Florida Special Durable Power of Attorney for Bank Account Matters

What this document covers

The Special Durable Power of Attorney for Bank Account Matters is a legal document that allows you to authorize an agent to manage specific bank account transactions on your behalf. This form is distinct from a general power of attorney as it limits the agent's authority strictly to bank-related matters, such as making deposits, writing checks, and opening accounts. By executing this form, you ensure that your financial affairs can be properly handled in case you become unavailable or incapacitated.

What’s included in this form

- Identification of the principal and the agent.

- Designated bank and account details for transaction authorization.

- Specific powers granted to the agent regarding banking activities.

- Initialing specific powers that the agent is authorized to exercise.

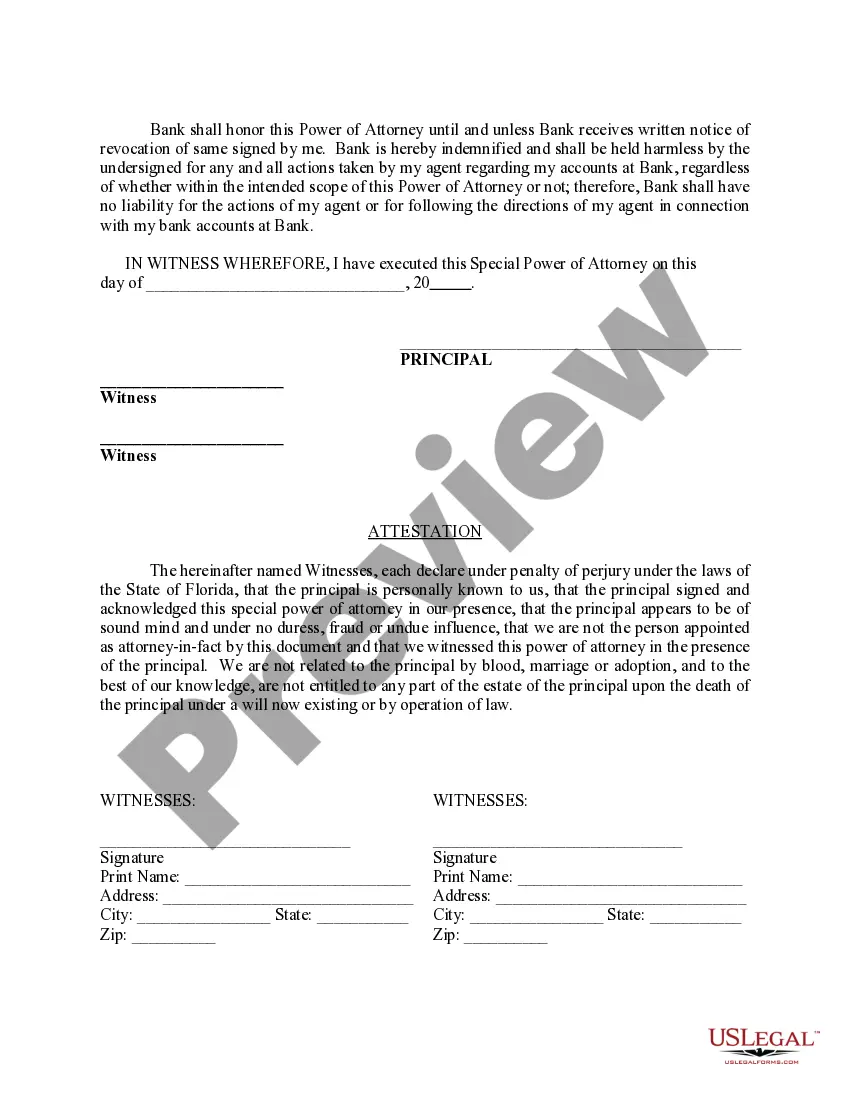

- Witness and notary signature requirements for legal validity.

