Louisiana Bond for Deed - Contract for Deed

What this document covers

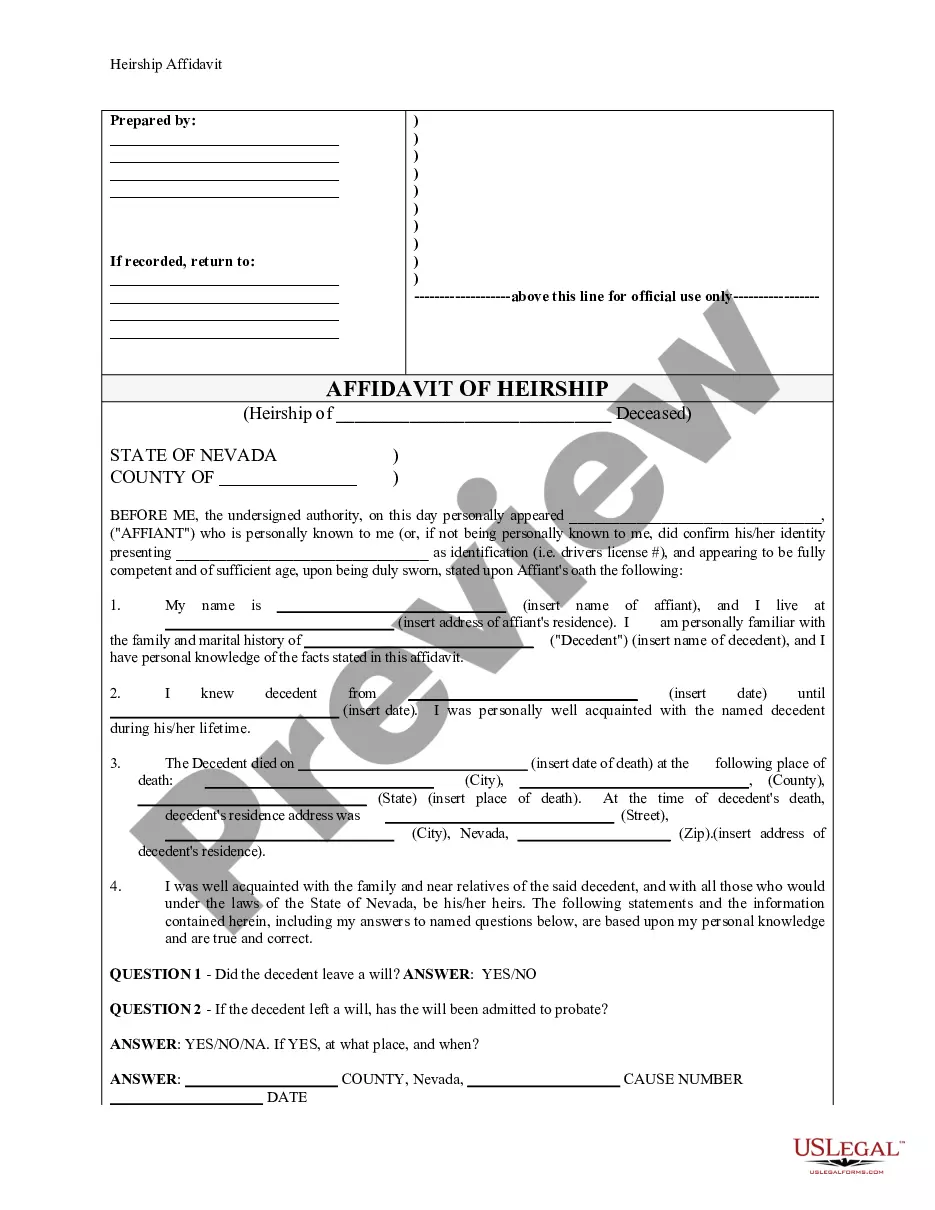

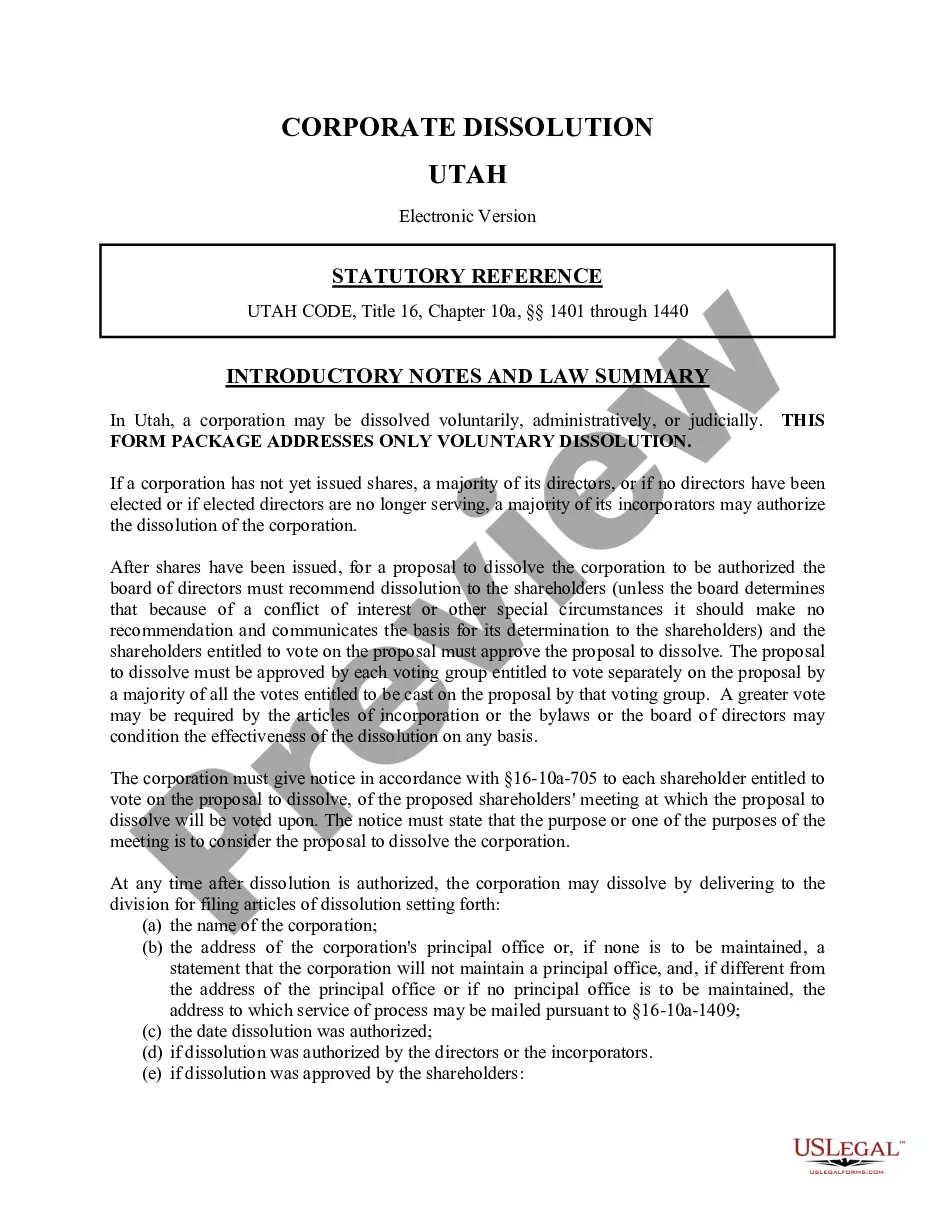

A Bond for Deed, also known as a Contract for Deed, is a legal agreement that facilitates owner financing for purchasing real property. In this arrangement, the Seller retains title to the property until the Buyer pays the agreed amount. Once payment is completed, the Seller then transfers ownership of the property to the Buyer. This form is particularly useful for buyers who may not qualify for traditional financing, as it allows them to pay for their property through installments directly to the Seller.

