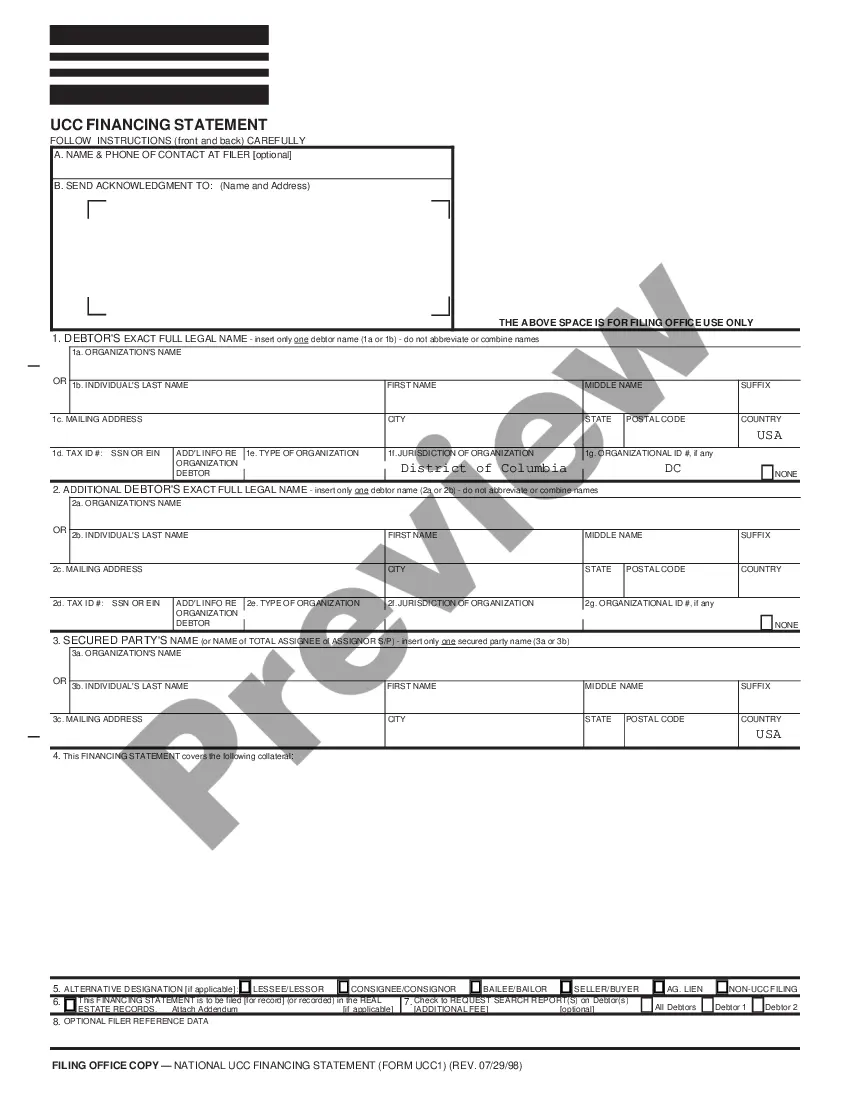

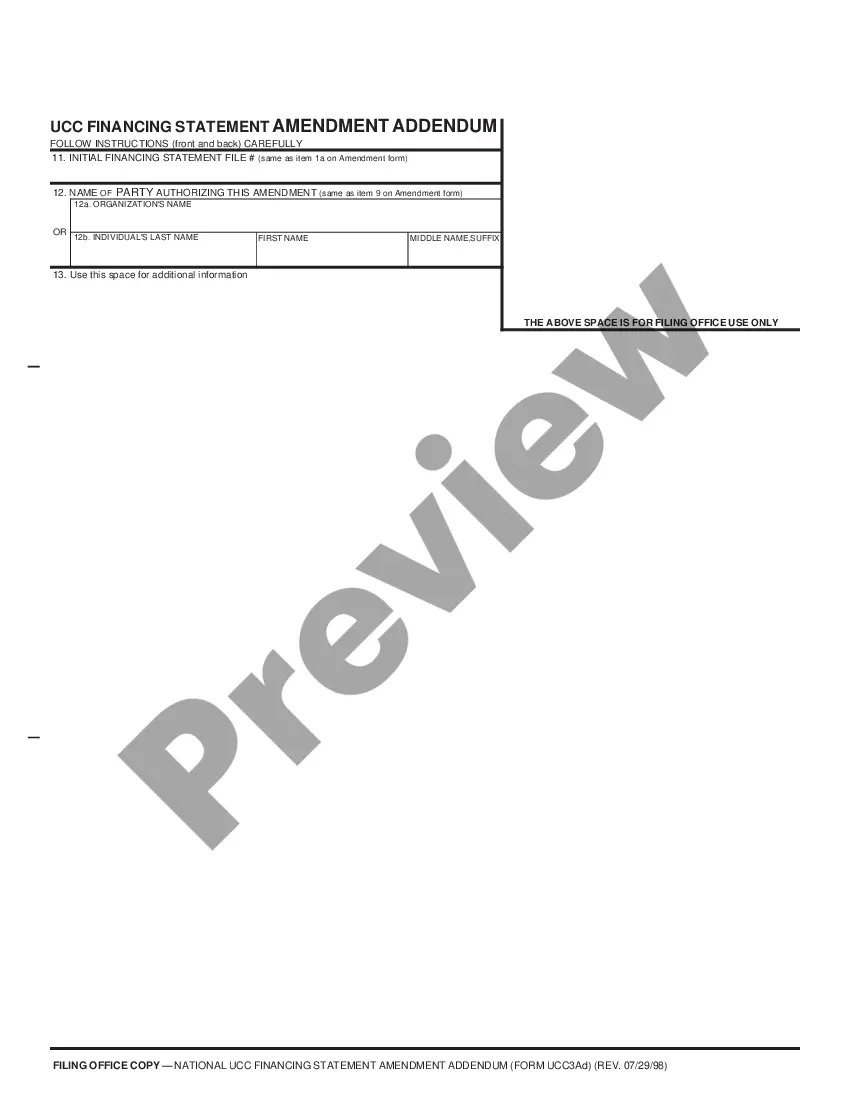

Financing Statement Addendum form for adding information to a Financing Statement filed with the District of Columbia filing office.

District of Columbia UCC1 Financing Statement Addendum

Description

How to fill out District Of Columbia UCC1 Financing Statement Addendum?

The greater number of documents you need to compile, the more uneasy you become.

You can acquire countless District of Columbia UCC1 Financing Statement Addendum templates on the internet, yet you remain uncertain about which ones to trust.

Remove the complexity and simplify obtaining samples with US Legal Forms.

Proceed by clicking on Buy Now to initiate the registration process and select a pricing plan that suits your needs. Provide the necessary information to create your account and complete the payment for your order using PayPal or a credit card. Select your preferred file format and obtain your copy. Locate every sample you download in the My documents section. Visit there to complete a new copy of the District of Columbia UCC1 Financing Statement Addendum. Even when using professionally drafted templates, it is still advisable to consider consulting a local attorney to verify that your submitted form is accurately filled out. Achieve more while spending less with US Legal Forms!

- Obtain accurately prepared forms that are crafted to adhere to state regulations.

- If you currently hold a US Legal Forms subscription, Log In to your account, and you will find the Download button on the District of Columbia UCC1 Financing Statement Addendum page.

- If this is your first time using our website, complete the registration process with the following instructions.

- Ensure that the District of Columbia UCC1 Financing Statement Addendum is applicable in your state.

- Confirm your choice by reviewing the description or utilizing the Preview option if available for the chosen file.

