Illinois Amendment to Living Trust

About this form

The Amendment to Living Trust is a legal document used to modify specific terms of an existing living trust while maintaining its overall intent and structure. Unlike creating a new trust, this form allows the Trustor to change certain provisions, such as asset distribution or trustee appointments, without affecting other established parts of the trust. This is essential for ongoing estate planning as needs and circumstances change over time.

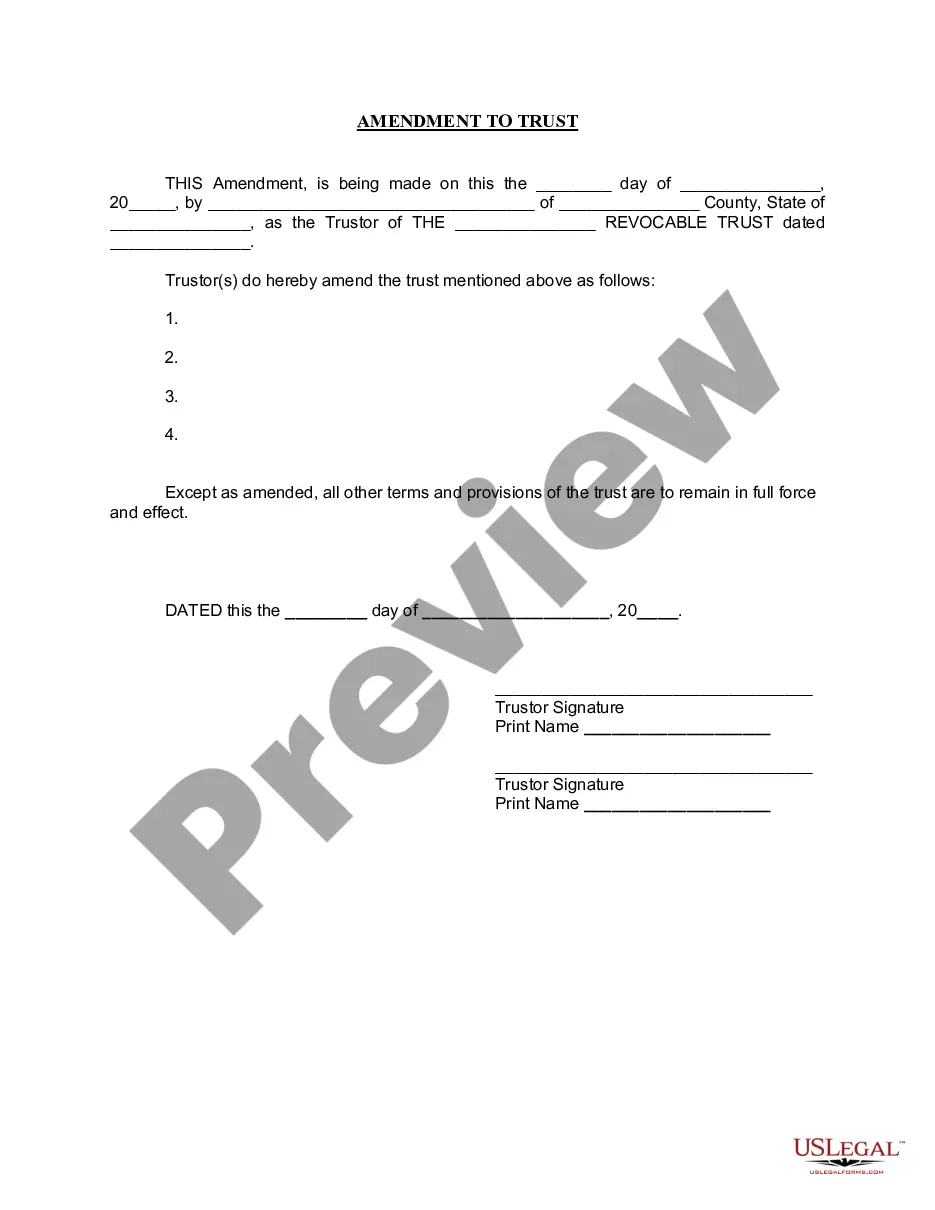

Key parts of this document

- Date of amendment

- Name and address of the Trustor

- Name of the existing living trust

- Details of the amendments being made

- Signature lines for the Trustor(s)

