Maryland Closing Statement

What this document covers

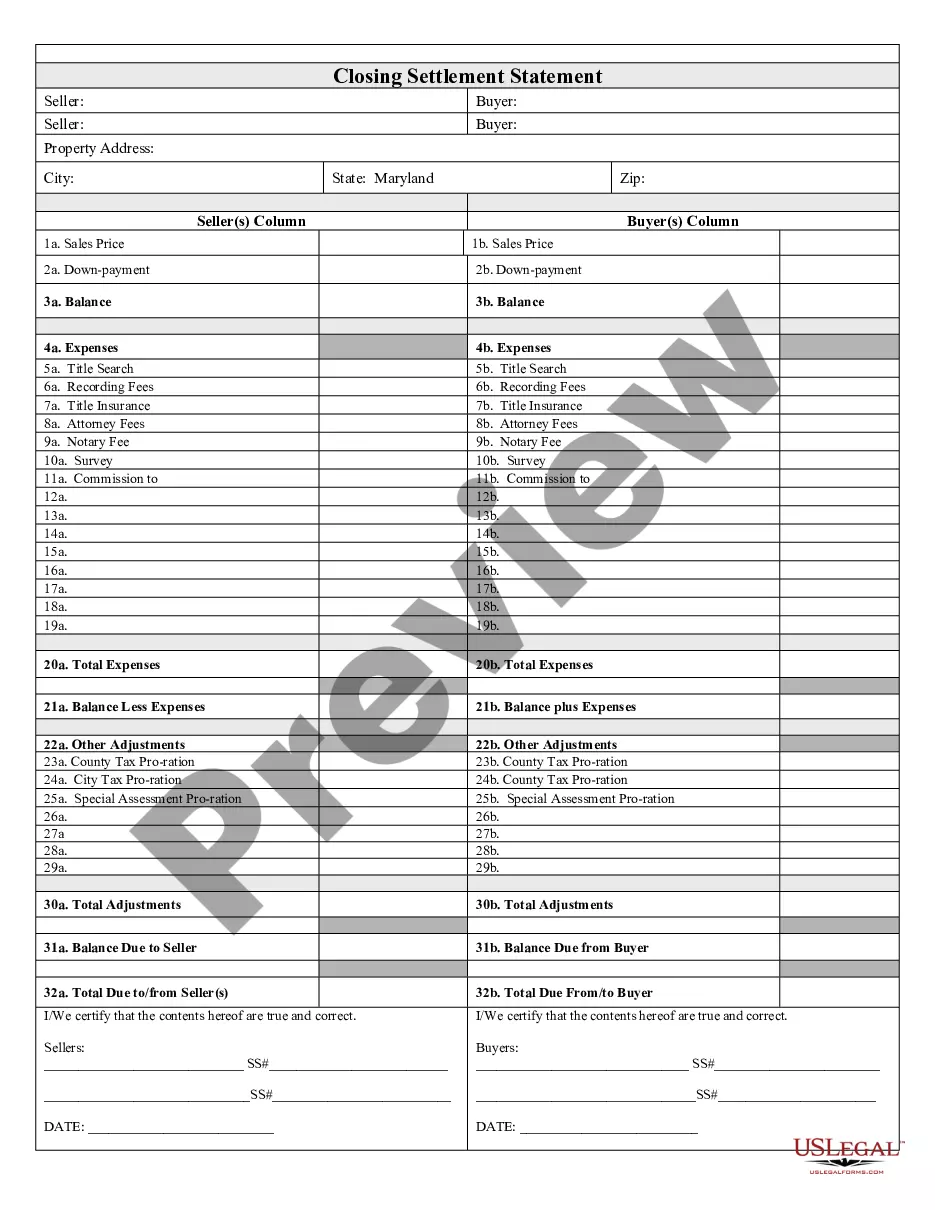

The Closing Statement is a crucial document in real estate transactions involving cash sales or owner financing. This form serves as a verified settlement statement that summarizes the financial aspects of the sale, including expenses, credits, and final balances. It distinguishes itself from other closing documents by providing a comprehensive breakdown of all financial transactions, ensuring that both the seller and buyer have a clear understanding of their respective obligations and receipts.

Form components explained

- Balance: Records the overall financial summary after expenses are deducted.

- Expenses: Details various costs associated with the transaction, such as title search, recording fees, and attorney fees.

- Adjustments: Captures any necessary prorations for taxes or special assessments.

