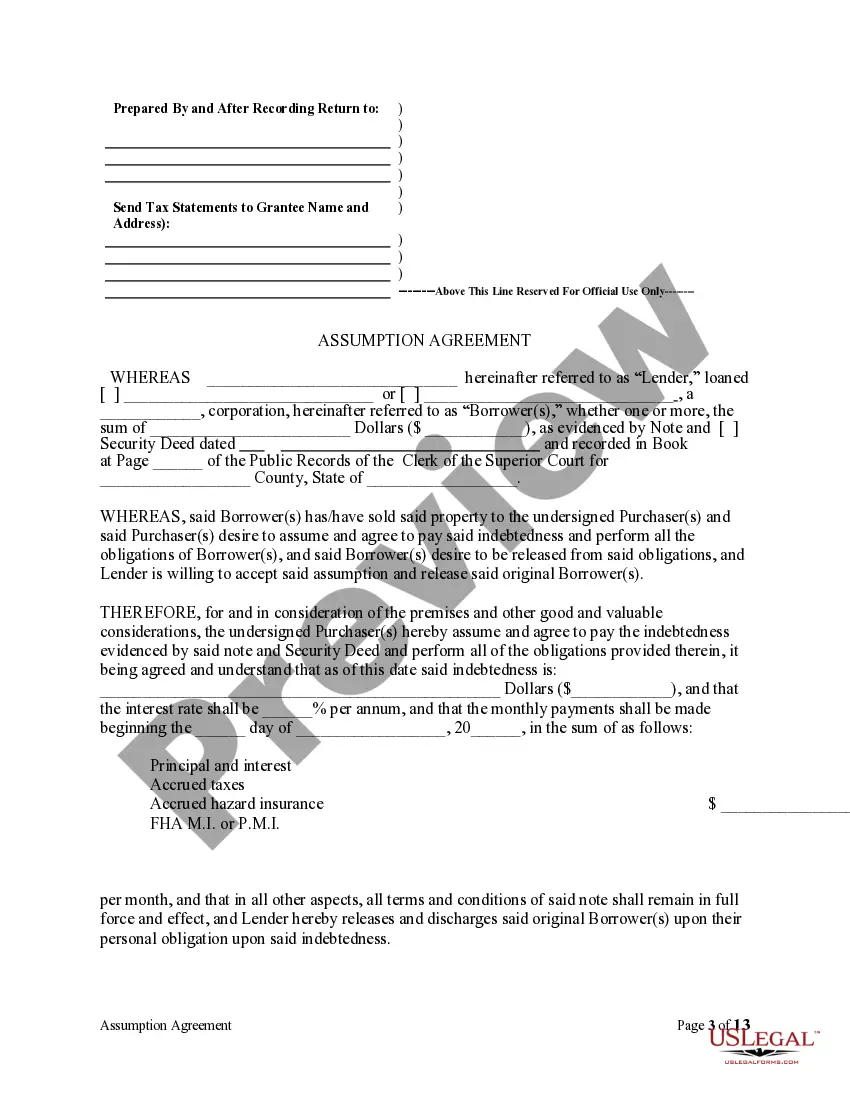

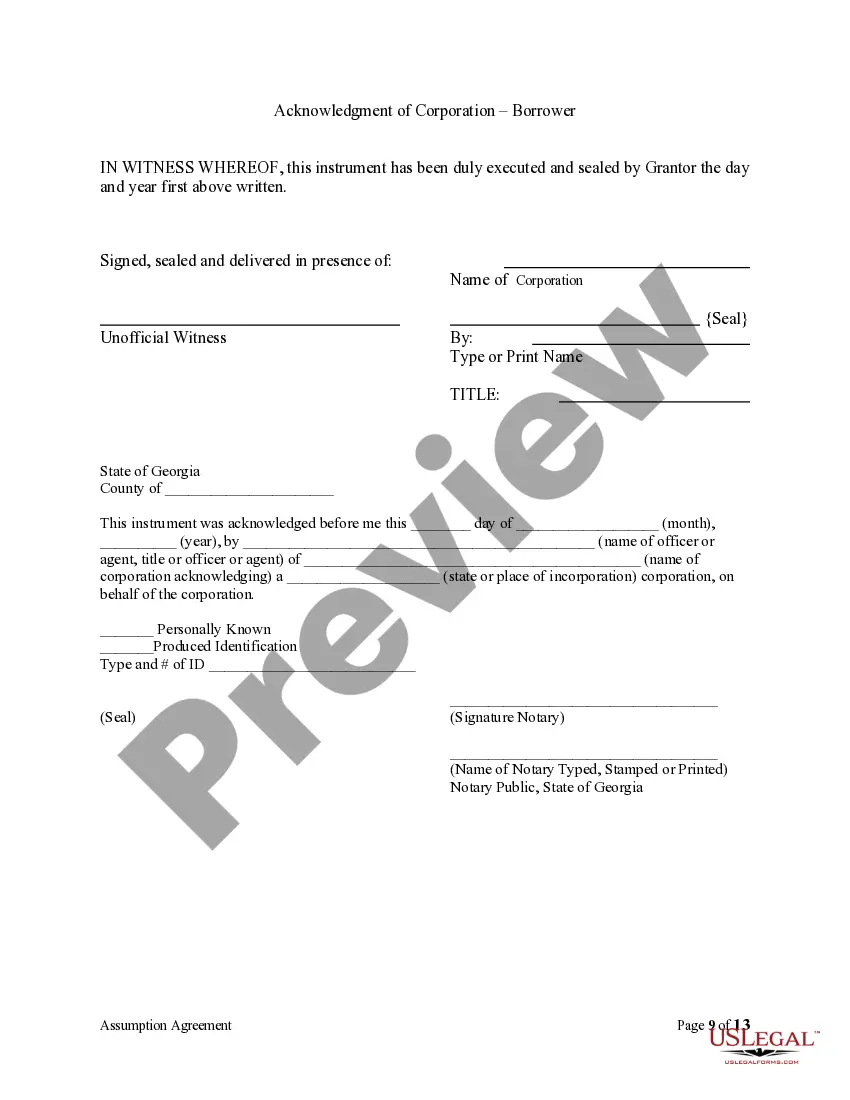

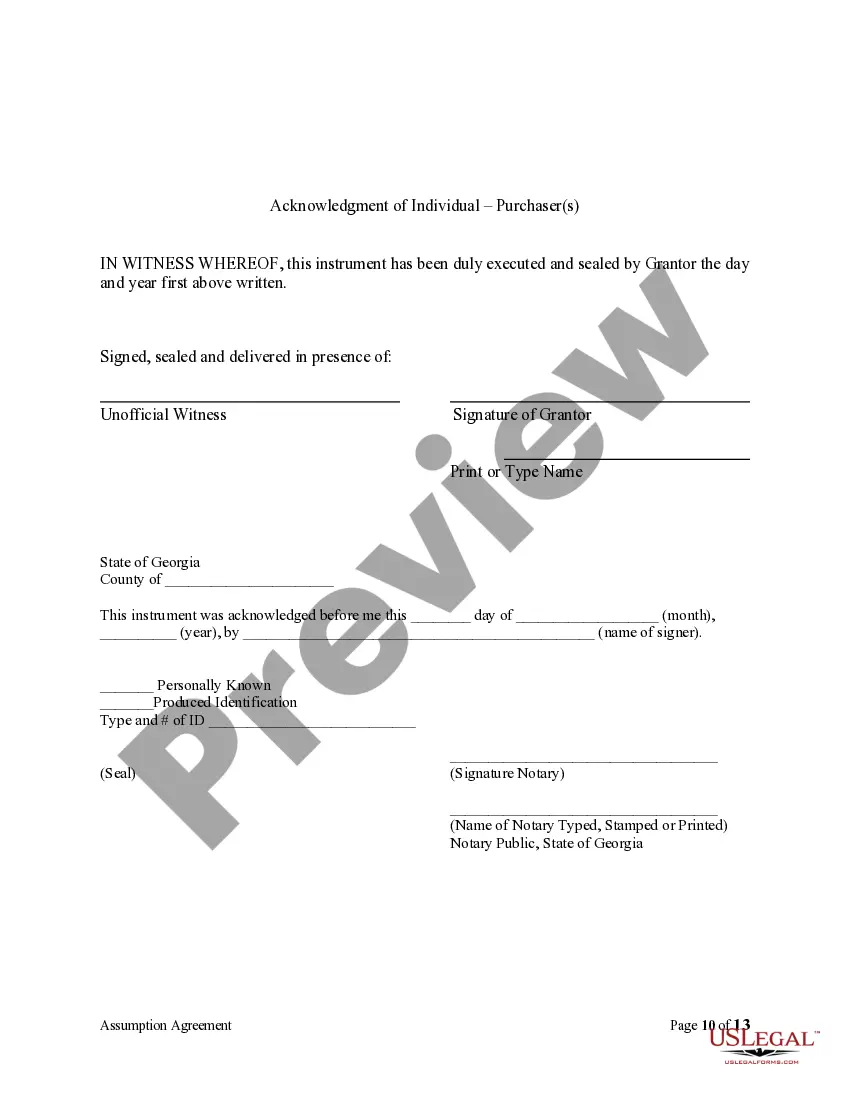

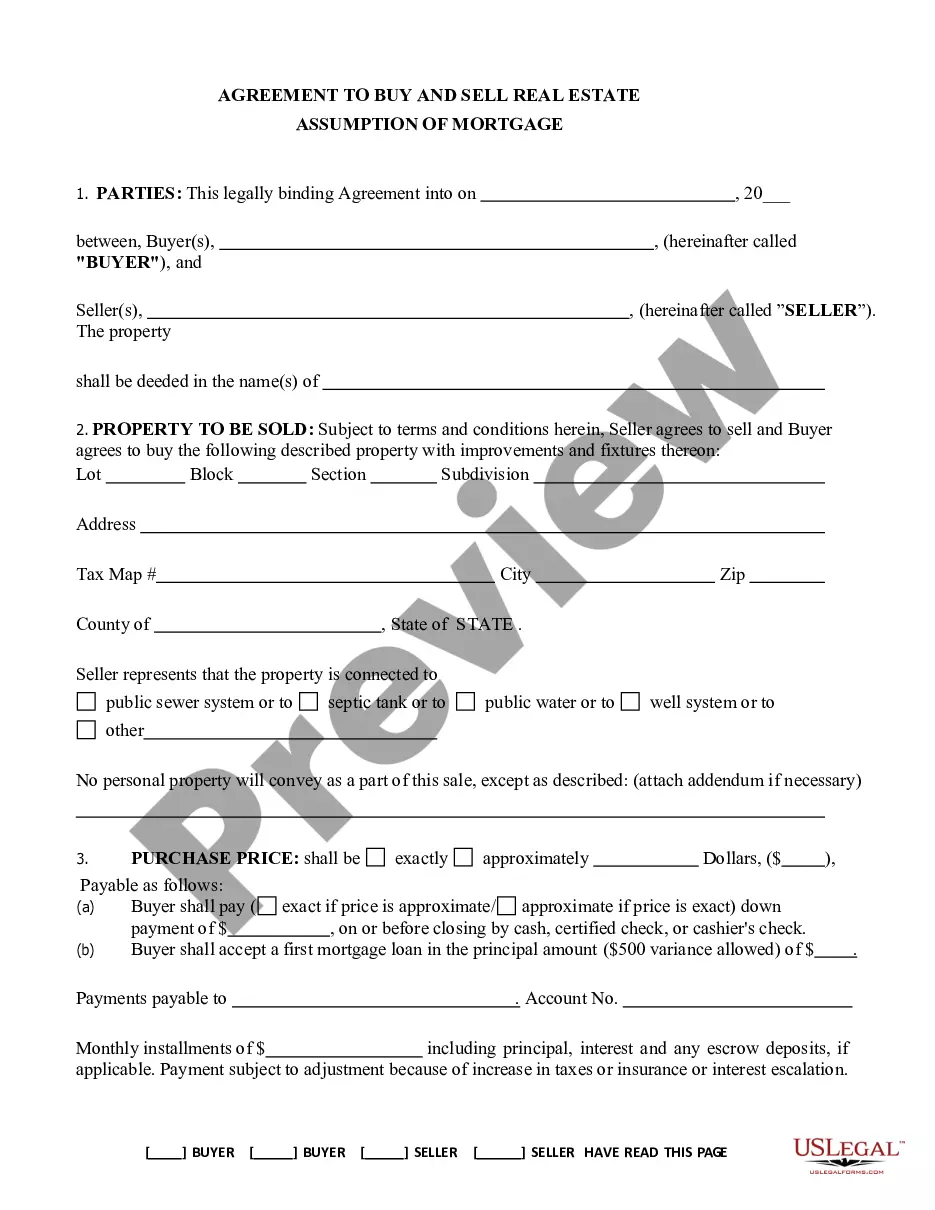

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors

Description

How to fill out Georgia Assumption Agreement Of Security Deed And Release Of Original Mortgagors?

Obtain entry to the largest collection of legal documents.

US Legal Forms serves as a platform where you can locate any state-specific document with a few clicks, including samples like the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors.

There's no need to invest hours searching for a court-acceptable example. Our certified experts guarantee that you receive current samples each time.

After selecting a pricing plan, create an account. Pay with a credit card or PayPal. Download the sample to your computer by clicking Download. That's it! You should complete the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors form and check it. To ensure everything is precise, consult your local legal advisor for assistance. Register and easily find approximately 85,000 useful samples.

- To utilize the forms library, choose a subscription and establish an account.

- If you have done so, just Log In and click on the Download button.

- The template for the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors will be instantly saved in the My documents tab (the section for all forms you download from US Legal Forms).

- To create a new account, follow the simple instructions below.

- If you plan to use state-specific documents, ensure you indicate the correct state.

- If available, review the description to understand all the details of the form.