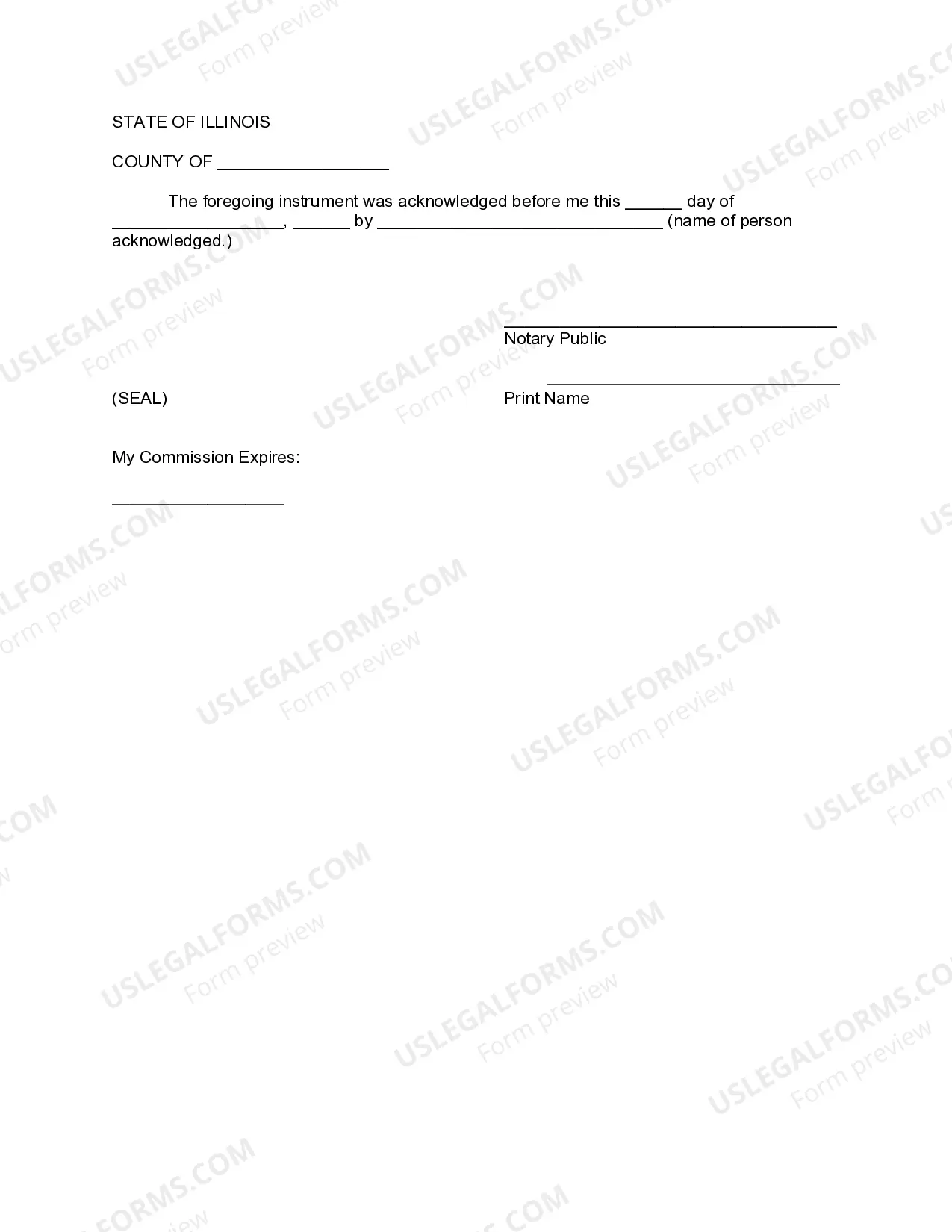

- Notary acknowledgment section

Common use cases

This form is useful when the Trustor wants to make specific changes to their living trust without the need to create a new document. Common scenarios include updating beneficiary details, altering the distribution of assets, or changing trustees due to life events such as marriage, divorce, or the passing of a previously appointed trustee. Regularly reviewing and amending a living trust can help ensure that it reflects the Trustor's current wishes.

Who this form is for

This amendment is intended for:

- Individuals who have established a revocable living trust.

- Trustors who wish to modify specific terms within their existing trust.

- Estate planners seeking to ensure that their trust accurately reflects current intentions.

How to complete this form

- Enter the date of the amendment at the top of the form.

- Provide the full name and address of the Trustor.

- Specify the name of the existing living trust and its date.

- Clearly outline the specific amendments being made to the trust.

- Sign the document in the presence of a notary public, ensuring all required signatures are included.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to clearly define the amendments being made.

- Not including the necessary signatures or notarization.

- Omitting important identifying information about the Trustor or trust.

- Using outdated versions of the amendment form.

Key takeaways

- The Amendment to Living Trust allows Trustors to modify specific provisions of their trust.

- Updates to a living trust can reflect changes in the Trustor's life and intentions.

- Signature and notarization are required for the amendment to be valid.

Looking for another form?

Form popularity

FAQ

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.