Situations where this form applies

You should use this Special Durable Power of Attorney for Bank Account Matters when you need someone else to manage your bank accounts while you are unavailable, whether due to travel, illness, or other reasons. This form is particularly useful for individuals who may face temporary or permanent incapacitation and want to ensure their financial affairs are managed according to their wishes.

Intended users of this form

- Individuals who want to delegate authority for banking matters to a trusted person.

- Those who anticipate potential incapacity and need someone to manage their finances.

- Individuals who wish to limit their agentâs powers strictly to banking activities.

Completing this form step by step

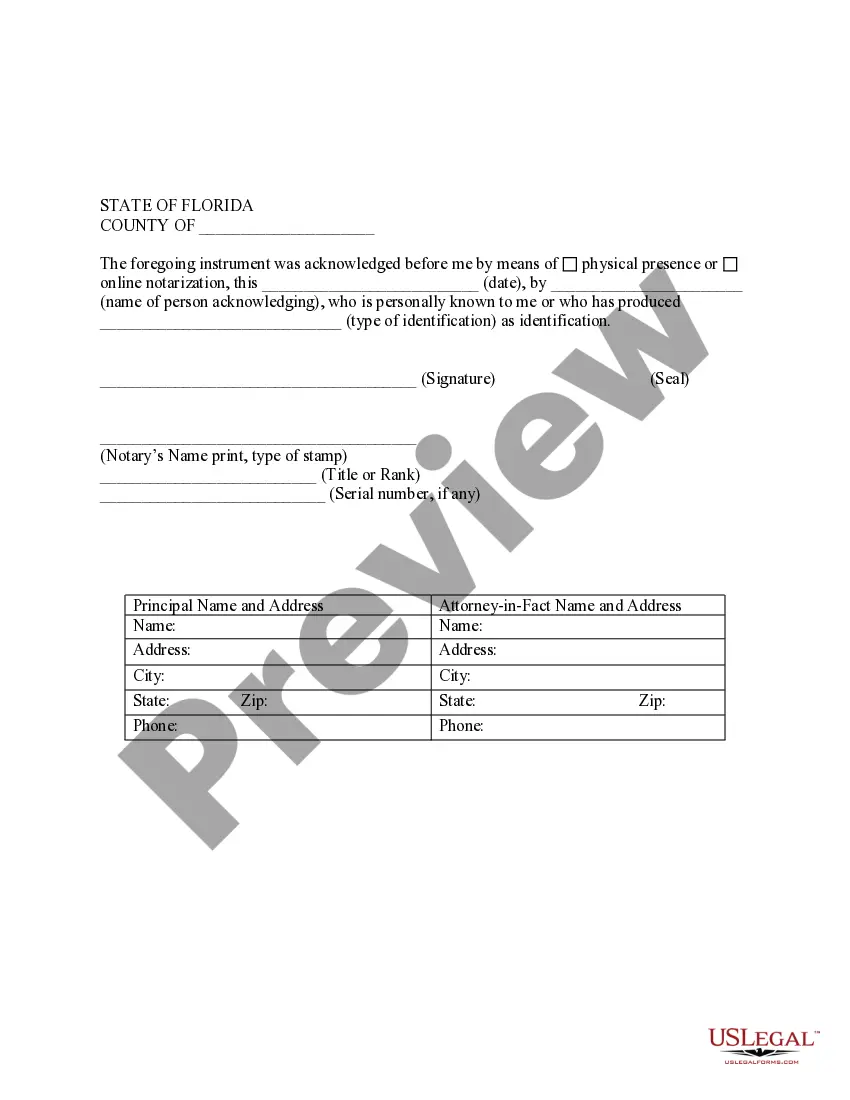

- Identify and provide your name and address as the principal.

- Fill in the name and address of your chosen agent.

- Specify the name and address of the bank and the nature of the accounts involved.

- Review and initial the specific powers you wish to grant the agent.

