California Grant Deed from Two Individuals to LLC

Understanding this form

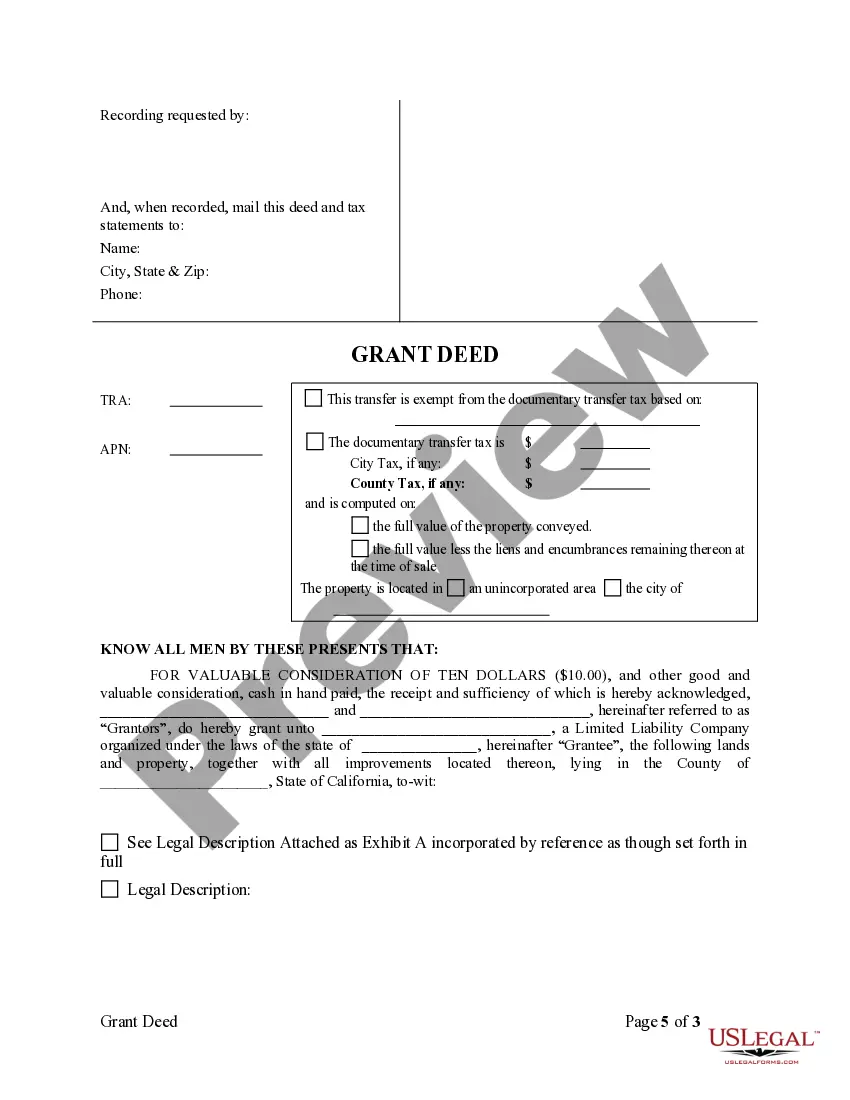

The Grant Deed from Two Individuals to LLC is a legal document used to transfer property ownership from two individuals (the Grantors) to a limited liability company (the Grantee). This warranty deed ensures that the Grantors convey the property while typically reserving rights to any oil, gas, or minerals beneath the surface. Unlike other deed forms, this specific grant deed provides unique protection for the LLC regarding title claims and encumbrances.

Form components explained

- Identification of Grantors: The two individuals transferring property ownership.

- Identification of Grantee: The limited liability company receiving the property.

- Property Description: Clear and detailed description of the property being transferred.

- Reservation Clause: States that any oil, gas, or minerals are excluded from the transfer.

