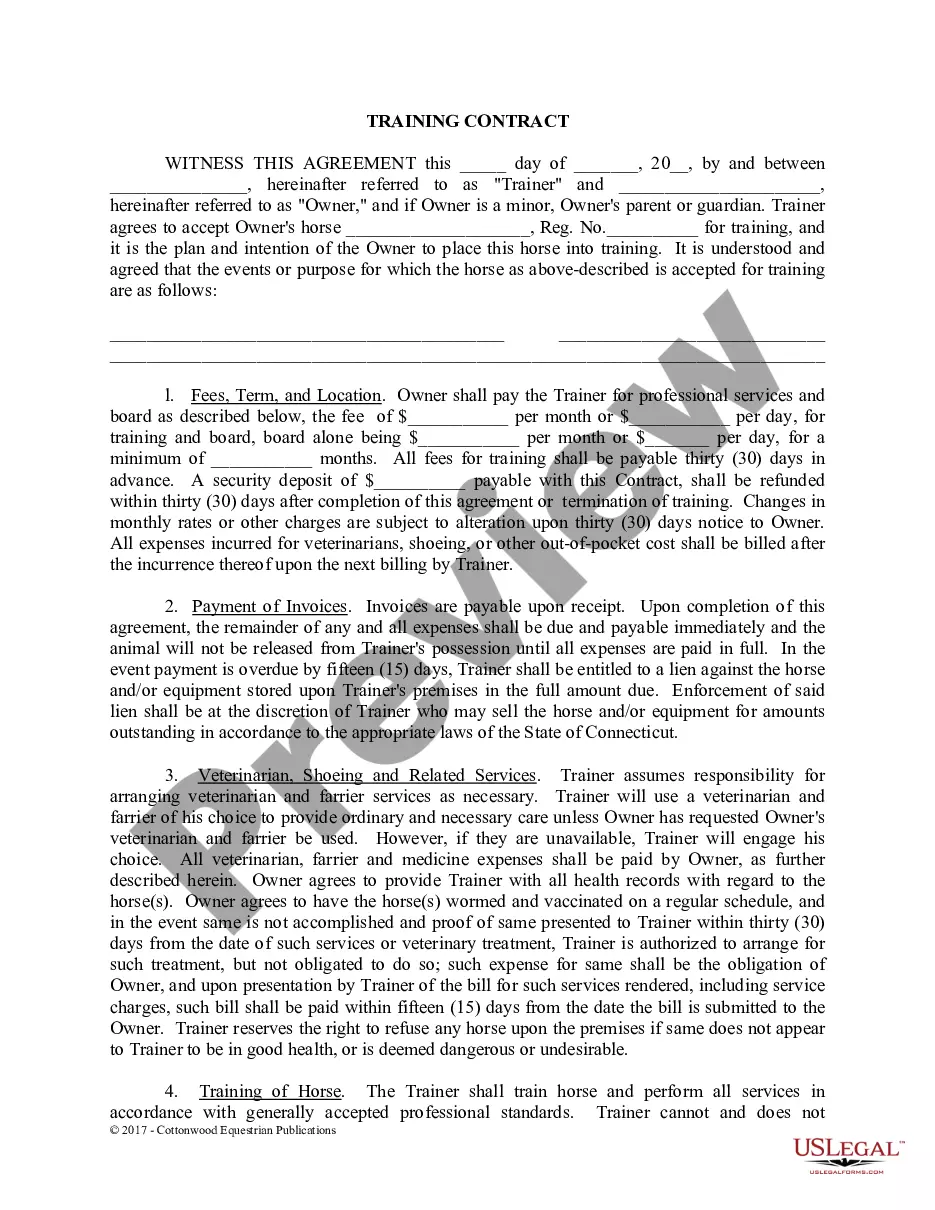

This Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

The higher the quantity of documents you must produce - the more anxious you feel.

You can discover a vast array of Connecticut Living Trust forms for individuals who are single, divorced, or a widow or widower without children on the internet, but you may not know which ones to trust.

Remove the difficulty of obtaining templates by using US Legal Forms.

Proceed to click Buy Now to initiate the registration process and select a pricing plan that suits your requirements. Provide the requested information to create your account and complete your purchase using your PayPal or credit card. Choose a convenient file format and obtain your template. Access every file you obtain in the My documents section. Simply navigate there to fill in a new copy of your Connecticut Living Trust for Individuals Who are Single, Divorced, or Widowed with No Children. Even when utilizing precisely drafted templates, it remains crucial to consider consulting your local attorney to double-check the completed form to ensure that your document is accurately filled out. Achieve more while spending less with US Legal Forms!

- Acquire professionally crafted documents that meet state requirements.

- If you are currently subscribed to US Legal Forms, Log In to your account, and you will see the Download button on the Connecticut Living Trust for Individuals Who are Single, Divorced, or Widowed with No Children’s webpage.

- If this is your first time using our website, complete the registration process with these steps.

- Ensure that the Connecticut Living Trust for Individuals Who are Single, Divorced, or Widowed without Children is applicable in your residing state.

- Verify your choice by reviewing the description or utilizing the Preview mode if available for the selected document.

Form popularity

FAQ

Yes, a single person with no children should consider having a trust. A Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children can clarify how your assets are managed and distributed, avoiding probate delays. Moreover, it allows you to appoint a trusted person to handle your affairs, ensuring that your intentions are upheld, even if your life takes unexpected turns.

One common mistake parents make is failing to properly fund the trust after it is established. Without funding, a trust has no assets to distribute or manage. For those considering a Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children, understanding the importance of funding your trust is crucial to avoiding complications later on.

If you are single and have no children, you may greatly benefit from a trust. A Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children can help you manage your assets, provide instructions for your estate, and designate someone to make decisions on your behalf. This could alleviate uncertainties and ensure that your wishes are honored in the event of incapacity or death.

If you get divorced, your living trust may need updates to reflect your new circumstances. In Connecticut, a living trust will generally remain intact unless the divorce decree specifies otherwise. It is wise to consult with a legal expert who specializes in creating a Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children to ensure your trust aligns with your new marital status and protects your interests.

While many couples establish living trusts to avoid probate, a Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children can still benefit married individuals without children. This type of trust can help manage assets, provide clear instructions for distribution, and protect your spouse in the event of your passing. Therefore, even if you are married and childless, consider creating a trust to maintain flexibility with your estate plans.

If your parents are considering a Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children, they may benefit from the protection and flexibility a trust offers. It allows for clearer distribution of assets and may help avoid probate. However, this decision should be made after thorough discussions about their financial situation and goals. Consulting with professionals or utilizing uslegalforms can provide them with the information needed to make a confident choice.

A potential downfall of a Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children lies in the complexity involved in managing the trust. If you do not keep your trust updated with changes in your assets or personal circumstances, it may not function as intended. Moreover, some individuals may struggle with the responsibilities that come with trust management. Engaging with a trustworthy platform like uslegalforms can simplify this process and ensure your trust reflects your wishes.

One downside of a Connecticut Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is that it may involve initial setup costs and ongoing maintenance fees. Additionally, creating a trust requires careful planning to ensure it meets your specific needs. If not done correctly, you might inadvertently create complications with your estate. It's crucial to consult with professionals who can guide you through the process effectively.