Louisiana Business Credit Application

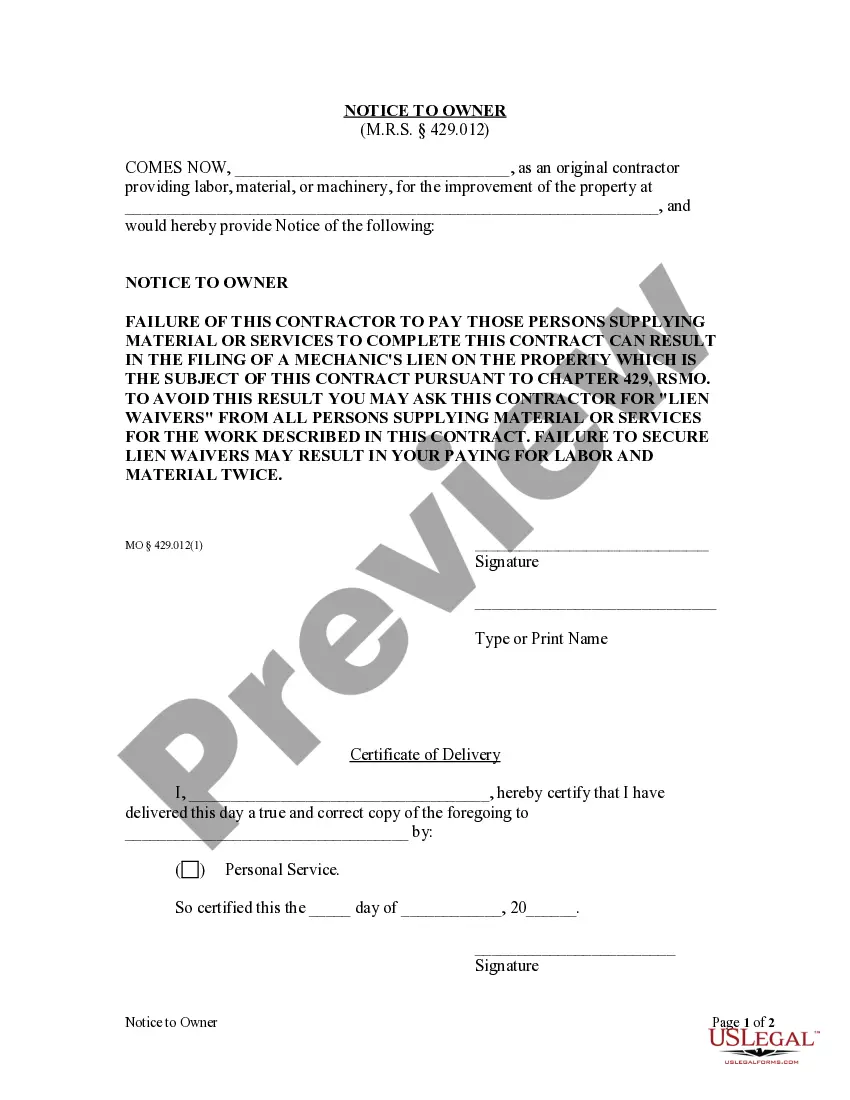

What this document covers

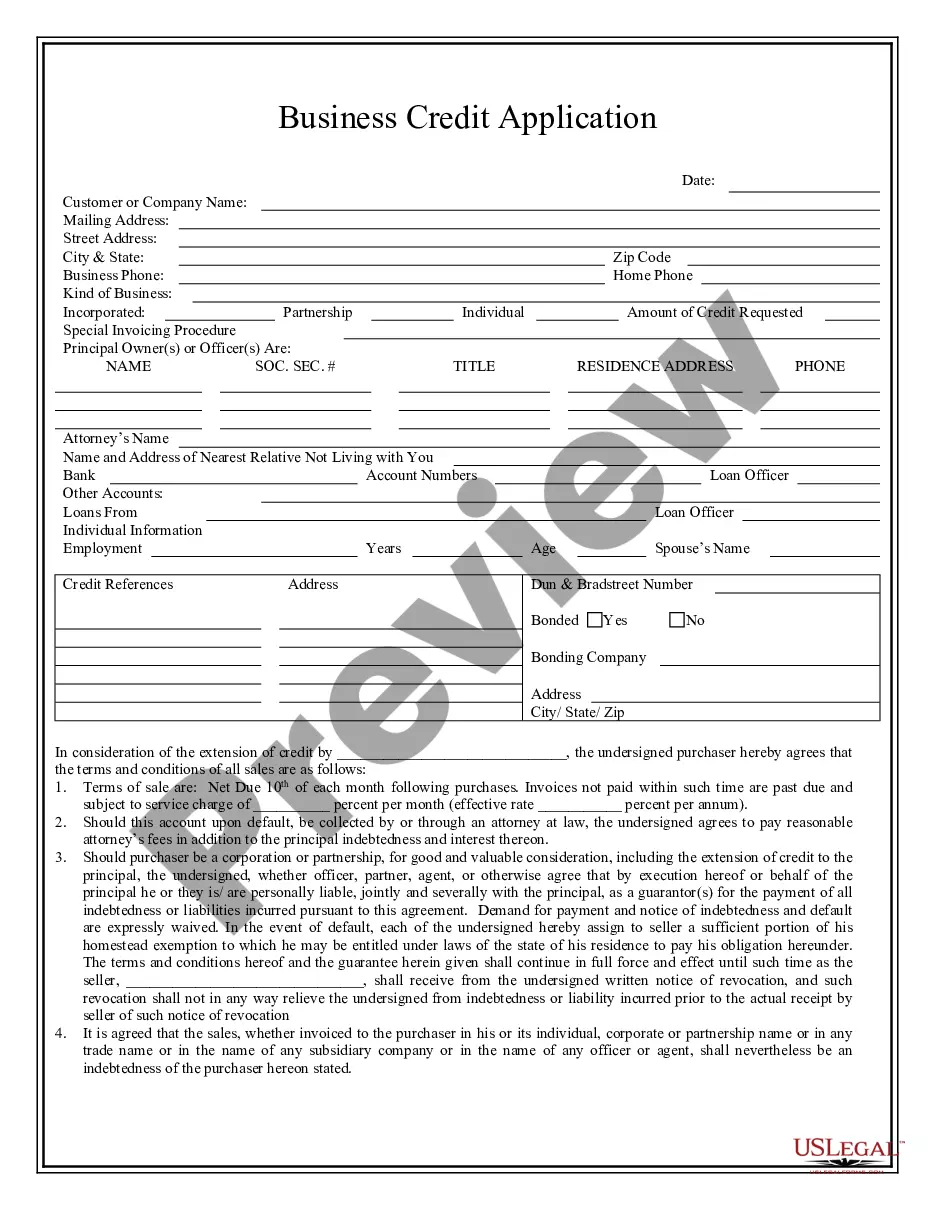

The Business Credit Application is a legal document designed for individuals seeking to establish credit with a business. This form outlines the terms of credit, including repayment schedules, interest rates, and default provisions, ensuring clarity and security for both the purchaser and the seller. Unlike other forms, this application specifically lays out the obligations pertaining to credit arrangements, providing necessary legal safeguards and recourse options.

