Arizona Closing Statement

What this document covers

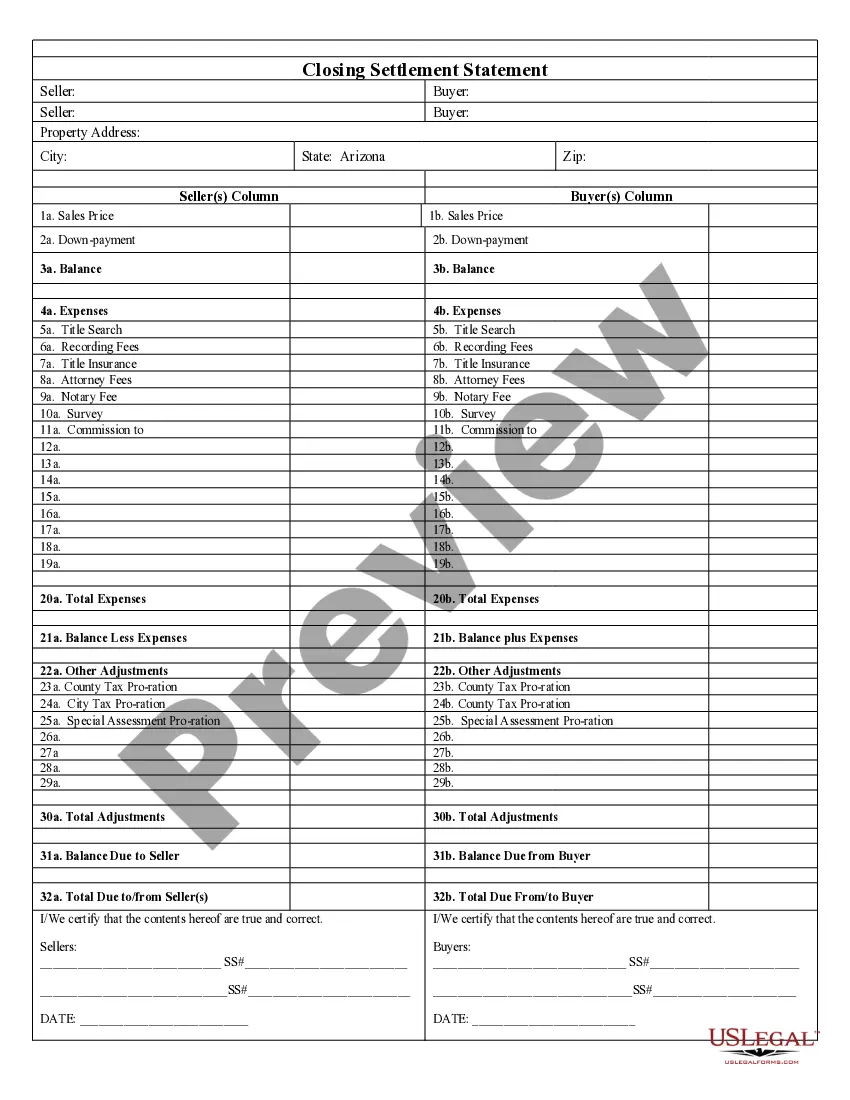

The Closing Statement is a crucial document used in real estate transactions, specifically for cash sales or owner-financed deals. It summarizes all financial aspects related to the sale, allowing both the buyer and seller to verify the transaction's accuracy. Unlike other settlement documents, this form is particularly focused on detailing the balance due, listing expenses, and confirming agreements between parties involved in the transaction.

What’s included in this form

- Balance summary: Details amounts owed by the buyer and amounts due to the seller.

- Expense breakdown: Lists all incurred costs, including title insurance, attorney fees, and survey costs.

- Adjustments: Provides information on pro-rated taxes and other adjustments affecting the final amounts.

- Certification of accuracy: Both parties sign to confirm the information is true and correct.

- Total calculations: Summarizes total expenses and final balances for clarity.

When this form is needed

This form should be used when finalizing a real estate transaction involving cash sales or owner financing. It is essential during the closing process to ensure that both parties are aware of all expenses and financial obligations associated with the sale.

