Illinois Warranty Deed from Husband and Wife to a Trust

Definition and meaning

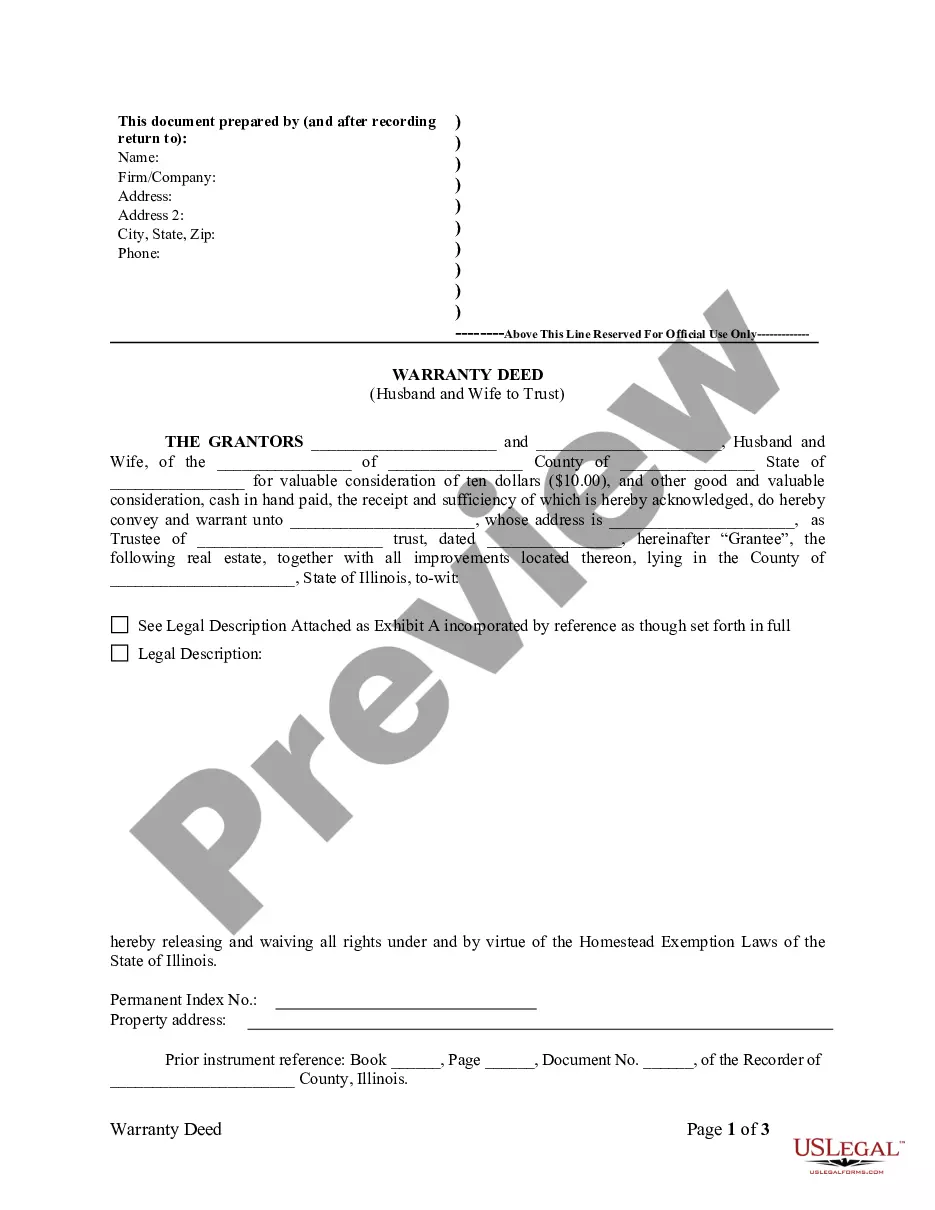

The Illinois Warranty Deed from Husband and Wife to a Trust is a legal document used to transfer ownership of real property from a married couple to a trust. This instrument ensures that the property is held within the trust for the benefit of designated beneficiaries according to the terms of the trust agreement. The warranty deed also provides a guarantee from the grantors that they hold clear title to the property and have the right to convey it, ensuring a legal assurance to the trust as the grantee.

How to complete a form

To properly fill out the Illinois Warranty Deed from Husband and Wife to a Trust, follow these steps:

- Enter the names of the grantors (the husband and wife) in the designated fields.

- List the address and county information for the property being conveyed.

- Fill in the name of the trust and the trustee's details.

- Include the legal description of the property, which can often be found on the existing property deed.

- Ensure to acknowledge any rights waived under the Homestead Exemption Laws of Illinois.

- Sign the document in front of a notary public, who will certify the signatures.

Who should use this form

This warranty deed is intended for use by married couples who wish to transfer their jointly owned property into a trust. Individuals looking to manage their estate planning more effectively, protect their assets, or streamline the transfer of property after death may find this form particularly useful. It is advisable for anyone considering this form to consult with a licensed attorney to ensure it meets their specific needs and complies with applicable laws.

Legal use and context

The Illinois Warranty Deed from Husband and Wife to a Trust is recognized in legal contexts as a binding agreement that transfers property rights. This form is essential in estate planning scenarios where the grantors intend to specify how their assets should be managed and distributed. By placing property in a trust, the grantors can potentially avoid probate, reduce estate taxes, and maintain greater control over asset distribution.

Common mistakes to avoid when using this form

When completing the Illinois Warranty Deed, it is crucial to avoid the following common errors:

- Failing to include the complete legal description of the property, which is vital for proper identification.

- Not having the signatures notarized, which makes the document invalid.

- Leaving out necessary details such as the grantor's and grantee's contact information.

- Incorrectly stating the trust details, which can lead to legal complications.

What to expect during notarization or witnessing

During the notarization of the Illinois Warranty Deed, the grantors will be required to appear before a notary public with valid identification. The notary will verify the identities of the grantors, witness their signatures, and then affix their official seal to the document. It is important for the grantors to understand that the notarization process is an essential step that helps to prevent fraud and ensures the integrity of the deed.

Form popularity

FAQ

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

A trustee deed offers no such warranties about the title.

Discuss the terms of the deed with the new owners. Hire a real estate attorney to prepare the deed. Review the deed. Sign the deed in front of a notary public, with witnesses present. File the deed on public record.

In Illinois, a special warranty deed transfers title in fee simple to the grantee with warranties and covenants of title that are limited to only the acts of the grantor or that result from the acts of the grantor and is the form of deed customarily used in commercial real estate transactions.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Under Illinois law, which of the following is NOT required in order for a deed to be valid? The answer is grantee's signature. The minimum requirements for a valid deed include a grantor, who has the legal capacity to execute (sign) the deed and a grantee named with reasonable certainty to be identified.