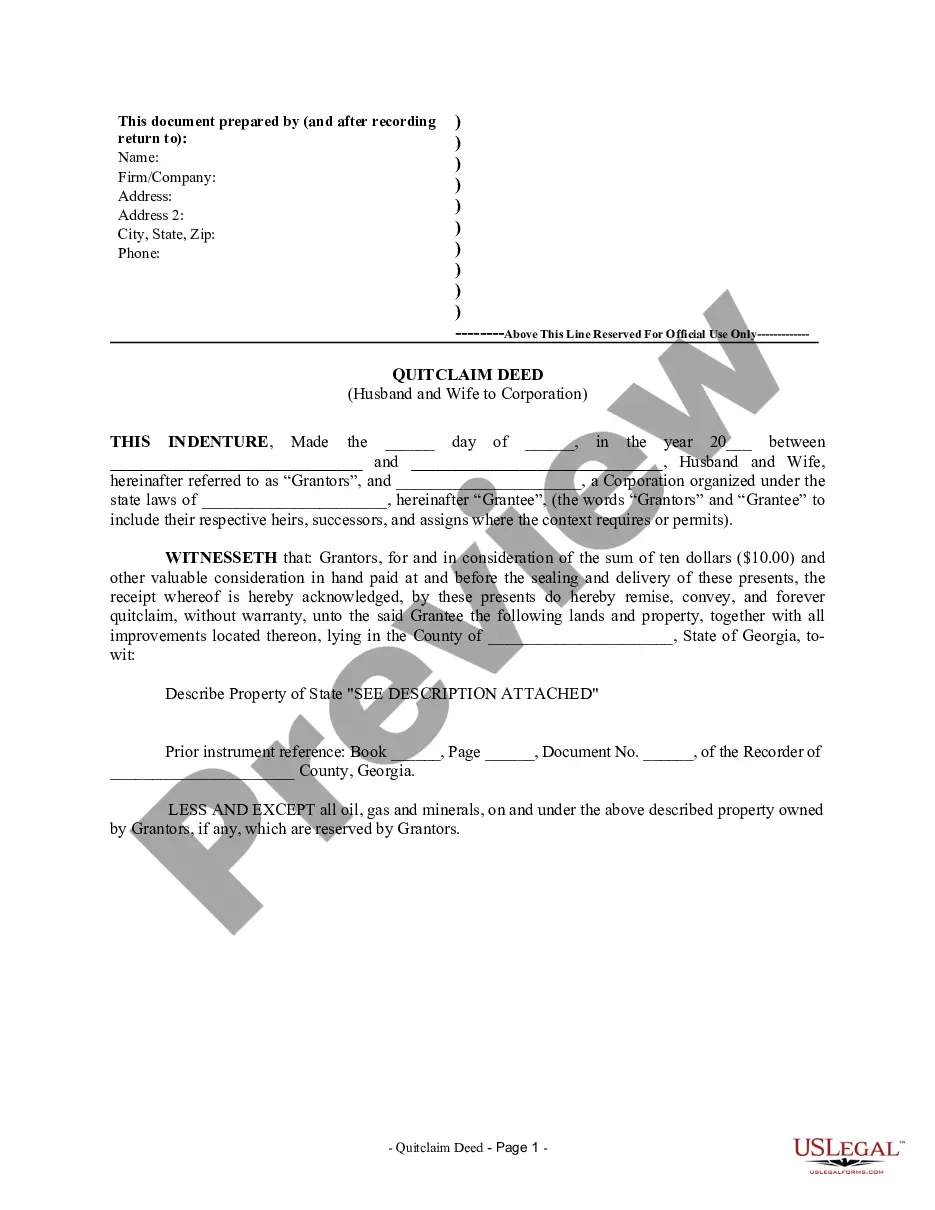

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Georgia Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Georgia Quitclaim Deed From Husband And Wife To Corporation?

Access the largest collection of legal documents.

US Legal Forms is essentially a site where you can locate any form specific to your state in just a few clicks, like the Georgia Quitclaim Deed from Husband and Wife to Corporation examples.

There's no need to waste several hours attempting to find a court-admissible template.

After selecting a pricing plan, create your account. Make payment via card or PayPal. Download the document to your computer by clicking Download. That's it! You need to complete the Georgia Quitclaim Deed from Husband and Wife to Corporation form and review it. To ensure accuracy, reach out to your local legal advisor for assistance. Register and effortlessly browse over 85,000 useful forms.

- To utilize the document library, select a subscription and create your account.

- Once you have done that, simply Log In and click on Download.

- The Georgia Quitclaim Deed from Husband and Wife to Corporation file will automatically be stored in the My documents section (a section for all forms you download from US Legal Forms).

- To create a new account, follow the simple instructions below.

- If you plan to use a state-specific template, ensure you select the correct state.

- If possible, review the description to understand all details of the document.

- Utilize the Preview option if it’s accessible to examine the information of the document.

- If everything is correct, click Buy Now.

Form popularity

FAQ

To execute a Georgia Quitclaim Deed from Husband and Wife to Corporation, both spouses must sign the deed in front of a notary public. Then, you should file the signed deed with the county's clerk of court where the property is located. It is essential to ensure the deed clearly identifies both the grantors and the corporation as the grantee. Using a platform like US Legal Forms can simplify this process, providing the necessary forms and guidance for a smooth execution.

If your name is not on a deed in Georgia, your rights depend on various factors, including marital property laws. Generally, Georgia follows the principle of equitable distribution, meaning both spouses have rights to marital assets, irrespective of whose name appears on the deed. However, to protect your interests, you may want to consider a Georgia quitclaim deed from husband and wife to corporation to clarify ownership. Consulting with a legal professional can provide clearer guidance tailored to your specific situation.

