California Notice of Assignment to Living Trust

Overview of this form

The Notice of Assignment to Living Trust is an important legal document that serves as formal notice that a trustor has transferred their property rights into a living trust. This form is crucial for estate planning, indicating the transfer of assets while the trustor is still alive. Unlike other estate planning documents, this notice specifically focuses on the assignment of assets to a living trust, ensuring clarity in asset management and distribution in the future.

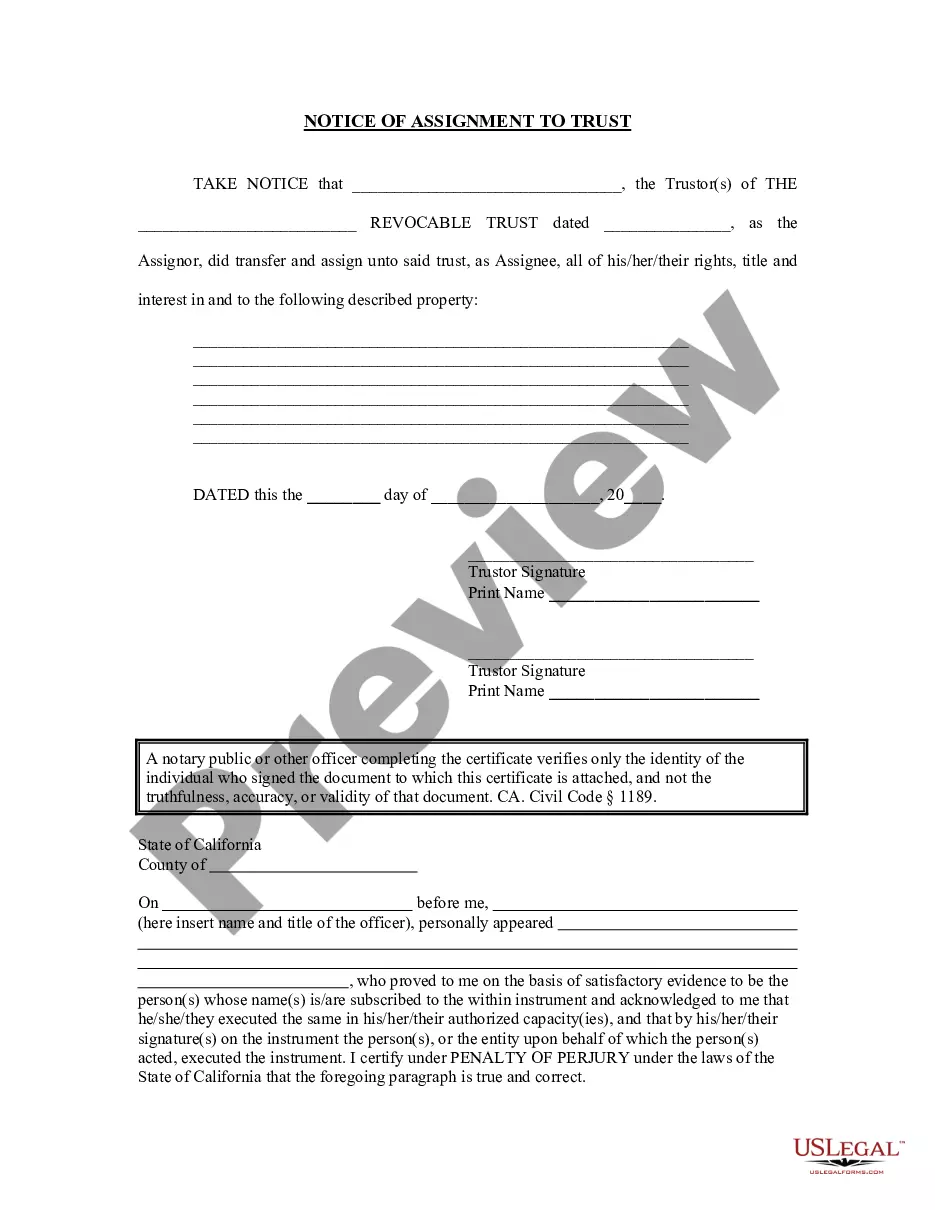

Form components explained

- Identification of the trustor(s) transferring the property.

- Details of the revocable trust being referenced.

- Description of the property being assigned to the trust.