Form components explained

- Identification of the Seller and Purchaser

- Property description and stipulations regarding the title

- Terms of sale, including the total purchase price and payment structure

- Clauses on acceleration of payment and warranty against liens

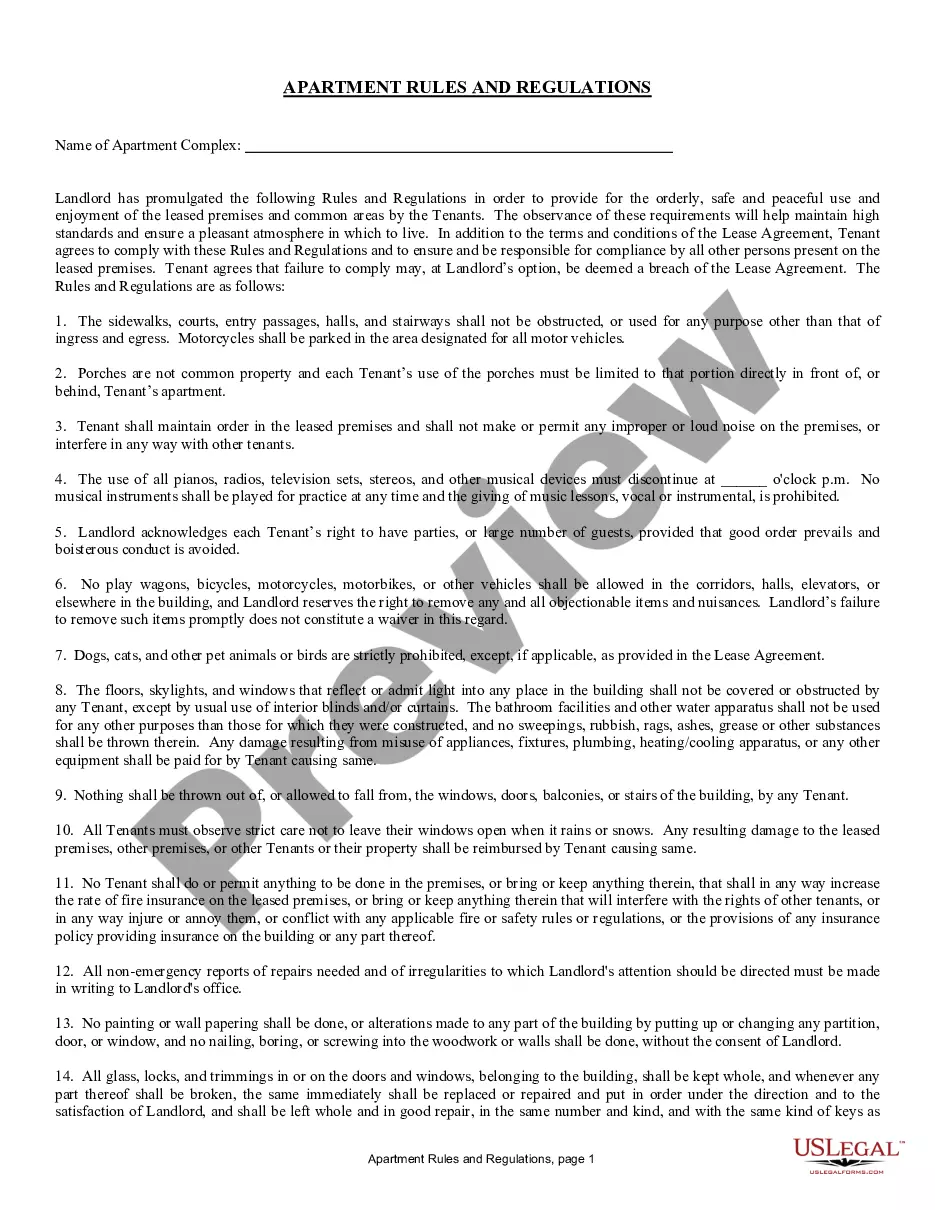

- Conditions regarding taxes, insurance, and property maintenance

- Provisions for default and potential forfeiture of payments

When to use this form

This form is needed when a Seller and Purchaser agree to a financing arrangement that does not involve a bank or traditional mortgage. Use it when a buyer wishes to purchase property solely through payments to the seller, especially when they may face challenges obtaining conventional financing. This form outlines both parties' rights and obligations until the purchase price is fully paid.

Who this form is for

This form is suitable for:

