California Grant Deed from Individual to Trust

Understanding this form

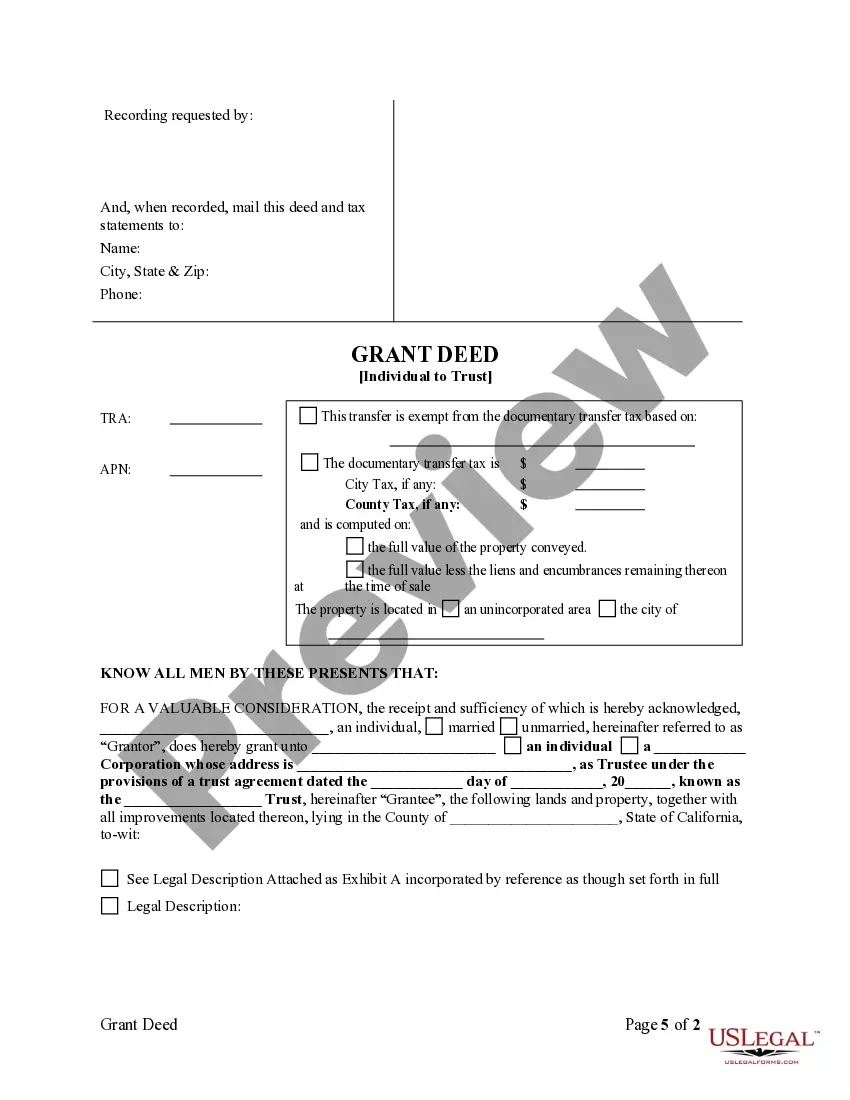

The Grant Deed from Individual to Trust is a legal document that facilitates the transfer of property ownership from an individual (the grantor) to a trust (the grantee). This form serves a specific purpose by allowing individuals to place their property in a trust for various reasons, such as estate planning or asset protection. Unlike other deeds, this document explicitly states that the grantor is reserving rights to oil, gas, and minerals beneath the property, making it unique among property transfer forms.

Main sections of this form

- Grantor's and grantee's information, including names and addresses.

- Legal description of the property being conveyed.

- Reservations for oil, gas, and minerals under the property.

- Signatures of both parties to confirm the transfer.

- Date of transfer as part of the documentation.

Situations where this form applies

This form should be used when an individual wishes to transfer property into a trust. Scenarios may include estate planning where the property will be managed according to the terms of the trust, or when an individual is looking to protect their assets from probate processes. It is also appropriate when the grantor wants to ensure the property is managed according to their wishes after their passing.

Who needs this form

- Individuals who own property and wish to create an estate plan that includes a trust.

- Trustees who need to formally receive property into a trust.

