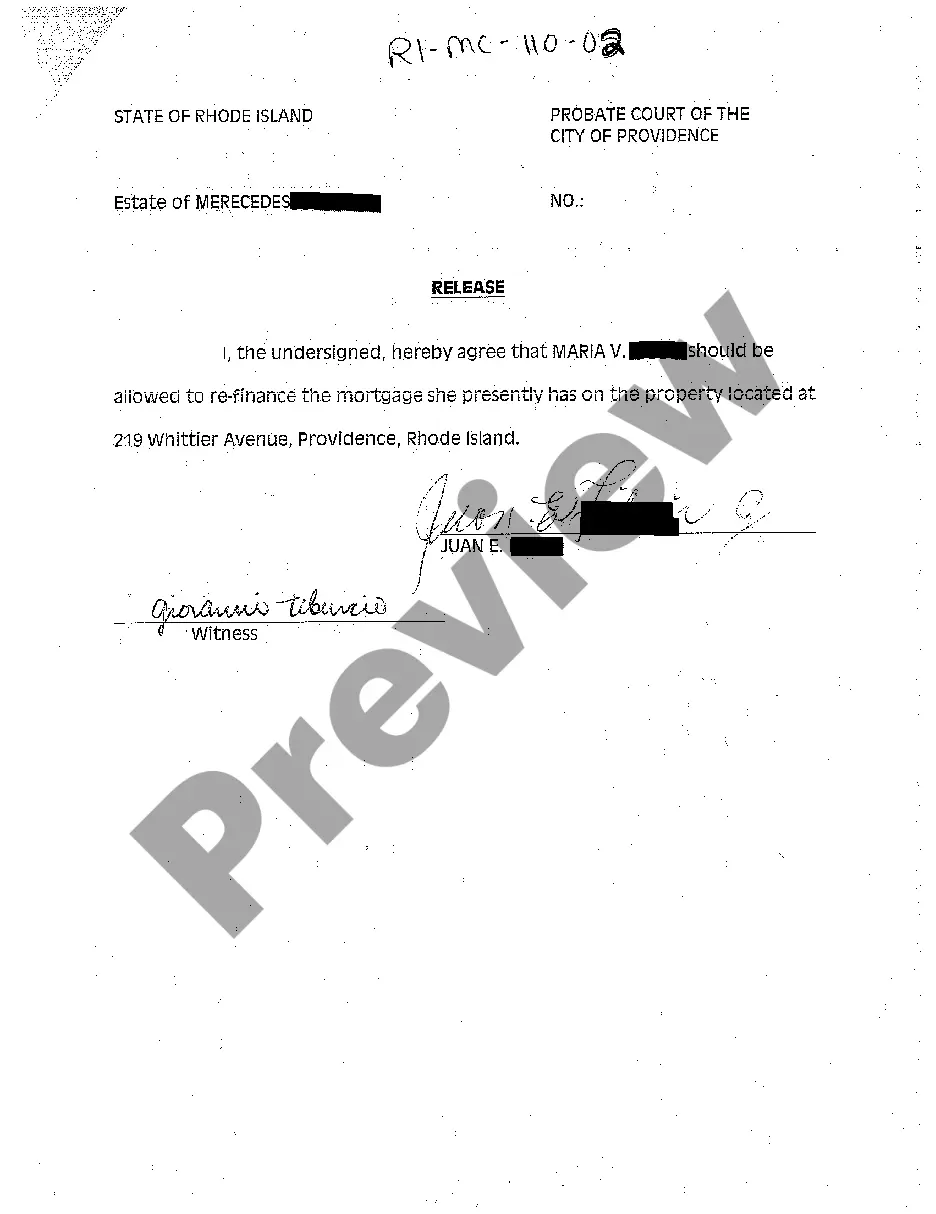

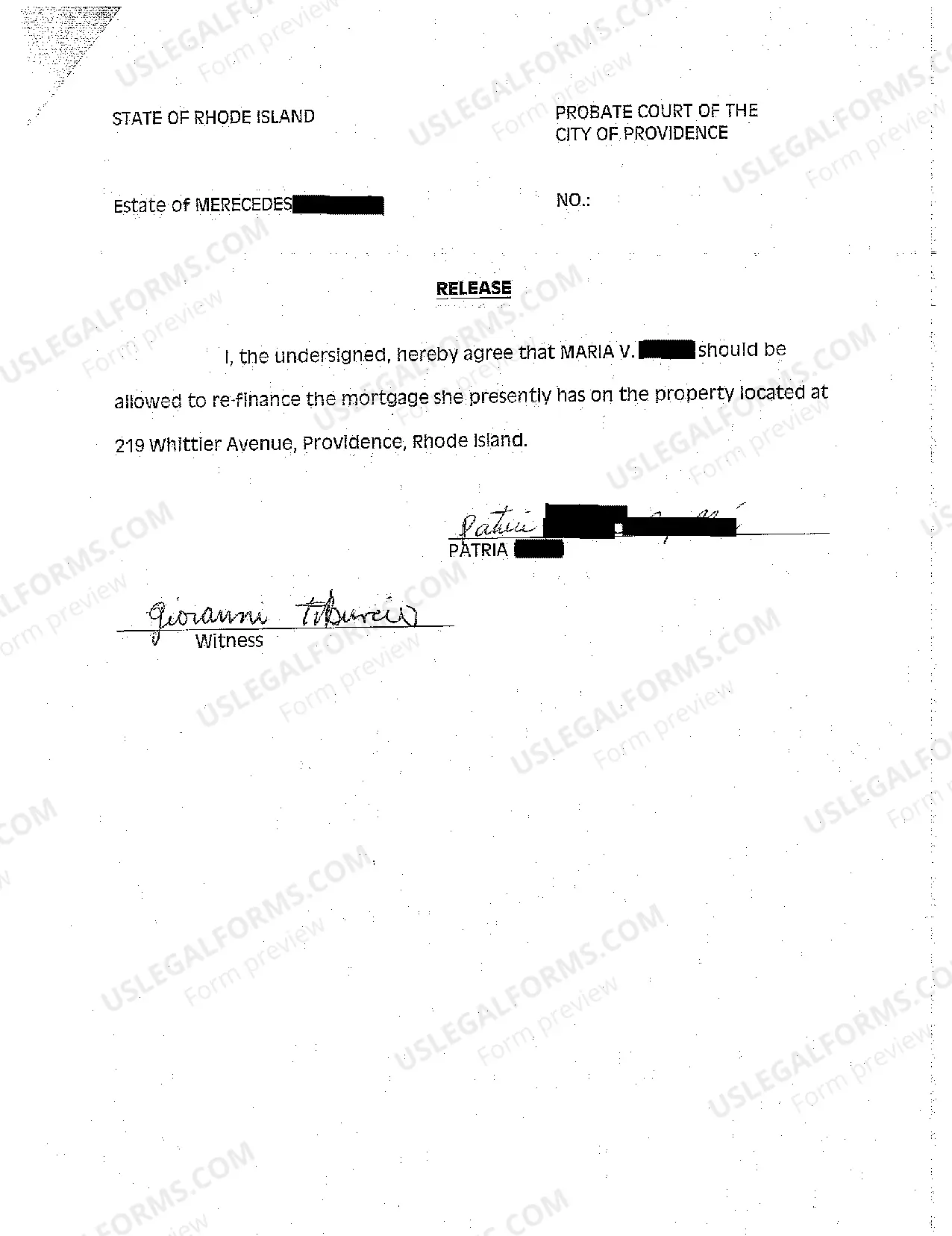

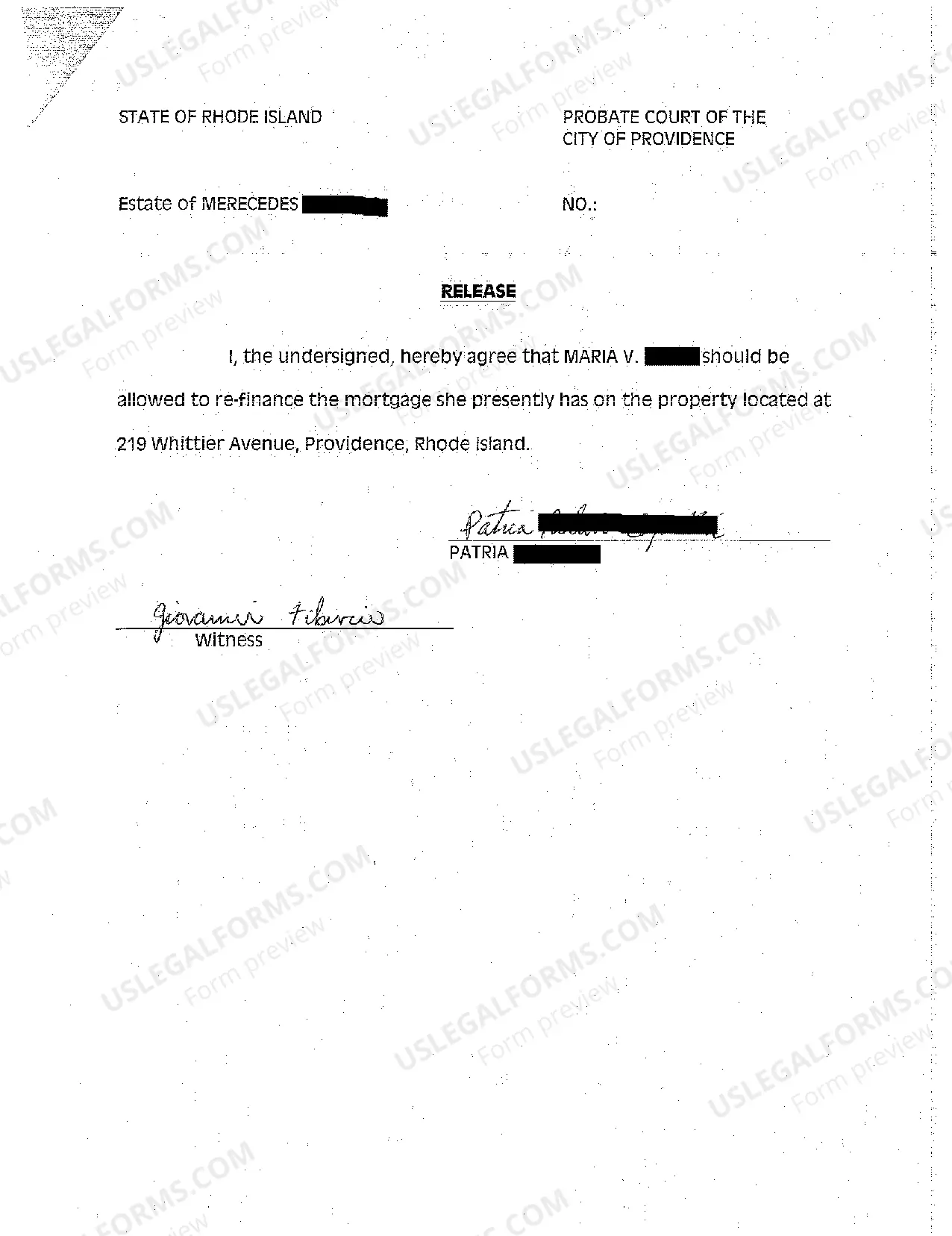

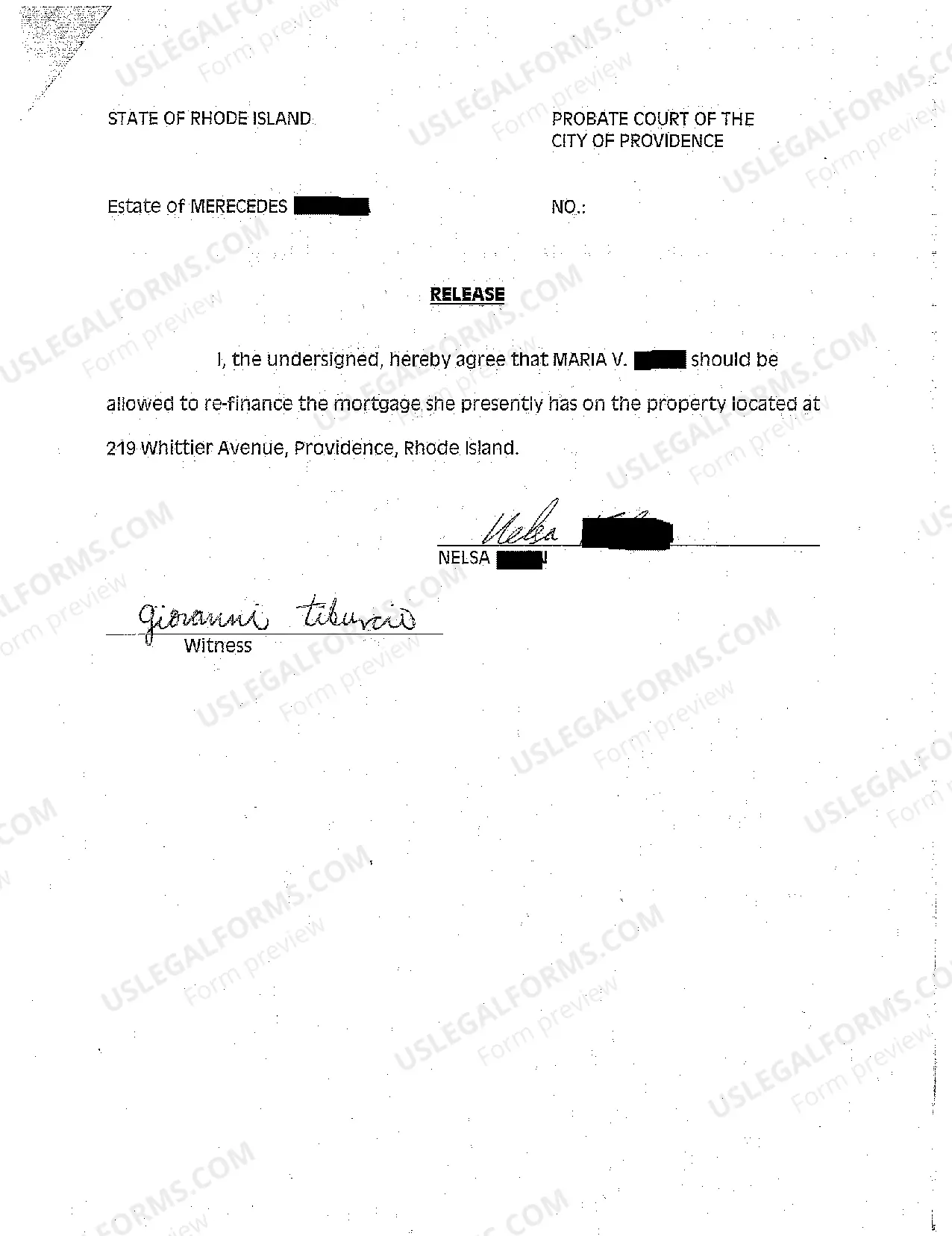

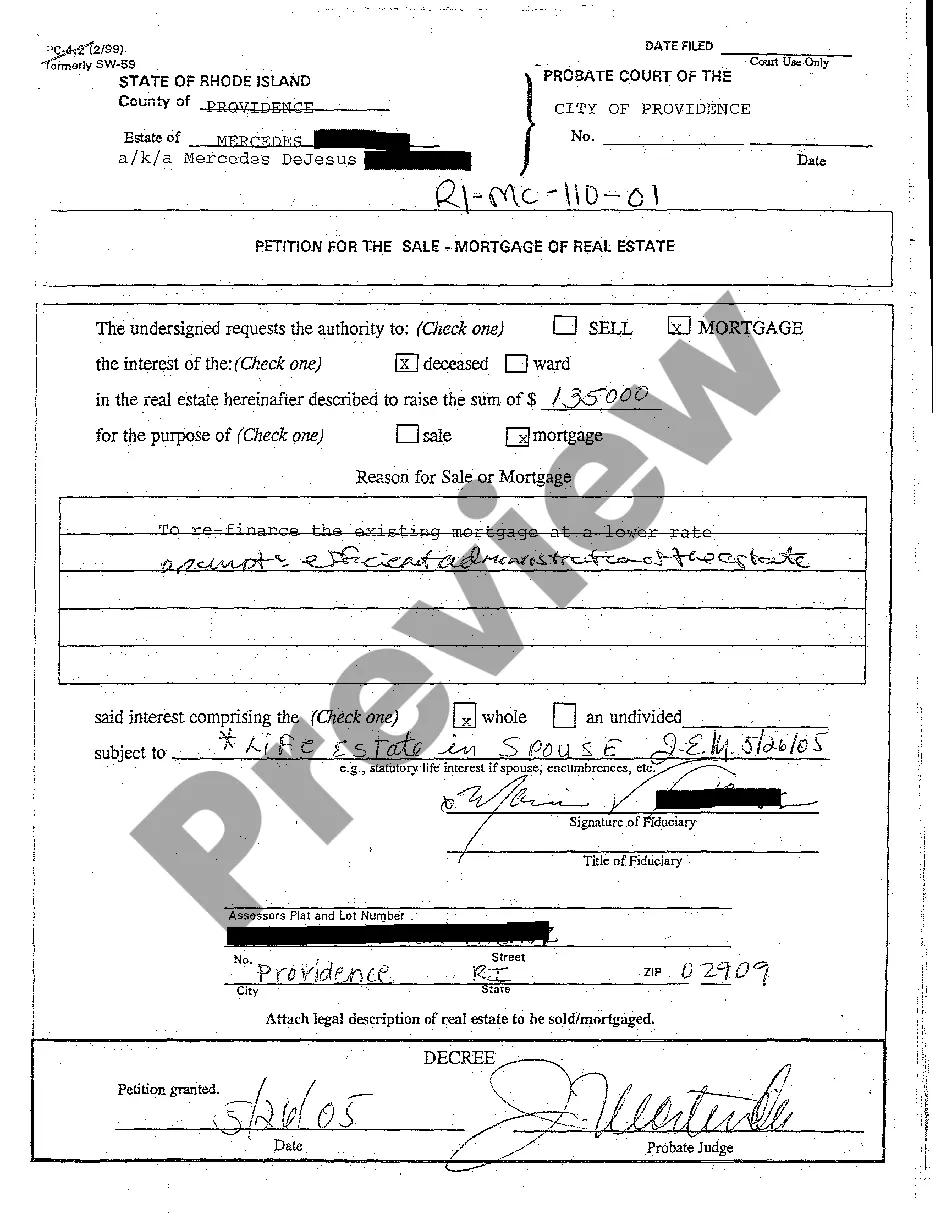

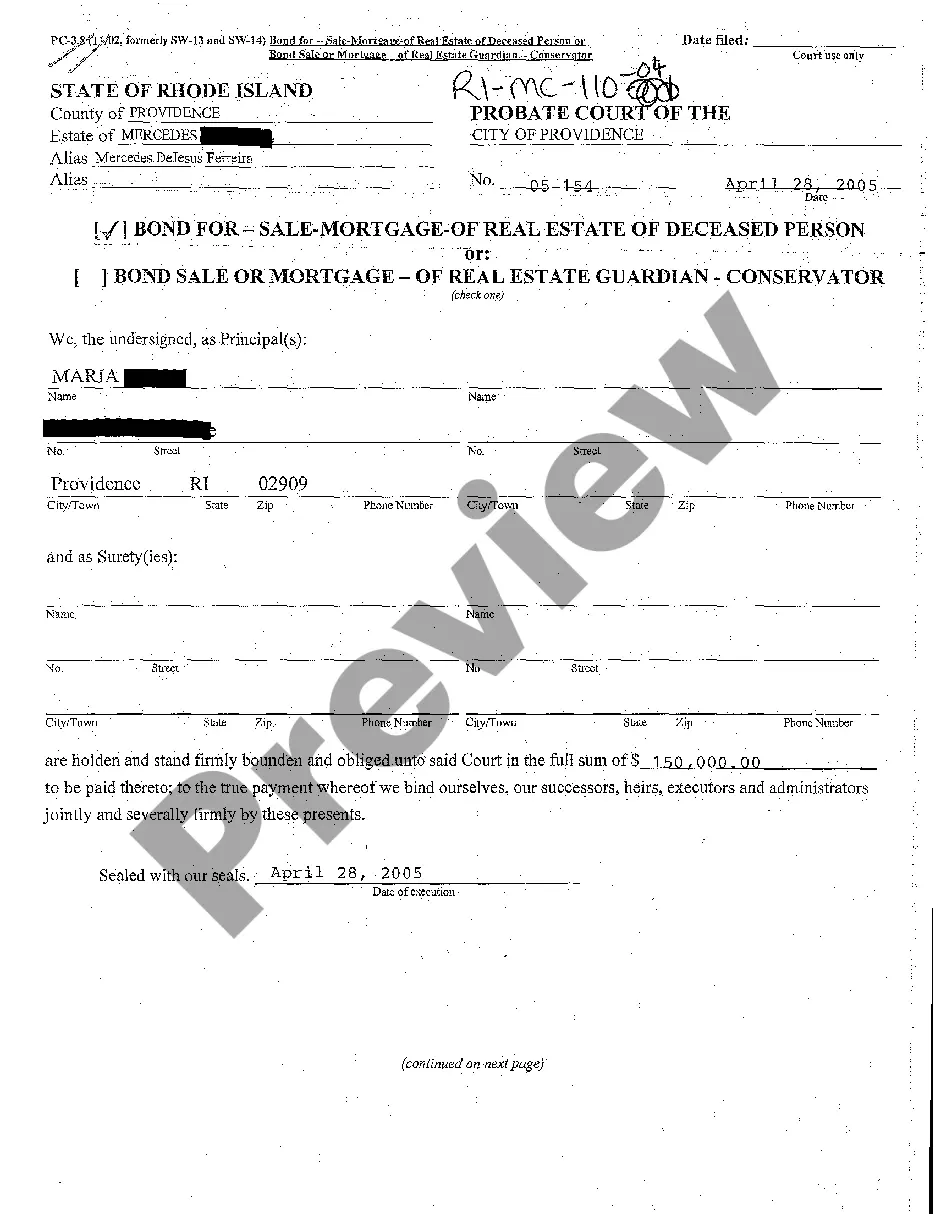

Rhode Island Release Allowing Refinancing of Mortgage

Description

How to fill out Rhode Island Release Allowing Refinancing Of Mortgage?

Among lots of paid and free samples that you’re able to find on the net, you can't be certain about their accuracy and reliability. For example, who made them or if they’re skilled enough to take care of the thing you need them to. Always keep relaxed and utilize US Legal Forms! Locate Rhode