California Grant Deed from Individual to LLC

Understanding this form

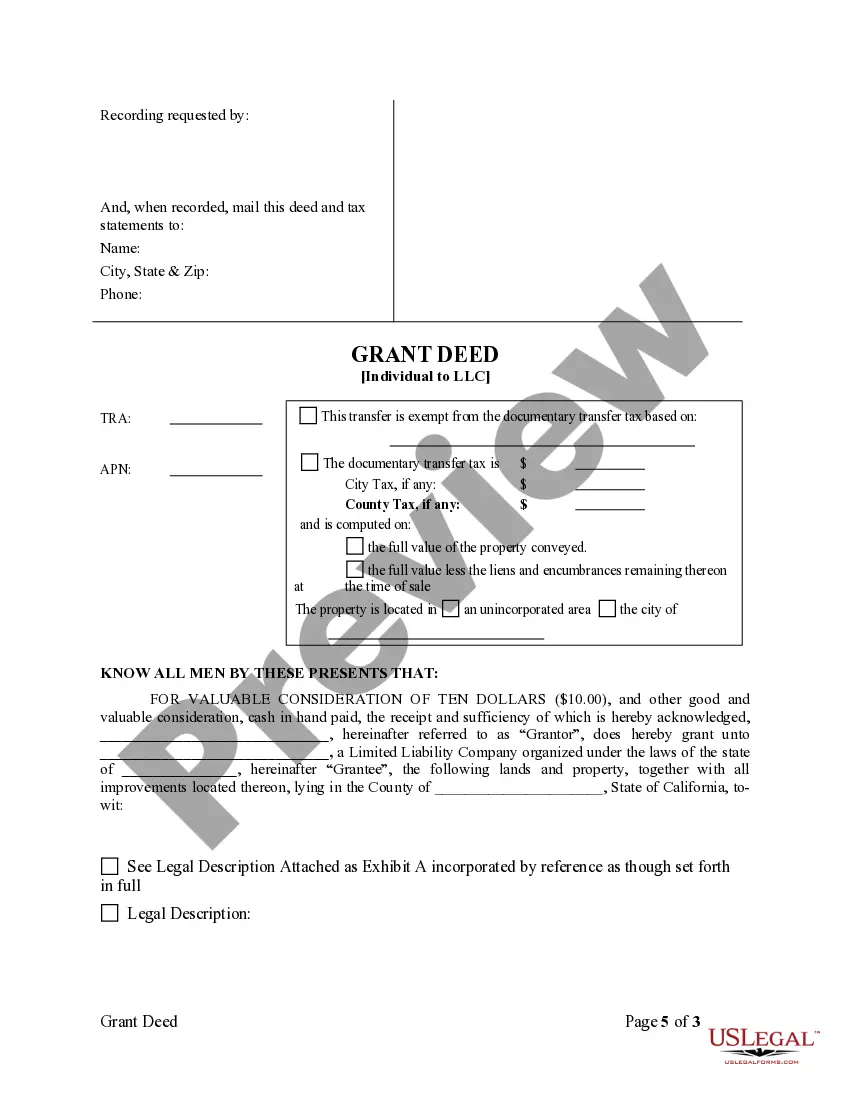

The Grant Deed from Individual to LLC is a legal document that conveys property ownership from an individual (grantor) to a limited liability company (grantee). This form is designed to ensure that the grantor warrants the title of the property to the LLC, while also excluding specific rights such as oil, gas, and mineral rights. It serves a distinct purpose compared to other property transfer forms, such as quitclaim deeds, by providing warranties regarding the title and ownership of the property.

What’s included in this form

- Identity of grantor and grantee: Clearly identifies who is transferring and receiving the property.

- Property description: Specifies the property being transferred in detail.

- Warranties: Includes clauses where the grantor warrants they hold title to the property and it is free from encumbrances.

- Exclusions: States the exclusion of oil, gas, and mineral rights from the transfer.

- Signature requirements: Requires signatures of the grantor and witnesses for authenticity.

When to use this form

This form should be used when an individual wants to legally transfer property ownership to their LLC. It is appropriate in scenarios such as establishing a business property within an LLC framework, securing business liabilities, or protecting personal assets from business-related risks. This form ensures that the property is properly conveyed with legal protections for both parties involved.

Who can use this document

- Individuals who are the current owners of real estate and want to transfer it to their LLC.

- Business owners seeking to protect personal assets by placing them under a business entity.

- Real estate investors who frequently move property into an LLC for management or liability purposes.

How to complete this form

- Identify the parties: Clearly state the names of the individual grantor and the LLC grantee.

- Specify the property: Provide a full description of the property being transferred.

- Enter relevant dates: Include the effective date of the transfer and the date of the deed signing.

- Complete warranty clauses: Fill in any warranties regarding ownership and encumbrances as relevant.

- Sign and date the document: Ensure the grantor and witnesses sign the document to validate it.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include a complete and accurate property description.

- Not obtaining the necessary signatures from witnesses.

- Omitting details about exclusions such as mineral rights.

- Using outdated or incorrect forms that may not comply with current regulations.

Why complete this form online

- Convenience: Quickly download and complete the form from anywhere.

- Editability: Easily make changes before finalizing the document.

- Reliability: Access forms drafted by licensed attorneys, ensuring legal soundness.

Looking for another form?

Form popularity

FAQ

Yes, you can transfer personal assets to an LLC, such as real estate or personal property. It's important to create the necessary legal documents, including a California Grant Deed from Individual to LLC, to properly execute the transfer. Make sure to consult with a professional to ensure compliance with applicable laws.

People often put their property in an LLC to protect their assets from personal liability, facilitate estate planning, and enhance privacy. By doing so, they can separate business and personal assets, curbing risks associated with property ownership. This strategic move can also offer tax benefits, making it appealing for many.

Transferring ownership of a property to an LLC starts with drafting a California Grant Deed from Individual to LLC. Be sure to include accurate property details and signatures from all involved parties. After notarizing, the deed should be filed with the county recorder to officially change ownership.

To transfer a deed from an individual to an LLC, complete a California Grant Deed from Individual to LLC. This deed needs to detail the property and the new owner, which is the LLC. Once signed and notarized, file the grant deed with your local county recorder to finalize the transfer.

To transfer personal assets to an LLC, you should first determine the assets you want to transfer, which may include property or equipment. After this, prepare the appropriate documents, including a California Grant Deed from Individual to LLC for any real estate. Proper documentation safeguards your ownership rights and the LLC’s legal standing.

Yes, you can transfer personal funds to your LLC. Typically, this is done through a capital contribution, which you should document for proper accounting. Keep in mind that maintaining clear records helps separate personal and business finances, ensuring your LLC's liability protection remains intact.

Putting personal assets in an LLC involves two main steps: identifying the assets and preparing the necessary documentation. You should create an operating agreement that outlines the transfer process and complete the California Grant Deed from Individual to LLC for any real estate. This process formalizes ownership and provides legal protection.

To transfer your property to an LLC in California, you need to prepare a California Grant Deed from Individual to LLC. This deed serves as the official document for the ownership transfer. After filling out the deed, you must sign it in front of a notary public and then file it with the county recorder's office.

To transfer a Grant Deed in California, you must first complete the required documents, including the Grant Deed form. Next, ensure that the deed accurately reflects the transfer from an individual to an LLC. After signing the deed, file it with the county recorder's office where the property is located. For a smooth process, consider using US Legal Forms to access professionally drafted templates and additional guidance on completing a California Grant Deed from Individual to LLC.