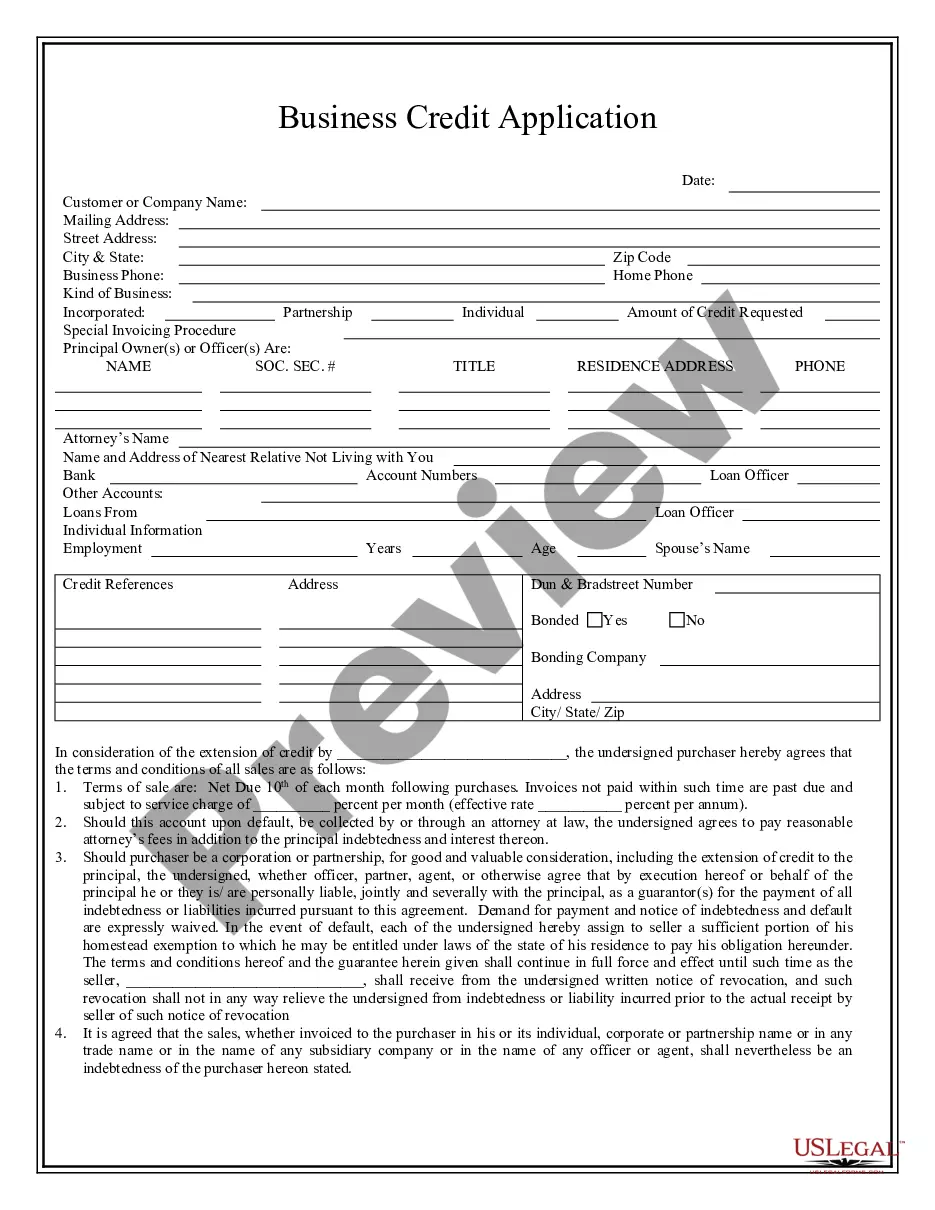

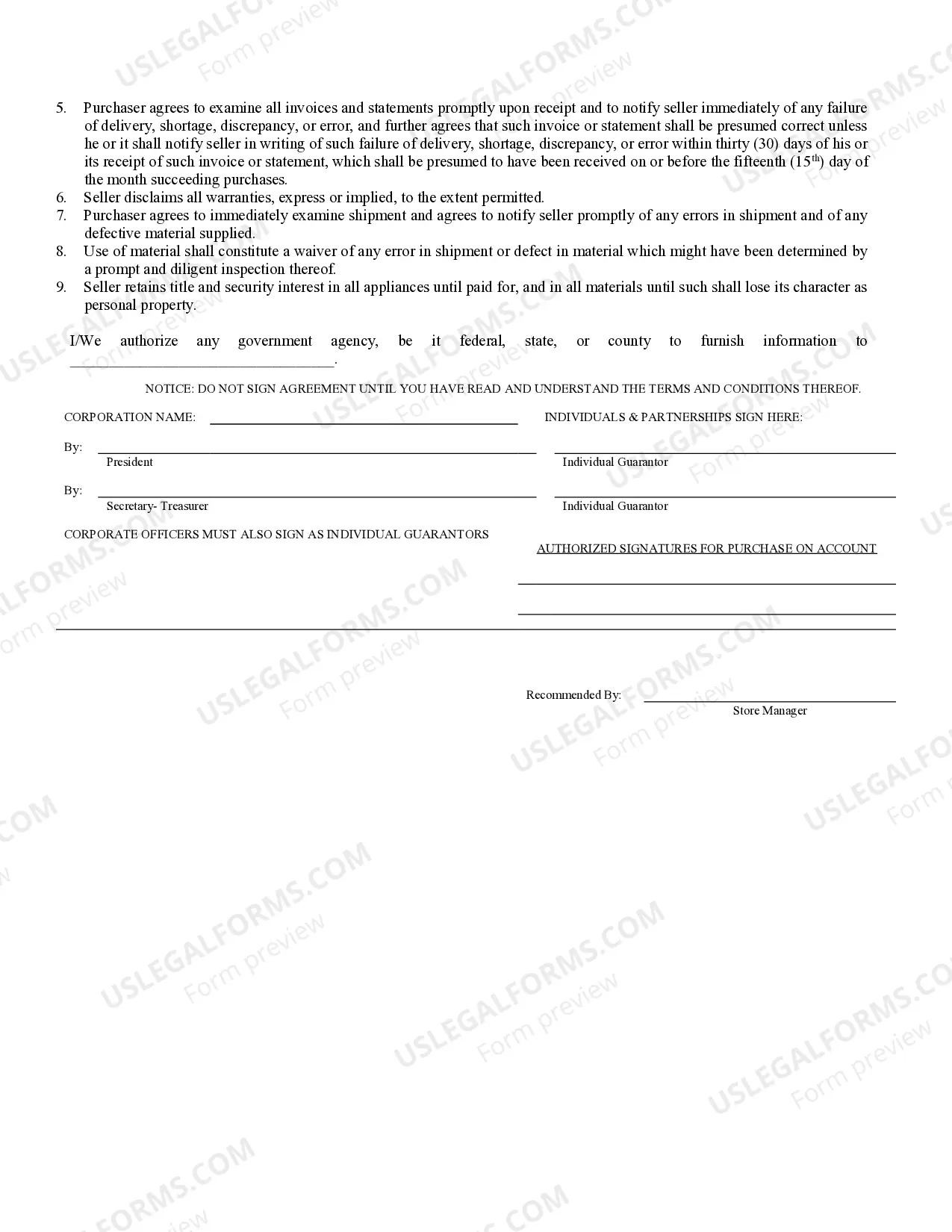

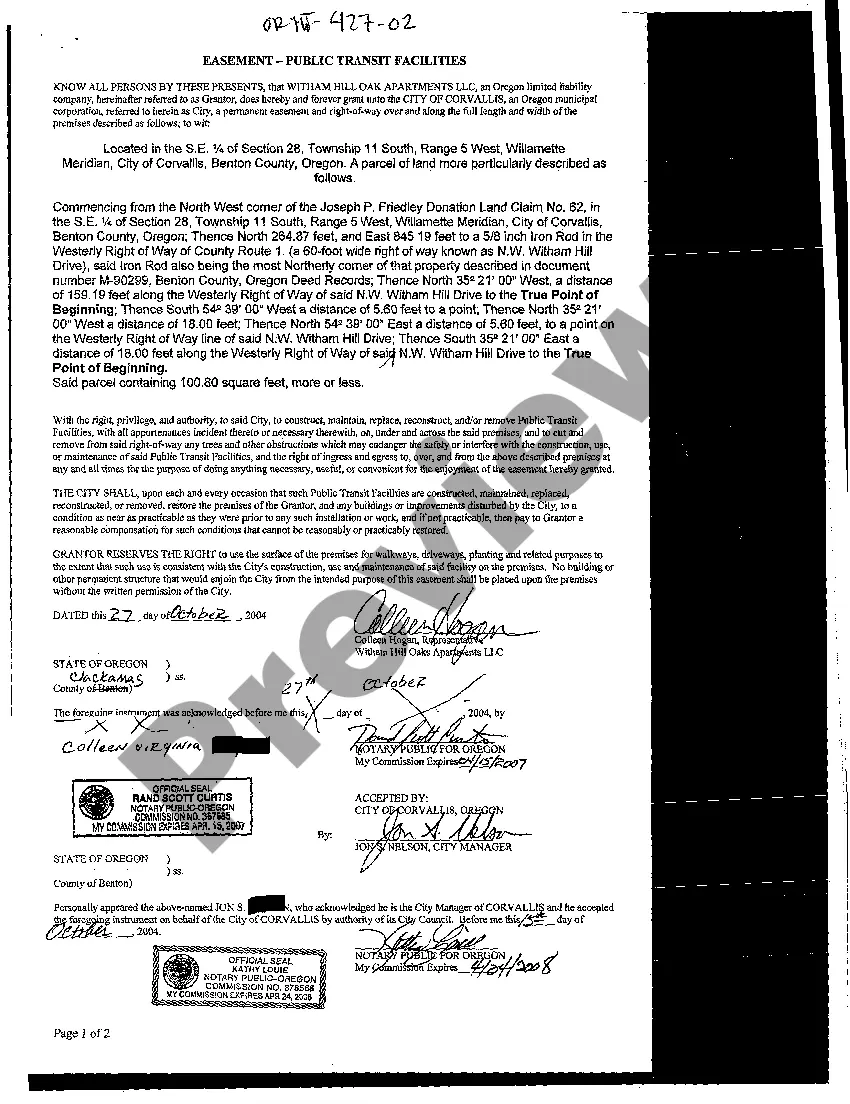

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

District of Columbia Business Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Business Credit Application?

The larger your volume of documentation is - the more anxious you become.

You can discover a vast array of District of Columbia Business Credit Application forms available online, yet you are uncertain which of them to trust.

Eliminate the inconvenience of making the search for templates easier with US Legal Forms. Obtain professionally created documents designed to meet state regulations.

Input the requested details to set up your profile and complete the payment for the order with your PayPal or credit card. Choose a preferred document format and download your template. Access every document you receive in the My documents section. Simply navigate there to complete a new version of your District of Columbia Business Credit Application. Even when using professionally prepared forms, it's still crucial to consider consulting your local attorney to review the filled-in document to ensure its accuracy. Achieve more for less with US Legal Forms!

- If you already have a subscription to US Legal Forms, Log In to your account, and you will find the Download button on the District of Columbia Business Credit Application’s page.

- If you have never utilized our service before, complete the registration process by following these instructions.