Island Release Allowing Refinancing of Mortgage templates created by professional lawyers and prevent the high-priced and time-consuming procedure of looking for an attorney and then having to pay them to draft a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access your previously acquired files in the My Forms menu.

If you’re making use of our website the very first time, follow the tips listed below to get your Rhode Island Release Allowing Refinancing of Mortgage quick:

- Make sure that the document you discover is valid in your state.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or look for another example utilizing the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you have signed up and purchased your subscription, you may use your Rhode Island Release Allowing Refinancing of Mortgage as many times as you need or for as long as it stays valid where you live. Edit it in your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Typically, mortgage refinancing options are reserved for qualified borrowers. You, as the homeowner, need to have a steady income, good credit standing and at least 20% equity in your home. You have to prove your creditworthiness to initially qualify for a mortgage loan approval.

So when does it make sense to refinance? The typical should-I-refinance-my-mortgage rule of thumb is that if you can reduce your current interest rate by 1% or more, it might make sense because of the money you'll save. Refinancing to a lower interest rate also allows you to build equity in your home more quickly.

One of the best reasons to refinance is to lower the interest rate on your existing loan. Historically, the rule of thumb is that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is enough of an incentive to refinance.

You can back out of a home refinance, within a certain grace period, for any reason, but you may face a fees or penalty if you choose to cancel or otherwise can't refinance. When a refinance doesn't go through, you typically must cut your losses for certain up-front costs you paid during the refinance process.

There's no legal limit on the number of times you can refinance your home loan. However, mortgage lenders do set a few rules that dictate the frequency of refinancing by loan type, and there are some special considerations to note if you want a cash-out refinance.

If you are buying a home with a mortgage, you do not have a right to cancel the loan once the closing documents are signed. If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract.

You can refinance your home as often as it makes financial sense. If you're cashing out, you may have to wait six months between refis.You were convinced that refinancing your home was the right thing to do the first time. Maybe you've even refinanced the mortgage since then.

You can back out of a home refinance, within a certain grace period, for any reason, but you may face a fees or penalty if you choose to cancel or otherwise can't refinance. When a refinance doesn't go through, you typically must cut your losses for certain up-front costs you paid during the refinance process.

You have to wait 6 months since your most recent closing (usually 180 days) to refinance if you're taking cash-out or using a streamline refinance program.Your current lender might ask you to wait six months between loans, but you're free to simply refinance with a different lender instead.