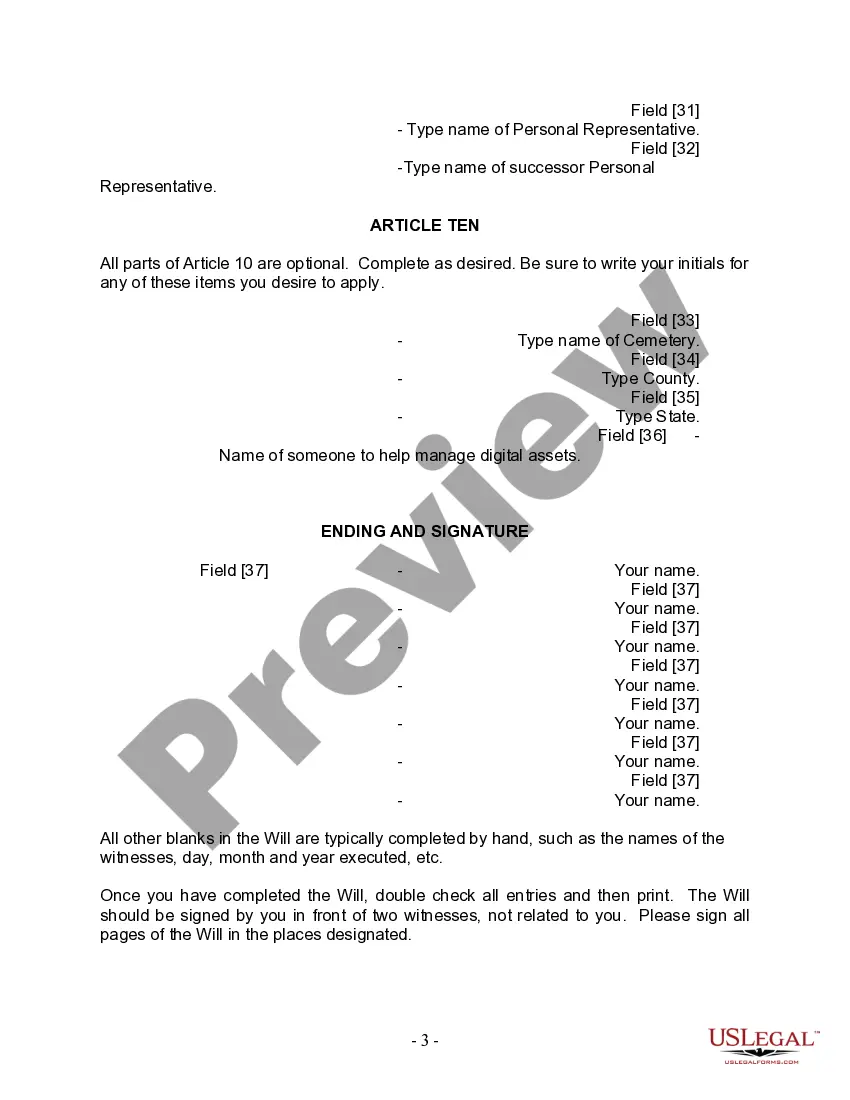

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

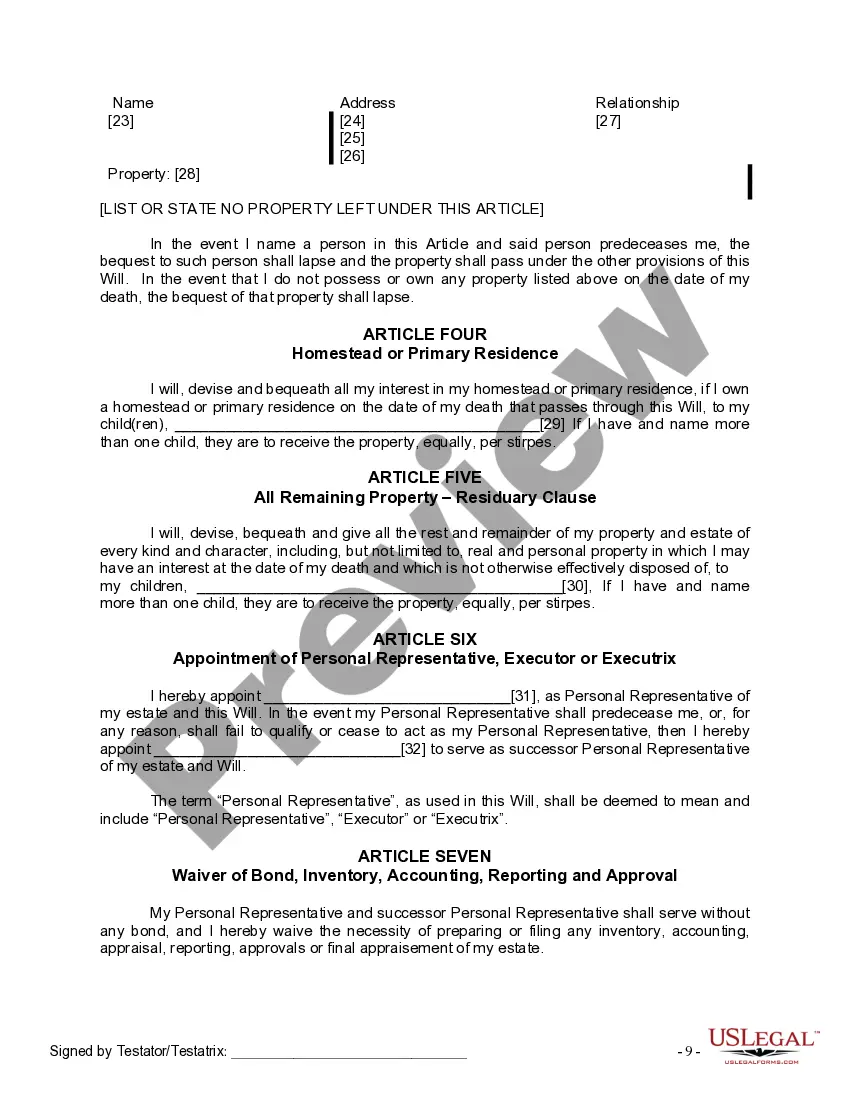