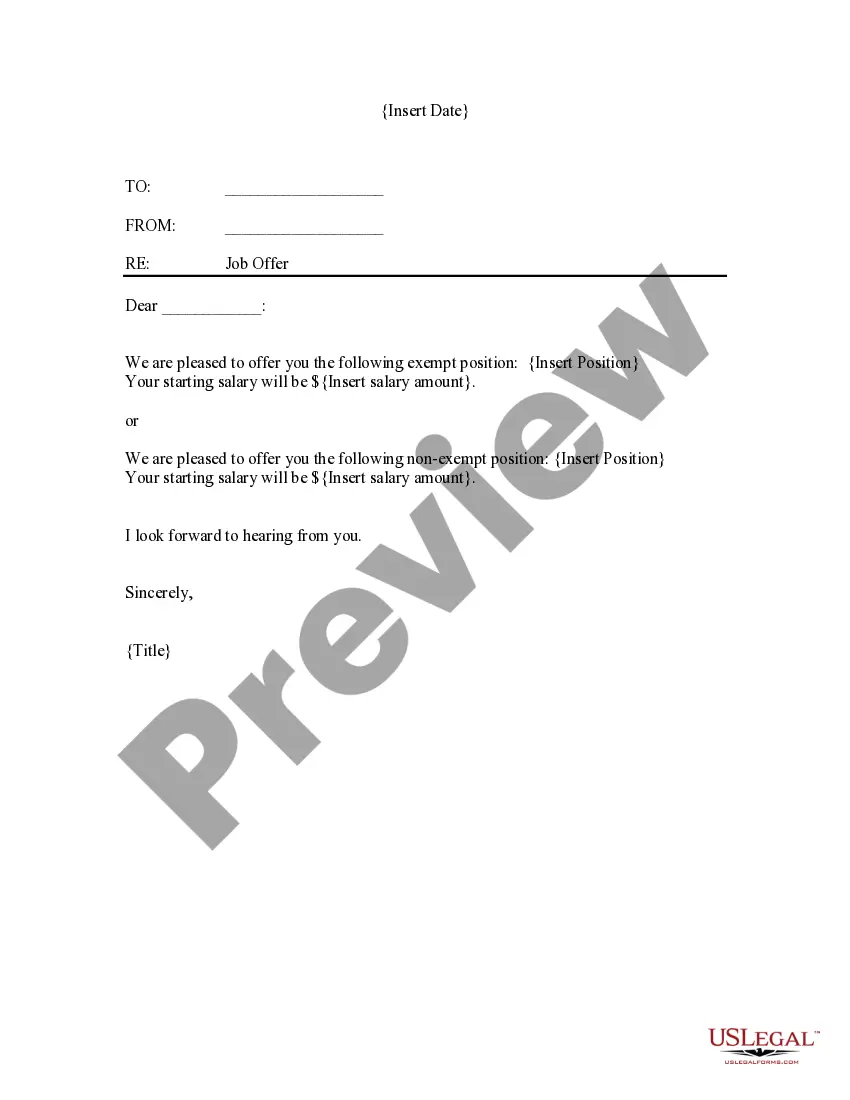

- Utilize the Preview feature, if accessible, to verify the document's details.

- If everything is correct, click Buy Now.

Form popularity

FAQ

To obtain a deed to your property in Georgia, you must first ensure that the current deed is legally recorded with the county in which the property is located. You can visit the local county clerk's office or their website to access property records. If you are executing a Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors, this legal document may provide additional clarity and ownership details. For easy access to forms and guidance, consider using USLegalForms, which can simplify the process for you.

An assumption and release agreement allows a new borrower to take over the existing mortgage responsibilities of the original borrower. This agreement typically involves the original mortgagor being released from financial obligations once the new borrower assumes the mortgage. In the context of the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors, this type of agreement can facilitate a smoother transition when transferring property ownership.

In a warranty deed, the parties involved typically include the grantor and the grantee. The grantor is the person or entity transferring the property, while the grantee is the one receiving it. When considering the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors, understanding the roles of these parties is essential for a smooth transaction.

For a deed to be valid in Georgia, it must include essential elements like proper identification of the parties, adequate description of the property, and the signatures of the parties involved. Notarization is also a key component, ensuring the authenticity of the document. Understanding these elements is vital, and the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors can guide you through the validity requirements.

False. In Georgia, a deed can be valid even if it is not recorded; however, unrecorded deeds lack the protection afforded by public notice. Without recording, your ownership might be challenged by other parties. The Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors highlights the critical benefits of recording your deed.

To prove a deed is invalid in Georgia, you typically need to demonstrate that it failed to meet legal requirements, such as lacking proper signatures or notarization. Additionally, discrepancies in the execution or any violations of state laws can also render a deed invalid. Engaging with the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors can provide clarity in such challenging situations.

In Georgia, a deed does not necessarily need to be recorded to be valid, but recording it provides legal protection. A recorded deed gives public notice of ownership, which secures your claim against any legal challenges. The Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors can assist you in understanding the importance of recording your deed.

In Georgia, you should record a deed as soon as possible, ideally within 30 days of signing. Recording the deed timely helps protect your interest in the property and streamlines any future transactions involving the property. With the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors, you can navigate these timelines more comfortably.

To release a deed in Georgia, you need to complete a release form that acknowledges the satisfaction of the debt associated with the security deed. This release form must be signed and notarized before being filed with the county clerk’s office. Using the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors simplifies this process, ensuring you fulfill all legal requirements efficiently.

You can find the title deed to your house by visiting the local county recorder's office or the registry of deeds. Many counties also offer online databases where you can search for your property details by address or owner's name. If you encounter difficulties locating your deed, utilizing platforms like USLegalForms can provide you with easy access to relevant documentation, including the Georgia Assumption Agreement of Security Deed and Release of Original Mortgagors.