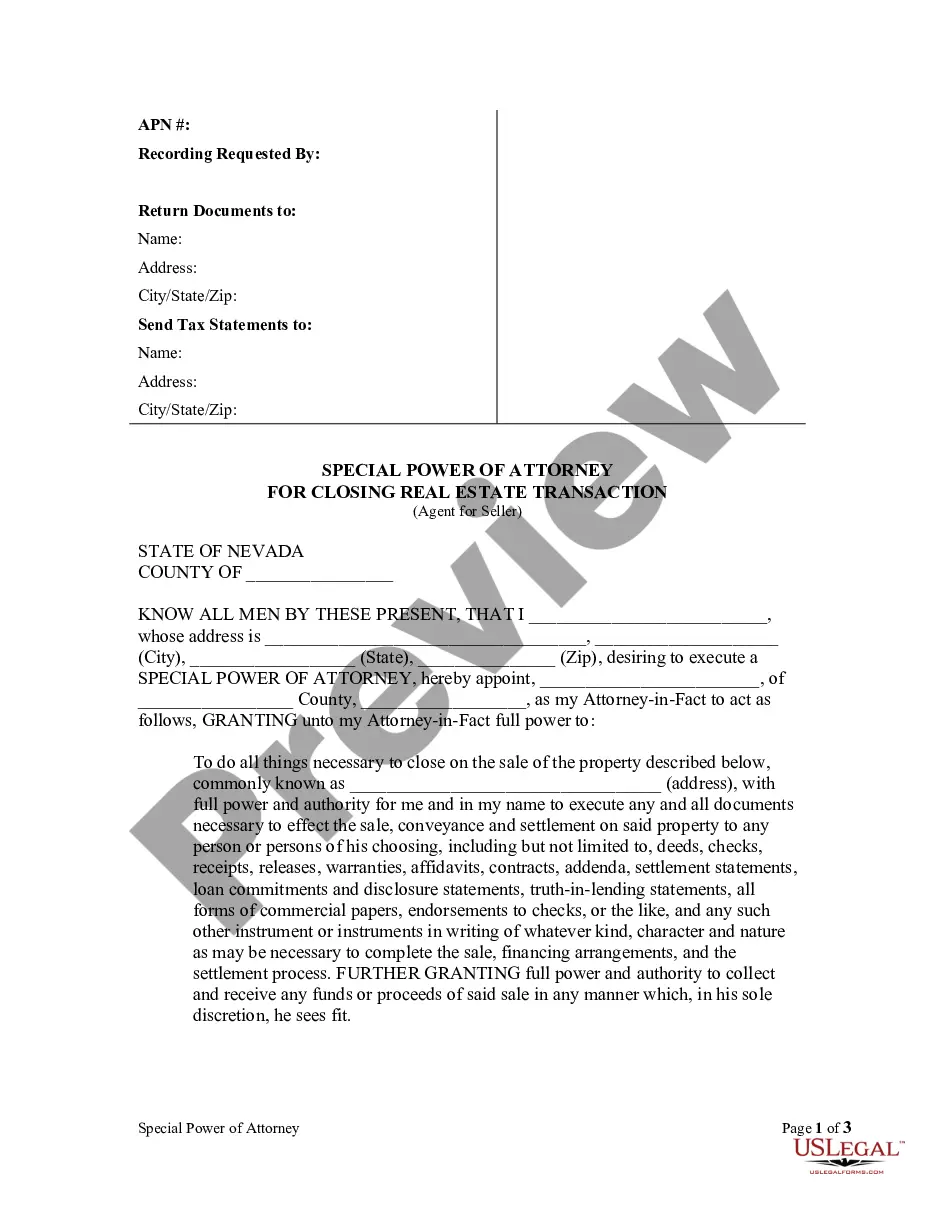

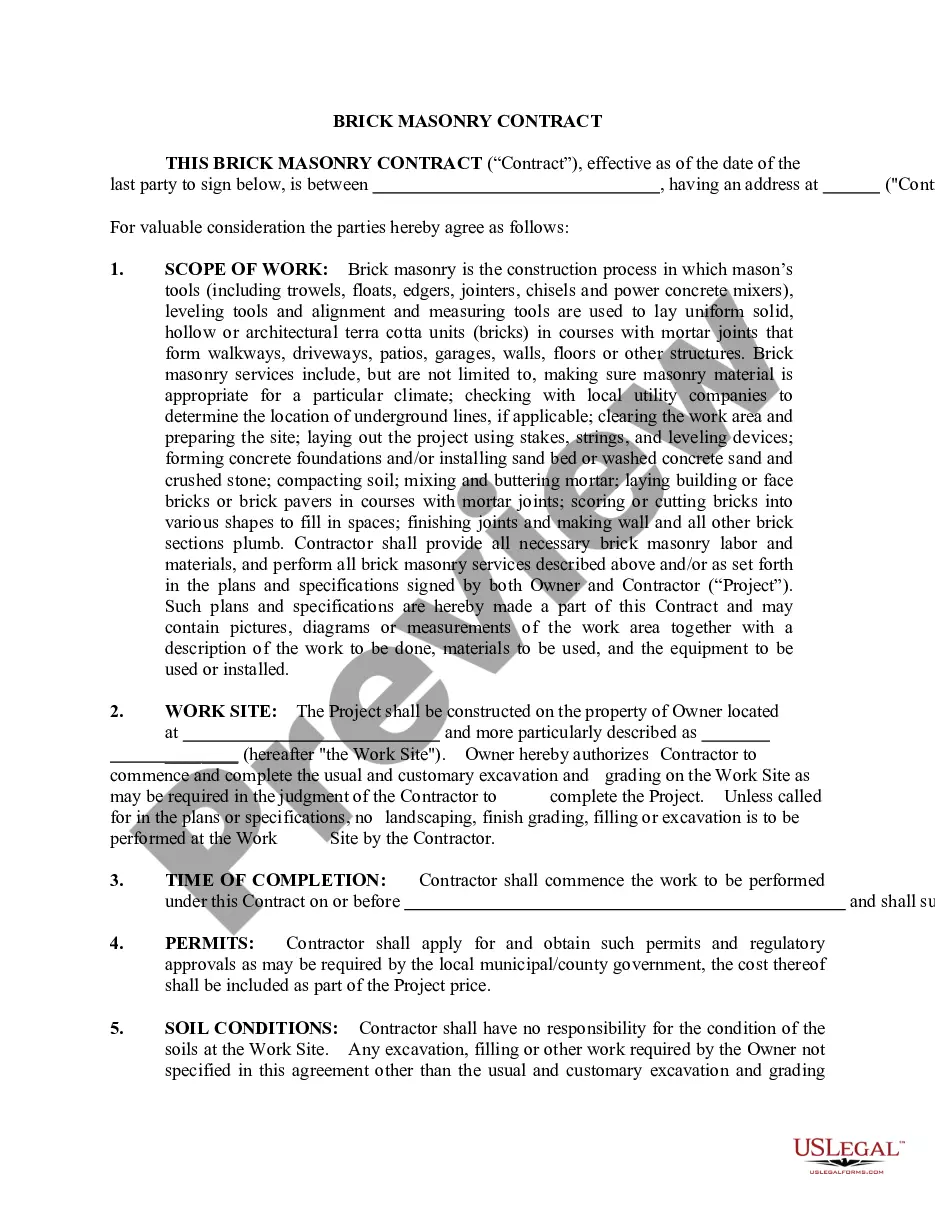

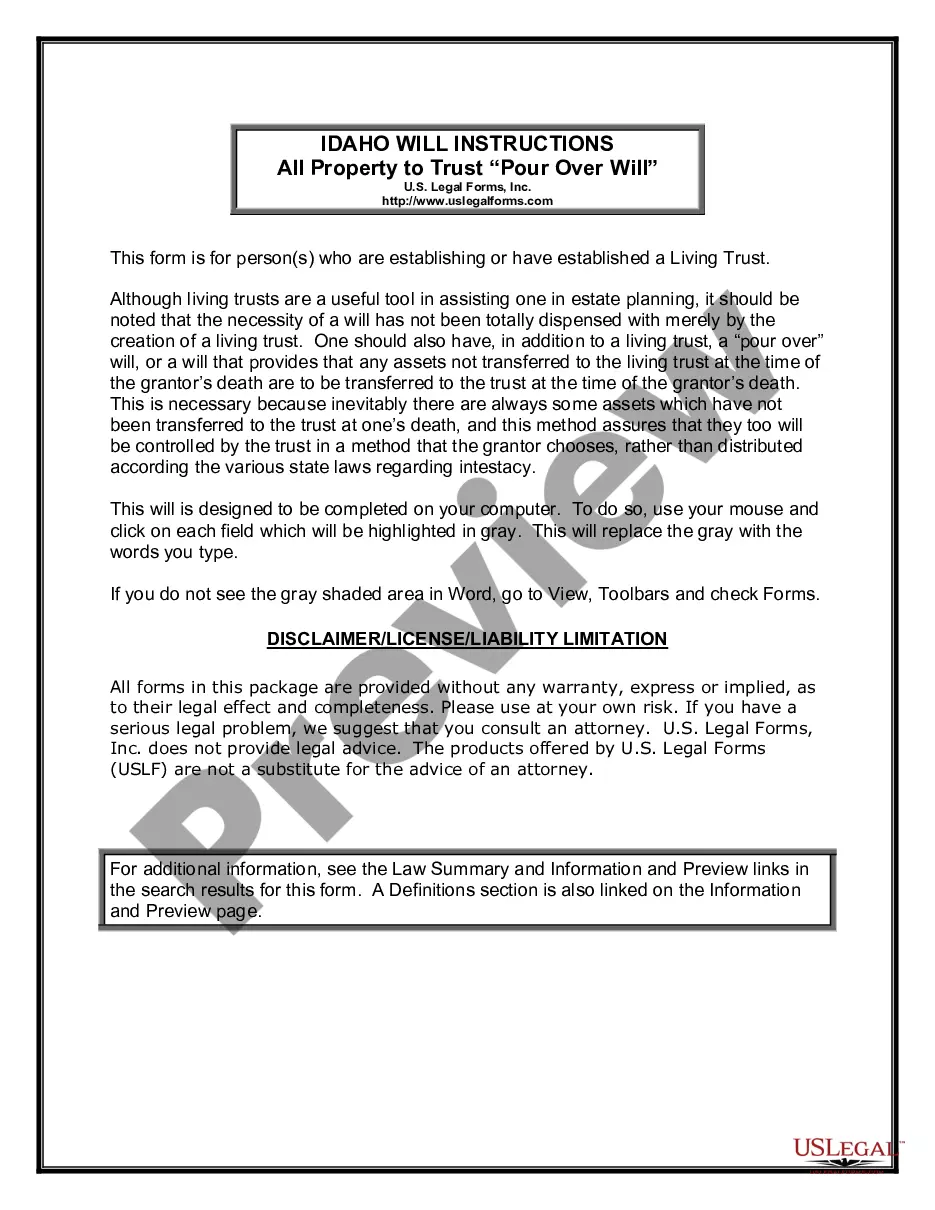

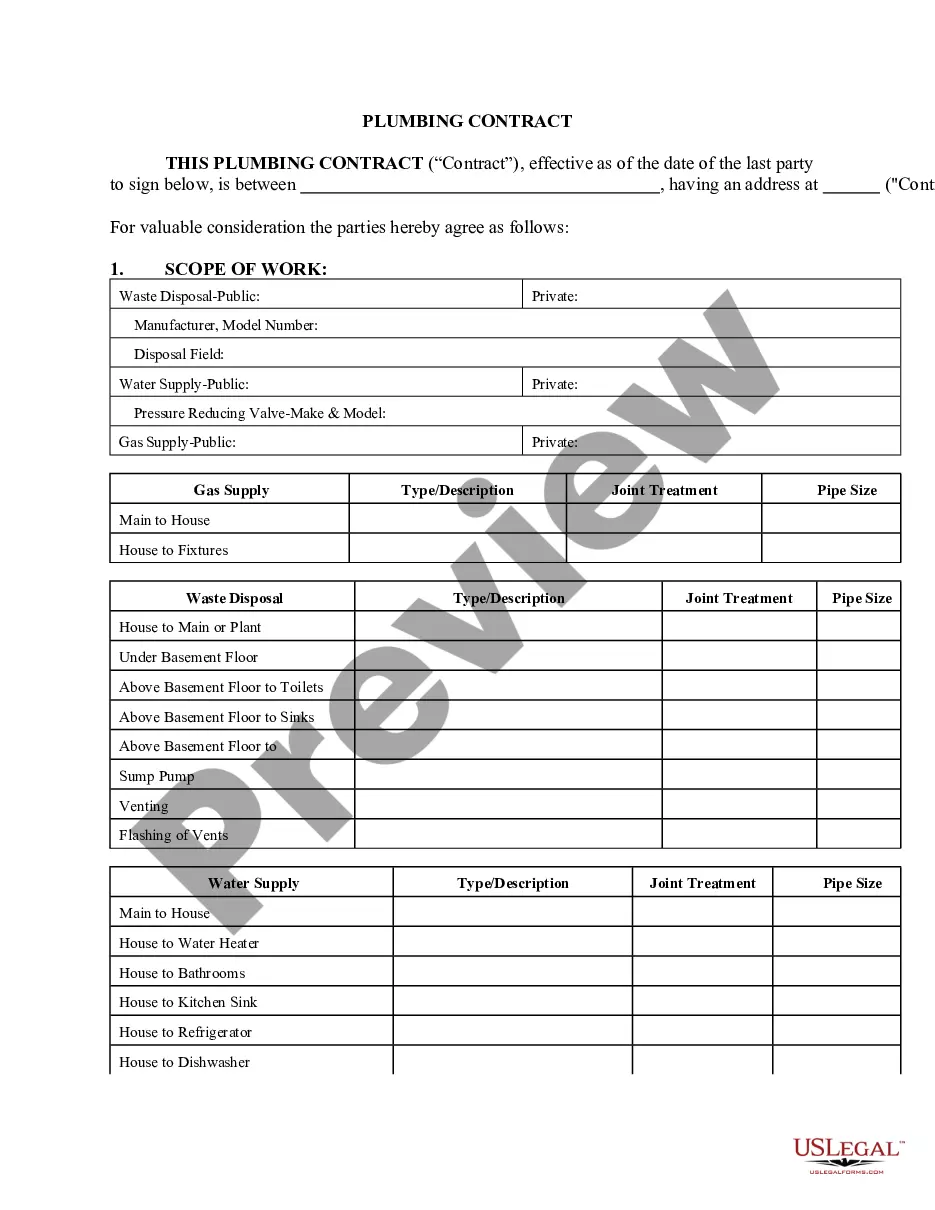

- Ensure that the District of Columbia Business Credit Application is applicable in your state.

- Verify your choice by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing plan that aligns with your needs.

Form popularity

FAQ

The FR 500 new business registration form is a critical document for newly established businesses in DC, as it registers your business for various taxes and compliance requirements. When you complete this form, you provide essential information about your business structure, operations, and tax obligations. It plays a vital role in your overall business registration process, complementing your District of Columbia Business Credit Application.

To apply for a business license in the District of Columbia, visit the DCRA's online portal, where you'll find step-by-step guidance. You should fill out the necessary