Form popularity

FAQ

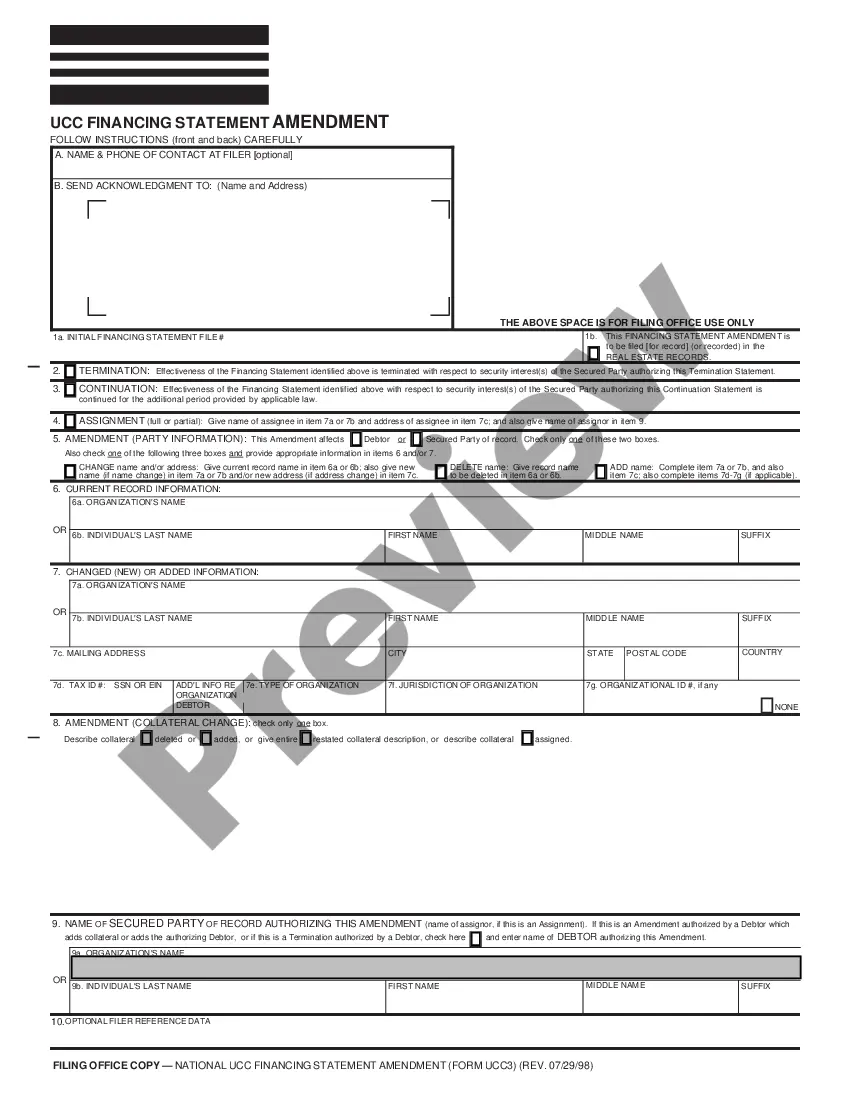

To remove a UCC financing statement, you need to file a UCC termination statement, commonly referred to as a UCC3 form. This statement must refer to the original UCC filing, and you should adhere to the instructions laid out in the District of Columbia UCC1 Financing Statement Addendum. Once you complete the form, submit it to the Secretary of State’s office with any associated fees. This will effectively remove the financing statement from public records.

1 financing statement requires specific details, including the debtor's name, the secured party's name, and a description of the collateral. Ensure that all information aligns with the District of Columbia UCC1 Financing Statement Addendum. It's important to follow state regulations for formatting and submission. Meeting these requirements will facilitate a smoother filing process.

To file a UCC-3 financing statement amendment to terminate your SBA lien, you must complete the UCC-3 amendment form. Be sure to include the original UCC filing information and explicitly state the intention to terminate, following the guidelines outlined in the District of Columbia UCC1 Financing Statement Addendum. Submit this form along with any associated fees to your Secretary of State. This will officially update the public record.

Filing a UCC3 termination requires you to use the UCC3 form specifically designed for this purpose. Fill out the form accurately, ensuring it references the original UCC filing, as outlined in the District of Columbia UCC1 Financing Statement Addendum. After completing the form, submit it directly to the appropriate Secretary of State. This action will help remove any non-existing liens on your assets.

Requesting a UCC termination involves completing the necessary UCC termination statement. You need to specify the original UCC filing details in accordance with the District of Columbia UCC1 Financing Statement Addendum. After filling out the termination statement, submit it to your Secretary of State along with any required fees. This process will clear the lien associated with the original statement.

To fill out the UCC financing statement, begin by gathering necessary information, such as the debtor's name, address, and details about the secured party. Ensure you include all required information in accordance with the District of Columbia UCC1 Financing Statement Addendum. It's crucial to review your completed form for errors. Once verified, submit the document to your local Secretary of State office.

UCC financing statements should be filed in the jurisdiction where the debtor is located. For entities based in the District of Columbia, this means submissions must go to the local Department of Consumer and Regulatory Affairs. This filing is crucial for establishing a valid and enforceable security interest. Services like USLegalForms can guide you through filing to ensure accuracy and compliance with legal requirements.

In the District of Columbia, UCC financing statements are filed at the Department of Consumer and Regulatory Affairs. This office manages the recording and retrieval of UCC documents, ensuring they are publicly accessible. When dealing with the District of Columbia UCC1 Financing Statement Addendum, filing there protects your claim and upholds legal standards. Always check specific requirements for complete and accurate submissions.

UCC liens are recorded at the state or district level, specifically at the office handling UCC filings. For those in the District of Columbia, this would be the Department of Consumer and Regulatory Affairs. Recording your UCC lien properly is critical, as it offers public notice and protects your security interests. Ensuring compliance with these requirements increases your credibility in the eyes of lenders.

Obtaining a copy of a UCC filing is straightforward. You can request it from the office where the original filing was made, such as the Department of Consumer and Regulatory Affairs in DC. Alternatively, using services like USLegalForms can simplify this process, providing access to copies of UCC filings without the hassle of navigating the public records system. It's essential to keep a copy for your records.