Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed

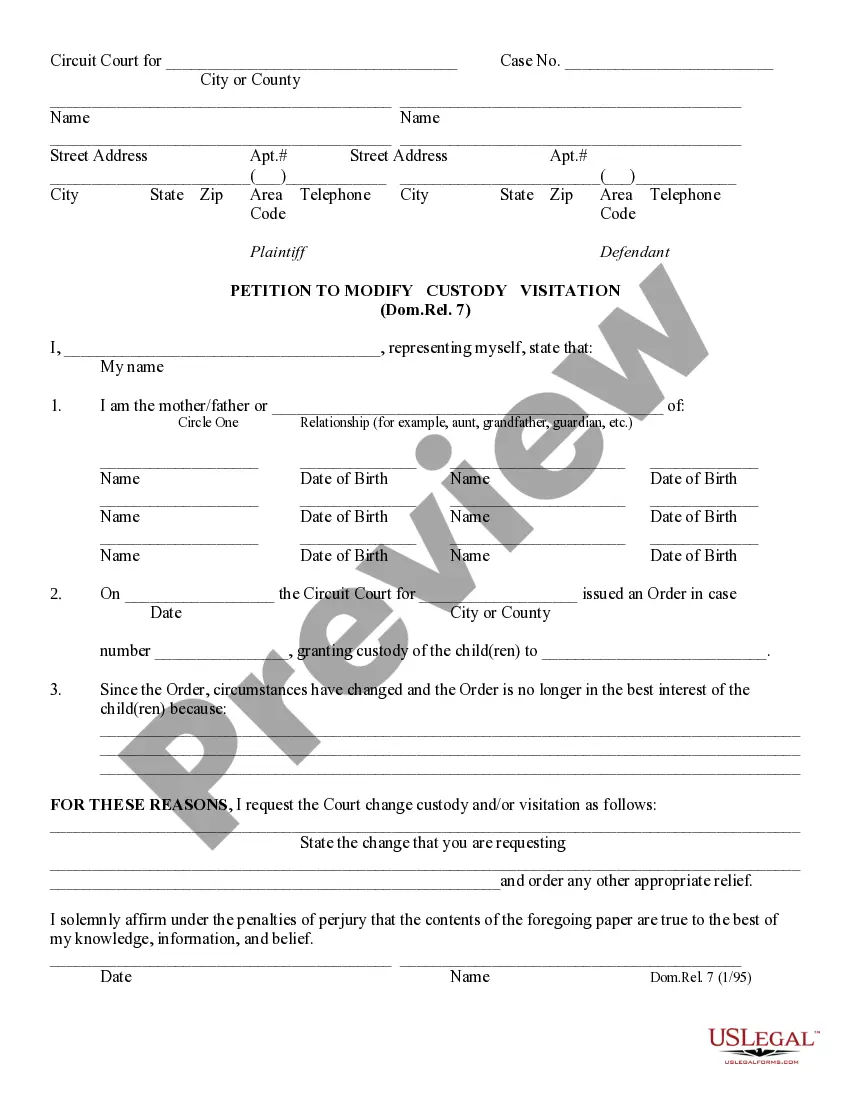

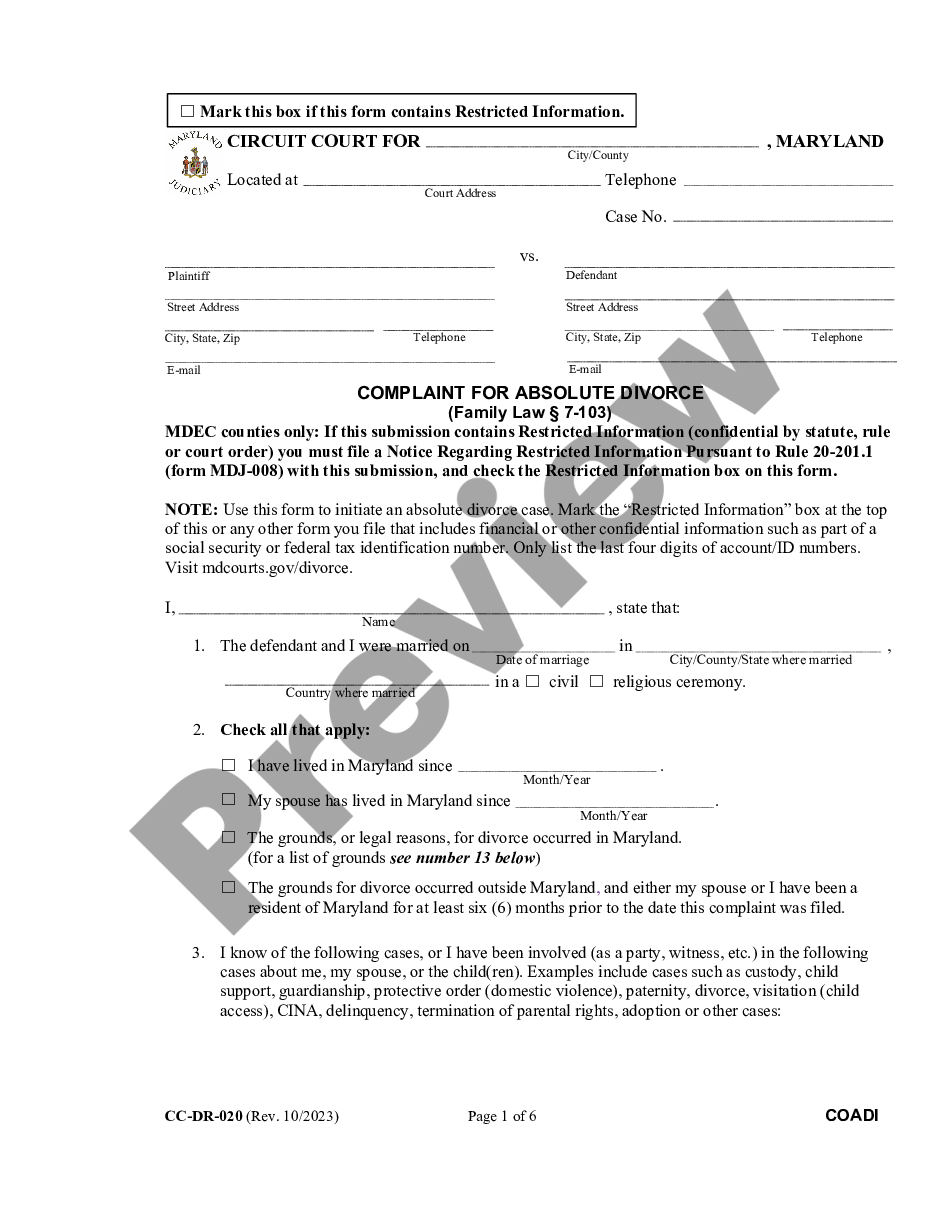

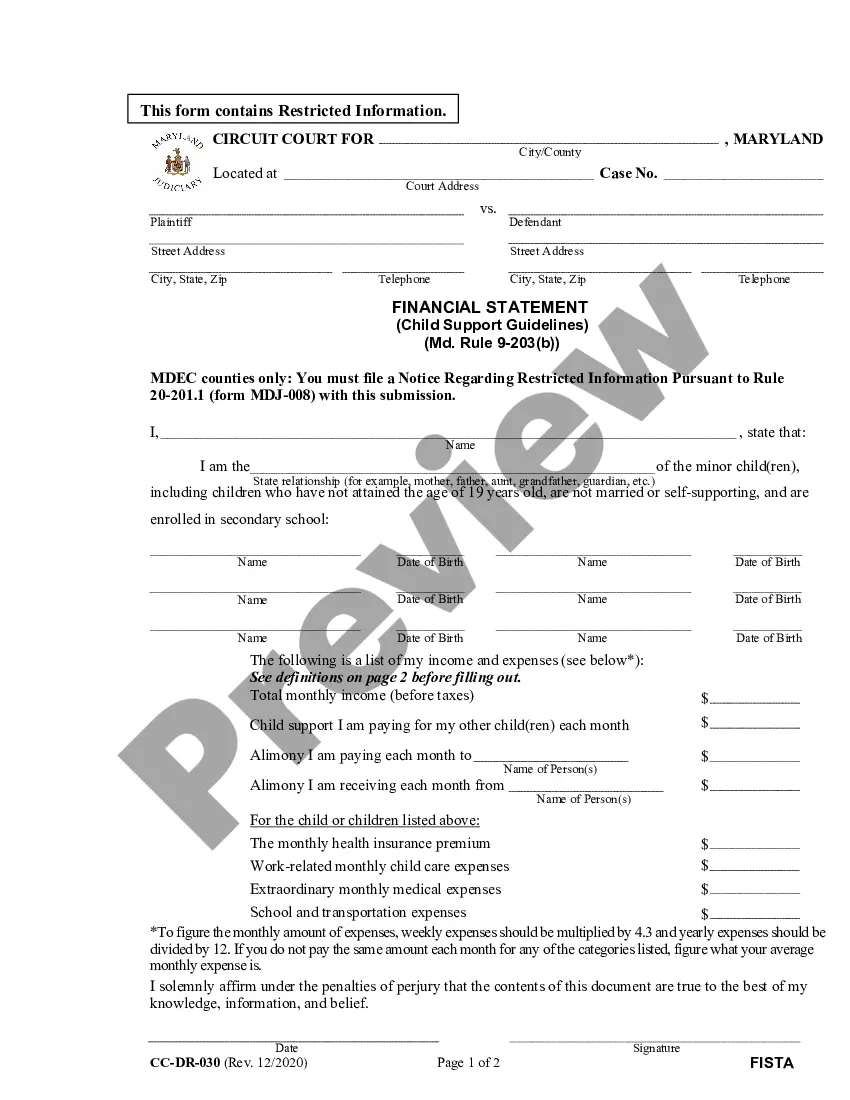

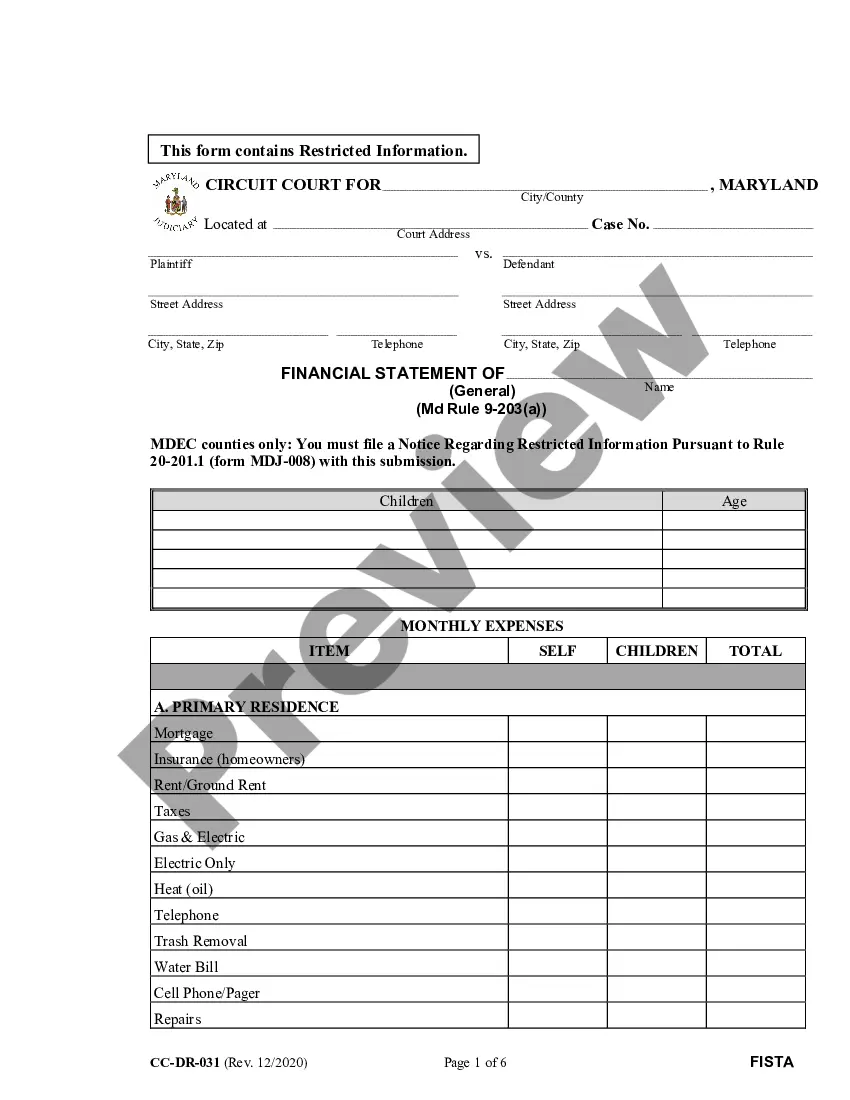

Understanding this form

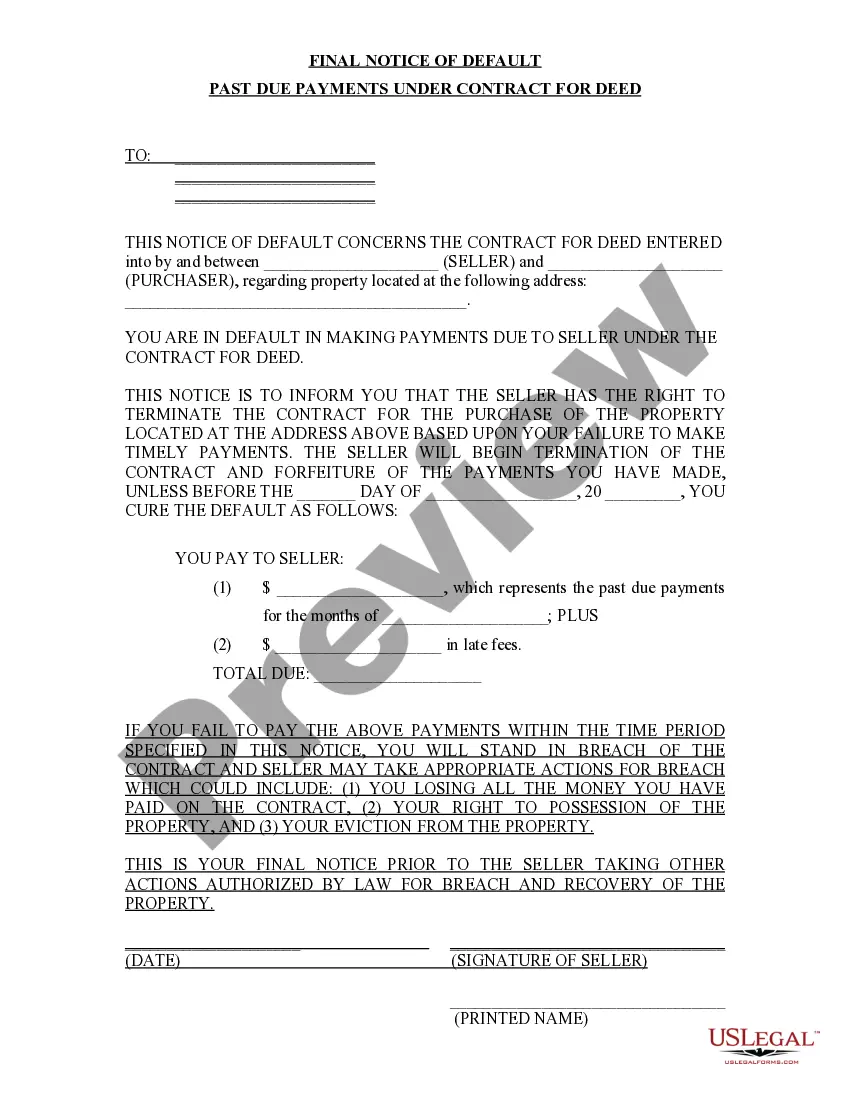

This Final Notice of Default for Past Due Payments in connection with Contract for Deed is a critical document that serves as the seller's last warning to the purchaser regarding overdue payments. It informs the purchaser that failure to rectify their payments could lead to the contract being declared in default, potentially culminating in loss of property and forfeiture of previous payments. This form is necessary in situations involving a Contract for Deed, distinguishing it from other warning notices which may not specify default conditions related to property agreements.

Form components explained

- Identifies the parties involved â Seller and Purchaser.