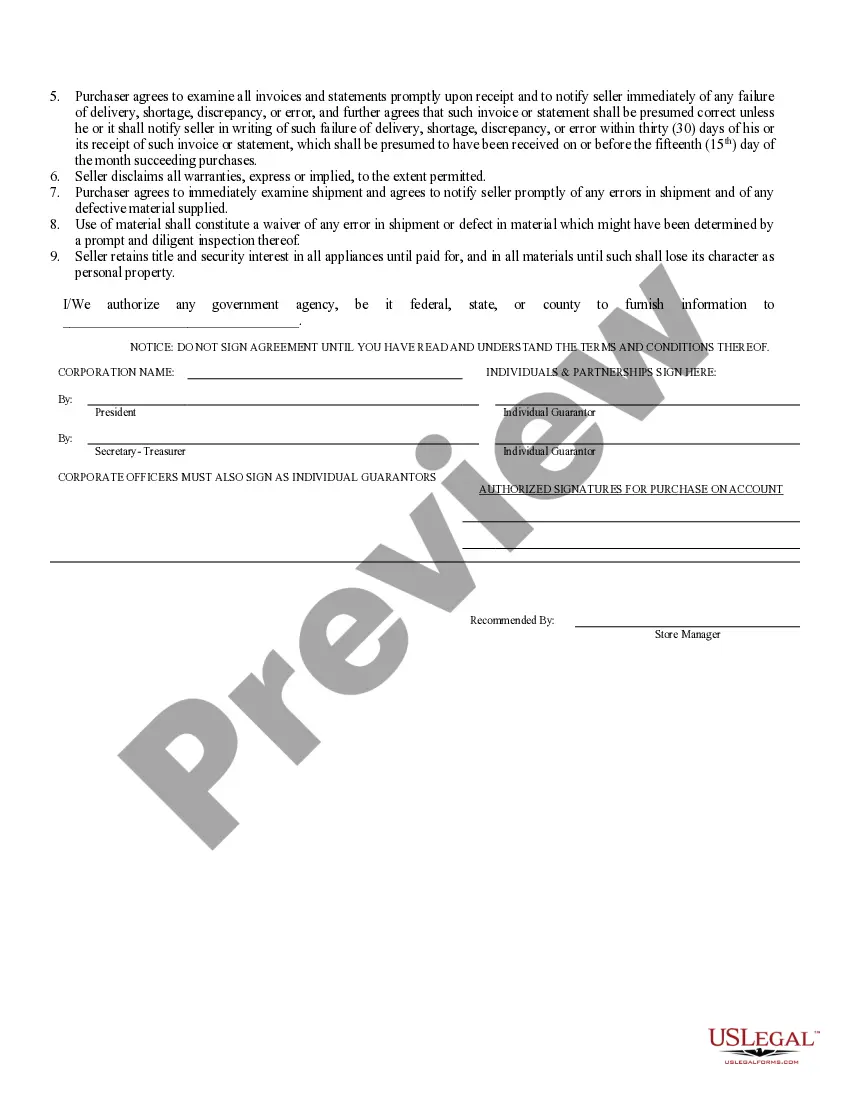

Form components explained

- Identifies the seller extending the credit.

- Details the terms of sale, including due dates and late fees.

- Includes default provisions and liability clauses.

- Addresses acknowledgment of warranties and the seller's title retention.

- Specifies the process for handling invoices and discrepancies.

- Provides space for signatures of individuals or corporate officers acting as guarantors.

When to use this document

This form is necessary when an individual or business wishes to apply for credit to make purchases, particularly when those purchases involve significant expenses. It is used commonly in various retail, service, or supply industries where businesses offer credit terms to buyers. Use this form to formally document the agreement and expectations surrounding the credit extension.

Who this form is for

- Individuals seeking credit from a business for purchasing goods.

- Small business owners applying for credit accounts.

- Partnerships or corporations looking for credit terms for operational expenses.

- Financial officers or managers responsible for credit management.

Steps to complete this form

- Enter the name of the business extending credit in the provided field.

- Specify the terms of the sale, including payment due dates and interest rates.

- Sign the form as the purchaser, ensuring all relevant individuals or officers also sign as guarantors if applicable.

- Review the invoice and terms thoroughly before submission.

- Maintain a copy of the signed form for your records.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not reviewing the terms and conditions before signing.

- Failing to include all necessary signatures, especially for corporations or partnerships.

- Overlooking the invoice review process, which can lead to disputes.

Benefits of completing this form online

- Convenient access to the form anytime and anywhere.

- Easy to fill out and edit as needed before finalizing.

- Reliability of using professionally drafted legal templates.