- Sign the document in the presence of witnesses and a notary public.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes

- Failing to provide complete information about the agent or bank accounts.

- Not initialing specific powers that the agent is intended to exercise.

- Neglecting to have the document properly witnessed and notarized.

Benefits of using this form online

- Convenience of completing and downloading the form instantly.

- Editability to tailor the form according to your specific needs.

- Access to reliable, attorney-drafted templates for legal peace of mind.

Form popularity

FAQ

POA stands for Power of Attorney, which allows someone to manage your bank account matters on your behalf. When you designate someone with a Florida Special Durable Power of Attorney for Bank Account Matters, they can access, withdraw, and handle funds in your account according to your instructions. This designation adds convenience and ensures that essential financial decisions can still be made even if you are unable to do so yourself. Knowing who has this authority can provide peace of mind for both you and your designated agent.

In Florida, a durable power of attorney does not have to be recorded to be valid, but recording it can offer additional benefits. By recording, the document becomes part of the public record, which can help avoid disputes. When it comes to managing your bank account matters, establishing a Florida Special Durable Power of Attorney for Bank Account Matters provides clarity to all parties involved. This way, you ensure that your intentions are clear and legally recognized.

Yes, a power of attorney can handle bank accounts on your behalf. The document, particularly a Florida Special Durable Power of Attorney for Bank Account Matters, gives your designated agent the authority to manage your financial affairs, including banking transactions. This empowerment is crucial, especially in emergencies or when you are unable to manage your accounts. Utilizing US Legal Forms can help you create this essential document accurately and efficiently.

Yes, you can grant a family member access to your bank account through a durable power of attorney. When you create a Florida Special Durable Power of Attorney for Bank Account Matters, you specify the authority you wish to give them. This arrangement allows your family member to manage financial tasks on your behalf if you become incapacitated. Using US Legal Forms can simplify the process of drafting this specific document to ensure all aspects are covered.

While hiring a lawyer for a durable power of attorney in Florida is not mandatory, it is often beneficial. A legal professional can clarify your options and ensure that the document, especially a Florida Special Durable Power of Attorney for Bank Account Matters, adheres to state laws. This guidance can prevent misunderstandings later on. Accessing resources through US Legal Forms can also help simplify the process and provide you with essential information.

Yes, you can write your own power of attorney letter in Florida. However, creating a legally binding document, such as a Florida Special Durable Power of Attorney for Bank Account Matters, requires careful attention to specific requirements set by state law. It is advisable to ensure the document meets all legal standards to avoid potential complications in the future. Using platforms like US Legal Forms can provide you with templates and guidance for drafting a comprehensive power of attorney.

While a Florida Special Durable Power of Attorney allows for efficient management of your bank account matters, there are potential disadvantages to consider. One major concern is the risk of misuse if the agent acts against the principal's interests. It's vital to choose a trustworthy individual as your agent. Understanding these risks can help you make informed decisions about your financial planning.

Yes, a Florida Special Durable Power of Attorney for Bank Account Matters specifically allows designated agents to manage bank accounts on behalf of the principal. This includes tasks such as accessing funds, making deposits, and managing transactions within those accounts. It's essential to clearly state these powers in the document to avoid any confusion. Using a reputable service like uslegalforms can help you tailor a POA to fit your needs.

In Florida, a durable power of attorney cannot make decisions related to certain matters such as health care, marriage, or divorce—unless explicitly authorized. It also does not extend to decisions about a principal's retirement accounts unless specifically included. Awareness of these restrictions can help you plan effectively. By using uslegalforms, you can create a well-defined POA that covers all necessary aspects.

A legal power of attorney typically cannot make decisions regarding the principal's will, gifting property beyond a certain value without explicit authorization, or health care decisions if a separate document is not in place. These limitations ensure that certain personal rights remain protected. It's important to understand the scope of your Florida Special Durable Power of Attorney for Bank Account Matters. Knowing these limits can help prevent misunderstandings.