Minnesota Registration of Foreign Corporation

Description

How to fill out Minnesota Registration Of Foreign Corporation?

Obtain any variation from 85,000 legal documents like the Minnesota Registration of Foreign Corporation online with US Legal Forms. Each template is crafted and revised by state-licensed attorneys.

If you already possess a subscription, Log In. Once you’re on the form’s page, hit the Download button and navigate to My documents to access it.

If you have not subscribed yet, adhere to the guidelines below.

With US Legal Forms, you will always have immediate access to the correct downloadable sample. The platform provides access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Registration of Foreign Corporation quickly and effortlessly.

- Verify the state-specific criteria for the Minnesota Registration of Foreign Corporation you wish to utilize.

- Browse through the description and preview the example.

- When you are confident the example meets your needs, simply click Buy Now.

- Select a subscription plan that truly accommodates your budget.

- Establish a personal account.

- Make the payment using either of the two suitable methods: by credit card or through PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable form is downloaded, print it or save it to your device.

Form popularity

FAQ

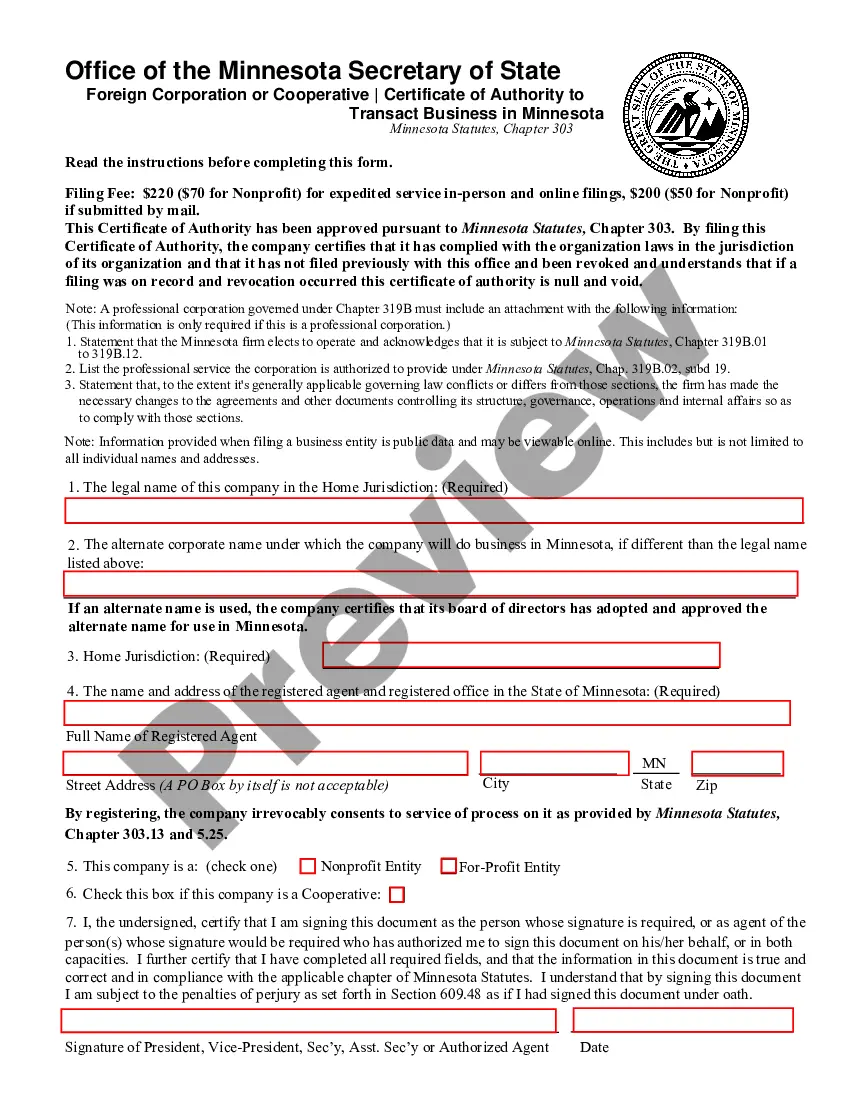

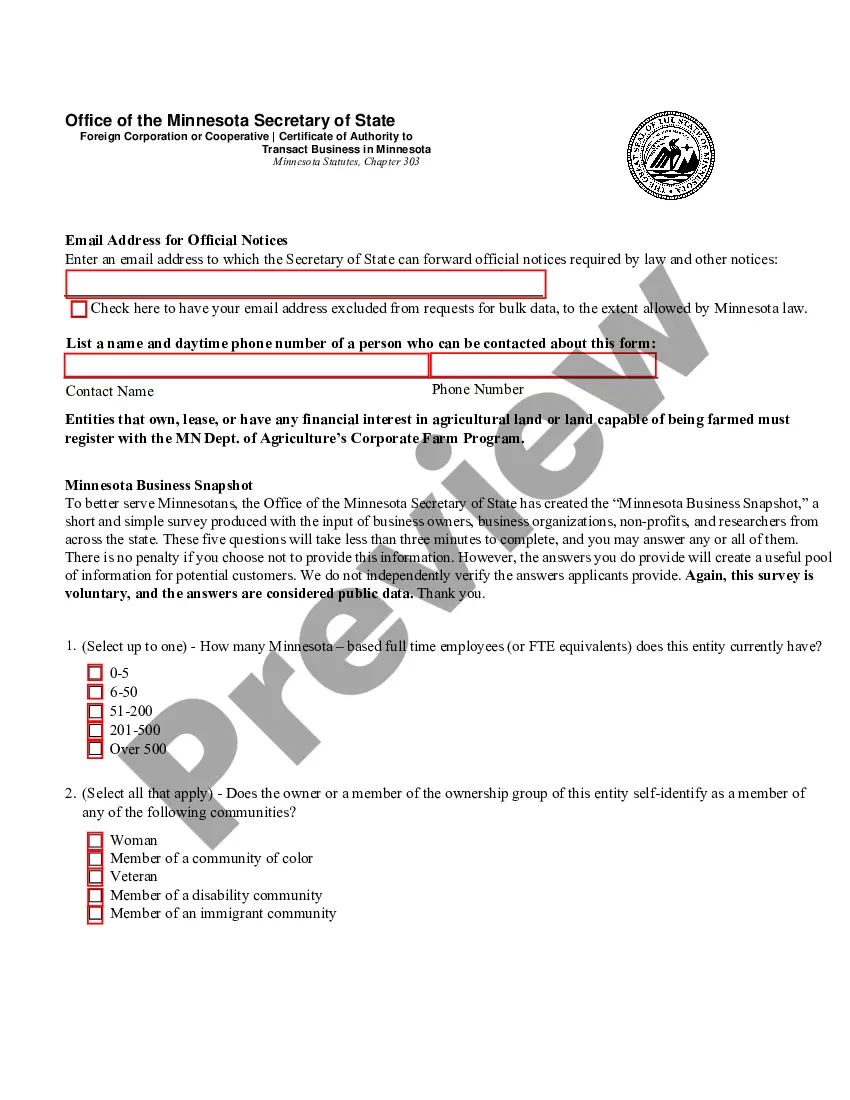

