Connecticut Living Trust for Husband and Wife with Minor and or Adult Children

What is this form?

This Living Trust for Husband and Wife with Minor and/or Adult Children is a legal document that establishes a revocable trust during the lifetime of the trustors (the husband and wife). This type of living trust allows the couple to manage their assets and property while maintaining control. By utilizing a living trust, the assets are not subject to probate upon death, which simplifies the transfer of property to the beneficiaries, typically their children.

Key components of this form

- Name of Trust: Specifies the title under which the trust will be known.

- Trustor and Beneficiaries: Identifies the husband and wife as Trustors and their children as beneficiaries.

- Trustee Appointment: Designates who will manage the trust assets, typically the Trustors themselves.

- Assets of Trust: Lists the properties and assets included in the trust.

- Trustee Powers: Outlines the powers granted to the Trustee regarding trust management and asset distribution.

- Distribution Terms: Details how the trust assets will be distributed upon the death of the Trustors.

Common use cases

This form should be used when a married couple wants to establish a living trust to manage their assets and provide for their children. It is particularly useful for estate planning to avoid probate, ensure privacy, and facilitate the smooth transfer of assets after death. Additionally, it's appropriate when the couple has children, both minors and adults, and wishes to include them as beneficiaries.

Who needs this form

- Married couples who wish to manage their assets effectively during their lifetime.

- Parents of minor and adult children seeking to provide for their family's future.

- Individuals looking to simplify the transfer of assets upon death and avoid the probate process.

- Those wanting to maintain control over their property while allowing for management by a Trustee.

Steps to complete this form

- Identify the parties involved, including the Trustors (husband and wife) and the Trustee.

- Specify the name of the trust and list the assets included in the trust.

- Designate the beneficiaries, including minor and adult children.

- Complete any sections regarding trustee powers and responsibilities.