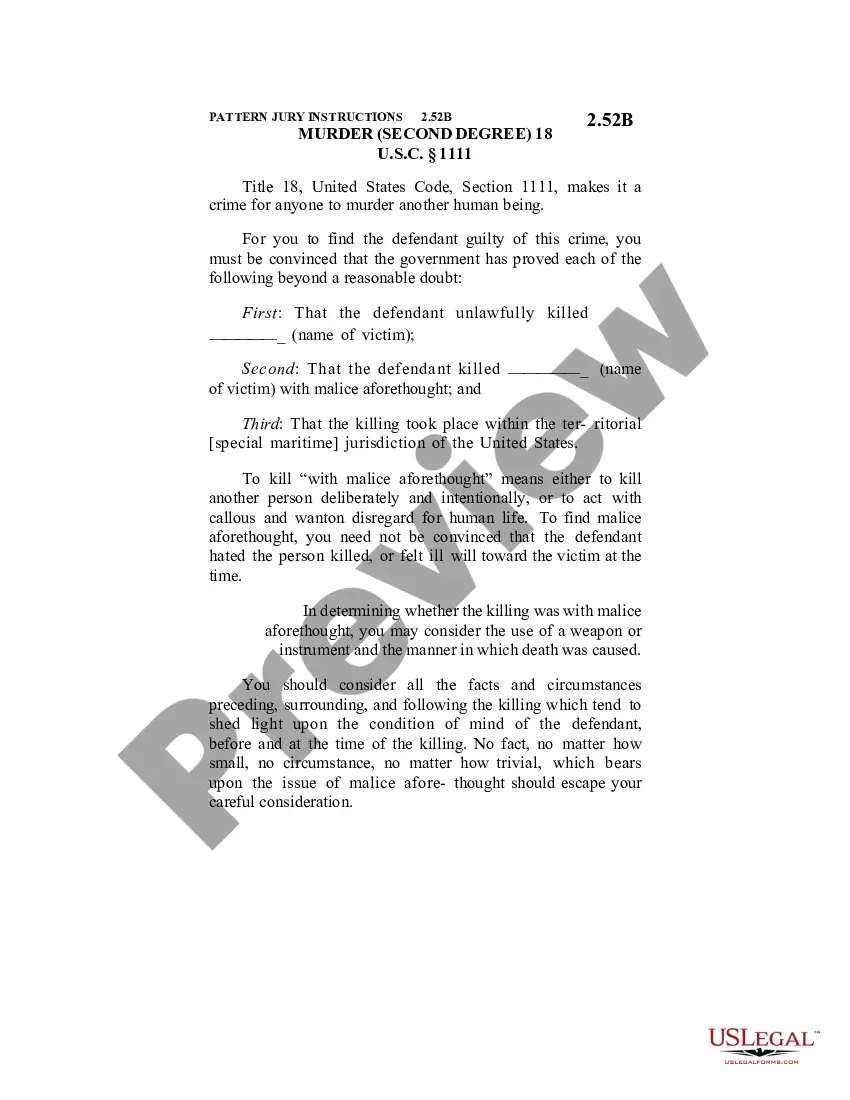

Legal use & context

- This document serves as a formal agreement for credit and can be enforced in court if necessary.

- Failure to adhere to the terms can result in legal action for collections.

- It is advisable to consult with a legal professional if there are uncertainties regarding any aspects of the agreement.

Quick recap

- The Business Credit Application helps secure credit arrangements between buyers and sellers.

- Carefully review all terms before signing to avoid misunderstandings.

- Keep a copy of the signed document for future reference and compliance.

Looking for another form?

Form popularity

FAQ

Credit Score. Most lenders believe that past results reflect what will happen in the future. Annual Revenue. One of the chief business loan requirements for a lender is to understand the trends in your business, especially how sales and cash flow have grown. Updated Business Plan. Additional Collateral.

Complete a comprehensive business plan. Submit a copy of the completed business plan to a Louisiana bank or other commercial lending entity. A completed application form must be submitted to LEDC by the bank or other commercial lending entity seeking the loan guaranty.

Choose a business name. File an application to register a trade name with the Parish Clerk of Court. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

Term loan. Business line of credit. Invoice financing. SBA microloan.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.

It is difficult to qualify for a small business loan with a credit score lower than 700.Additionally, you should build a strong personal credit score and drive down any debt prior to applying for a business loan.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

Getting Started Submit your completed business plan or project proposal to a Louisiana bank and establish a relationship with a lending officer. A completed application form must be submitted to LEDC by the bank or other commercial lending entity seeking the loan guaranty.