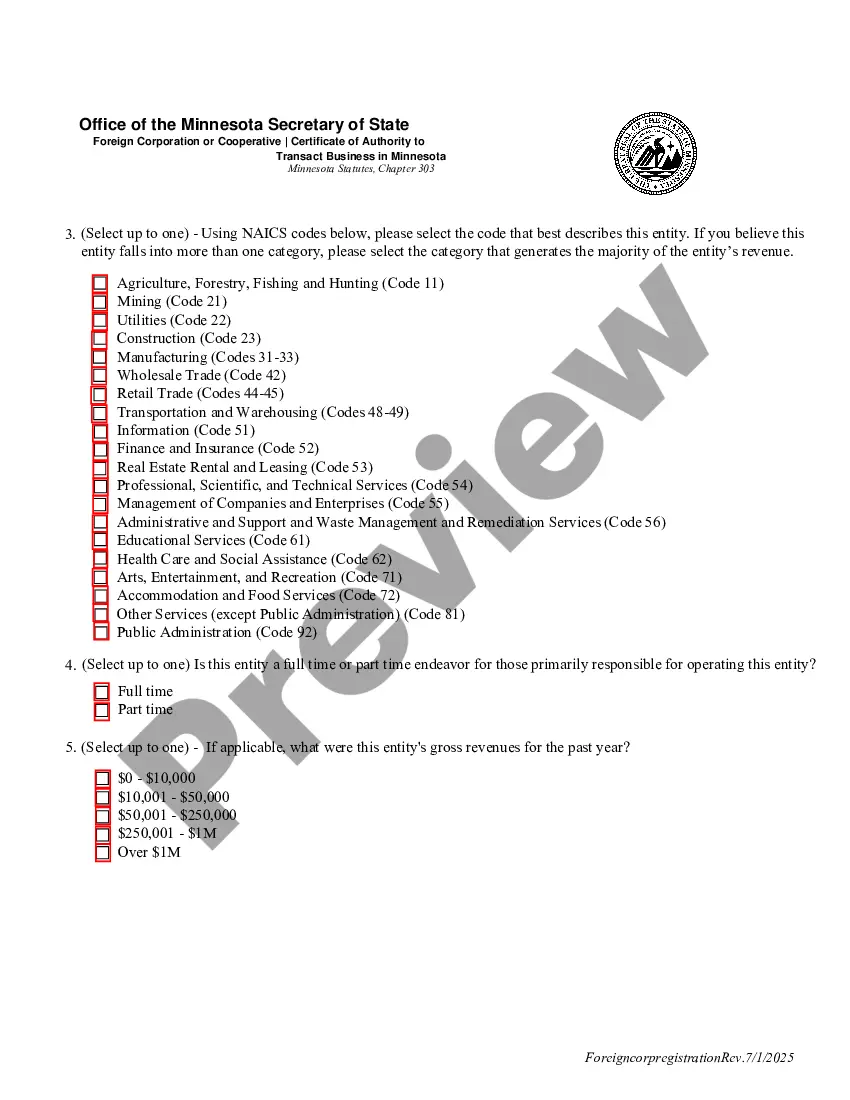

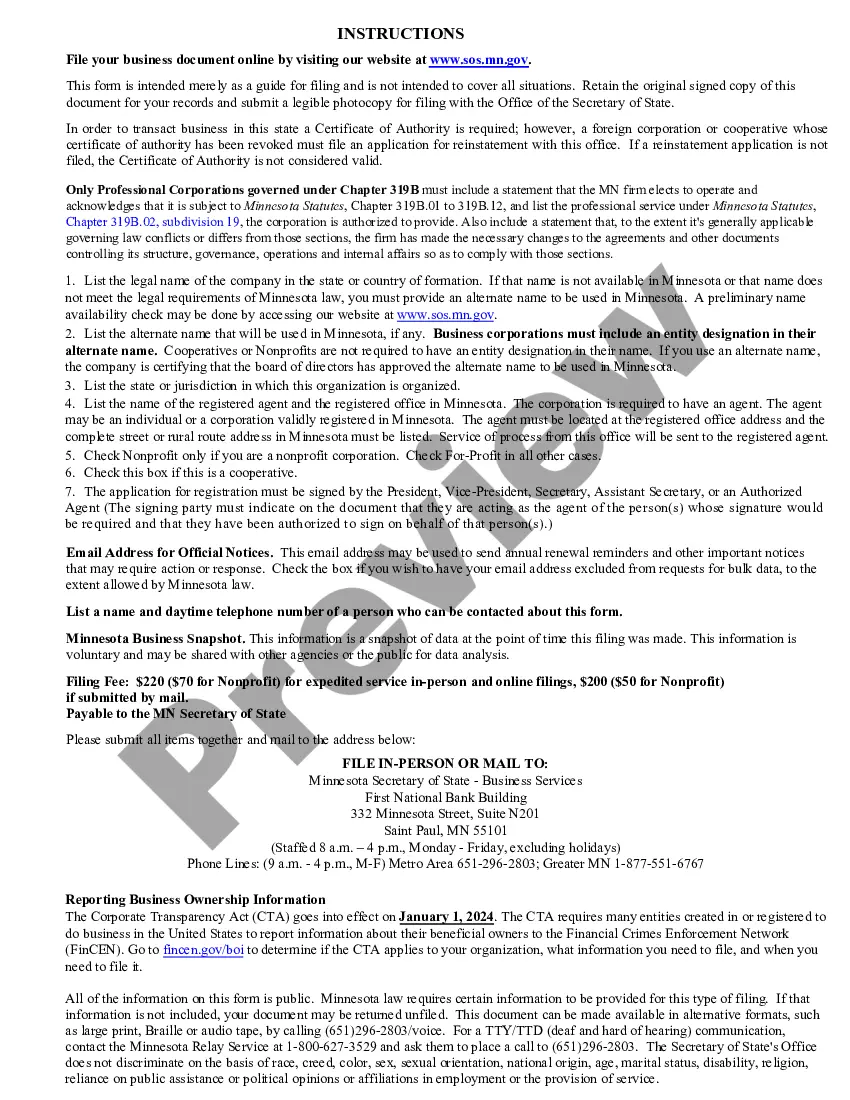

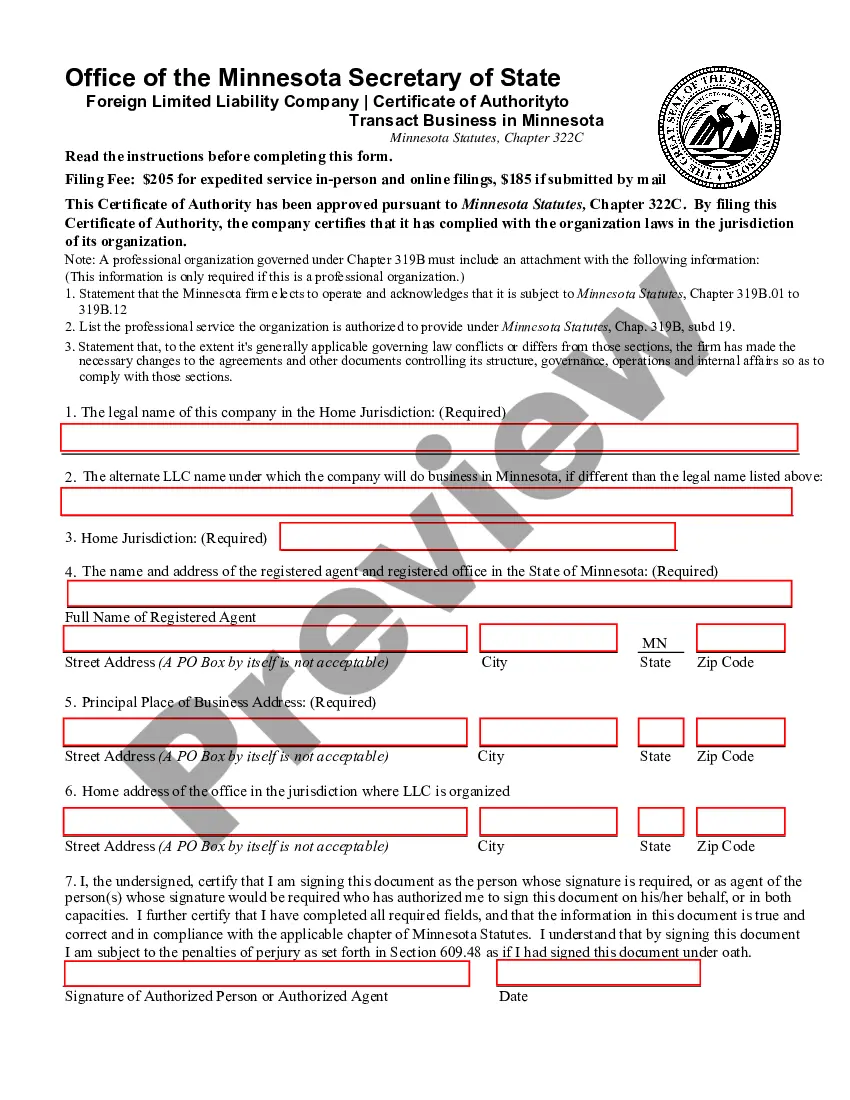

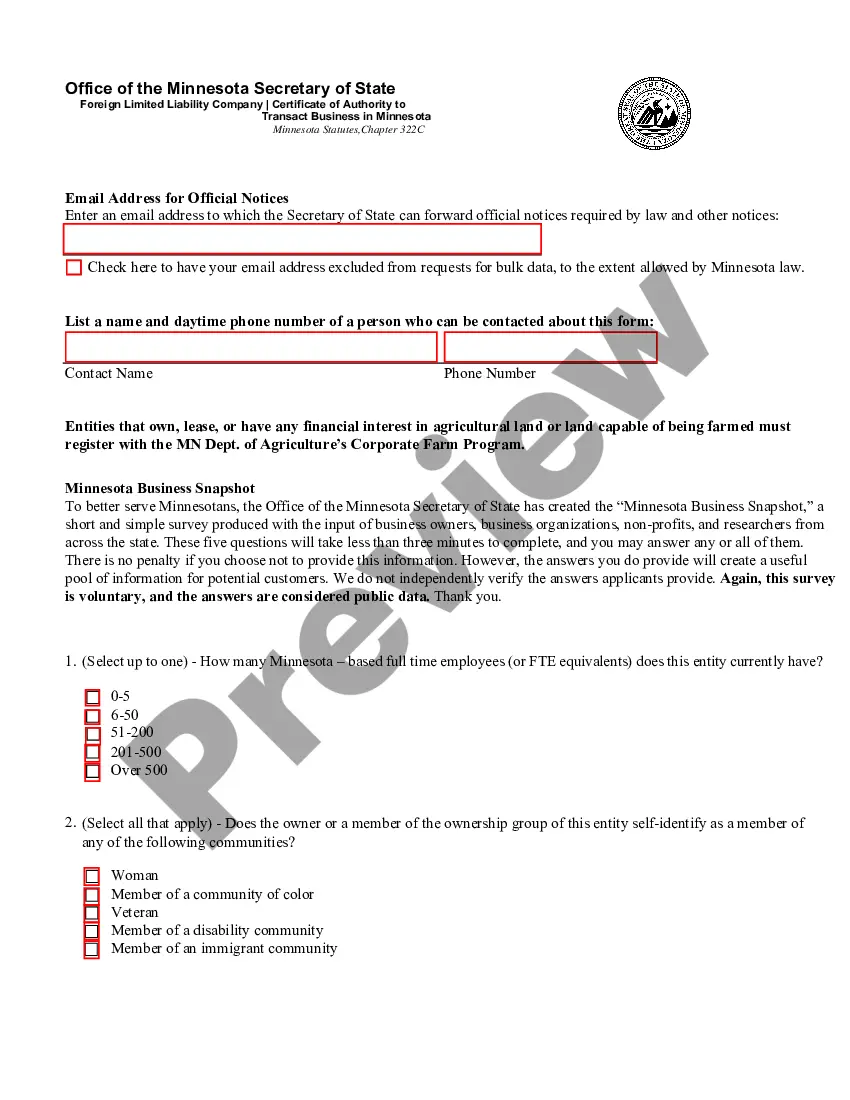

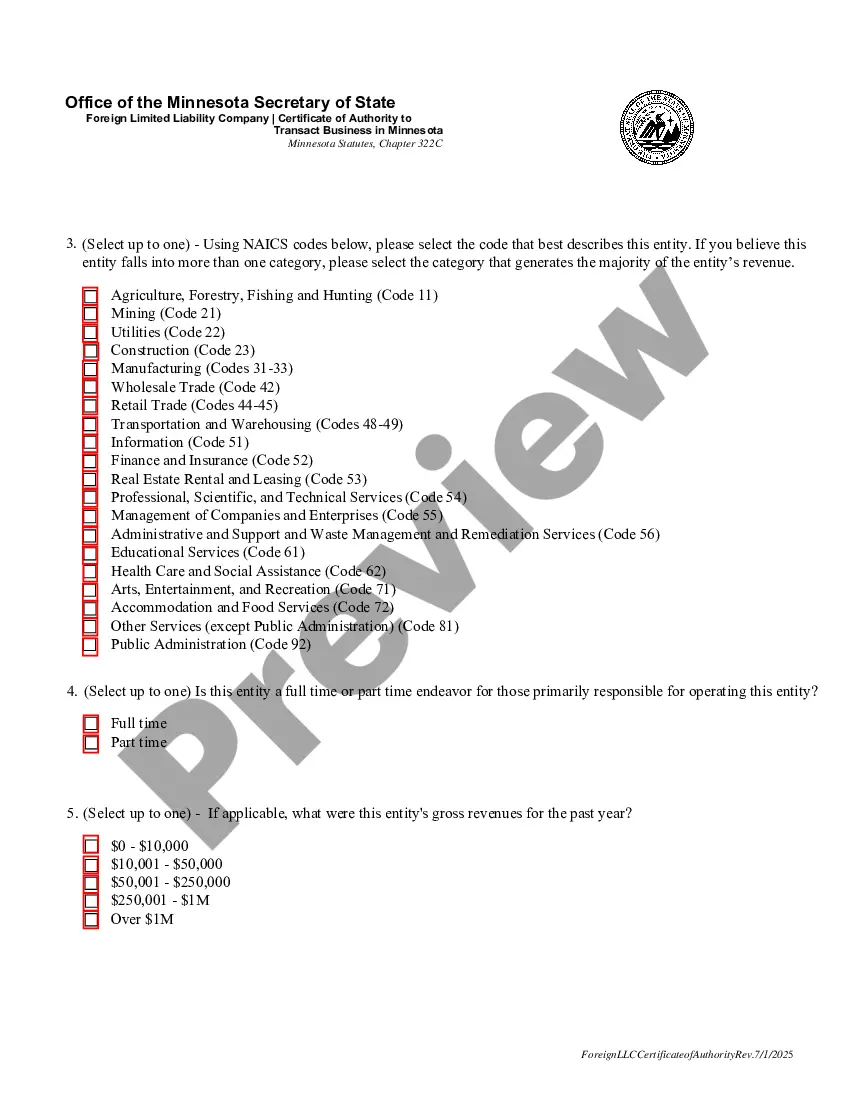

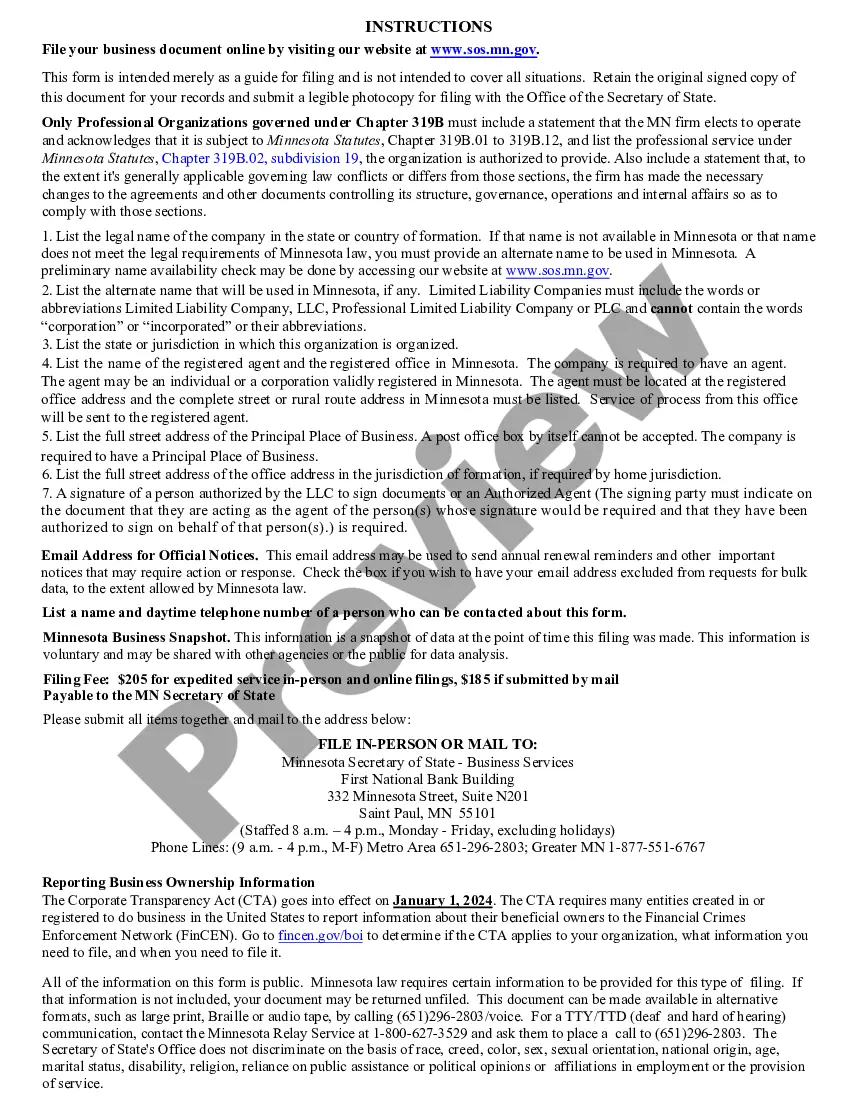

To register an out of state business in Minnesota, you need to file for a Certificate of Authority with the Minnesota Secretary of State. This process includes providing your business name, formation state, and necessary documentation. Remember to designate a registered agent in Minnesota to handle legal paperwork. For support with Minnesota registration of foreign corporation, consider leveraging US Legal Forms for step-by-step guidance.

