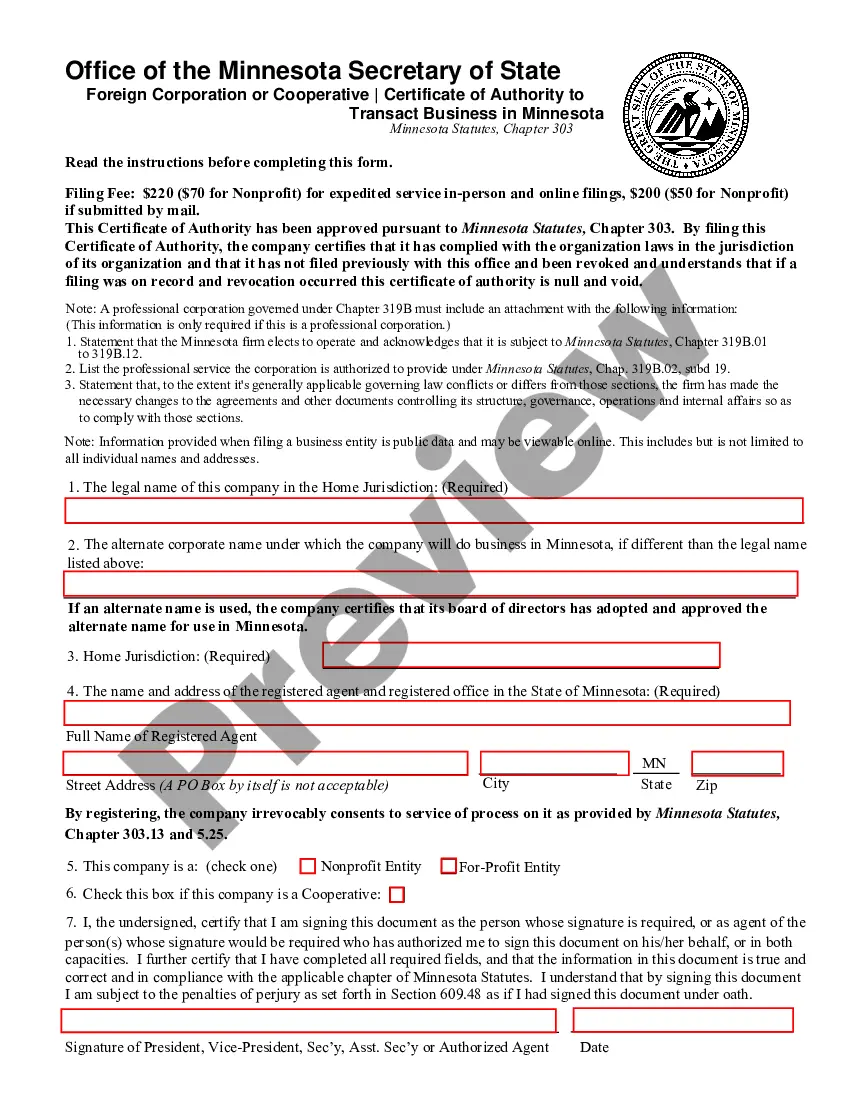

Withdrawal from Minnesota (Foreign Corp) is the process of a foreign corporation ceasing to do business in the state of Minnesota. It involves the filing of paperwork with the Minnesota Secretary of State and the payment of applicable taxes. Different types of Withdrawal from Minnesota (Foreign Corp) include: voluntary withdrawal, involuntary withdrawal, and administrative dissolution. Voluntary withdrawal involves the foreign corporation filing a Certificate of Withdrawal with the Secretary of State and paying any applicable taxes. Involuntary withdrawal occurs when the Secretary of State dissolves the foreign corporation due to failure to comply with state law or due to a court ruling. Administrative dissolution occurs when the Secretary of State dissolves the foreign corporation due to failure to file the required reports or pay the necessary fees. In all of these cases, the foreign corporation must also file a Final Report with the Secretary of State, and pay any applicable taxes.

Withdrawal from Minnesota (Foreign Corp)

Description

How to fill out Withdrawal From Minnesota (Foreign Corp)?

