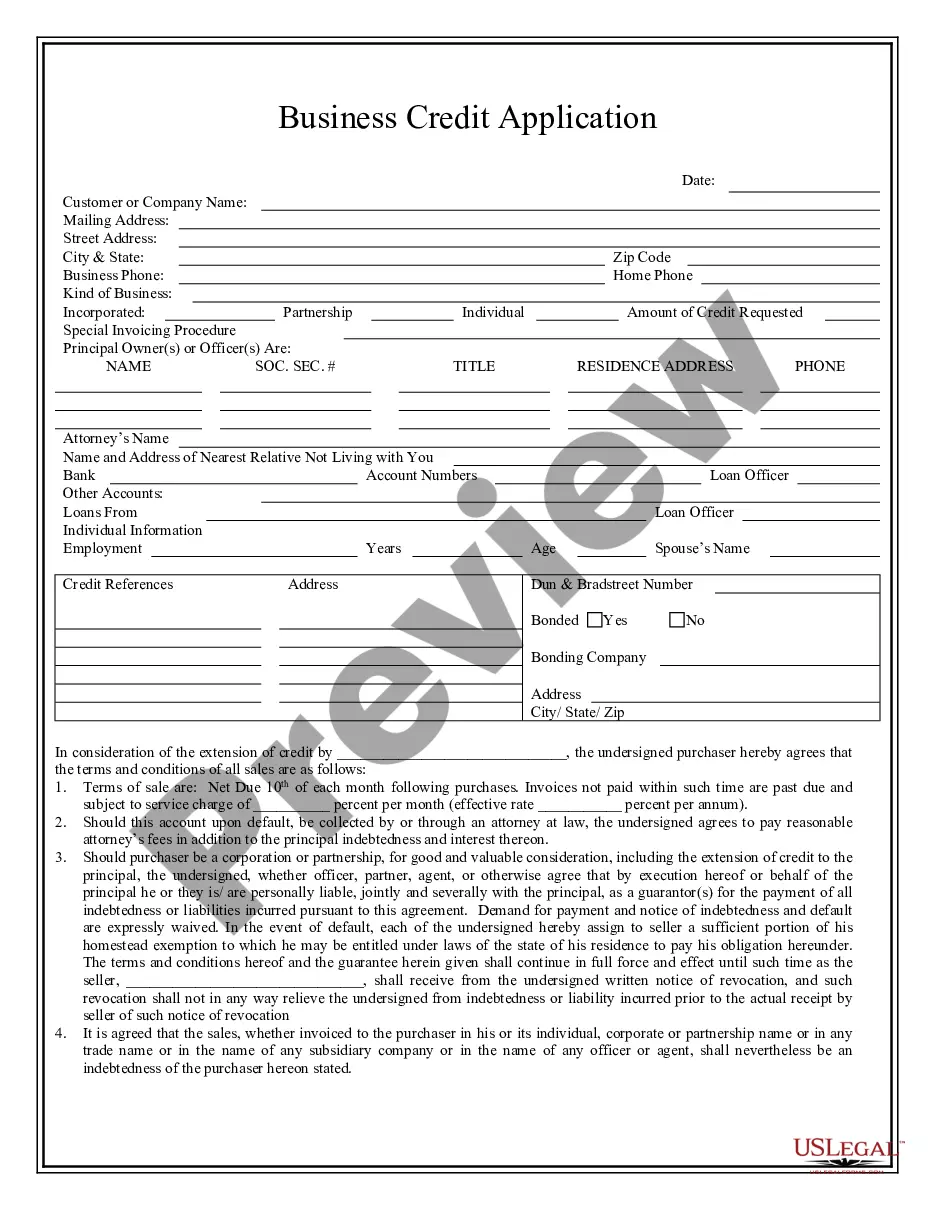

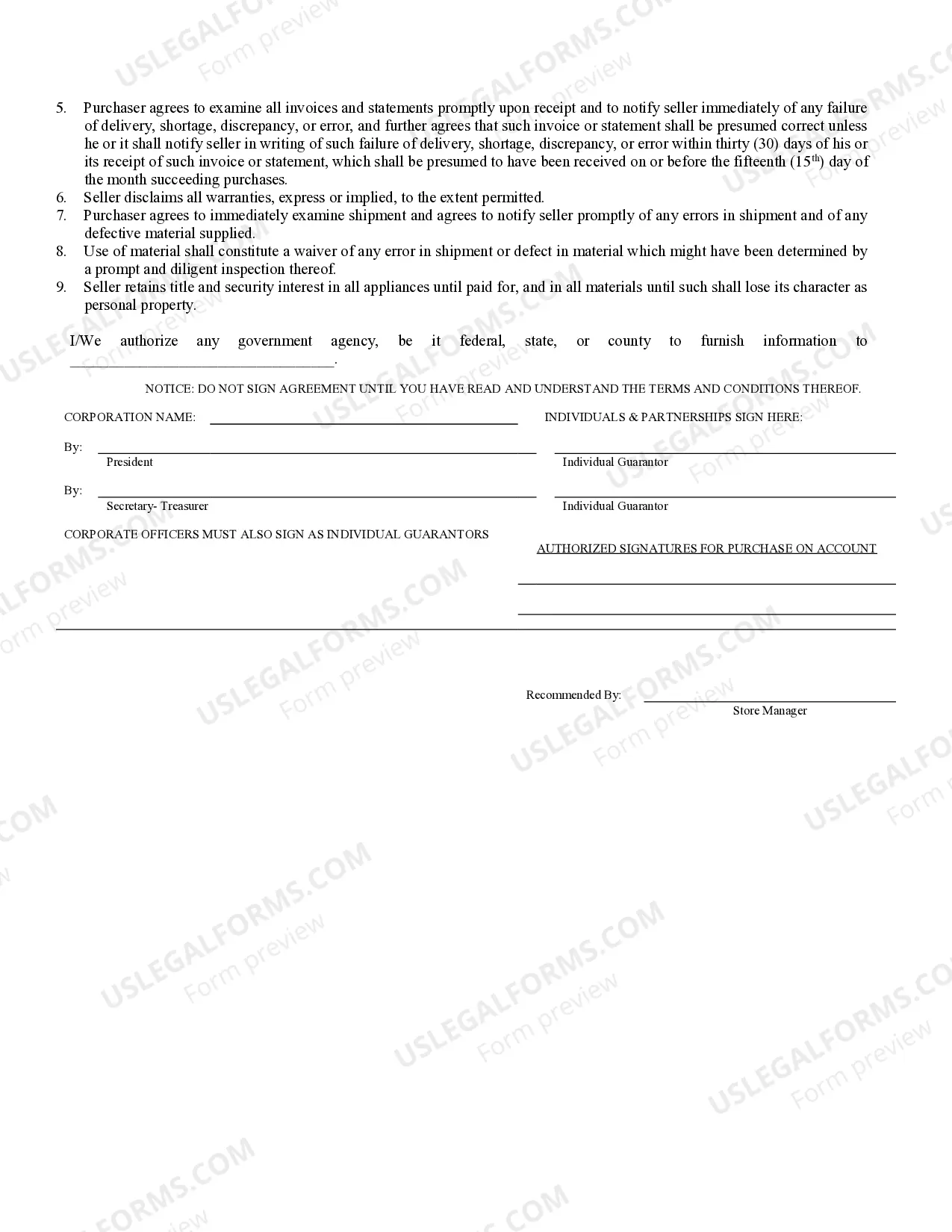

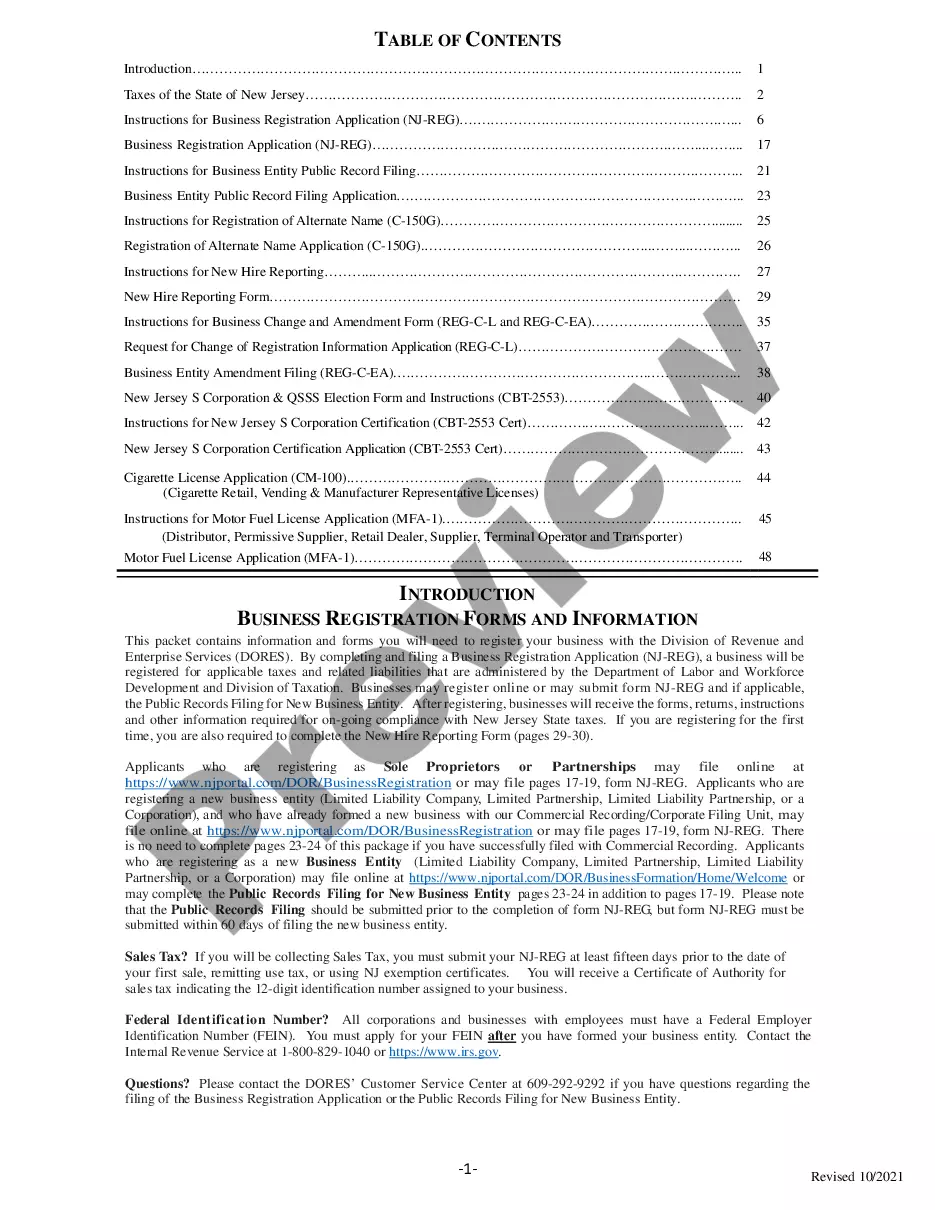

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Iowa Business Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Business Credit Application?

Gain entry to one of the most comprehensive collections of certified forms.

US Legal Forms is a resource where you can locate any state-specific form in just a few clicks, including examples of Iowa Business Credit Applications.

There's no need to squander hours searching for a court-acceptable example.

If everything appears correct, click Buy Now. After selecting a pricing plan, create an account. Make payments via credit card or PayPal. Download the template to your device by clicking Download. That's it! You need to complete the Iowa Business Credit Application template and check out. To confirm that all is correct, consult your local legal advisor for assistance. Sign up and easily browse through approximately 85,000 valuable templates.

- To utilize the forms library, choose a subscription and register your account.

- If you have already signed up, simply Log In and click the Download button.

- The Iowa Business Credit Application template will be immediately saved in the My documents tab (the tab for all forms you save on US Legal Forms).

- To create a new account, review the brief suggestions outlined below.

- When using state-specific documents, ensure you specify the correct state.

- If possible, review the description to grasp all the details of the form.

- Use the Preview feature if available to examine the content of the document.

Form popularity

FAQ