Registering a foreign corporation requires you to apply for a Certificate of Authority in the state where you wish to operate. Each state has its requirements, including submitting formation documents and appointing a registered agent. Ensure that you comply with both state and federal regulations. Using a service like US Legal Forms can help streamline the process for Minnesota registration of foreign corporation and other states.

To register a foreign corporation in Minnesota, start by completing the application for Certificate of Authority. You must include your corporation's name, formation state, and a copy of your formation documents. It's essential to designate a registered agent who will receive legal documents on behalf of your corporation. Utilizing US Legal Forms can help you navigate the Minnesota registration of foreign corporation with ease.

Registering a foreign corporation in Minnesota involves submitting an application for Certificate of Authority to the Minnesota Secretary of State. You will need to provide your corporation's name, formation state, and other essential details. Additionally, having a registered agent in Minnesota is required to handle legal documents. US Legal Forms can simplify this process by providing the required forms and instructions for Minnesota registration of foreign corporation.

To register a foreign company in the US, you'll need to follow specific steps that vary by state. Generally, you must apply for a Certificate of Authority in the state where you plan to conduct business. Be prepared to provide details about your company, including its formation documents and a registered agent. For a seamless process, consider using platforms like US Legal Forms to access the necessary forms and guidance.

If you need to file a foreign qualification, you will have to register in the state(s) by submitting a Certificate of Authority application (sometimes called Statement & Designation by a Foreign Corporation) with the particular state's Secretary of State office.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Before you make any taxable sales in Minnesota, you must register for a Minnesota Tax ID Number and a Sales and Use Tax account. If you need a Minnesota Tax ID Number, you can apply: Online Go to Business Tax Registration.

Foreigner registration is a mandatory requirement by the Government of India under which all foreign nationals (excluding overseas citizens of India) visiting India on a long term visa (more than 180 days) are required to register themselves with a Registration Officer within 14 days of arriving in India.

Minnesota requires that different articles be filed, based on whether the LLC accepted or did not accept contributions. If your LLC accepted contributions, you must first file a notice of dissolution with the Secretary of State by mail or in person. This is followed by filing an articles of termination form.