Who can use this document

- Home buyers and sellers engaged in cash transactions or owner financing.

- Real estate agents or brokers facilitating the sale.

- Attorneys involved in the closing process of real estate transactions.

Instructions for completing this form

- Identify the parties involved in the transaction: seller(s) and buyer(s).

- List all expenses related to the transaction, including fees for title search and insurance.

- Complete the balance section: outline amounts due to the seller and amounts owed by the buyer.

- Detail any adjustments, such as county tax pro-ration to ensure accurate financial representation.

- Both parties should sign and date the document to validate its contents.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Forgetting to include all expenses, which can lead to disputes later on.

- Not obtaining signatures from both parties, making the document invalid.

- Failing to double-check calculations for final balances and adjustments.

Why complete this form online

- Convenience: Easily download and fill out the form from the comfort of your home.

- Editability: Customize sections to reflect your transaction accurately without any hassle.

- Reliability: Access forms drafted by licensed attorneys, ensuring legal compliance.

Main things to remember

- The Closing Statement is essential for real estate transactions involving cash sales or owner financing.

- Accurate completion ensures clarity on financial responsibilities for both parties.

- Always double-check figures and obtain necessary signatures to validate the form.

Looking for another form?

Form popularity

FAQ

Closing fees in Arizona can vary based on factors such as property location and transaction type. Generally, these costs may include title insurance, recording fees, attorney fees, and possibly escrow fees. Reviewing your Arizona Closing Statement will clarify which fees apply to your specific situation. By utilizing resources like US Legal Forms, you can better prepare for these fees and ensure a smooth closing experience.

In Arizona, the closing process involves several important steps to finalize a real estate transaction. You will typically review and sign various documents, including the Arizona Closing Statement. This document details the financial transactions of the sale, ensuring all parties understand their obligations. Working with a qualified real estate agent or attorney can streamline the process and provide clarity.

In Arizona, bank accounts that have designated beneficiaries typically do not go through probate, as they pass directly to the listed individuals. This can be beneficial, helping to expedite the transfer of assets. However, if there are additional complexities, such as other estate debts, preparing an Arizona Closing Statement might still be necessary to ensure all matters are properly addressed.

While it's not mandatory to hire a lawyer for probate in Arizona, having legal guidance can simplify the process greatly. A lawyer can help you navigate the paperwork, including the Arizona Closing Statement, ensuring all documents are complete and filed correctly. This assistance can save you time and minimize stress during a challenging period.

In Arizona, you typically have two years from the date of death to file probate. However, it is wise to start the process sooner to avoid complications, especially when handling assets. An effective Arizona Closing Statement can help track all estate assets and streamline the filing process.

Filing Arizona probate involves submitting the required forms to the probate court. Begin by completing the petition for probate and include necessary documents like the will and death certificate. After filing, the court will schedule a hearing, and you may also need to prepare an Arizona Closing Statement to summarize the estate's financial situation.

To start probate in Arizona, you need to file a petition with the appropriate court in the county where the deceased resided. You will also need to provide a copy of the death certificate and the last will, if available. It's important to understand the required documents, as an Arizona Closing Statement may be needed to detail the estate's assets and debts.

When an estate closes, it signifies the completion of all legal and financial procedures related to a deceased person's estate. This includes settling debts, distributing assets to beneficiaries, and filing necessary documents with the court. An Arizona Closing Statement helps summarize these final financial aspects. Closing the estate effectively releases the personal representative from their duties and provides closure for the remaining family members.

While you don't necessarily need an attorney to close on a house in Arizona, having legal guidance is often beneficial. An attorney can help you navigate the complexities of real estate transactions, ensuring that all paperwork, including the Arizona Closing Statement, is correctly handled. Whether you're buying or selling, professional support can lead to a smoother closing experience.

In Arizona, you generally have up to one year to settle an estate after the probate process begins. However, this timeline can vary based on the complexity of the estate and any disputes that may arise. Keeping track of deadlines is crucial, as some actions require settlement within specific time frames. So, be prepared to manage those expectations with accurate Arizona Closing Statements.