Illinois Articles of Incorporation for Professional Corporation

Description

How to fill out Illinois Articles Of Incorporation For Professional Corporation?

Locating Illinois Articles of Incorporation for Professional Corporation examples and completing them can be quite challenging.

To save time, expenses, and effort, utilize US Legal Forms to find the suitable template specifically for your state within a few clicks.

Our lawyers prepare each document, so you only need to fill them out. It’s really that easy.

Select your plan on the pricing page and set up your account. Choose how you wish to pay, either by credit card or PayPal. Save the form in your preferred file format. You can print the Illinois Articles of Incorporation for Professional Corporation form or fill it in using any online editor. Don’t worry about making errors, as your example can be used and submitted, and printed as many times as you wish. Explore US Legal Forms to access over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to download the document.

- Your downloaded templates are saved in My documents and are always available for future use.

- If you haven’t signed up yet, you will need to register.

- To obtain a qualified example, check its relevance for your state.

- Review the example using the Preview feature (if it’s available).

- If there's a description, read it to grasp the details.

- Click on the Buy Now button if you found what you're searching for.

Form popularity

FAQ

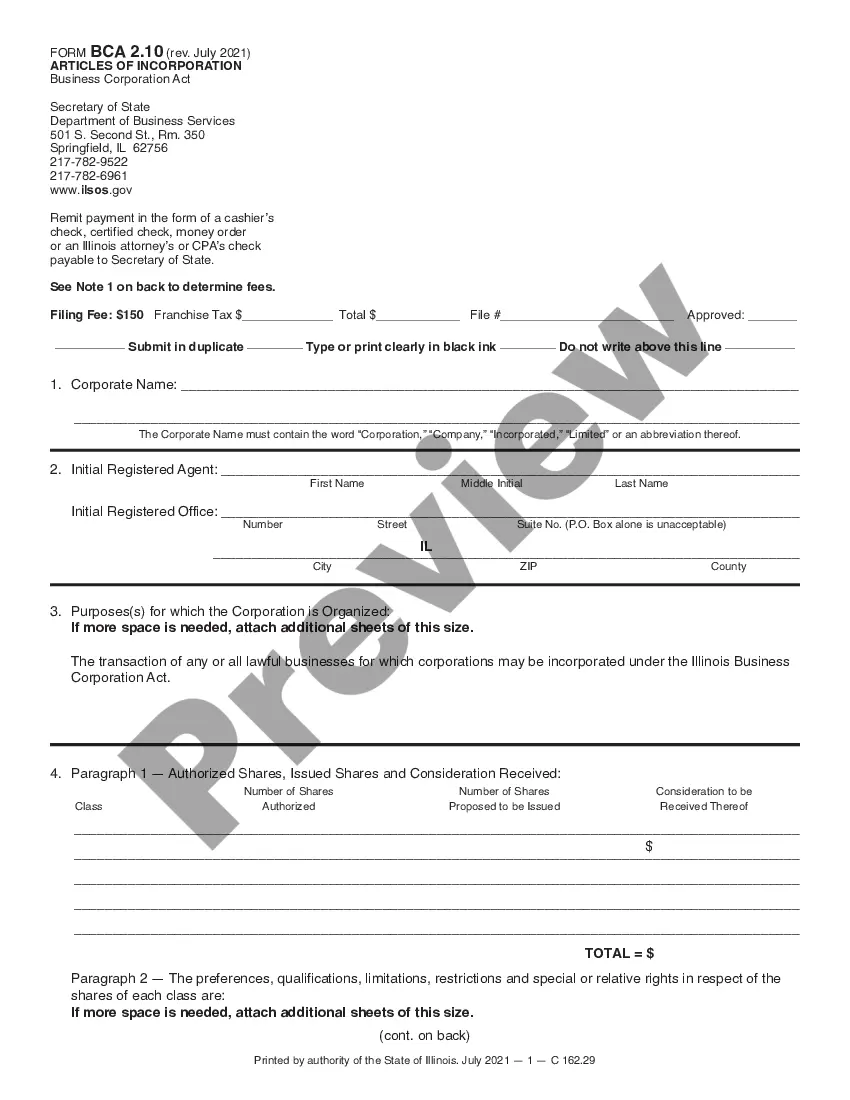

File Illinois Articles of Incorporation $150 filing fee + franchise tax ($25 minimum) + optional $100 expedite fee. The expedite fee is required if you file online. Franchise tax is calculated as $1.50 per $1,000 on the paid-in capital represented in this state.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

A professional corporation is a corporation organized under the Professional Service Corporation Act solely for the purpose of rendering one category of professional service or related professional services and which has as its shareholders, directors, officers, agents and employees (other than ancillary personnel)

How long does it take to incorporate in Illinois? Regular processing of articles of incorporation takes about four weeks, plus an additional two or three days to mail the final documents. Regular filing time for an LLC (limited liability company) is between seven and ten business days.