- Defines the property address covered by the contract.

- Statement of default, including specific past due payments.

- Payment details required to cure the default, including total amount owed.

- Consequences of failing to address the default, including potential eviction.

- Signature section for the seller to validate the notice.

Common use cases

This form should be used when a seller has not received timely payments from a purchaser under a Contract for Deed. It is particularly crucial when the seller wants to formally notify the purchaser of default, providing a final opportunity to make overdue payments before further legal action is taken. It is also a precursor to potential eviction proceedings if the default is not remedied.

Who should use this form

- Real estate sellers who have entered into a Contract for Deed.

- Property owners seeking to notify a purchaser of overdue payments.

- Individuals involved in real estate transactions where payment defaults have occurred.

Steps to complete this form

- Identify the seller and purchaser by entering their names.

- Specify the property address pertinent to the Contract for Deed.

- List the past due payments, including the payment amount and late fees.

- Complete the final payment deadline to cure the default.

- Have the seller sign and print their name along with the date of the notice.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Avoid these common issues

- Failing to accurately state the total amount due, including fees.

- Not providing a clear deadline for payment to fix the default.

- Omitting signatures or dates, which are critical for legal validity.

Advantages of online completion

- Convenience of completing the form from home without needing to visit a lawyer.

- Provides editable templates that can be filled out quickly.

- Reliability of using professionally drafted forms created by licensed attorneys.

Legal use & context

- This notice serves as a formal declaration of default and may be legally recognized in court as evidence of non-payment.

- Proper completion and delivery of this form are essential for the seller to pursue further legal remedies, such as eviction.

What to keep in mind

- The form serves as the final warning to the purchaser regarding overdue payments.

- Timely and accurate completion of the form is crucial for legal enforceability.

- Understanding the consequences of default can help purchasers avoid losing their investment in the property.

Form popularity

FAQ

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

Contact the other party and ask whether they are willing to negotiate the cancellation of the contract. Offer the other party an incentive to cancel the contract for deed.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.