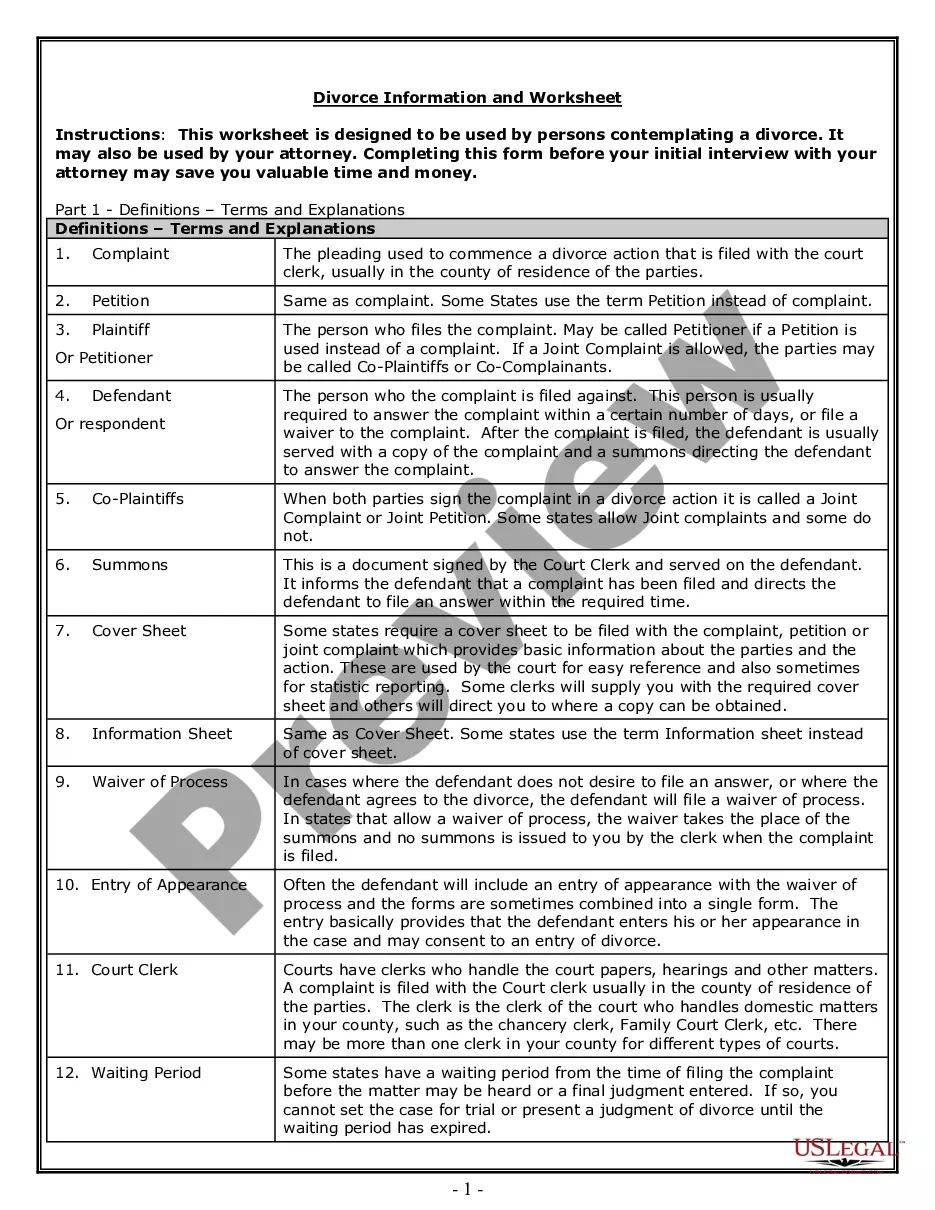

FAQ

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.

The contractual agreement for repaying the property loan includes the interest that the borrower has to pay per month in addition to the principal repayments to the lender.Therefore, an assumable mortgage during this period is likely to have a lower interest rate reflecting the current state of the economy.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.