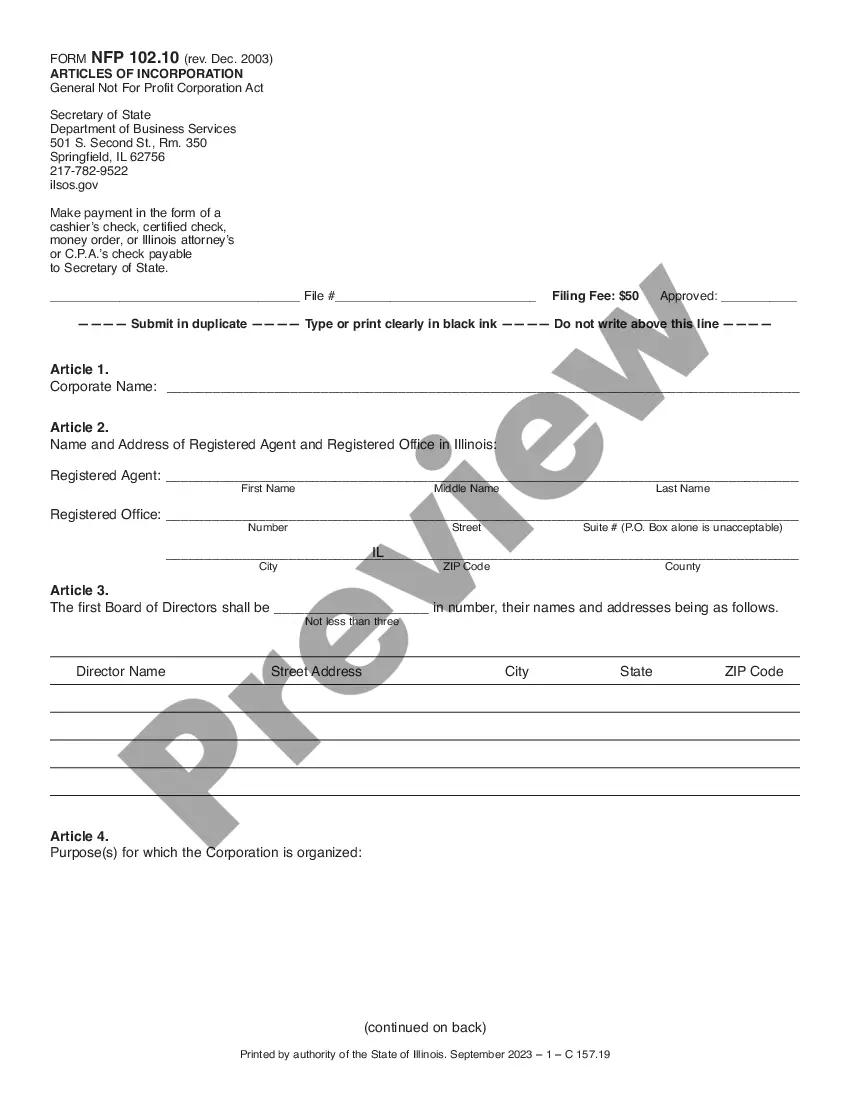

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

Step One) Choose a PLLC Name. Step Two) Designate a Registered Agent. Step Three) File Formation Documents with the State. Step Four) Create an Operating Agreement. Step Five) Handle Taxation Requirements. Step Six) Obtain Business Licenses and Permits.

To form an Illinois LLC you will need to file the Articles of Organization with the Illinois Secretary of State, which costs $150. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Illinois limited liability company.

The articles must include the corporate name; the name and street address of an agent for service of process; its purpose; the number of shares the corporation is authorized to issue and the consideration (money or property) the corporation will receive for the shares; and the names and addresses of the incorporators.