- Those looking to keep property within a family or manage it for specific beneficiaries.

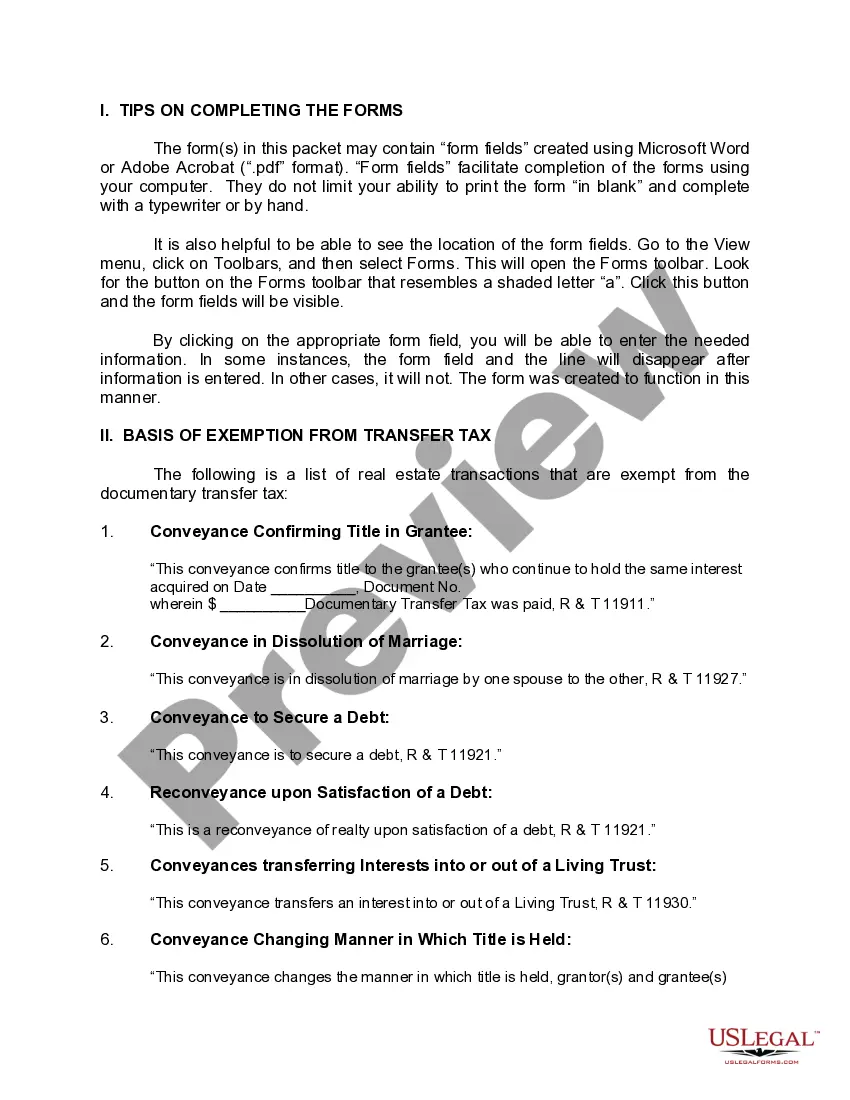

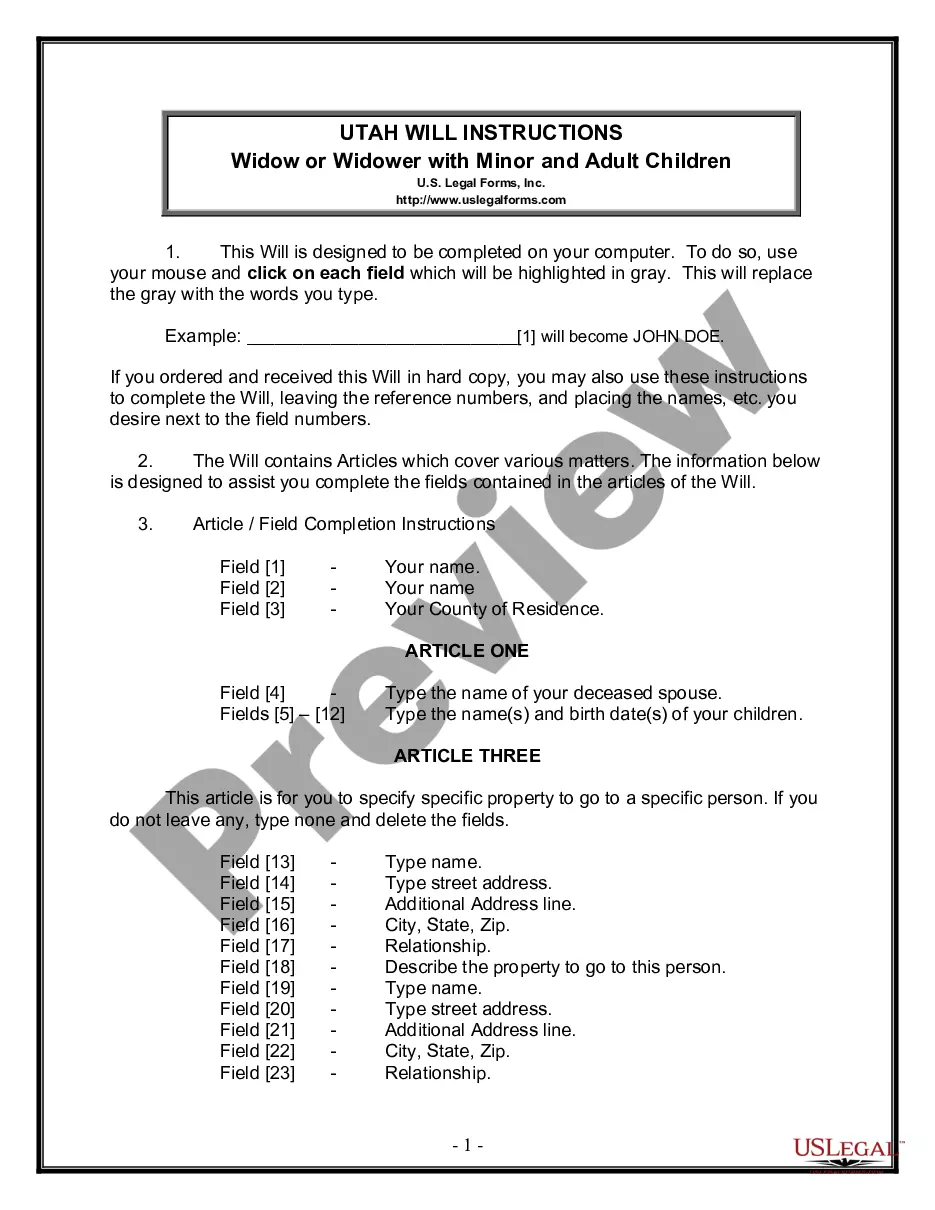

How to prepare this document

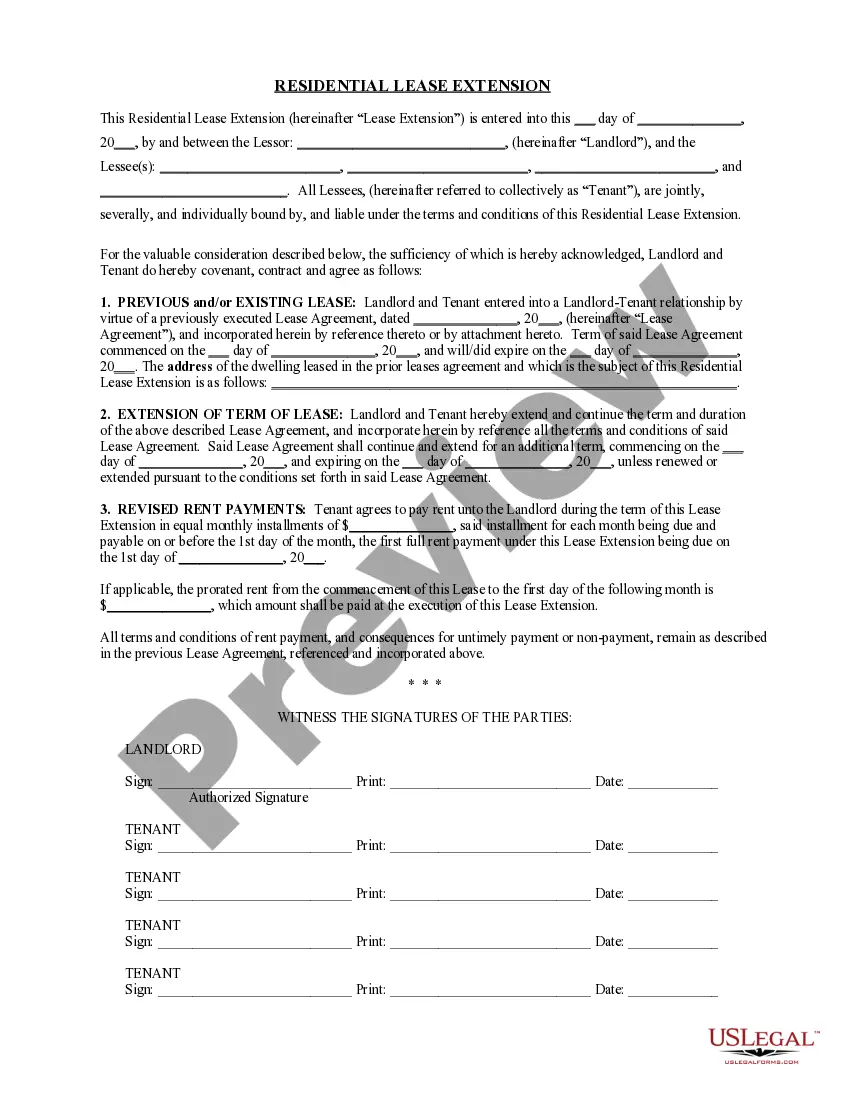

- Identify and fill in the names and addresses of the grantor and the trust as grantee.

- Provide a legal description of the property being conveyed, ensuring accuracy.

- Note any reservations for oil, gas, or minerals that the grantor wishes to retain.

- Have both parties sign the form to confirm the transfer.

- Include the date of the transaction at the specified location on the form.