- Covenant of Seisin: Assurance that Grantors own the property free of encumbrances.

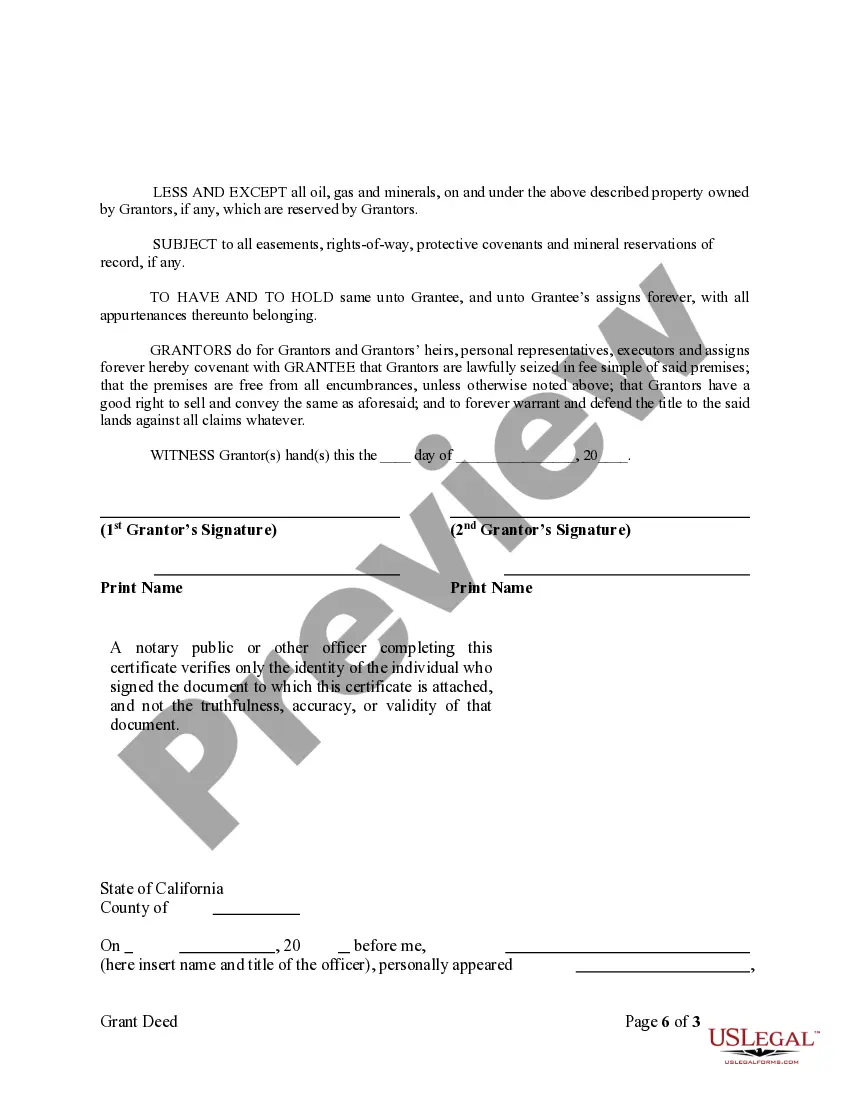

- Signatures: Required signatures of both Grantors and notarization to validate the transfer.

Common use cases

This form is typically used when two individuals wish to transfer their jointly owned property to a limited liability company. Common scenarios include: - Converting personal property ownership into an LLC to enhance liability protection. - Facilitating joint investments in real estate through a business entity rather than as individuals. - Streamlining the management of property under a single business structure.

Who can use this document

- Real estate investors looking to protect their personal assets.

- Business owners forming an LLC for property ownership.

- Individuals transferring property for estate planning purposes.

Steps to complete this form

- Identify the Grantors: Enter the names of the two individuals transferring the property.

- Specify the Grantee: Include the name of the limited liability company receiving the property.

