1. Statutory General Power of Attorney with Durable Provisions

2. Power of Attorney for Care and Custody of Children

3. Health Care Directive as Living Will

Minnesota Power of Attorney Forms Package

Description

How to fill out Minnesota Power Of Attorney Forms Package?

Obtain any template from 85,000 legal documents such as the Minnesota Power of Attorney Forms Package online with US Legal Forms. Each template is crafted and refreshed by state-certified legal experts.

If you already possess a subscription, Log In. Once you are on the form’s page, click on the Download button and navigate to My documents to gain access to it.

If you haven’t subscribed yet, follow the instructions outlined below.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable sample. The service provides access to documents and organizes them into categories to enhance your search efficiency. Use US Legal Forms to acquire your Minnesota Power of Attorney Forms Package quickly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Power of Attorney Forms Package you intend to utilize.

- Review the description and view the sample.

- When you are confident that the template meets your needs, click Buy Now.

- Choose a subscription plan that fits your financial plan.

- Establish a personal account.

- Make a payment through one of two convenient methods: by credit card or via PayPal.

- Select a format to download the document in; two choices are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

You can easily obtain a Minnesota Power of Attorney Forms Package through online platforms like US Legal Forms. This platform offers a comprehensive selection of customizable forms that meet Minnesota's legal requirements. Simply visit their website, select the Minnesota Power of Attorney Forms Package, and follow the prompts to download your forms. With this package, you can ensure that your documents are accurate, up-to-date, and ready for use.

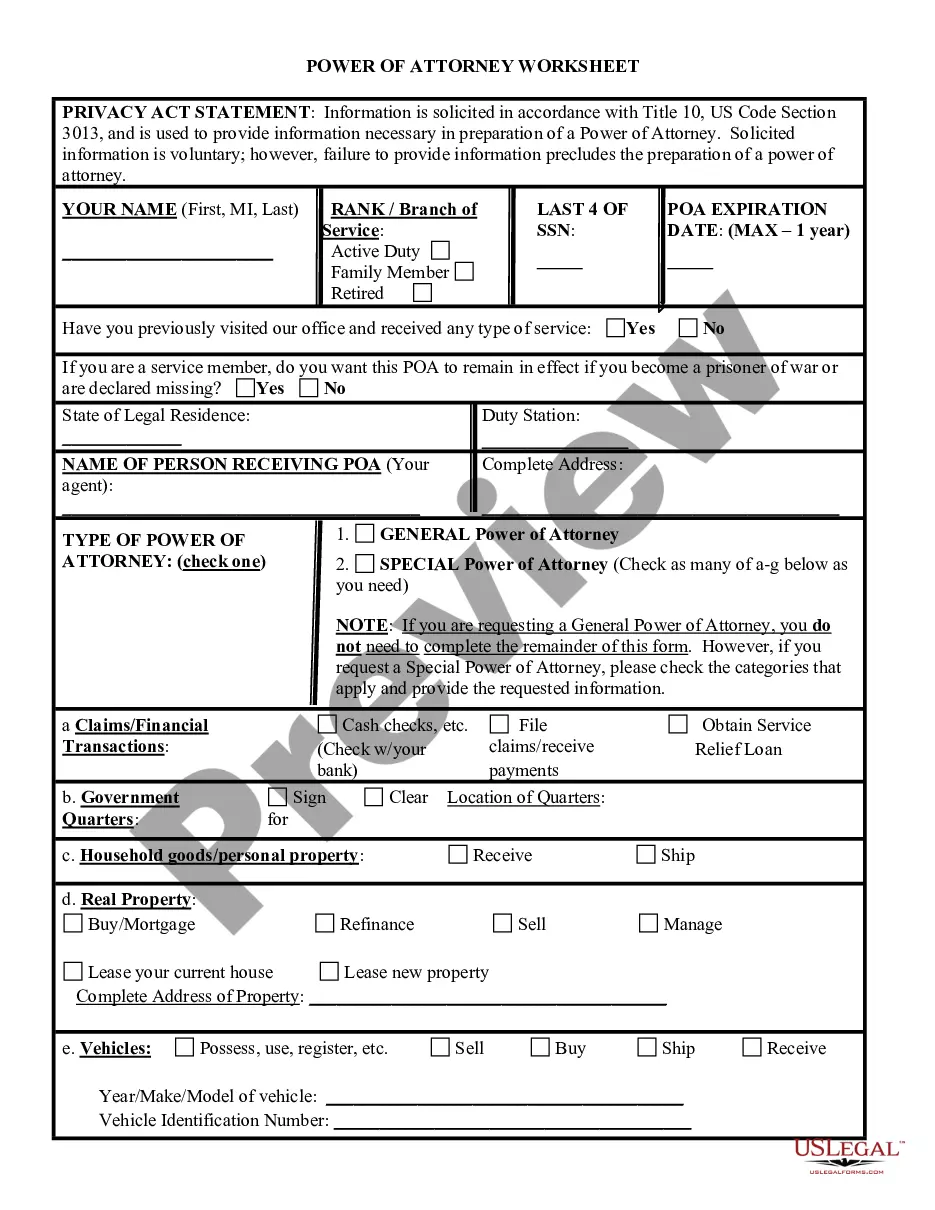

To properly fill out a power of attorney form, start by selecting the appropriate form from the Minnesota Power of Attorney Forms Package available at USLegalForms. Accurately enter your personal information and the details of your agent. It’s crucial to follow the instructions provided with the form, ensuring that all necessary sections are completed and signed. Taking the time to do this correctly ensures that your power of attorney will be effective when you need it.

Yes, in Minnesota, a power of attorney generally needs to be notarized to be legally valid. When you use the Minnesota Power of Attorney Forms Package from USLegalForms, you receive clear instructions that help you understand the notarization process. Notarization adds an extra layer of authenticity to the document, ensuring that it is accepted by banks and other institutions. Always check the specific requirements to ensure your POA meets legal standards.

To fill out a lasting power of attorney form, begin by downloading the Minnesota Power of Attorney Forms Package from a trusted source like USLegalForms. Carefully read each section and provide the necessary information about yourself and the person you are appointing as your agent. Ensure that you sign the document in front of a notary if required, and keep copies for your records. This package simplifies the process, making it easy to complete your form accurately.

You can obtain power of attorney forms through various sources, but the best option is to use a reliable online platform like US Legal Forms. They offer a comprehensive Minnesota Power of Attorney Forms Package that meets state requirements and simplifies the process. By choosing this package, you ensure that your forms are accurate and legally binding. Additionally, US Legal Forms provides guidance and support to help you complete your documents correctly.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

Under the Minnesota power of attorney statutes, the principal's signature on a Minnesota Power of Attorney document need not be acknowledged before a notary public. However, third parties may require it, and a Minnesota Statutory Short Form Power of Attorney document will look incomplete without such an acknowledgment.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner.Before signing an LPOA, the client should be aware of the specific functions they have delegated to the portfolio manager, as the client remains liable for the decisions.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

A power of attorney is a legal document that allows a principal to appoint an agent to act for them should they become incapacitated. The agent is expected to place the principal's interests ahead of his or her own, which is why it is important for you and your loved one to pick a trusted individual.