application forms and submit any required fees and supporting documents. Including your District of Columbia Business Credit Application can help demonstrate your business's legitimacy and financial health.

A business credit application form is a document that potential credit providers use to assess creditworthiness. This form typically requires information about your business, including its financial details, ownership structure, and credit history. Completing this form accurately is essential for obtaining credit, and the District of Columbia Business Credit Application serves as a key element in your financial planning.

The time it takes to obtain a business license in the District of Columbia can vary. Generally, you can expect the process to take anywhere from a few weeks to a couple of months, depending on the complexity of your application and any required inspections. To expedite your application, ensure your District of Columbia Business Credit Application and all documentation are accurately completed.

To apply for a basic business license in the District of Columbia, you can start by visiting the Department of Consumer and Regulatory Affairs (DCRA) website. There, you will find detailed instructions and the necessary forms. Make sure to gather all required documents, including your District of Columbia Business Credit Application if applicable, to streamline your application process.

To create a business credit profile, start by registering your business and obtaining an EIN. Completing a District of Columbia Business Credit Application with a lender helps you establish a profile, as they report your payment history to credit agencies. Consistent, responsible financial behavior will strengthen your business credit profile over time.

Generally, you do not need a down payment for a business line of credit, as these are often based on your creditworthiness. However, some lenders may require collateral or a form of guarantee when you complete your District of Columbia Business Credit Application. Always read the terms carefully to understand your obligations.

Yes, you can get a line of credit using your Employer Identification Number (EIN). When submitting a District of Columbia Business Credit Application, provide your EIN to help lenders verify your business identity. Keep in mind that they will also check your business credit history and other financial details.

A new LLC can establish credit by applying for a business credit line and making timely payments. Complete a District of Columbia Business Credit Application to begin building a credit history. It's important to keep personal and business finances separate as this will enhance your LLC’s credibility.

To obtain a business line of credit, you typically need to provide financial statements, a strong business plan, and a District of Columbia Business Credit Application. Lenders assess your creditworthiness based on your business revenue and credit scores. Having a good relationship with your bank may also help facilitate the process.