- Certification: Statement affirming the accuracy of the contents, signed by both the seller and buyer.

- Total Due: Summarizes the final amounts owed to or from each party.

When to use this form

This Closing Statement should be utilized whenever a real estate transaction occurs, especially in cases of cash sales or owner-financed purchases. It is essential during the closing process to ensure that all parties are aware of financial terms, to settle any outstanding fees, and to finalize the transaction correctly.

Who should use this form

- Buyers engaged in purchasing real estate with cash or owner financing.

- Sellers who need documentation of the financial aspects of the property sale.

- Real estate agents or attorneys assisting in the transaction.

- Title companies managing the closing process.

Instructions for completing this form

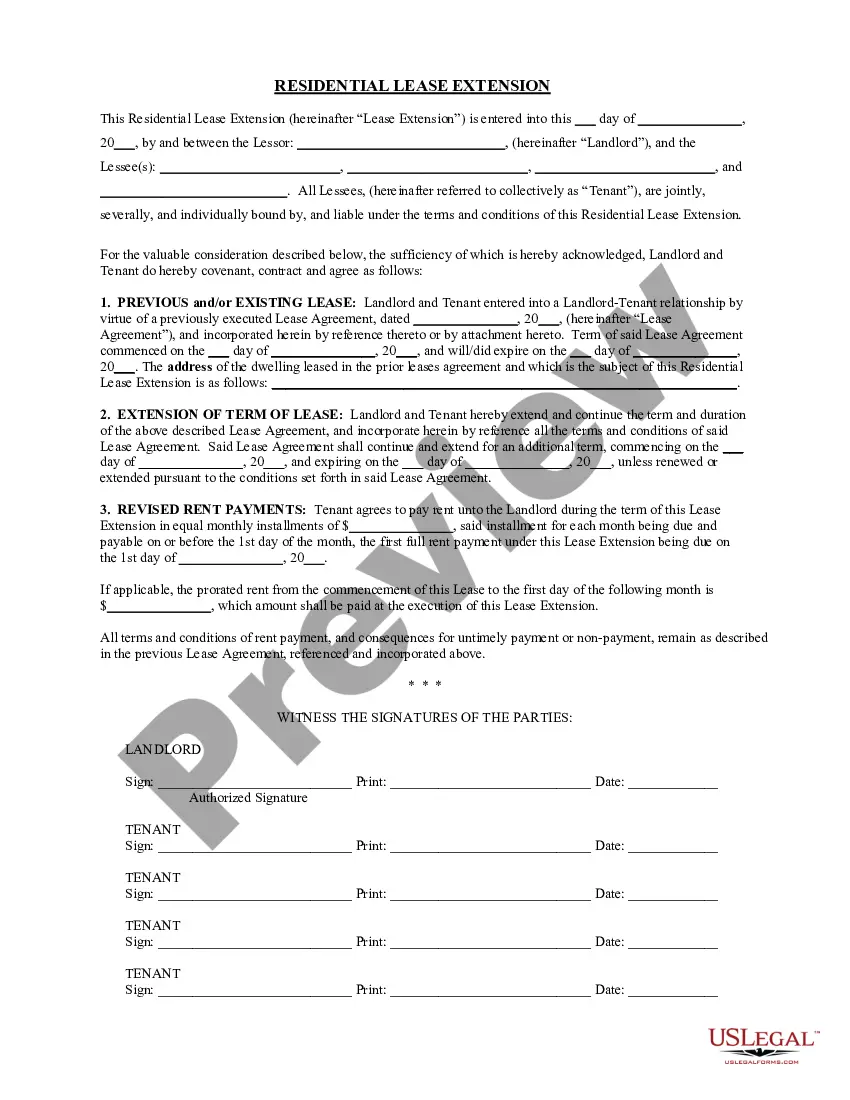

- Identify the parties involved, including the seller and buyer details.

- Specify the property being sold, including the address and legal description.

- Document all expenses related to the transaction, such as title searches and attorney fees.

- Calculate the total expenses and adjust for any credits or prorations.

- Obtain signatures from both seller and buyer to certify the statement's accuracy.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all relevant expenses, leading to discrepancies in final totals.

- Not obtaining signatures from both parties, which may invalidate the statement.

- Incorrectly calculating prorated taxes and fees, resulting in financial misunderstandings.

Why use this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows adjustments to be made quickly without starting over.

- Reliability from using templates drafted by licensed attorneys for legal accuracy.

