California Limited Liability Company LLC Formation Package

What is this form package?

The California Limited Liability Company LLC Formation Package provides all necessary legal forms to establish a Limited Liability Company (LLC) in California. This package includes step-by-step instructions, Articles of Organization, an Operating Agreement, and additional resolutions and forms tailored specifically for California's legal requirements. Unlike other general formation packages, this one is designed by licensed attorneys to meet the specific needs of California businesses, ensuring that users adhere to state laws while enjoying the benefits of an LLC structure.

Documents contained in this package

- Limited Liability Company LLC Operating Agreement

- Single Member Limited Liability Company LLC Operating Agreement

- California Articles of Organization for Domestic Limited Liability Company LLC

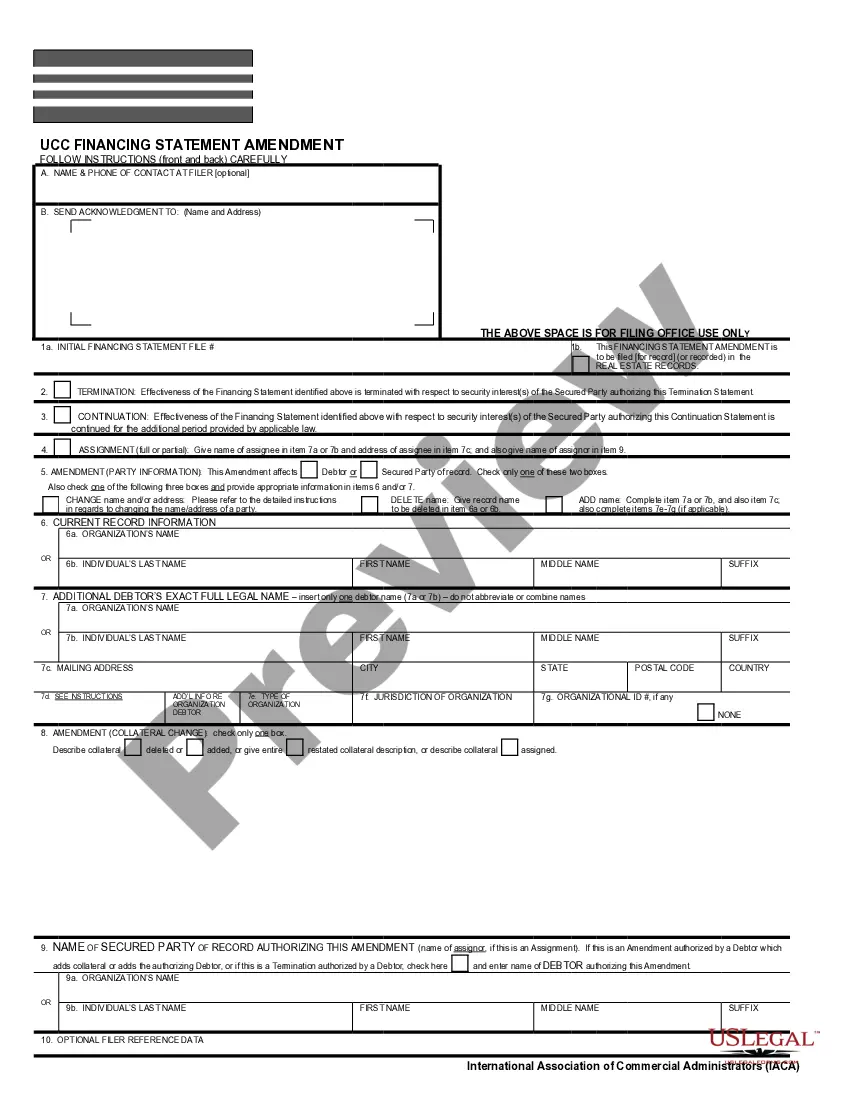

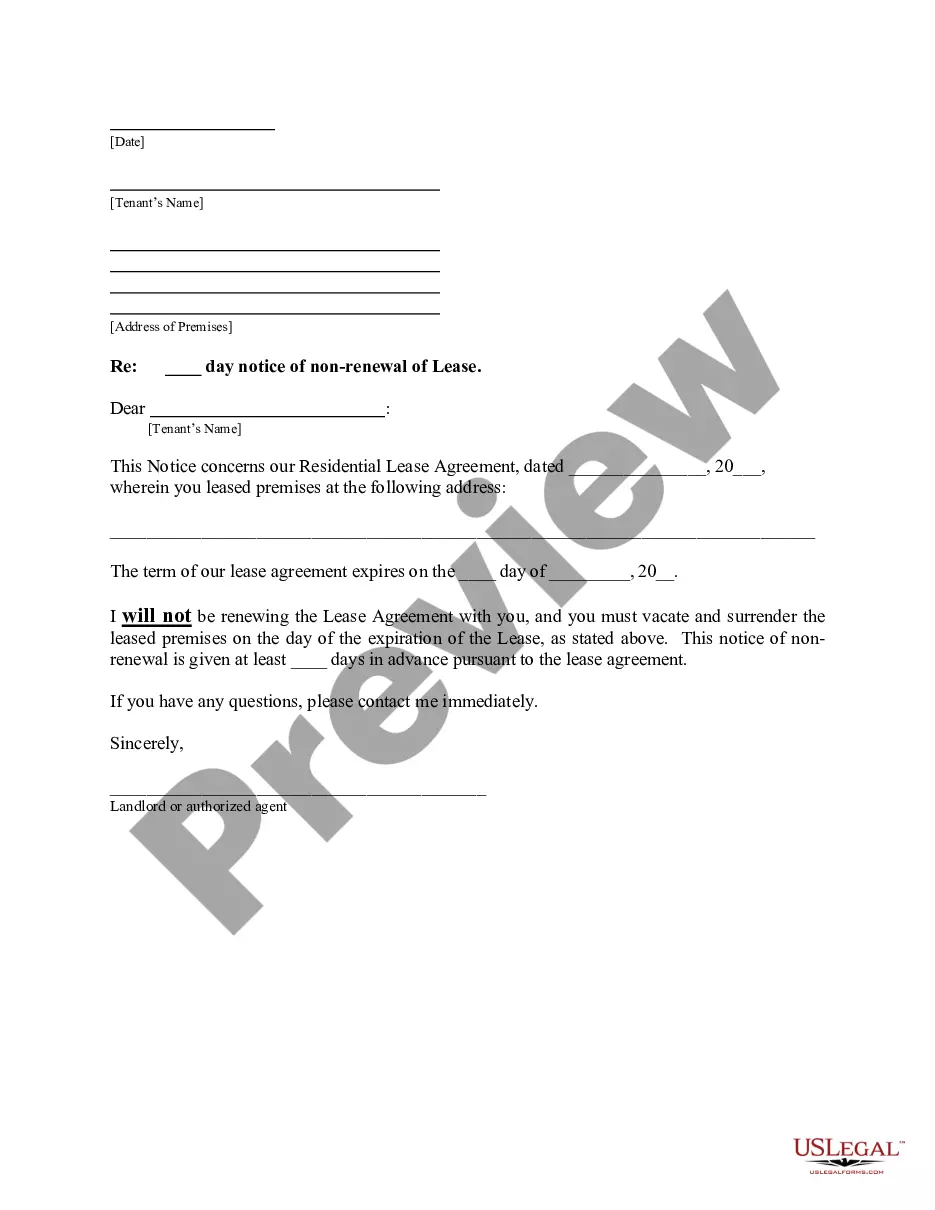

- LLC Notices, Resolutions and other Operations Forms Package

- Sample Cover Letter for Filing of LLC Articles and Certificate with Secretary of State

- Application for Name Reservation

- I.R.S. Form SS-4 (to obtain your federal identification number)

When to use this document

This package is ideal for individuals or groups looking to start a business in California and want the liability protection offered by an LLC. It is particularly useful when:

- You want to limit personal liability for business debts and obligations.

- You seek flexible management arrangements and tax treatment options.

- You are forming a business that does not involve professional services, as these are not eligible for LLC formation in California.

Who needs this form package

- Entrepreneurs planning to start a new business in California.

- Small business owners looking to protect personal assets from business liabilities.

- Individuals forming a partnership that requires a formal business structure.