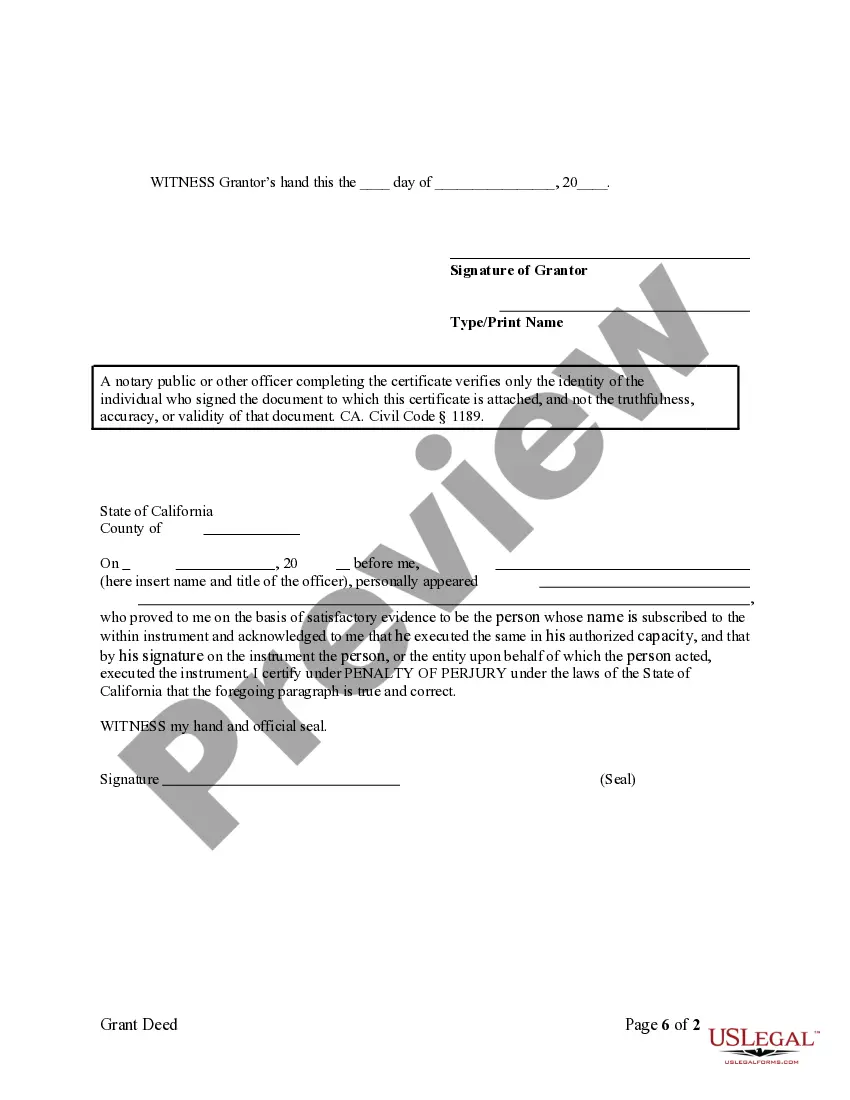

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include a complete legal description of the property.

- Not reserving rights to oil, gas, or minerals, when applicable.

- Missing signatures from one or both parties involved in the transfer.

- Not dating the deed, which can lead to legal disputes over the timing of the transfer.

Benefits of using this form online

- Convenience of downloading and editing the form as needed from anywhere.

- Assurance of using documents that meet current legal standards for property transfer.

- Quick access to templates created by licensed attorneys, reducing the risk of legal errors.

Looking for another form?

Form popularity

FAQ

To file a California Grant Deed from Individual to Trust, start by preparing the grant deed form with accurate details about the property and the trust. After filling out the form, ensure it is signed by the grantor in the presence of a notary public. Next, file the completed grant deed with the local county recorder's office in the county where the property is located. For a streamlined process, consider using US Legal Forms to access templates and guidance specific to California transactions.

To transfer a California Grant Deed from Individual to Trust, first, you need to prepare a new grant deed that includes the legal description of the property and the name of the trust. Next, sign the deed before a notary public to ensure its validity. Once signed, you must file the deed with the county recorder's office where the property is located. This process effectively transfers the property into the trust, providing potential benefits like avoiding probate and simplifying estate management.

Yes, you can transfer ownership of a trust, subject to the terms of the trust document. This process can include assigning property titles such as real estate using a California Grant Deed from Individual to Trust. It is essential to review the trust's provisions and consult with a legal expert to ensure proper execution. This way, you can effectively manage how your assets are distributed according to your wishes.

Changing your suppressor from individual ownership to a trust is a viable option. You will need to complete the necessary paperwork and use a California Grant Deed from Individual to Trust for any associated property. This process helps streamline the management and transferability of your suppressor under the terms of the trust. Always check the latest regulations to ensure compliance.

