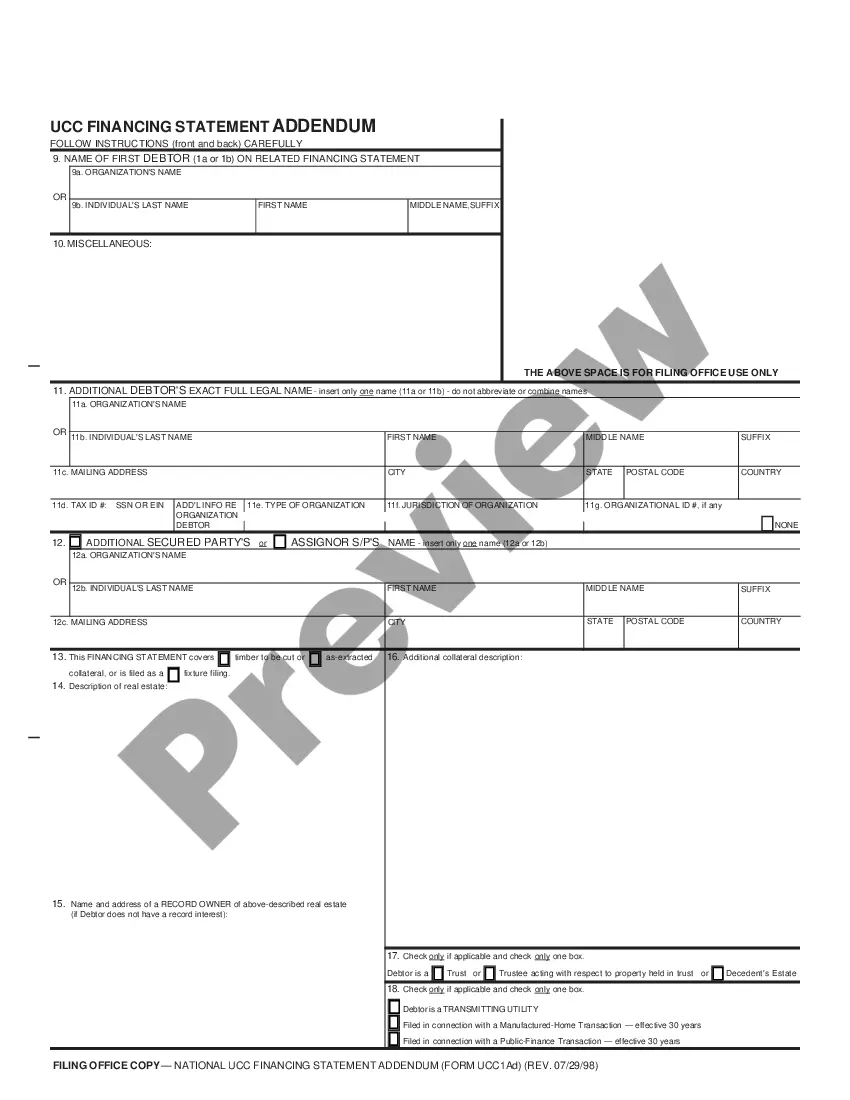

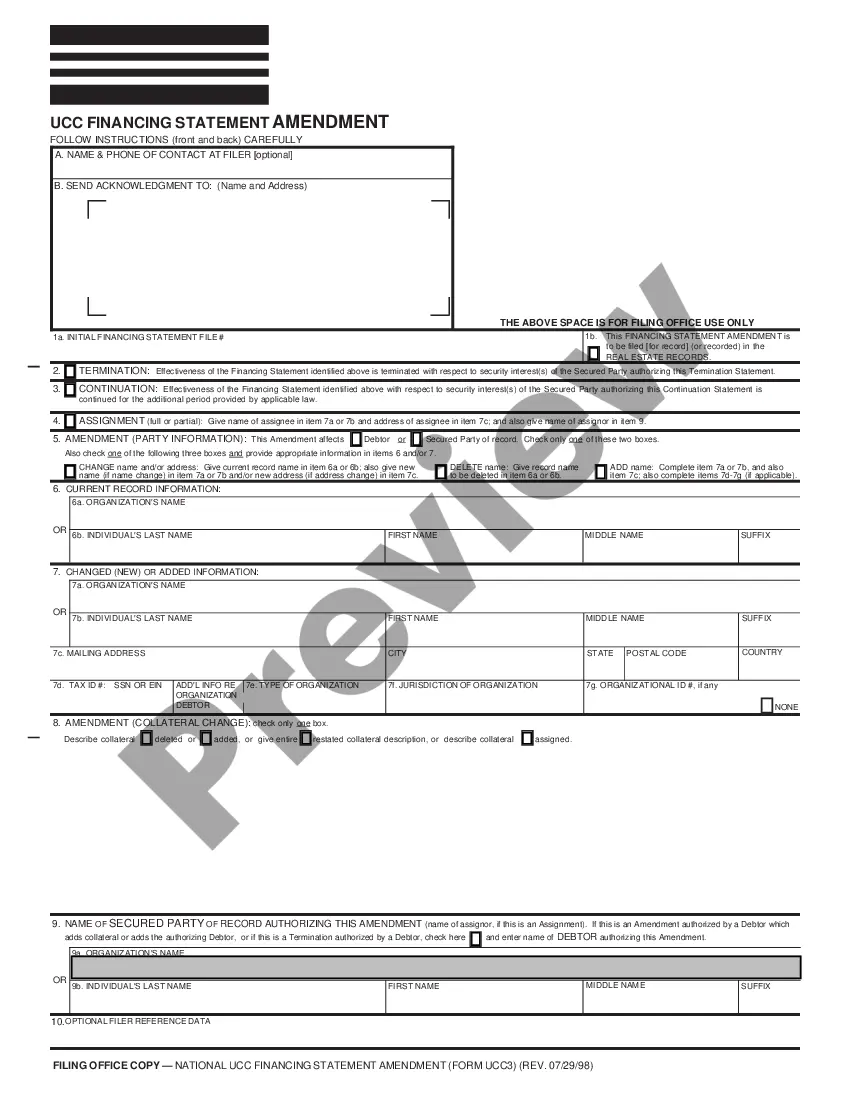

Financing Statement form for reporting a security interest to be filed with the District of Columbia filing office.

District of Columbia UCC1 Financing Statement

Description

Key Concepts & Definitions

District of Columbia UCC1 Financing Statement: A legal document filed by a secured party to give public notice that they have an interest in the personal property of a debtor. This document is used primarily in securing transactions related to personal property, commercial goods, and not for real property.

Secured Party: An individual or organization that holds an interest in the debtor's personal property as collateral for a debt.Financing Statement: A record filed to the filing office, providing the necessary public notice.

Step-by-Step Guide

- Identify the collateral: Determine if the assets are commercial goods or other types of personal property.

- Gather the debtor's information: Include personal name, contact information, and any other required details.

- Prepare the UCC1 form: Fill out the financing statement details accurately.

- File the form with the appropriate filing office in the District of Columbia: Ensure all provided information conforms to DC regulations.

- Receive email update or confirmation: Most filings will offer an email confirmation for records and future reference.

Risk Analysis

- Inaccuracy Risk: Incorrect information on the UCC1 form can lead to legal discrepancies or invalidation of the security interest.

- Timeliness: Delayed filings might not serve the intended public notice in time, leading to prioritization issues with other creditors.

- Legal Compliance: Non-adherence to specific filing rules can result in fines or a failure to perfect the security interest.

Common Mistakes & How to Avoid Them

- Not verifying debtor's details: Always double-check the debtors personal name and contact information before filing.

- Filing under incorrect jurisdiction: Confirm that filings are made in the District of Columbia if the collateral is held there.

- Omitting important content in the UCC1: Ensure all fields on the UCC1 form are filled correctly according to local and federal laws.

Best Practices

- Regular Updates: Keep the financing statement updated to reflect any changes in the debtor's information or the status of the collateral.

- Professional Assistance: Consider consulting with a legal professional experienced in UCC filings to ensure compliance and efficacy of the filing.

- Clear Definitions of Collateral: Precisely define the scope and details of the collateral to prevent any ambiguity or disputes.

FAQ

What is the purpose of filing a UCC1 financing statement in the District of Columbia?