How much time and resources do you frequently utilize on preparing official documents.

There’s a better way to obtain such forms than hiring legal professionals or squandering hours searching the internet for a suitable template. US Legal Forms is the leading online repository that offers expertly drafted and validated state-specific legal documents for any purpose, such as the Withdrawal from Minnesota (Foreign Corp).

Another benefit of our library is that you can access previously acquired documents that you securely store in your profile in the My documents tab. Retrieve them at any time and re-complete your paperwork as often as you need.

Conserve time and effort filling out official documents with US Legal Forms, one of the most reliable online solutions. Register with us today!

- Review the form content to ensure it complies with your state regulations. To do this, read the form description or utilize the Preview option.

- If your legal template doesn’t satisfy your requirements, find an alternative using the search tab at the top of the page.

- If you already possess an account with us, Log In and download the Withdrawal from Minnesota (Foreign Corp). Otherwise, continue to the next steps.

- Click Buy now once you discover the correct template. Choose the subscription plan that fits you best to access our library’s full offerings.

- Create an account and pay for your subscription. You can make a payment using your credit card or through PayPal - our service is entirely secure for that.

- Download your Withdrawal from Minnesota (Foreign Corp) onto your device and complete it on a printed hard copy or electronically.

Form popularity

FAQ

Dissolving a foreign corporation in New York requires you to file a Certificate of Withdrawal with the New York Department of State. This document must include information about the corporation and a statement confirming that the company has settled all debts. Completing the Withdrawal from Minnesota (Foreign Corp) can be straightforward with the right resources, such as US Legal Forms, which offers templates and support to help you navigate this process smoothly.

To dissolve your business in Minnesota, you must file the appropriate dissolution documents with the Minnesota Secretary of State. This process includes submitting a Certificate of Dissolution and paying the required fees. Additionally, ensure you settle all outstanding debts and obligations before initiating the Withdrawal from Minnesota (Foreign Corp). Using a platform like US Legal Forms can simplify this process by providing the necessary forms and guidance.

In Minnesota, the length of time you have to cancel a contract varies based on the type of contract. For most consumer contracts, you typically have three days to cancel, known as the 'right of rescission.' However, certain contracts may have different stipulations, so it's essential to review the specific terms. If you need assistance navigating these regulations, consider using US Legal Forms to access templates and guides tailored to your needs.

To register a foreign corporation in Minnesota, you must file an application with the Minnesota Secretary of State. This application includes information about your corporation such as its name, the state of incorporation, and the principal office address. Additionally, you need to provide a certificate of good standing from your home state. Once your application is approved, you can operate as a foreign corporation in Minnesota, ensuring compliance with all state regulations.

Rule of Practice 105 in Minnesota pertains to the procedures for the dissolution of a corporation, including the requirements for notice and the filing process. This rule is designed to ensure transparency and compliance during the dissolution process. If you are navigating a withdrawal from Minnesota (Foreign Corp), it is beneficial to familiarize yourself with Rule 105 to ensure all legal obligations are met efficiently.

In Minnesota, the statute of limitations for state taxes generally spans three years from the date you filed your return. However, if you did not file a return or underreported your income, the statute can extend to six years or more in some cases. Understanding the statute of limitations is crucial, especially when considering a withdrawal from Minnesota (Foreign Corp), as it impacts your tax-related decisions and responsibilities.

To dissolve a corporation in Minnesota, you must file the appropriate paperwork with the Secretary of State, including a Resolution to Dissolve. After filing the necessary forms, you need to settle any outstanding debts, notify creditors, and distribute the remaining assets. If you’re planning a withdrawal from Minnesota (Foreign Corp), following these steps correctly will ensure a smooth and compliant dissolution process.

Yes, Minnesota does tax foreign income, but it depends on various factors including residency status and the nature of the income. If you are a foreign corporation operating in Minnesota, you may be subject to Minnesota taxes on income sourced from within the state. Therefore, when considering a withdrawal from Minnesota (Foreign Corp), it is essential to understand your tax obligations to avoid unexpected liabilities.