Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

About this form

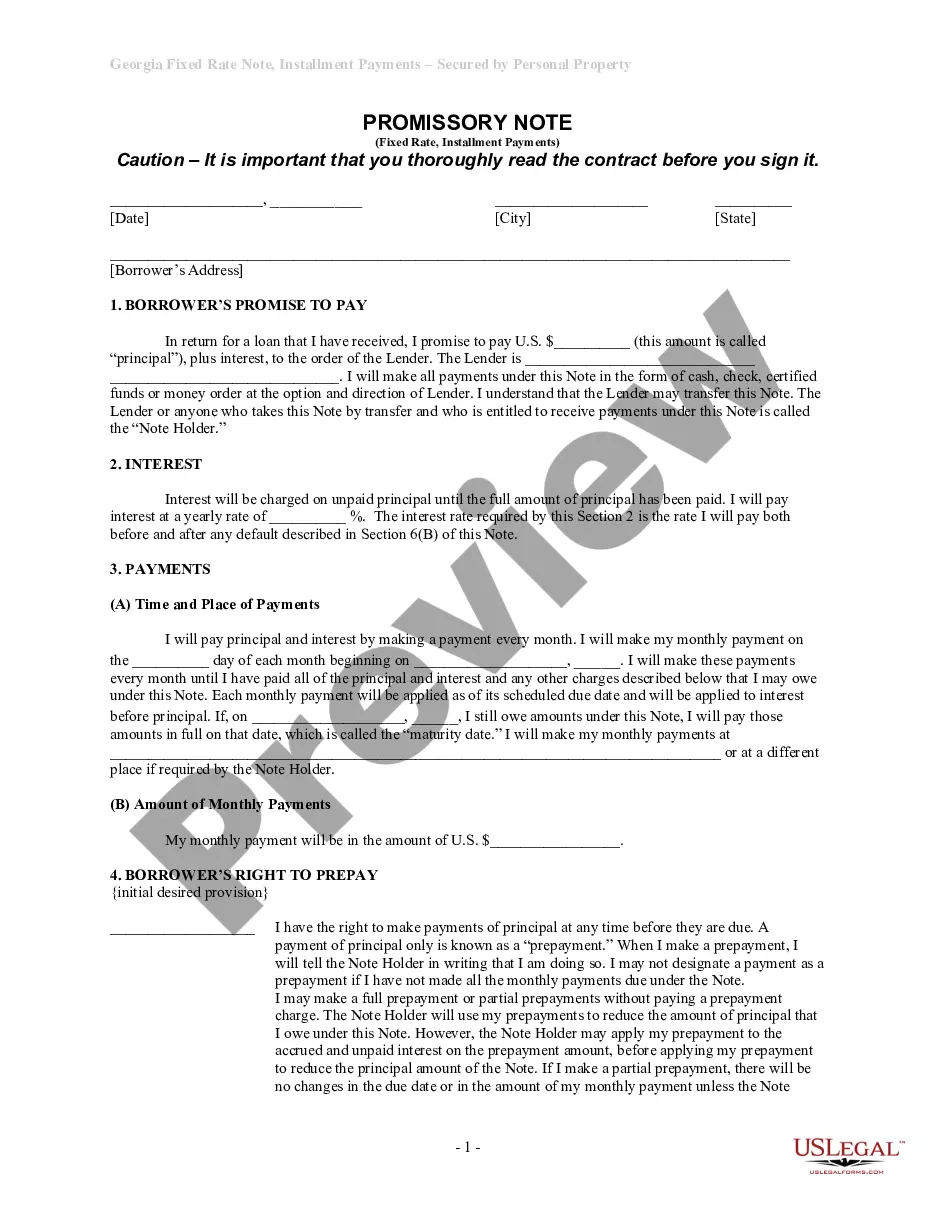

The Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that outlines a borrower's promise to repay a loan secured by commercial property. This type of promissory note specifies the repayment schedule, interest rates, and conditions under which the lender can enforce the note. It is distinct from other promissory notes due to its specific use of commercial real estate as collateral, making it suitable for business loans.

Key components of this form

- Borrower's promise to pay principal and interest, including payment details.

- Specified interest rate and payment schedule.

- Prepayment rights and conditions for reducing principal.

- Details about late charges and default provisions.

- Requirements for secure transactions involving commercial real estate.

- Notice procedures for payment and default situations.

When this form is needed

This form should be used when a borrower obtains a loan that is secured by commercial real estate. It applies when a financial institution or individual lender offers a loan specifically for purchasing or refinancing property used for business purposes. Typical scenarios include acquiring office buildings, retail spaces, or warehouses where the property itself guarantees the loan.

Who needs this form

- Business owners seeking to borrow funds secured by commercial real estate.

- Lenders who require a legal agreement to outline the terms of the loan.

- Real estate investors needing to formalize loan agreements for property investments.

- Entities engaged in transactions involving commercial properties.

Completing this form step by step

- Identify the borrower(s) and lender by entering their names and addresses.

- Specify the loan amount and interest rate that will apply to the principal.

- Enter the payment schedule, including the due date of the monthly installments.

- Include the rights related to prepayment if applicable.

- Detail any late fees or charges for overdue payments as per state law.

- Obtain signatures from all parties involved to finalize the agreement.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to complete all required fields, which can lead to disputes.

- Not understanding the implications of late fees and default provisions.

- Neglecting to update the parties involved if addresses change.

- Assuming no legal advice is needed; consulting with an attorney is advisable.

Why complete this form online

- Easy access: Download and complete the form from anywhere at any time.

- Editable: Fill in your specific information without needing to write by hand.

- Reliable: Templates are drafted by licensed attorneys to ensure legal compliance.

- Time-saving: This form can streamline the borrowing process and avoid legal delays.

Looking for another form?

Form popularity

FAQ

In Georgia, notarization of promissory notes is not strictly required, but it is highly recommended. Notarization adds an extra layer of legal protection and verifies the identities of the parties involved. For a Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, including notarization can strengthen your position in case of disputes.

A promissory note can be either secured or unsecured, depending on whether it is backed by collateral. In the case of a Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the note is secured by the property itself. This means that if the borrower defaults, the lender has a legal claim to the commercial real estate.

Yes, a properly executed promissory note can hold up in court. Courts generally enforce promissory notes that are clear and specific about the terms of the agreement. If you follow the guidelines and use a reliable resource like uslegalforms, your Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate will have legal standing.

To fill out a promissory note sample, begin by detailing the borrower's and lender's names, the principal amount, and the terms of repayment. Incorporate specifics such as interest rates and maturity dates to ensure clarity. Include a description of the commercial real estate that secures the note, as this is vital for enforcement. Using USLegalForms can simplify this process by offering clear samples and a straightforward framework tailored for the Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

In Georgia, a promissory note is typically not filed with a government office but is kept on record by the parties involved. However, if it is secured by real estate, you should file a deed of trust or mortgage in the county where the property is located. This filing protects the lender's interest in the property and supports the terms of a Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Filing correctly is crucial to uphold your rights under the agreement.

Yes, a promissory note can indeed be secured by real property. This is often done through a Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. By securing the note with property, lenders have an added layer of protection, which can make financing more accessible. Such arrangements are common in commercial real estate transactions and enhance security for all parties involved.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

A promissory note is a contract, a mortgage (in California a deed of trust) is a lien. The deed of trust would refer to the promissory note.