To establish a public record that there is a secured interest in the debtors personal property or commercial goods.

How often do I need to renew the UCC1 filing?

The UCC1 filing typically needs to be renewed every five years to continue its validity. Specific rules can vary, so it is recommended to check with local regulations.

Summary

The District of Columbia UCC1 financing statement serves as a critical tool for secured parties to protect their financial interests in a debtor's personal and commercial property. By understanding and carefully following the specified procedures for UCC filings, parties can effectively manage their legal and financial risks.

How to fill out District Of Columbia UCC1 Financing Statement?

The larger the quantity of documents you need to create - the more anxious you become.

You can discover numerous District of Columbia UCC1 Financing Statement templates available online, however, you may be uncertain about which ones to trust.

Eliminate the difficulty to make locating samples simpler with US Legal Forms. Obtain professionally crafted documents that are designed to meet state requirements.

Access every document you acquire in the My documents section. Just navigate there to create a new version of the District of Columbia UCC1 Financing Statement. Even when preparing professionally drafted templates, it is still important to consider consulting your local attorney to verify the completed sample to ensure that your document is filled out correctly. Achieve more for less with US Legal Forms!

- Verify if the District of Columbia UCC1 Financing Statement is applicable in your state.

- Confirm your selection by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that suits your preferences.

- Provide the required details to set up your account and pay for the order using PayPal or credit card.

- Select a preferred document format and download your copy.

Form popularity

FAQ

UCCs should be filed in the state where the debtor is located or where the collateral is based. In Washington D.C., the correct place is the Department of Consumer and Regulatory Affairs. This ensures your District of Columbia UCC1 Financing Statement is legally effective and can be upheld in future transactions.

To file a UCC-1 in D.C., you need to go to the Department of Consumer and Regulatory Affairs. This office accepts all UCC filings and maintains a database of recorded statements. By filing a District of Columbia UCC1 Financing Statement, you effectively secure your financial interest in the assets listed.

UCCs are filed with the designated state office, which varies by jurisdiction. In D.C., you will file with the Department of Consumer and Regulatory Affairs. This office will record your District of Columbia UCC1 Financing Statement, allowing other parties to see your security interest.

A financing statement must be filed in the appropriate location based on the debtor's details. For a business operating in Washington D.C., you would submit the District of Columbia UCC1 Financing Statement at the Department of Consumer and Regulatory Affairs. Proper filing ensures your claim is legally recognized.

UCCs must be filed in the state where the debtor is located or where the property is situated. For individuals, this typically means the state of residence, while for businesses, it is usually the state of incorporation. Filing a District of Columbia UCC1 Financing Statement provides you with priority over other creditors in the event of default.

In the District of Columbia, UCCs are filed with the Department of Consumer and Regulatory Affairs. This office is responsible for managing all UCC filings, ensuring they are properly recorded and accessible. When you file a District of Columbia UCC1 Financing Statement, you establish your legal claim to collateral, which can protect your interests in various transactions.

You must file UCC-1 financing statements with the appropriate state office, typically the Secretary of State or a designated filing office. In the District of Columbia, this is located in the Department of Consumer and Regulatory Affairs. Using the U.S. Legal Forms platform allows you to easily understand the filing process, ensuring you submit your District of Columbia UCC1 Financing Statement correctly and efficiently.

Looking up a UCC-1 filing is straightforward. You can access the District of Columbia’s online filing office or contact them directly for assistance. Utilizing the U.S. Legal Forms platform can also simplify this process by providing clear instructions and resources to help you find the specific District of Columbia UCC1 Financing Statement you need.

A UCC filing, specifically a District of Columbia UCC1 Financing Statement, is a legal document that secures a creditor's interest in a debtor's assets. It’s a way for lenders to protect their rights to collateral in case the debtor defaults. Simply put, it establishes publicly that a lender has a claim over certain assets, which can be easily understood with help from user-friendly platforms like uslegalforms.

Filing a District of Columbia UCC1 Financing Statement generally involves completing the form, collecting required documentation, and submitting it to the appropriate state filing office. You can file in person, by mail, or electronically, depending on the state’s options. For an easier filing experience, consider using platforms such as uslegalforms.