- Signatures of the trustor(s) acknowledging the transfer.

- Notary acknowledgment for verification and legal validity.

Common use cases

This form should be used when an individual or individuals wish to assign property rights to their living trust. Scenarios for its use include transferring real estate, bank accounts, or other significant assets into the trust as part of a comprehensive estate planning strategy. It is particularly useful when making changes to what is included in the trust during the trustor's lifetime.

Who can use this document

- Individuals establishing a living trust for the first time.

- Trustors who wish to update or change the assets held within their existing living trust.

- Estate planners and financial advisors helping clients manage their assets.

Steps to complete this form

- Identify the trustor(s) involved by entering their names at the beginning of the form.

- Specify the name of the revocable trust and its date.

- Clearly describe the property being transferred to the trust, including any relevant details.

- Fill in the date of the assignment and gather signatures from all trustor(s).

- Have the form notarized to ensure its legal validity.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide a complete description of the property being assigned.

- Not obtaining the required signatures from all trustors involved.

- Neglecting to have the form notarized, which can impact its legal enforceability.

Benefits of completing this form online

- Convenience of instant access to the form, allowing for immediate use in estate planning.

- Editability features enable users to customize the form as needed for their specific circumstances.

- Reliability ensured by templates drafted by licensed attorneys with relevant legal expertise.

Looking for another form?

Form popularity

FAQ

In California, the trustee must notify beneficiaries and heirs about the existence of the trust, as well as any pertinent changes. This notice typically outlines the trust's terms and informs recipients of their rights regarding the trust assets. By adhering to the guidelines outlined in the California Notice of Assignment to Living Trust, the trustee can ensure compliance and proper communication with all parties involved.

Transferring property to a living trust in California involves changing the title of the property to reflect the trust's name. This process often requires filing specific forms with your county's recorder office. Implementing the California Notice of Assignment to Living Trust during this transfer can simplify the procedure and ensure that the property's ownership is transferred correctly.

To amend an existing living trust in California, you generally need to create a written document that clearly states the changes you wish to make. This typically requires signing the amendment in front of a notary to ensure its validity. Remember, a well-drafted California Notice of Assignment to Living Trust can help clarify any revisions you make, safeguarding your intentions.

Beneficiaries of a trust are typically notified through a formal communication sent by the trustee. This notification often includes details regarding the trust terms, their rights, and how the assets will be managed or distributed. Utilizing the California Notice of Assignment to Living Trust can help streamline this communication process, ensuring beneficiaries understand their entitlements clearly.

A common mistake parents make when setting up a trust fund is failing to fund it properly, which can lead to complications down the line. If assets are not transferred into the trust, it may not serve its intended purpose and could complicate the distribution of your estate. Keeping the California Notice of Assignment to Living Trust in mind can help ensure that all necessary documents are completed efficiently, minimizing any potential hiccups.

One potential disadvantage of placing your house in a trust in California is the associated costs, which may include initial setup fees and ongoing management expenses. Additionally, transferring title to a living trust might complicate your property tax situation, especially if you qualify for certain exemptions. This is where understanding the California Notice of Assignment to Living Trust comes into play, ensuring that the process aligns with your estate planning goals.

In California, a living trust does not require court filing. You create it to manage your assets during your lifetime and to distribute them after your passing. The California Notice of Assignment to Living Trust serves to formalize the transfer of assets into the trust, but it's not a court document. For assistance with this process and to learn more about managing your trust, consider using our platform at uslegalforms.

An assignment to a trust refers to the process of transferring ownership of assets into a trust to benefit the beneficiaries. This action is essential for the effective management of a living trust, as it allows the trust to operate as a separate legal entity. By completing a California Notice of Assignment to Living Trust, you confirm the assets designated for the trust, which helps streamline future distributions and protect the trust’s benefits.

The 16061.7 notice is provided to beneficiaries and heirs when a trust is created or modified. This notice informs them about the trust's existence and their rights under its provisions. If you have received a California Notice of Assignment to Living Trust, it signifies eligibility to receive this critical information, ensuring that all interested parties are properly informed.

In California, beneficiaries of a trust generally have the right to view the trust document. This access ensures beneficiaries understand the terms and conditions outlined within the trust, which is essential for managing expectations about asset distribution. If you have received a California Notice of Assignment to Living Trust, you are likely one of the individuals entitled to inspect the trust.