- Business owners complying with California's legal requirements for LLC formation.

How to complete these forms

- Review the included step-by-step instructions to understand the process.

- Complete the Articles of Organization and the Statement of Information forms, ensuring all necessary details are provided.

- Draft the Operating Agreement, specifying member roles and management structures.

- File the Articles of Organization with the California Secretary of State along with the required filing fee.

- Apply for a Federal Tax Identification Number (EIN) using the IRS Form SS-4.

- Open a business bank account under your LLC name to manage your business finances.

Notarization details for included forms

Forms in this package usually don’t need notarization, but certain jurisdictions or signing circumstances may require it. US Legal Forms provides a secure online notarization option powered by Notarize, accessible 24/7 from anywhere.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to check the availability of the LLC name before filing.

- Not including the Statement of Information with the Articles of Organization.

- Neglecting to draft and adopt an Operating Agreement.

- Overlooking the need for a registered agent within California.

- Not securing an EIN before starting business operations.

Benefits of using this package online

- Convenient access to all necessary forms and documents in one package.

- Step-by-step guidance simplifies the LLC formation process for users with limited legal experience.

- Reliable documents drafted by licensed attorneys, ensuring compliance with California laws.

- Ability to easily edit and customize forms to match specific business needs.

Looking for another form?

Form popularity

FAQ

The best way to file LLC taxes varies based on your structure and revenue. If you're a single-member LLC, filing through your personal return often proves easiest. For multi-member LLCs, filing Form 1065 and providing each member with a K-1 is recommended. Consider our California Limited Liability Company LLC Formation Package for detailed instructions tailored to your specific situation.

To file your LLC taxes by yourself, first ensure you have all necessary documents like income statements and receipts for business expenses. Depending on your LLC structure, you'll either use Schedule C or Form 1065. Our California Limited Liability Company LLC Formation Package offers resources that provide insights into navigating the self-filing process.

Yes, if you operate a single-member LLC, your LLC’s income is reported on your personal tax return as part of your overall income. This integration simplifies tax season since both your LLC and personal taxes are filed on the same return. By using our California Limited Liability Company LLC Formation Package, you can ensure you're meeting all necessary requirements and deadlines.

To fill out your LLC tax return, gather all income and expense statements to ensure accuracy. For most single-member LLCs, you'll use Schedule C on your personal tax return. If you have a multi-member LLC, you may need to file Form 1065. Utilizing the California Limited Liability Company LLC Formation Package can help streamline this process.

A single owner LLC in California typically files taxes as a sole proprietorship. This means you report income and expenses on your personal tax return using Schedule C. When you take advantage of our California Limited Liability Company LLC Formation Package, you can receive guidance on tax obligations and filing requirements.

To fill out your limited liability company operating agreement, start by including your LLC's name and formation date. Then, outline the management structure, members' rights, and profit distribution. It's important to have clarity in this document, as it regulates how your California Limited Liability Company operates, especially if you face disputes in the future.

To avoid the $800 tax for a new LLC in California, you can opt for the California Limited Liability Company LLC Formation Package, which helps you structure your LLC properly from the start. As a new business, your LLC may qualify for certain exemptions based on your revenue levels. Additionally, consider filing your LLC before the end of the year, as this can impact your tax obligations. By leveraging the expert guidance and resources offered by uslegalforms, you can navigate these potential tax savings effectively.

If you need a copy of a statement of information in California, you can access it through the California Secretary of State's website as well. Search for the desired LLC using the business entity search function and follow the prompts to download the document. Utilizing the California Limited Liability Company LLC Formation Package can help streamline this process, making it easier for you to manage your business's compliance needs.

To obtain a copy of your California statement of information, visit the California Secretary of State's website. You can use the business search tool to locate your LLC and request a copy online. It's an important step in managing your California Limited Liability Company LLC Formation Package, as it ensures your filings are up to date and compliant.

To avoid the $800 annual LLC fees in California, consider establishing your business in another state or exploring non-profit status, which may exempt you from certain fees. Additionally, a California Limited Liability Company LLC Formation Package can guide you on any potential deductions or exemptions available. Always consult with a tax professional to understand the best strategies for your situation and remain compliant.