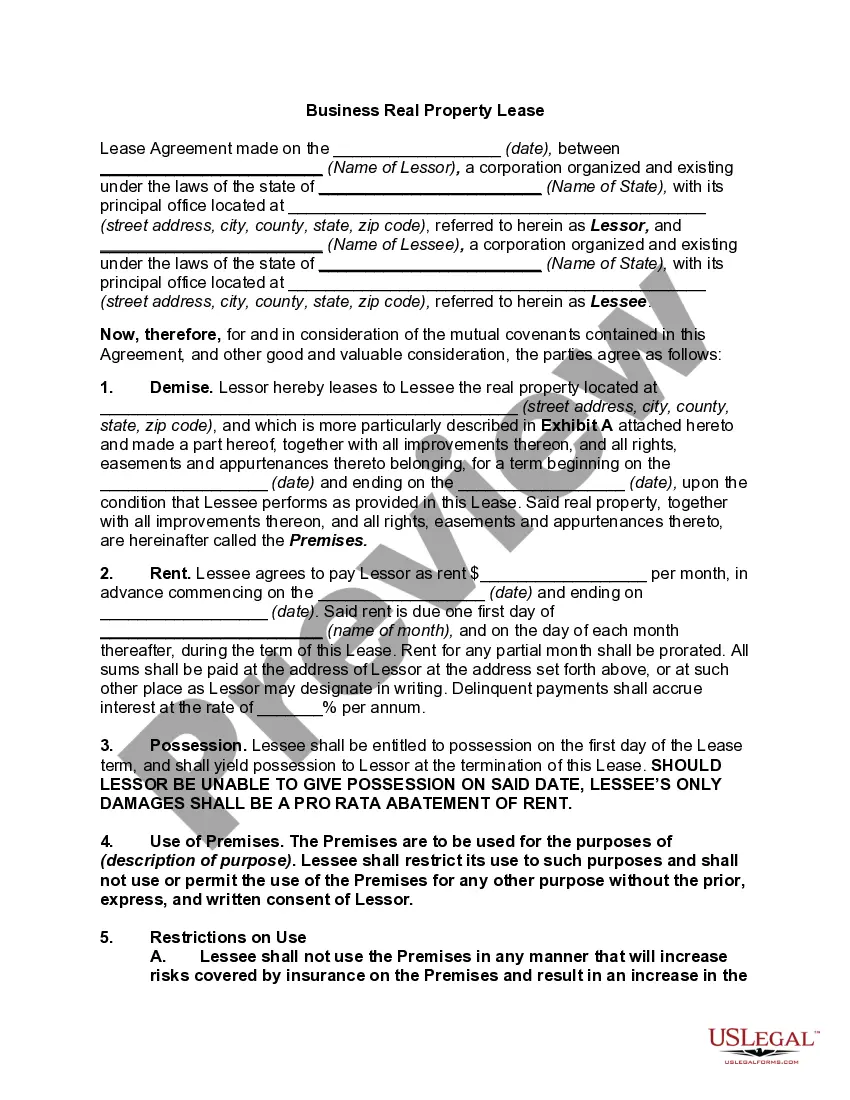

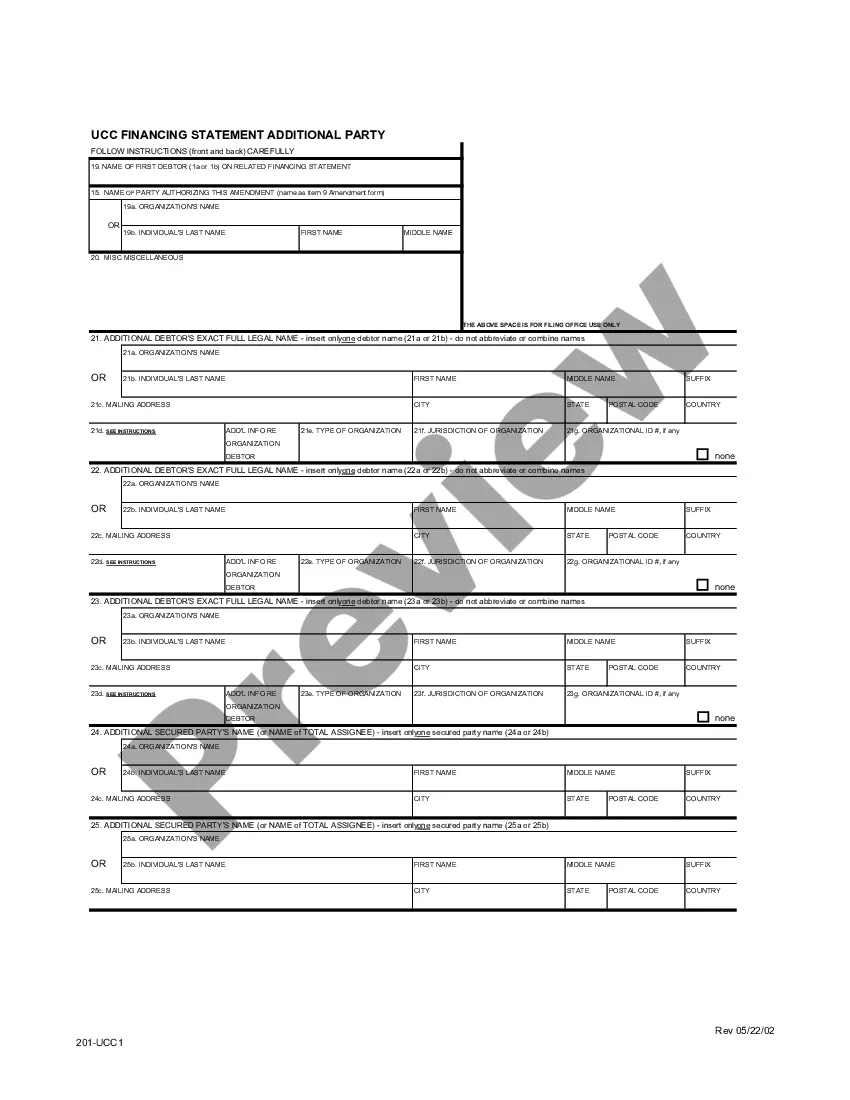

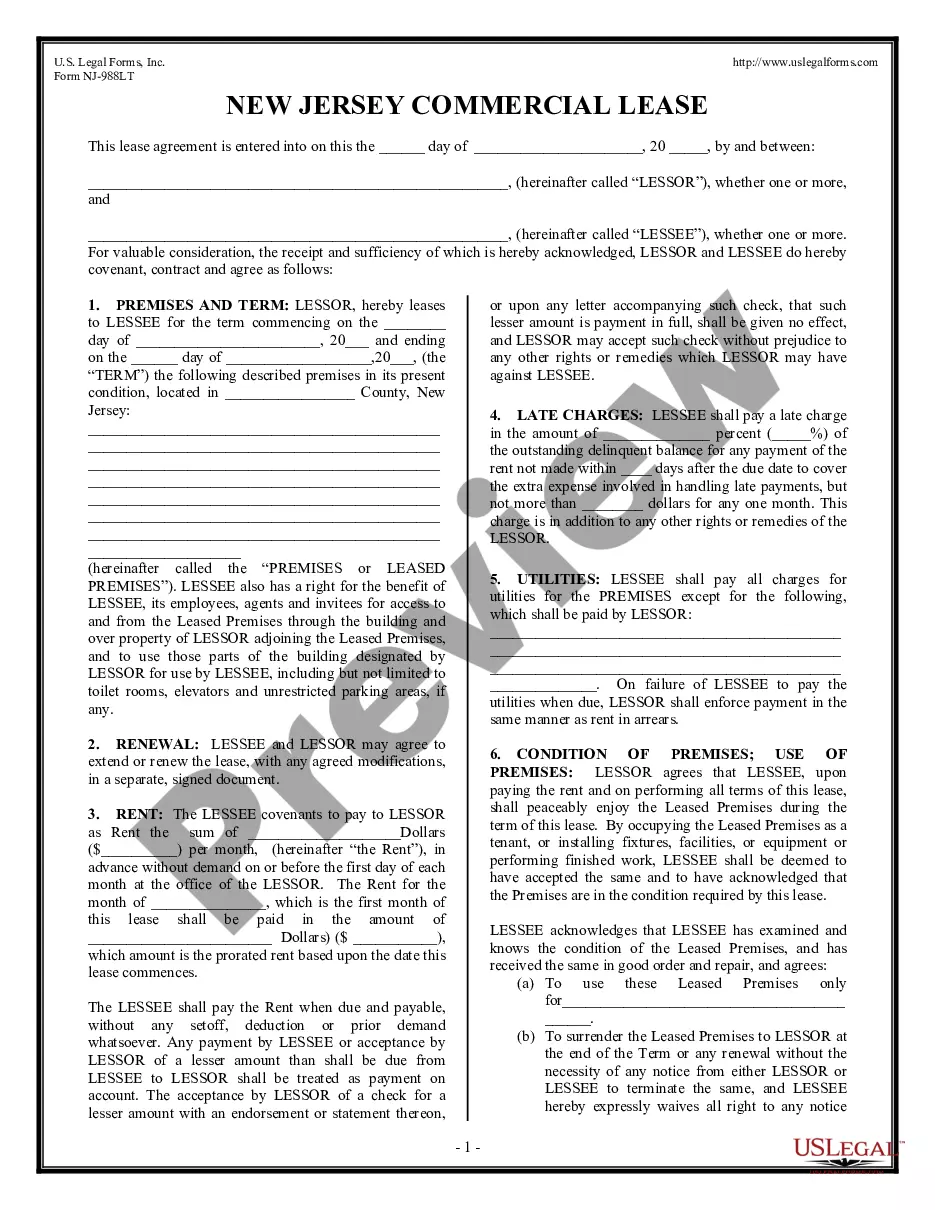

District of Columbia Form 1D-Commercial Property is a form used to provide information about the ownership, use, and/or occupancy of a commercial property in Washington, D.C. The form is used to collect information relevant to the taxation of the property. There are two types of District of Columbia Form 1D-Commercial Property: 1) the Initial Filing Form and 2) the Annual Filing Form. The Initial Filing Form is used when a new property is being registered with the District of Columbia. It collects information about the property owner, the property address, and any applicable tax credits and exemptions. The Annual Filing Form is used when the property is already registered with the District of Columbia. It collects information about any changes in the property, occupancy, or ownership since the last filing. Both forms are used to ensure that the District of Columbia is collecting the correct amount of tax revenue from commercial properties.

District of Columbia Form 1D-Commercial Property

Description

How to fill out District Of Columbia Form 1D-Commercial Property?

US Legal Forms is the easiest and most economical method to discover appropriate legal templates.

It’s the largest online collection of commercial and personal legal documents crafted and validated by legal experts.