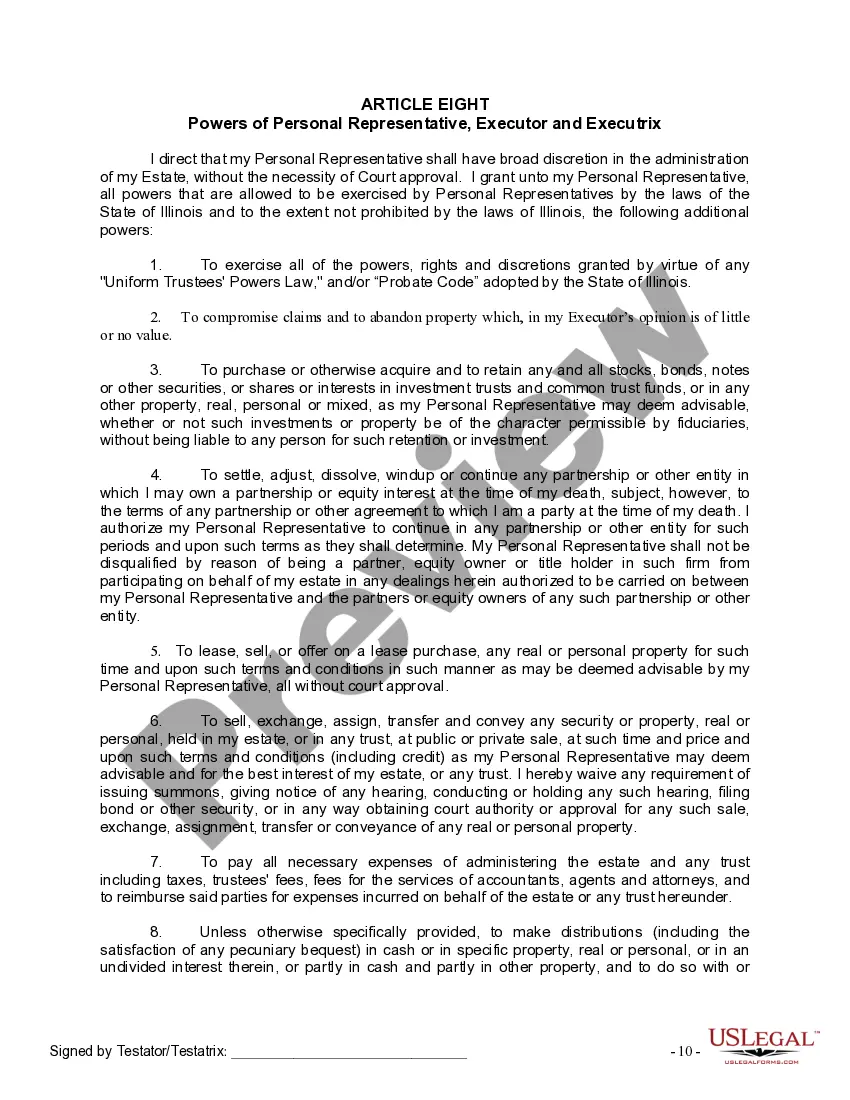

Illinois Last Will and Testament for Divorced person not Remarried with Adult Children