Looking for another form?

Form popularity

FAQ

Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

The Deed: public record of the ownership of the property It often includes a description of the property and signed by both parties. Deeds are the most important documents in your closing package because they contain the statement that the seller transfers all rights and stakes in the property to the buyer.

- The final costs of a closing statement are often expressed in a document that is called the HUD or the HUD-1 Statement. HUD is an abbreviation for the Housing and Urban Development department part of the federal government that mandates the recording of certain information about real estate transactions.

Double-check the loan amount, loan type, loan term, interest rate, monthly payment amount, whether there is a prepayment penalty, whether you are paying points or receiving credits, and other key details. Compare the Annual Percentage Rate (APR) on the Closing Disclosure to the APR listed on your Loan Estimate.

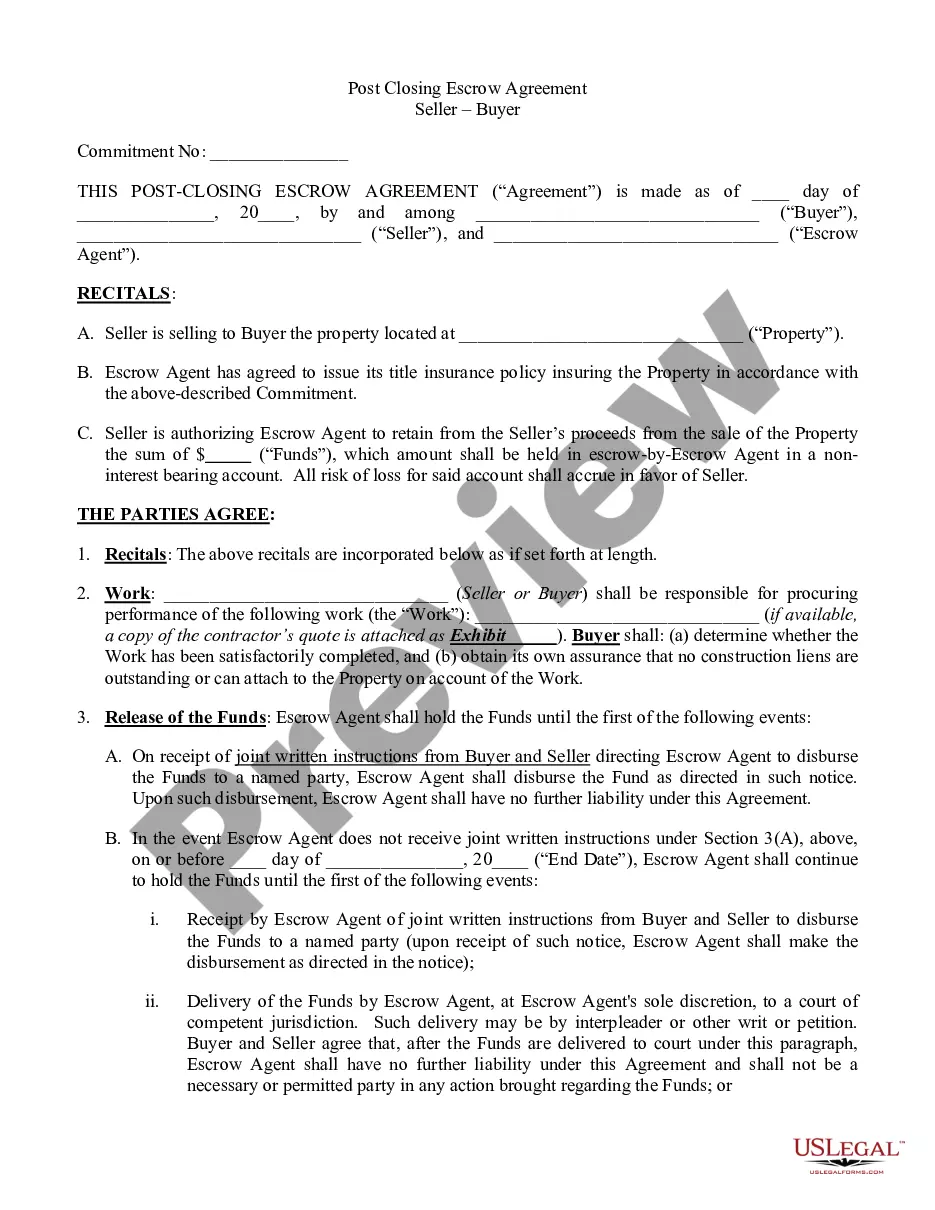

Some common closing papers you can expect include your completed loan application, mortgage promissory note, deed of trust, loan estimate and closing disclosure, bill of sale, title insurance documents, affidavit of title, escrow statement, tax documents and notice of right to cancel.

