Illinois Last Will and Testament with All Property to Trust called a Pour Over Will

What this document covers

This Last Will and Testament, known as a Pour Over Will, is a legal document that directs that all property not already transferred to a living trust will be moved into that trust upon death. Unlike a traditional will, this form ensures that any assets inadvertently left outside the trust are still managed according to the grantor's wishes, avoiding intestacy laws that might dictate unintended distributions. It's particularly important for those who have established or are in the process of establishing a living trust as part of their estate planning goals.

What’s included in this form

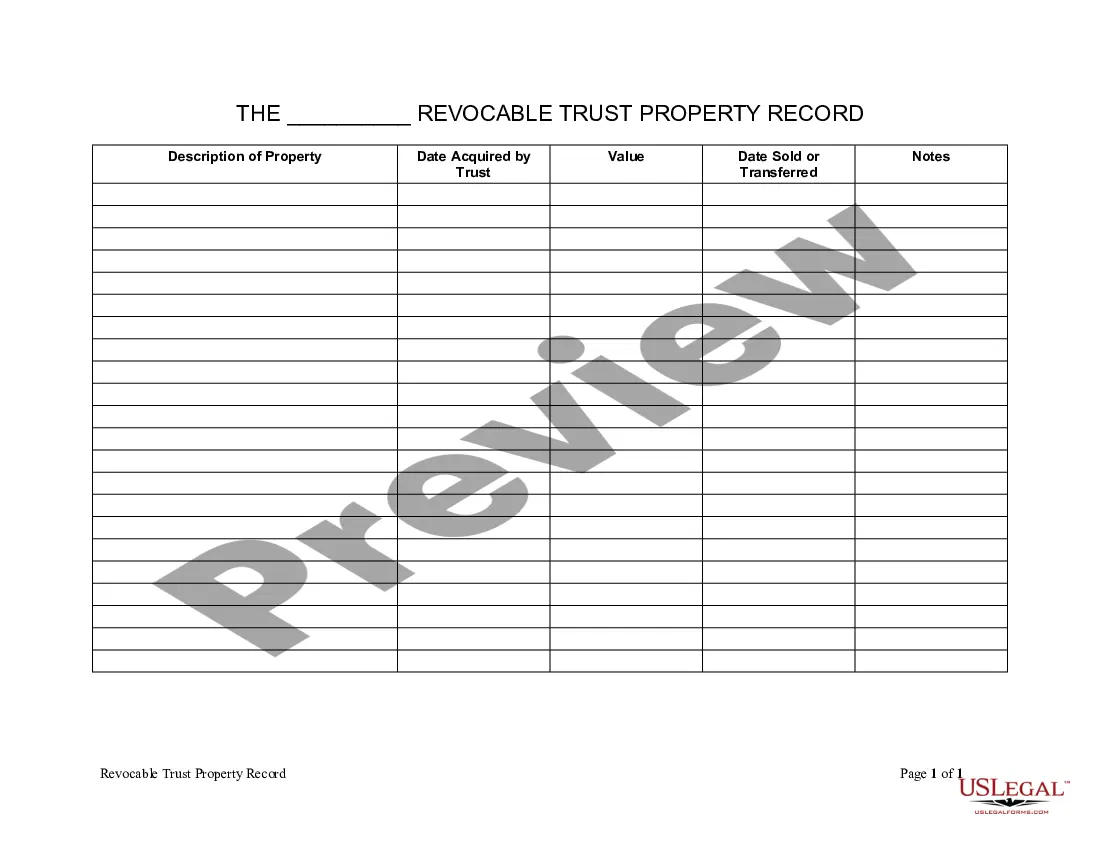

- Article of conveyance that transfers all remaining property to the living trust.

- Provisions for the payment of debts and administrative expenses.

- Appointment of a guardian for minor children, if applicable.

- Designation of a personal representative to administer the estate.

- Waivers of bond, inventory, and accounting requirements for the personal representative.

- Instructions for the cooperation between the personal representative and the trustee of the trust.

When this form is needed

This Pour Over Will is commonly used when you have created a living trust or are in the process of doing so. It is essential for ensuring that any assets not explicitly placed in the trust during your lifetime are still incorporated into it upon your death. You would use this form if you want to prevent your assets from being distributed by state laws, control how they should be distributed, and ensure that all your wishes regarding your estate are honored.

Intended users of this form

This form is ideal for:

- Individuals establishing a living trust.

- Those wishing to ensure all assets are managed under a trust upon their death.

- People who want to avoid probate for any assets remaining outside of their trust.

- Anyone who desires to have specific distribution instructions for their remaining properties.

How to complete this form

- Begin by identifying the testator and their residence details.

- Clearly outline the property assets owned by the testator to be transferred to the living trust.

- Indicate the appointment of a guardian for any minor children, if applicable.

- Designate a personal representative to manage the estate and ensure compliance with the will.

- Have the will signed and witnessed by at least two competent adults in accordance with state law.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Typical mistakes to avoid

- Failing to transfer all property into the trust before death.

- Not appointing a personal representative.

- Overlooking the need for witnesses when signing the will.

- Neglecting to update the will after major life changes, such as marriage or divorce.

Why complete this form online

- Conveniently complete and download the form from your computer.

- Edit fields easily to ensure accuracy and clarity.

- Access to legal forms drafted by licensed attorneys.

- Immediate availability without the need for in-person appointments.

Form popularity

FAQ

Handwritten Wills in Illinois In the state of Illinois, holographic wills are not considered to be valid. Illinois does recognize, however, handwritten wills that are signed by two witnesses and satisfy all other requirements for wills as stated in the law.

Do I Need to Have My Will Notarized? No, in Illinois, you do not need to notarize your will to make it legal.However, Illinois allows your will to be self-proved without a self-proving affidavit, as long as you sign and witness it correctly.

In Illinois, to have a valid will it is required that two or more credible witnesses validate or attest the will. This means each witness must watch the testator (person making his or her will) sign or acknowledge the will, determine the testator is of sound mind, and sign the will in front of the testator.

It's very common for a lawyer to charge a flat fee to write a will and other basic estate planning documents. The low end for a simple lawyer-drafted will is around $300. A price of closer to $1,000 is more common, and it's not unusual to find a $1,200 price tag. Lawyers like flat fees for several reasons.