- Individuals looking to buy real estate without bank financing

- Property owners who want to offer financing directly

- Parties interested in an alternative method of property transfer

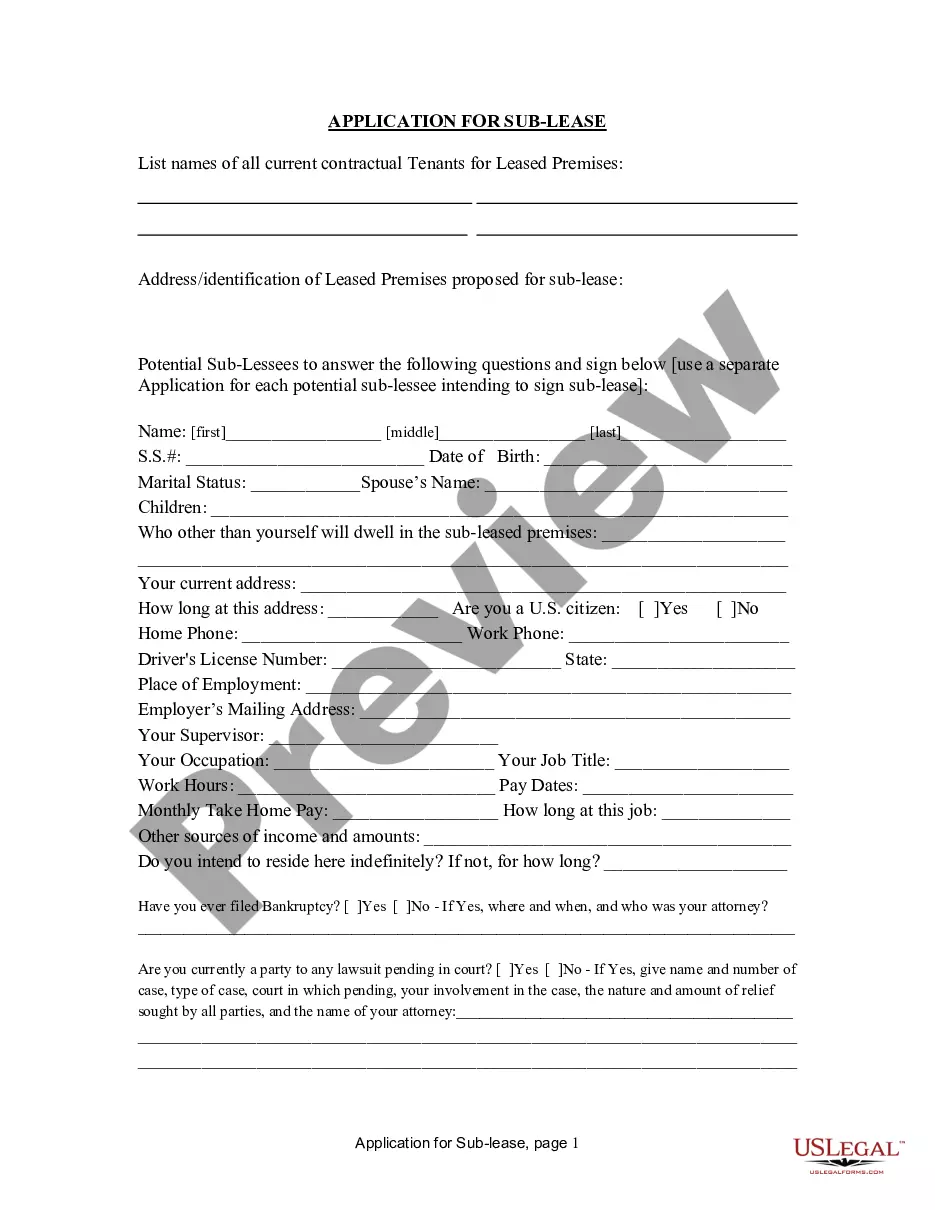

How to complete this form

- Identify and provide the names of both the Seller and Purchaser.

- Clearly describe the property being sold, including any improvements.

- Specify the total purchase price and payment terms, including interest rates.

- Include any details related to taxes and insurance to be assumed by the Purchaser.

- Ensure both parties sign and date the document in the presence of a notary public.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to complete all payment terms and clarity in the installment plan.

- Not accurately describing the property and its legal boundaries.

- Omitting any clauses related to eviction and default procedures.

- Neglecting to have the document notarized when required.

- Not keeping a copy of the signed contract for both parties' records.

Benefits of using this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows customization to fit specific transaction needs.

- Reliability of legally vetted templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

Bond for title represents an agreement that the funds associated with the closing of the real estate sale are not misused or stolen. The bond for title method can help people become homeowners. Sellers who allow a bond for title are protected since they maintain deed and title to the property.

Bond for Deed - a contract to sell real property, in which the purchase price is to be paid by the buyer to the seller in installments and in which the seller, after payment of a stipulated sum, agrees to deliver title to the buyer.Real Property - immovable property located in Louisiana.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

Bond for deed" defined. A bond for deed is a contract to sell real property, in which the purchase price is to be paid by the buyer to the seller in installments and in which the seller after payment of a stipulated sum agrees to deliver title to the buyer.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.