To reserve a business name in Iowa, you must first check the availability of your desired name through the Iowa Secretary of State's website. Once you confirm that the name is available, you can complete the Name Reservation Application online or by mail. This process typically allows you to hold the name for 120 days, ensuring that it can be used when you apply for an Iowa Business Credit Application. Utilizing services like USLegalForms can simplify your application process, making it easier to secure your business name.

To file a biennial report in Iowa, you can complete the process online through the Iowa Secretary of State's website. Make sure to gather your business details beforehand to ease the filing process. If you are looking for additional assistance, USLegalForms can provide you with resources to aid in completing your Iowa Business Credit Application smoothly.

The purpose of a biennial report is to maintain accurate records of your business with the state. This report helps ensure transparency and accountability, allowing the state to track active businesses. A timely filed report is crucial for your Iowa Business Credit Application, as it shows lenders that you are responsible and organized.

Yes, your business needs to file a biennial report in Iowa if you want to stay in good standing. This report ensures that your business information remains current with state authorities. By keeping your records updated, you also support your Iowa Business Credit Application and improve your chances for financing opportunities.

A biennial registration report is a document that businesses in Iowa must file every two years. It provides the state with updated information about your business, including the registered agent and business address. Proper filing is essential to keep your Iowa Business Credit Application valid and up to date, enhancing your credibility with lenders.

Yes, in Iowa, you must renew your LLC every year to maintain its active status. Failing to renew can lead to administrative dissolution. For a smoother process, consider utilizing the Iowa Business Credit Application through USLegalForms. This can help streamline your business needs while ensuring compliance.

To apply for business credit, first gather your financial documents, including your business credit application form. Present your application to lenders, banks, or credit card companies that offer business credit solutions. The Iowa Business Credit Application available through US Legal Forms can ease the application process and help you showcase your business accurately.

Yes, you can use your Employer Identification Number (EIN) to build business credit. Your EIN acts as a Social Security number for your business, allowing credit agencies to track your credit history and activity. Leverage the Iowa Business Credit Application to officially establish your credit profile using your EIN.

Creating a business credit application form requires you to include fields for basic information such as the business name, ownership structure, financial details, and credit history. You can design this form using templates available on the US Legal Forms platform. The Iowa Business Credit Application provides a comprehensive guide to drafting your own application efficiently.

The quickest way to obtain business credit for an LLC is to apply for credit accounts with companies that cater specifically to businesses. By completing a solid Iowa Business Credit Application, you can present a clear financial picture and increase your chances of approval. Also, ensure you maintain a good payment history to access higher credit limits.