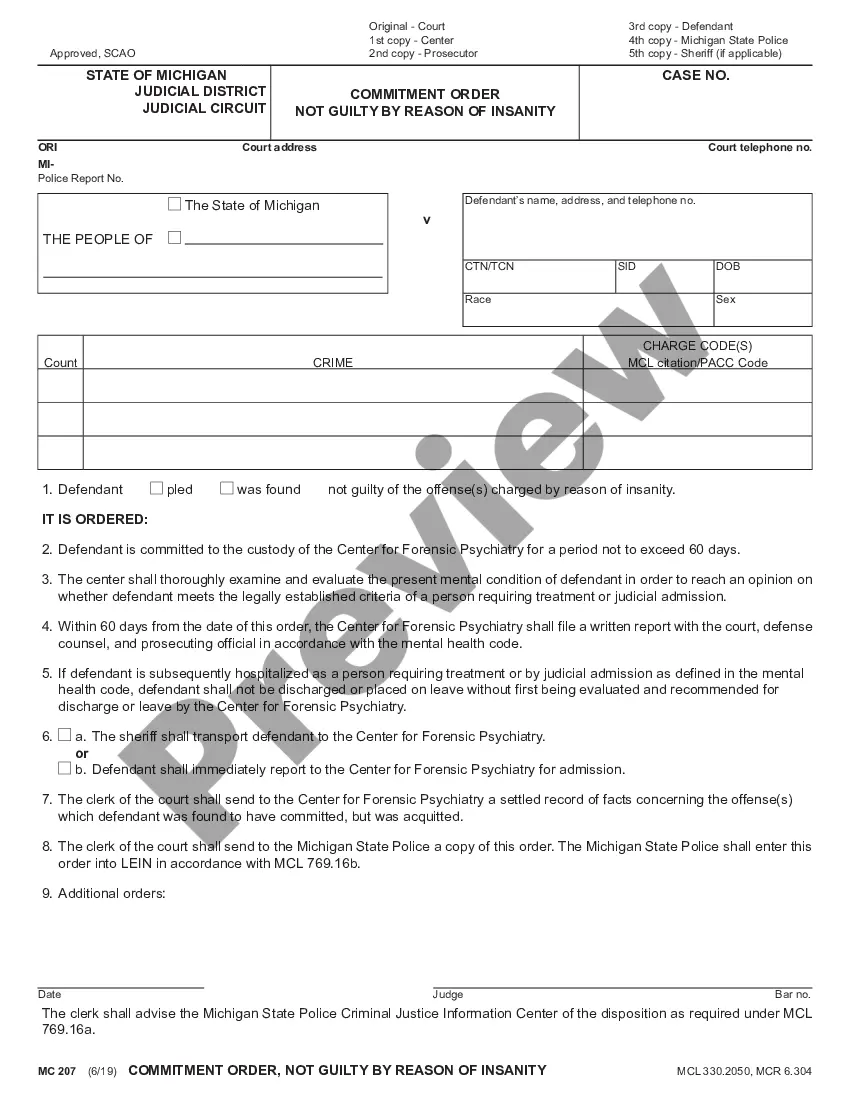

District of Columbia Form 27 is a form used by employers within the District of Columbia to report their employees' wages, tips, and other compensation. Employers are required to report wages and other compensation for all individuals employed in the District of Columbia, regardless of their residency, on a quarterly basis. There are two types of District of Columbia Form 27: Form 27-A for wages and Form 27-B for tips. The form is used to report the amount of wages earned, the number of hours worked, and the taxable wages, as well as to report the tip income earned by employees. Employers must also submit their quarterly taxes with Form 27.

District of Columbia Form 27

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Form 27?

US Legal Forms is the easiest and least expensive method to find suitable formal templates.

It’s the most comprehensive online collection of business and individual legal documents drafted and reviewed by attorneys.

Here, you can discover printable and fillable forms that adhere to federal and local laws - just like your District of Columbia Form 27.

Review the form description or preview the document to ensure you’ve located the one that fits your needs, or search for another using the tab above.

Select Buy now when you’re confident of its suitability with all the requirements, and choose the subscription plan that appeals to you the most.

- Obtaining your template only requires a few straightforward steps.

- Users who already possess an account with an active subscription simply need to Log In to the site and download the form to their device.

- Then, they can access it in their profile under the My documents section.

- Here’s how to acquire a properly prepared District of Columbia Form 27 if you’re utilizing US Legal Forms for the first time.

Form popularity

FAQ

Yes, the District of Columbia has its own circuit known as the D.C. Circuit. This court handles a variety of cases, particularly those related to federal regulations and agency actions. When engaging in legal matters within this circuit, understanding how to properly fill out forms like the District of Columbia Form 27 is essential. Uslegalforms offers resources to simplify this process and ensure compliance with local requirements.

District of Columbia status refers to its unique position within the United States as a federal district. It operates under its own set of laws and governance without being part of any state. This status affects everything from taxation to voting rights and legal documentation, including the District of Columbia Form 27. Utilizing services like uslegalforms can alleviate the complexity of navigating these unique legal frameworks.

The District of Columbia belongs to the U.S. Court of Appeals for the District of Columbia Circuit. This circuit is crucial for appeals from federal agencies located within D.C., making it a vital part of the judicial system. If you are involved in legal matters that require documentation such as the District of Columbia Form 27, being aware of the circuit helps you understand the appeal process and your legal rights better. Always consider platforms like uslegalforms for the necessary legal documents.

The District of Columbia is not a federal entity in the traditional sense, but it is a unique federal district. Established by the U.S. Constitution, it serves as the nation's capital and operates independently from any state. Despite its federal status, residents navigate local and federal law differently, especially when dealing with documents like the District of Columbia Form 27. Understanding this distinction can simplify your legal processes.

The District of Columbia rating is a system that assesses the performance and reliability of various legal documents in Washington, D.C. Specifically, when it comes to legal forms like the District of Columbia Form 27, having a clear understanding of the rating helps ensure you are using a valid and recognized document. This rating provides guidance on how well these forms meet legal standards, allowing you to proceed with confidence. By using platforms like uslegalforms, you can easily find rated forms that suit your needs.