Description

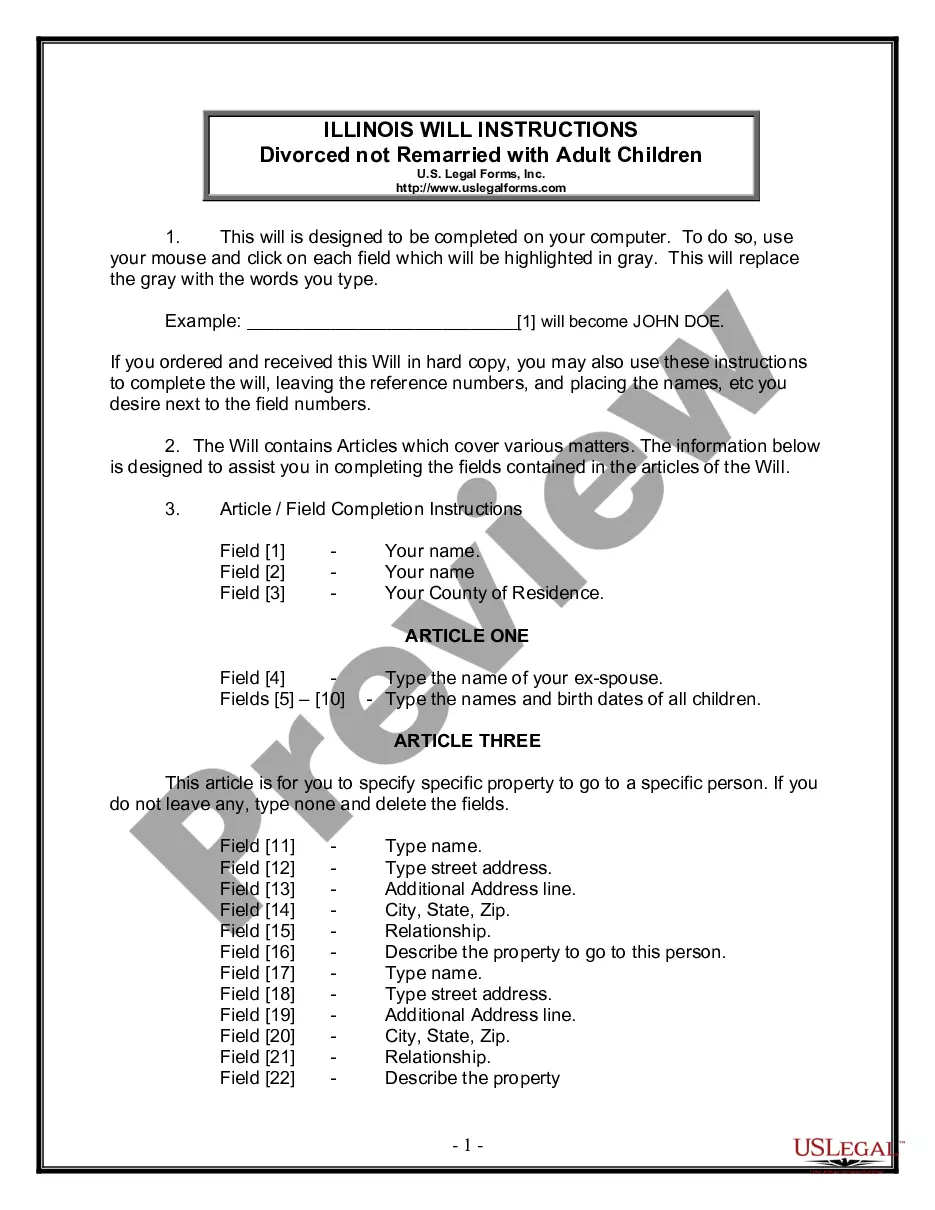

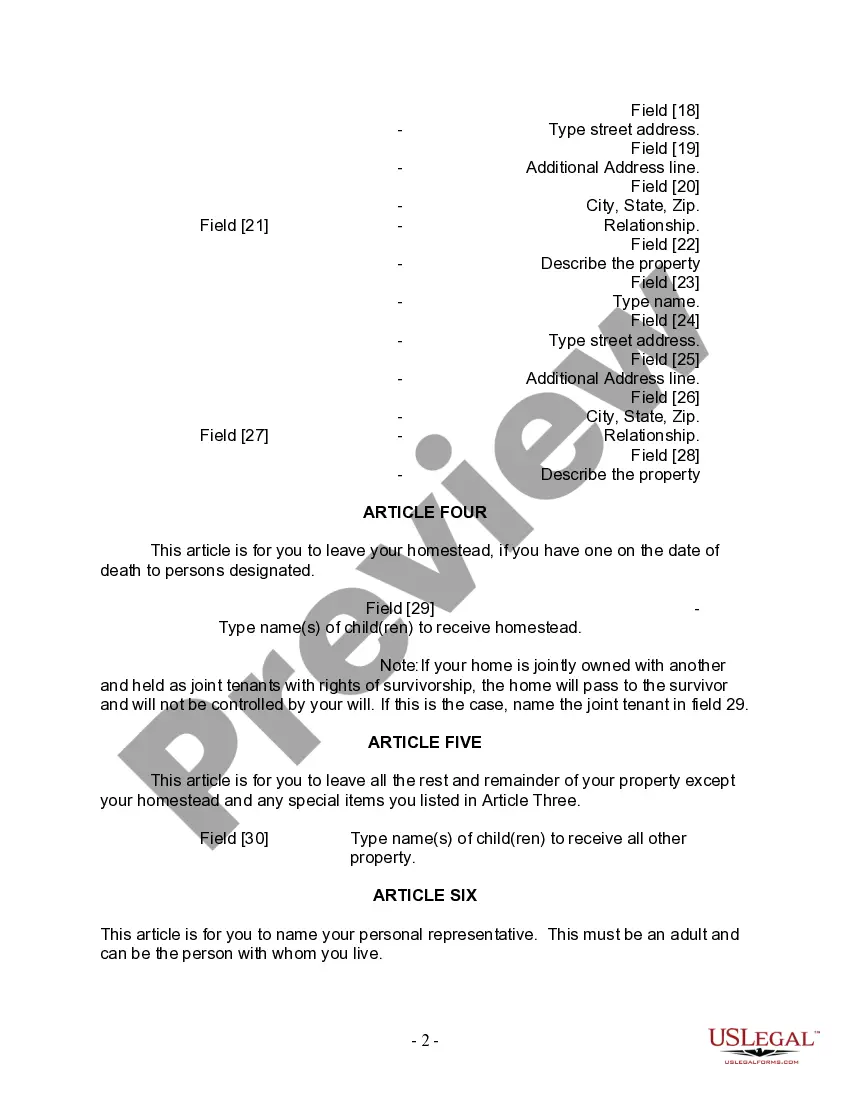

How to fill out Illinois Last Will And Testament For Divorced Person Not Remarried With Adult Children?

Looking for the Illinois Legal Last Will and Testament Template for a Divorced individual who is not Remarried and has Adult Children could pose a challenge. To conserve time, expenses, and effort, utilize US Legal Forms to locate the suitable example specific to your state in just a few clicks. Our legal experts prepare every document, allowing you to simply complete them. It really is that straightforward.

Log in to your account, return to the form's section, and save the template. Your downloaded documents are stored in My documents and are always accessible for later use. If you haven't yet subscribed, you'll need to register.

Review our detailed instructions on how to obtain the Illinois Legal Last Will and Testament Template for a Divorced person not Remarried and having Adult Children form within a few minutes.

You can now print the Illinois Legal Last Will and Testament Template for a Divorced person not Remarried with Adult Children form or complete it using any online editor. Don't worry about making mistakes because your form can be utilized, submitted, and printed multiple times. Experience US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- To get a valid form, verify its legitimacy for your state.

- Examine the sample using the Preview feature (if available).

- If there is an explanation, go through it to understand the specifics.

- Hit the Buy Now button if you discover what you are looking for.

- Choose your plan on the pricing page and set up an account.

- Specify if you prefer to pay via credit card or PayPal.

- Download the document in your desired format.

Form popularity

FAQ

If you remarry but don't draw up a new Will to reflect your new marriage, your existing Will is revoked, meaning you do not have a valid Will and your estate will be dealt with under intestacy rules.If you do not have surviving children, grandchildren or great grandchildren your spouse will receive the entire estate.

A will cannot be contested until someone dies. Children are often disinherited as a result of their father's remarriage. To maintain domestic harmony with the new wife, the husband will often do whatever the new wife says, including doing...

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.

You and your spouse may have one of the most common types of estate plans between married couples, which is a simple will leaving everything to each other. With this type of plan, you leave all of your assets outright to your surviving spouse. The kids or other beneficiaries only get something after you are both gone.