A spouse might opt for a quitclaim deed to transfer property for various reasons. This can include simplifying ownership, consolidating assets, or adjusting ownership due to changes in marital status. When two spouses execute a Georgia quitclaim deed from husband and wife to corporation, they can streamline property management and potentially enhance tax benefits. Overall, this serves as a practical method for reorganizing property ownership.

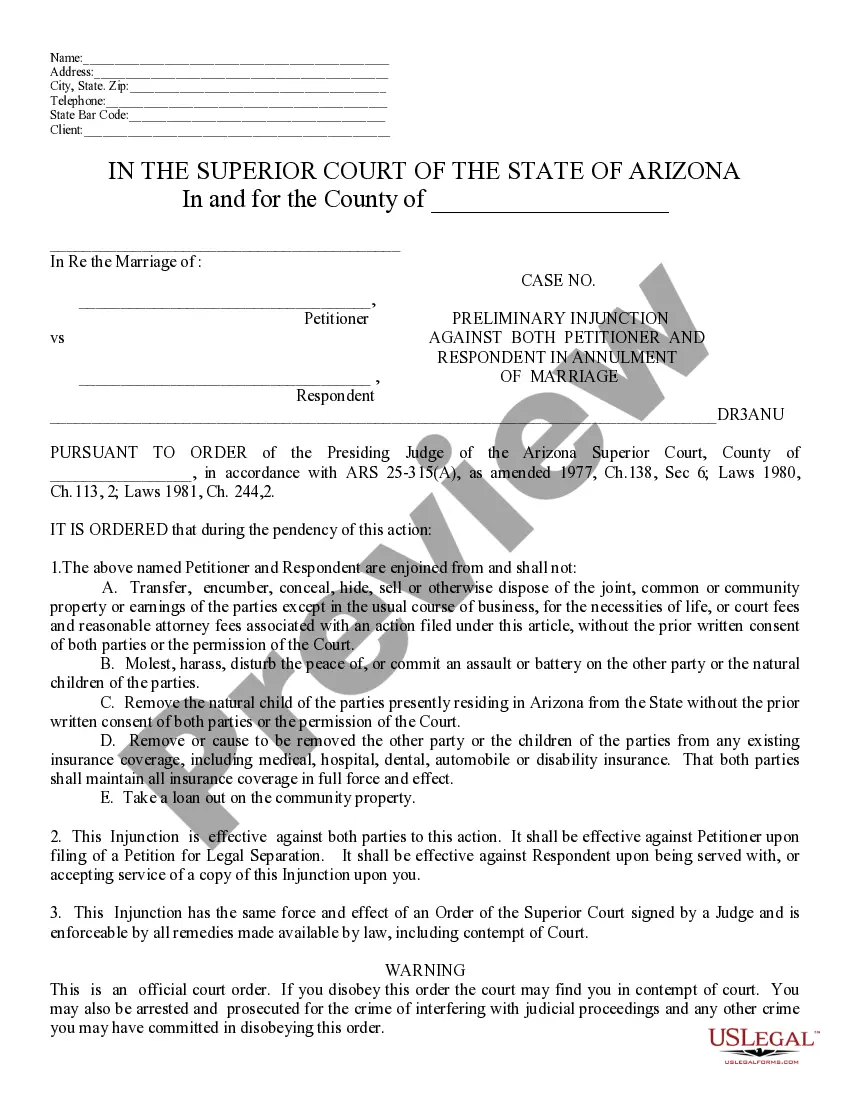

A quitclaim deed with right of survivorship in Georgia allows a husband and wife to jointly own property, ensuring that if one spouse passes away, the other automatically inherits the property. This type of deed avoids probate complications and simplifies the transfer process. When transferring to a corporation, it's crucial to note that this right can change when ownership shifts. Therefore, understanding the implications is essential for effective estate planning.

To create a valid quitclaim deed in Georgia, you need several key components. First, the deed must include the names of both the grantors and the grantee, which, in this case, would be the husband and wife and the corporation, respectively. Additionally, you must describe the property accurately and have both parties sign the deed in front of a notary. Lastly, filing the deed with the county clerk is vital to ensuring public record of the transfer.

In Georgia, a quitclaim deed allows one party to transfer their interest in a property to another. When a husband and wife execute a quitclaim deed to a corporation, they relinquish all claims to the property. This type of deed offers a straightforward method for property transfer, focusing on the rights of the parties involved rather than warranties of title. By using this approach, the process remains fast and uncomplicated.

A quitclaim deed primarily benefits the parties involved in transferring property ownership. In the context of a Georgia quitclaim deed from husband and wife to corporation, the corporation gains clear title to the property. Additionally, the spouses can simplify their estate planning and asset management. This can be especially beneficial if they aim to transfer property quickly without the complexities of other deed types.

Filling out a quitclaim deed in Georgia is straightforward. Start by obtaining the Georgia Quitclaim Deed from Husband and Wife to Corporation form. Note the property description, names of the parties involved, and their signatures. Remember to have the document notarized and file it with the county clerk to make the transfer official. You can simplify this process by using the resources available on the uslegalforms platform.

Adding a spouse to a deed can be considered a gift if the property transfer occurs without expecting anything in return. In the case of a Georgia Quitclaim Deed from Husband and Wife to Corporation, if you transfer ownership solely to include your spouse, it may be viewed as a gift for tax purposes. It's wise to consult a tax advisor to understand any potential gift tax implications that might arise from this transfer.

You can add your spouse to your deed without refinancing by using a Georgia Quitclaim Deed from Husband and Wife to Corporation. This process allows you to transfer ownership without modifying your mortgage. Simply complete the quitclaim deed with your spouse's information and file it with the county recorder. This ensures your spouse gains an interest in the property without the need for a costly refinance.