- Describe the Property: Clearly outline the location and boundaries of the property.

- Complete the Reservation Clause: Indicate any oil, gas, or mineral rights being reserved.

- Sign and Date: Both Grantors must sign and date the form in the presence of a notary public.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include a complete and accurate description of the property.

- Not specifying reservations for oil, gas, or mineral rights when applicable.

- Omitting signatures or dates, which can render the document invalid.

- Not having the form notarized, which may be required for legal acceptance.

Benefits of using this form online

- Convenience of accessing and downloading legal forms from anywhere.

- Editability of the form allows for personalization to fit specific needs.

- Reliability of attorney-drafted templates ensures compliance with legal standards.

Summary of main points

- This form allows the transfer of property from two individuals to an LLC.

- It must be completed with accurate property details and notarized for legal validity.

- Using this form online provides convenience and reliable legal templates.

Looking for another form?

Form popularity

FAQ

To avoid property tax reassessment when transferring property into an LLC, use a California Grant Deed from Two Individuals to LLC as it typically qualifies for certain exclusions from reassessment. Understanding the California Proposition 58 and Proposition 193 can further clarify how to maintain your property tax base. Consulting with a tax professional or real estate expert is advisable to ensure that your LLC's property transfers are in compliance with local laws. Additionally, US Legal Forms provides resources and templates to assist in this process.

Placing your rental property in an LLC in California can offer various benefits, such as liability protection and potential tax advantages. An LLC can protect your personal assets from risks associated with the property. If you decide to proceed, consider using a California Grant Deed from Two Individuals to LLC to formalize the transfer of the property title into the LLC. This action can simplify management and enhance your investment strategy.

Transferring property title between family members can be straightforward, especially with a California Grant Deed from Two Individuals to LLC. This deed type provides a simple way to transfer ownership while ensuring all parties are protected. You should consult an attorney or a real estate professional to confirm the transfer is in compliance with California regulations. Additionally, using the US Legal Forms platform can streamline the process and provide the necessary legal documents.

To transfer property to an LLC in California, you will need to execute a California Grant Deed from Two Individuals to LLC. Begin by preparing the grant deed, which includes essential details such as property description and the names of the individuals and the LLC. Once the deed is completed, sign and date it before a notary public. Finally, record the deed with the county recorder's office to legally finalize the transfer and ensure public notice of the new ownership.

While it is not strictly necessary to hire a lawyer to transfer a deed in California, doing so can provide valuable guidance. A legal expert can ensure all documents are filled correctly and comply with state laws. Using a platform like uslegalforms can also simplify the process by providing the necessary forms and instructions for completing your California Grant Deed from Two Individuals to LLC.

Transferring ownership of property to an LLC involves drafting a grant deed that lists the LLC as the new owner. Once the deed is signed and notarized, you should record it with the county recorder's office. This transition not only provides legal clarity but also aligns with your business objectives and asset protection strategies.

To transfer a deed from an individual to an LLC, you will create a new grant deed that identifies the LLC as the owner. After signing and notarizing this document, file it with your county recorder. This process, executed properly, helps protect both the individual and the LLC while clearly establishing ownership.

Many people choose to place their property in an LLC to limit personal liability and enhance asset protection. Additionally, an LLC can provide potential tax benefits and simplify the management of rental properties. By transferring property as a California Grant Deed from Two Individuals to LLC, owners can streamline their operations and improve financial outcomes.

Transferring your property to an LLC in California involves preparing a grant deed that names the LLC as the new owner. You will need to sign the deed, get it notarized, and submit it to the local county recorder’s office. This action not only protects your personal assets but also simplifies future property management.

To remove someone from a grant deed in California, you need to prepare a new grant deed that solely lists you as the owner. You must sign this new deed, have it notarized, and file it with the county recorder's office. This process is essential to reflect the current ownership accurately and may require additional documentation if the removal involves a significant relationship.