Transferring an individual tax stamp to a trust is not a standard process. Typically, tax stamps apply to property transfers, and using a California Grant Deed from Individual to Trust can facilitate the ownership transfer of real estate. Speak to a tax professional to understand any implications regarding tax stamps for your specific situation. Proper guidance will help you navigate any complexities involved.

Yes, you can transfer an individual account to a trust using a California Grant Deed from Individual to Trust. This deed allows you to formally change the title of your property into the trust's name. By doing so, you ensure that your assets are managed according to your wishes. It's important to follow proper legal procedures to make this transition seamless.

Yes, you can transfer property from an individual to a trust in California. This is often accomplished by executing a California Grant Deed from Individual to Trust. It's important to ensure that the document is properly filled out, signed, and recorded with the local county office to make sure the transfer is legally valid and enforceable.

To transfer a deed to a living trust in California, begin by drafting your living trust agreement. After establishing the trust, complete a California Grant Deed, clearly indicating that the property is being transferred to the living trust. Once signed and notarized, record the deed with the county recorder's office to ensure proper legal standing.

While putting your house in a trust in California has benefits, there are some disadvantages to consider. Transferring property to a trust may involve upfront costs and require ongoing management. Additionally, if not set up properly, a trust can complicate estate matters or tax situations. It is wise to consult a professional for personalized advice when considering a California Grant Deed from Individual to Trust.

To put your property in a trust in California, start by establishing the trust itself, which may require legal assistance for best practices. Once you have the trust document, you will need to execute a California Grant Deed that transfers ownership of the property to the trust. Remember to record this deed with the county recorder to finalize the process and protect your assets under the trust.