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

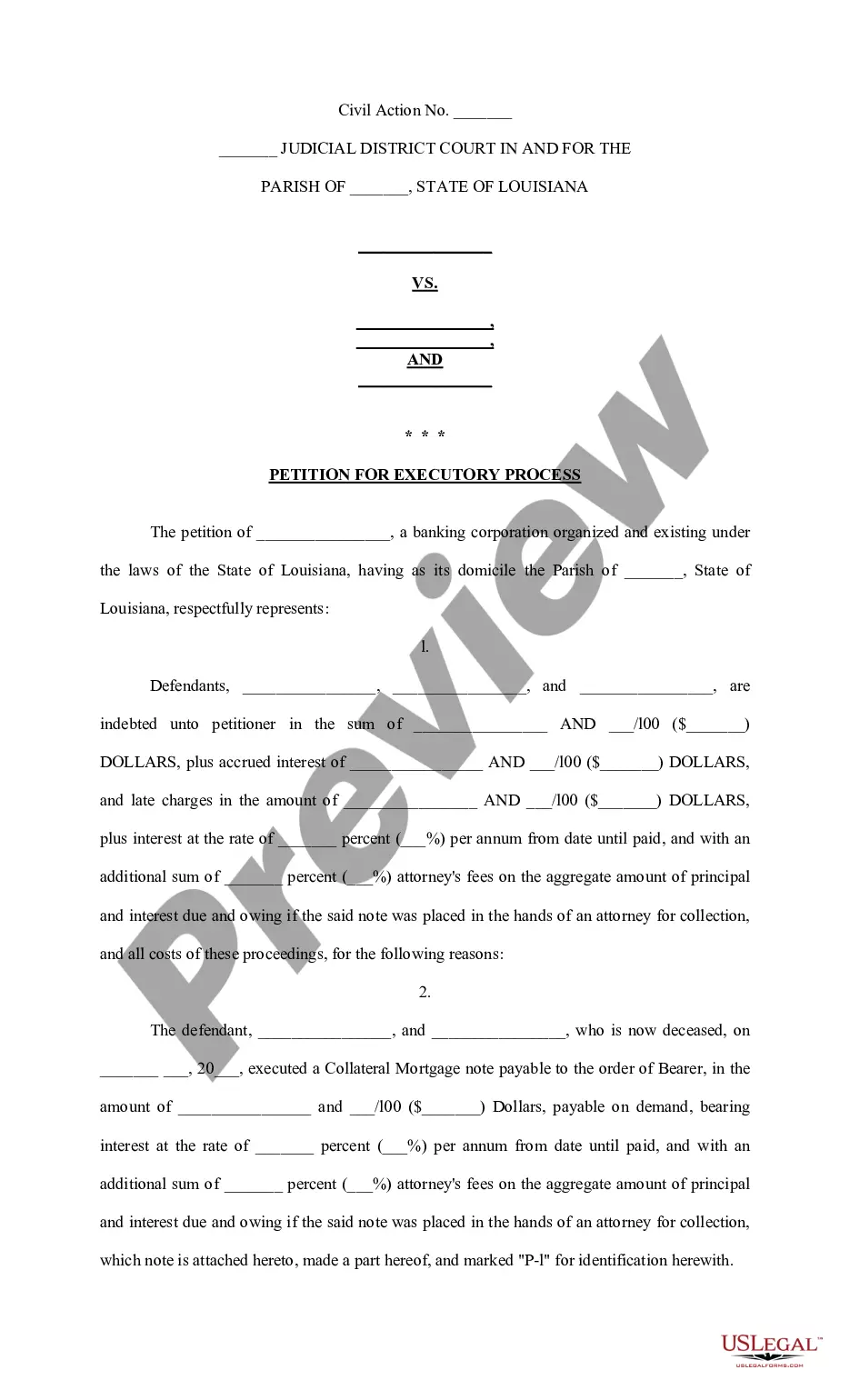

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

The Mortgage Promissory Note. The Mortgage / Deed of Trust / Security Instrument. The deed (for property transfer). The Closing Disclosure. The initial escrow disclosure statement. The transfer tax declaration (in some states)