Here, you can access printable and editable templates that adhere to national and local regulations - just like your District of Columbia Form 1D-Commercial Property.

Review the form description or preview the document to confirm you’ve located the one that fulfills your needs, or search for another using the search tab above.

Click Buy now when you’re confident about its suitability with all your requirements, and choose the subscription plan you prefer most.

- Acquiring your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription only need to sign in to the site and download the form onto their device.

- Subsequently, it can be found in their profile under the My documents section.

- Here’s how to acquire a professionally prepared District of Columbia Form 1D-Commercial Property if you are using US Legal Forms for the first time.

Form popularity

FAQ

To avoid taxes on the sale of commercial property, consider strategies like a 1031 exchange, which allows you to defer taxes by reinvesting in a similar property. Additionally, ensuring proper documentation, such as the District of Columbia Form 1D-Commercial Property, can assist you in showcasing deductions and benefits that may apply to your specific situation. Consulting with a tax professional can offer tailored strategies suited to your needs.

Calculating DC property tax requires knowing the assessed value of your property, which is determined by the DC Office of Tax and Revenue. The property tax rate is then applied to this assessed value. For commercial properties, such as those documented with the District of Columbia Form 1D-Commercial Property, it’s crucial to stay updated on the latest rates to budget appropriately.

Turning your property into commercial property involves several steps. First, consult local zoning laws to ensure your property can be classified as commercial. Next, complete the necessary application and paperwork, including the District of Columbia Form 1D-Commercial Property, to formally make the designation. Services like USLegalForms can guide you through the paperwork and requirements, making the process smoother.

To evict a commercial tenant in the District of Columbia, you must follow the legal process outlined in local regulations. Begin by providing proper notice to the tenant, specifying the reasons for eviction, such as non-payment of rent or lease violations. After the notice period, if the tenant does not comply, you can file a case in court. It is important to have all necessary documents, including the District of Columbia Form 1D-Commercial Property, prepared and organized to support your case.

A bell hearing is a legal procedure that occurs when a property's assessment is disputed. In the context of District of Columbia Form 1D-Commercial Property, this hearing allows property owners to contest tax assessments. It's essential for property owners to understand this process, as it impacts their financial obligations. Engaging with uslegalforms can help streamline this process, ensuring you have the necessary documentation and guidance.