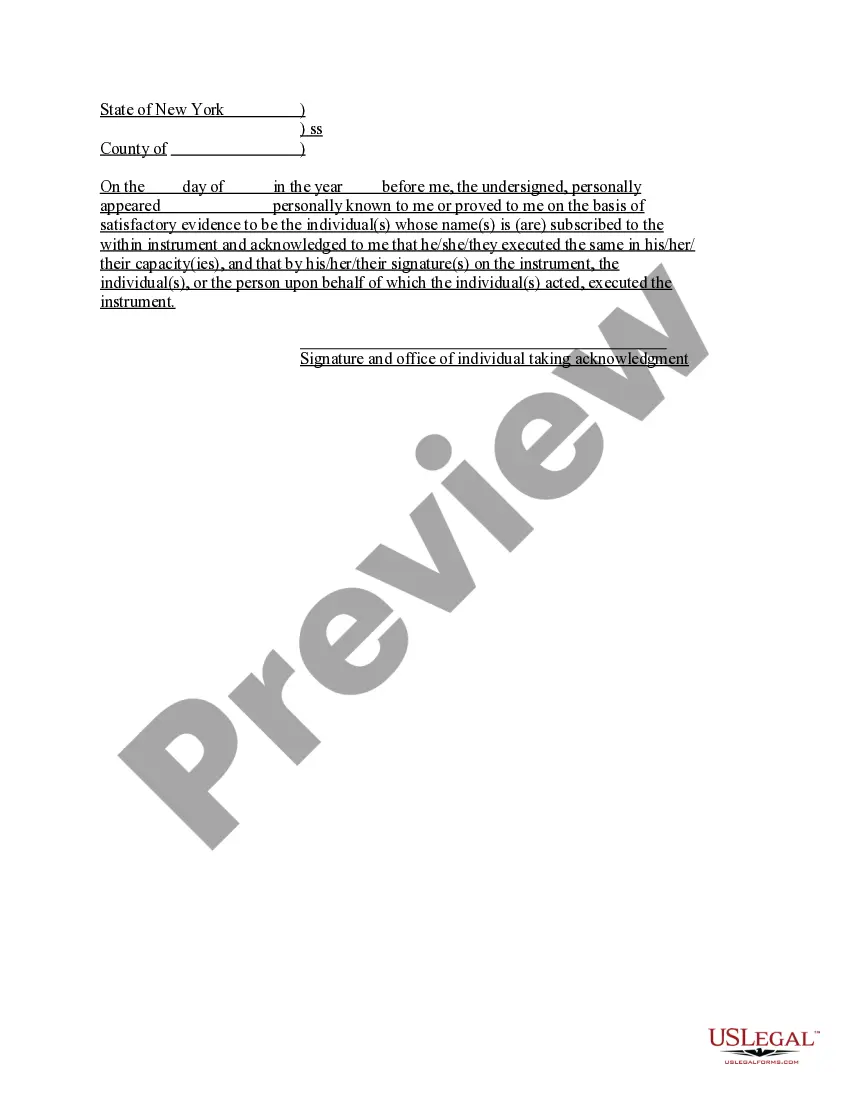

- Have the document signed and notarized as required to ensure its validity.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to list all assets intended to be included in the trust.

- Not properly appointing a successor Trustee in case the primary Trustee cannot serve.

- Overlooking necessary signatures or notarization, which can lead to disputes or invalidation.

- Failing to update the trust after significant life events, such as births, deaths, or changes in financial circumstances.

Benefits of using this form online

- Convenience of downloading and completing the form from your home.

- Editability allows for easy updates to provisions as family situations change.

- Reliable templates crafted by licensed attorneys, ensuring legal compliance.

- Time-saving compared to drafting a trust from scratch or seeking in-person consultations.

Looking for another form?

Form popularity

FAQ

Whether a husband and wife should have separate living trusts depends on individual circumstances. A Connecticut Living Trust for Husband and Wife with Minor and or Adult Children often offers a unified approach for managing assets collectively. However, there may be cases where separate trusts provide distinct benefits, such as protecting individual assets or addressing specific family situations. Consulting with a legal expert can help determine the best option for your family's needs.

Even if your children are adults, a Connecticut Living Trust for Husband and Wife with Minor and or Adult Children can still provide essential benefits. This trust helps manage and protect your assets, ensuring they are distributed according to your wishes. Additionally, it can simplify the estate administration process, avoiding the complexities of probate. By establishing a trust, you provide clarity and security for your adult children.

One significant downfall of having a Connecticut Living Trust for Husband and Wife with Minor and or Adult Children is the complexity that may arise when managing it. Trusts require ongoing maintenance and updates to reflect changing circumstances. Additionally, if not properly funded, the trust may not serve its intended purpose. It's important to be diligent in handling these responsibilities.

For married couples, particularly those with minor and or adult children, a Connecticut Living Trust for Husband and Wife with Minor and or Adult Children is often the best choice. This type of trust allows couples to manage their assets collaboratively while providing protections for their children. It can streamline the transfer of assets and reduce the burden of probate after one spouse passes away.

Deciding whether to put assets in a trust can depend on your parents' goals and financial situation. A Connecticut Living Trust for Husband and Wife with Minor and or Adult Children can provide peace of mind, ensuring that assets are managed according to their wishes. This option can also help avoid probate. Encourage your parents to consult a legal professional for tailored advice.

Many parents often fail to fund the trust properly when creating a Connecticut Living Trust for Husband and Wife with Minor and or Adult Children. They may forget to transfer assets into the trust, which can negate its benefits. Additionally, overlooking the need to regularly update the trust to reflect life changes can lead to complications later. It's vital to address these issues during the setup process.

Married couples do not necessarily need separate living trusts, especially when creating a Connecticut Living Trust for Husband and Wife with Minor and or Adult Children. Often, a joint trust simplifies management and provides straightforward asset distribution. However, separate trusts may be beneficial in certain circumstances, such as when one spouse has significant assets from before the marriage. Evaluating your unique situation with legal help can clarify the best approach for your family.

To set up a Connecticut Living Trust for Husband and Wife with Minor and or Adult Children, start by identifying the assets you wish to include in the trust. Next, choose a reliable trustee or trustees who will manage the trust effectively. After that, work with a legal professional or utilize platforms like USLegalForms to draft the trust document, ensuring it aligns with Connecticut laws and your family's needs. Finally, fund the trust by transferring your assets into it, securing your family's future.