Arizona Joint Tenancy Deed from Corporation to Two Individuals

Overview of this form

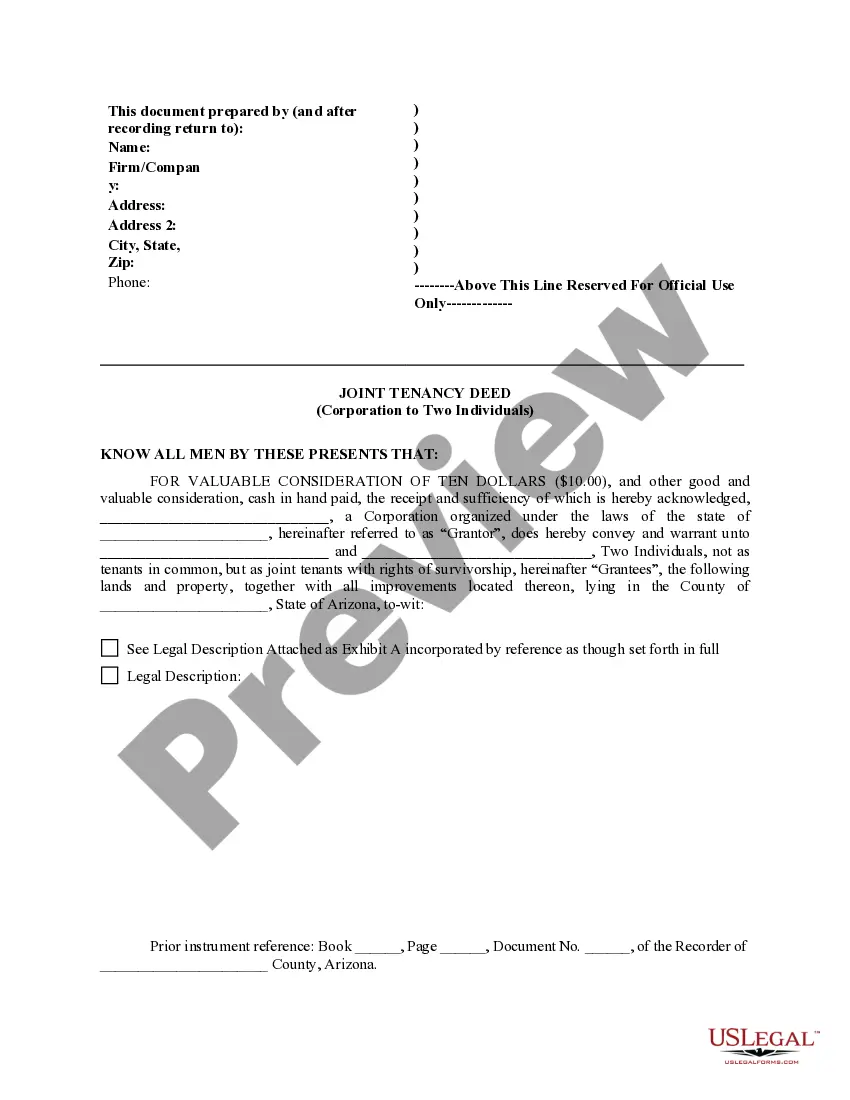

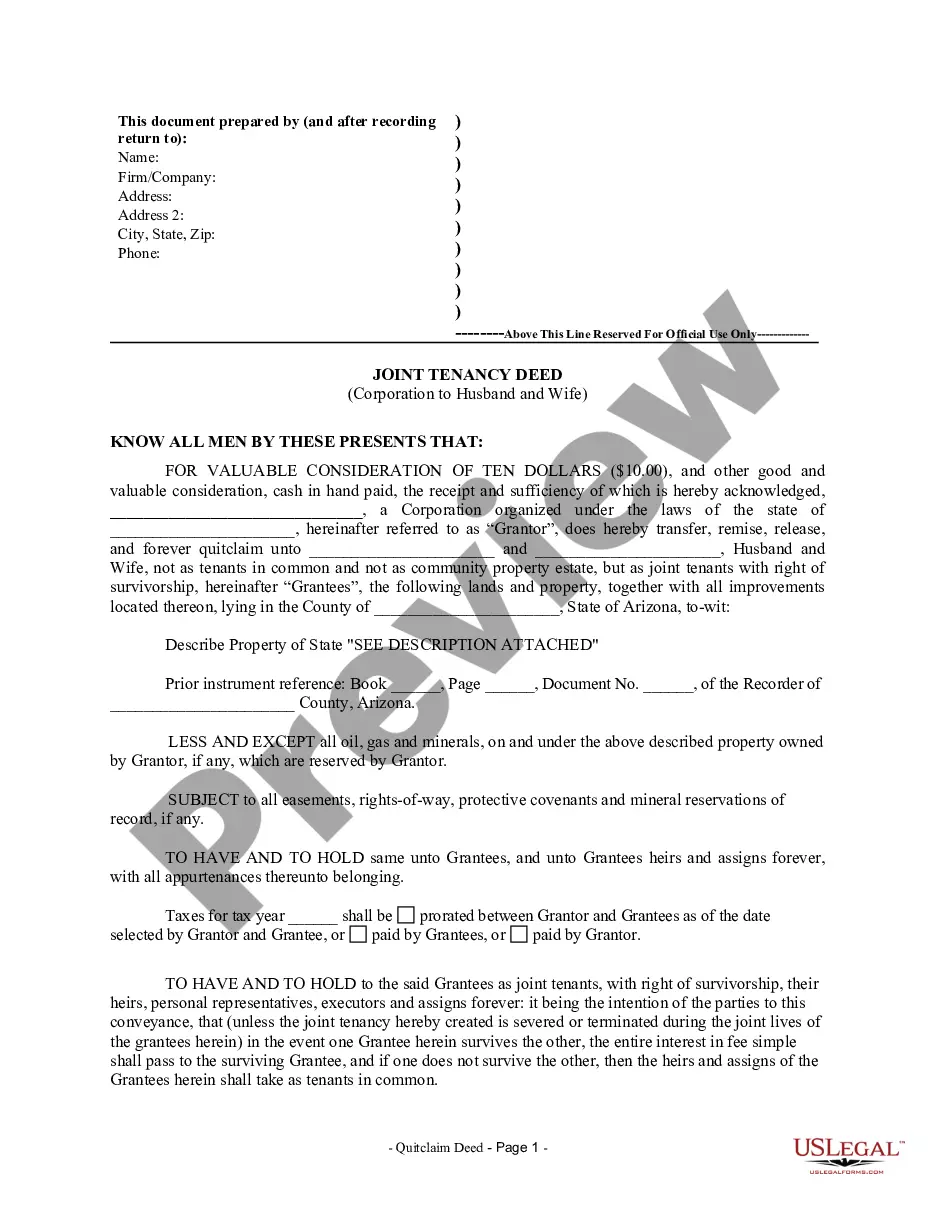

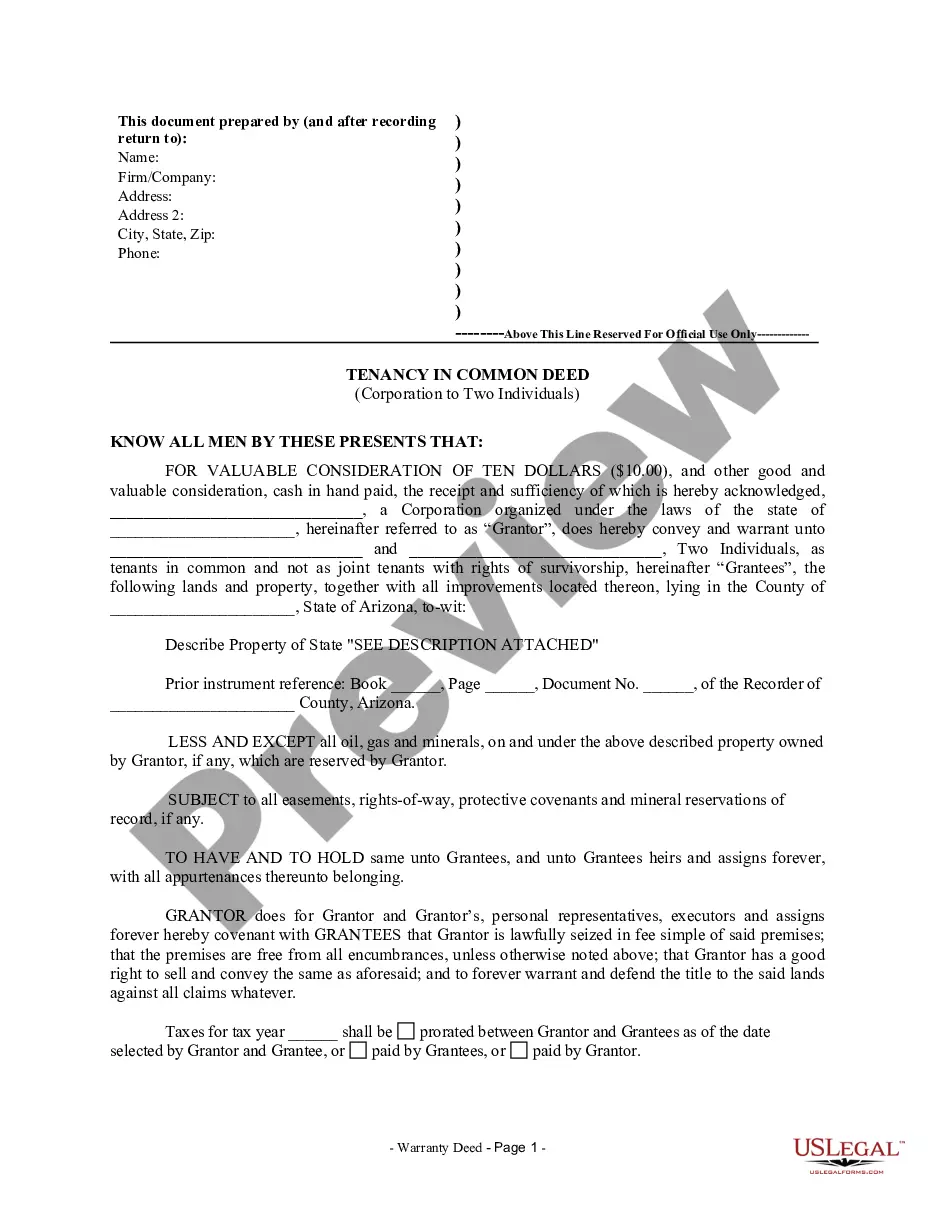

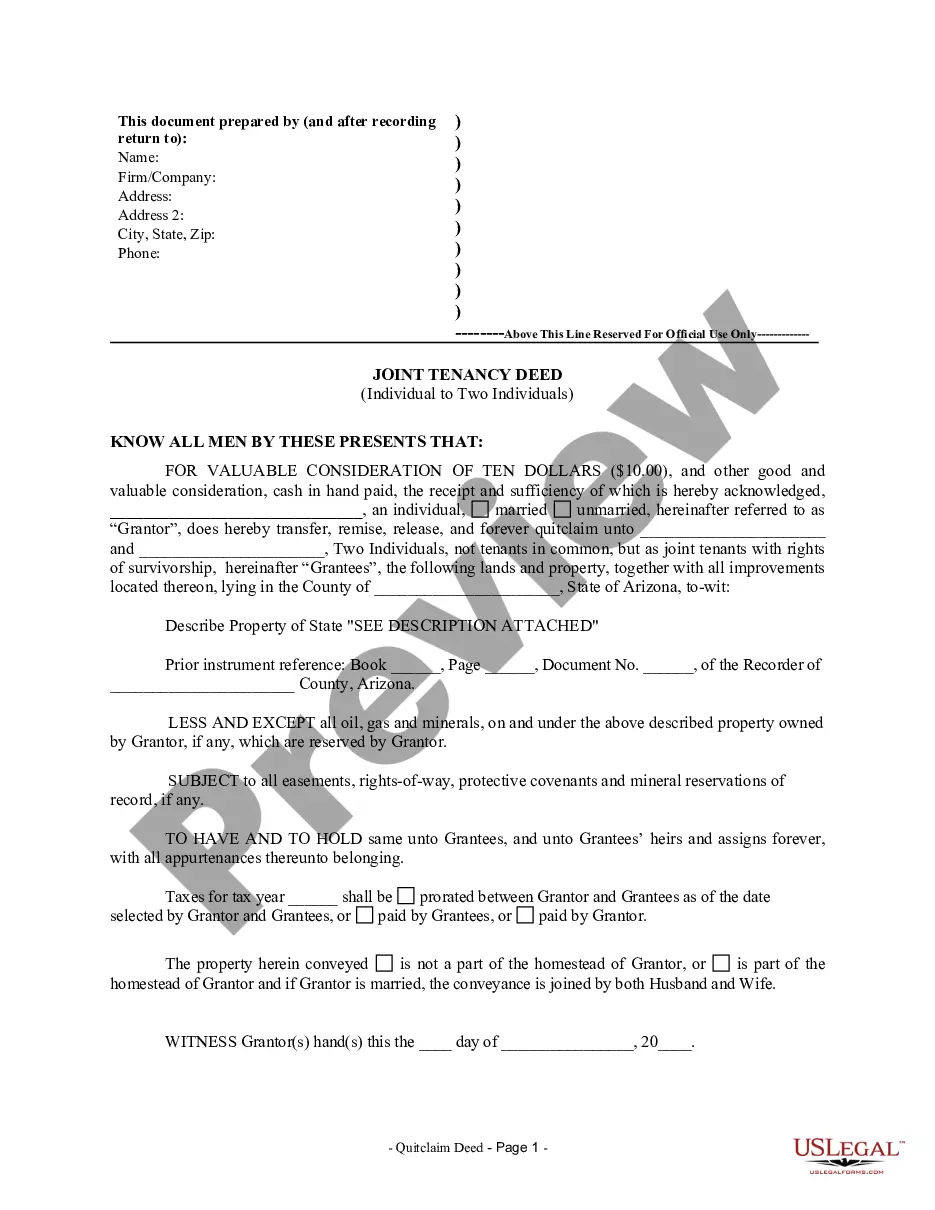

The Joint Tenancy Deed from Corporation to Two Individuals is a legal document used to transfer property ownership from a corporation to two individuals. This warranty deed provides a clear title to the grantees while reserving certain rights concerning oil, gas, and minerals. It differs from other forms of property transfers by specifically designating joint tenancy, which ensures that both individuals share equal rights in the property and have survivorship rights, meaning the property automatically passes to the surviving owner upon the death of one owner.

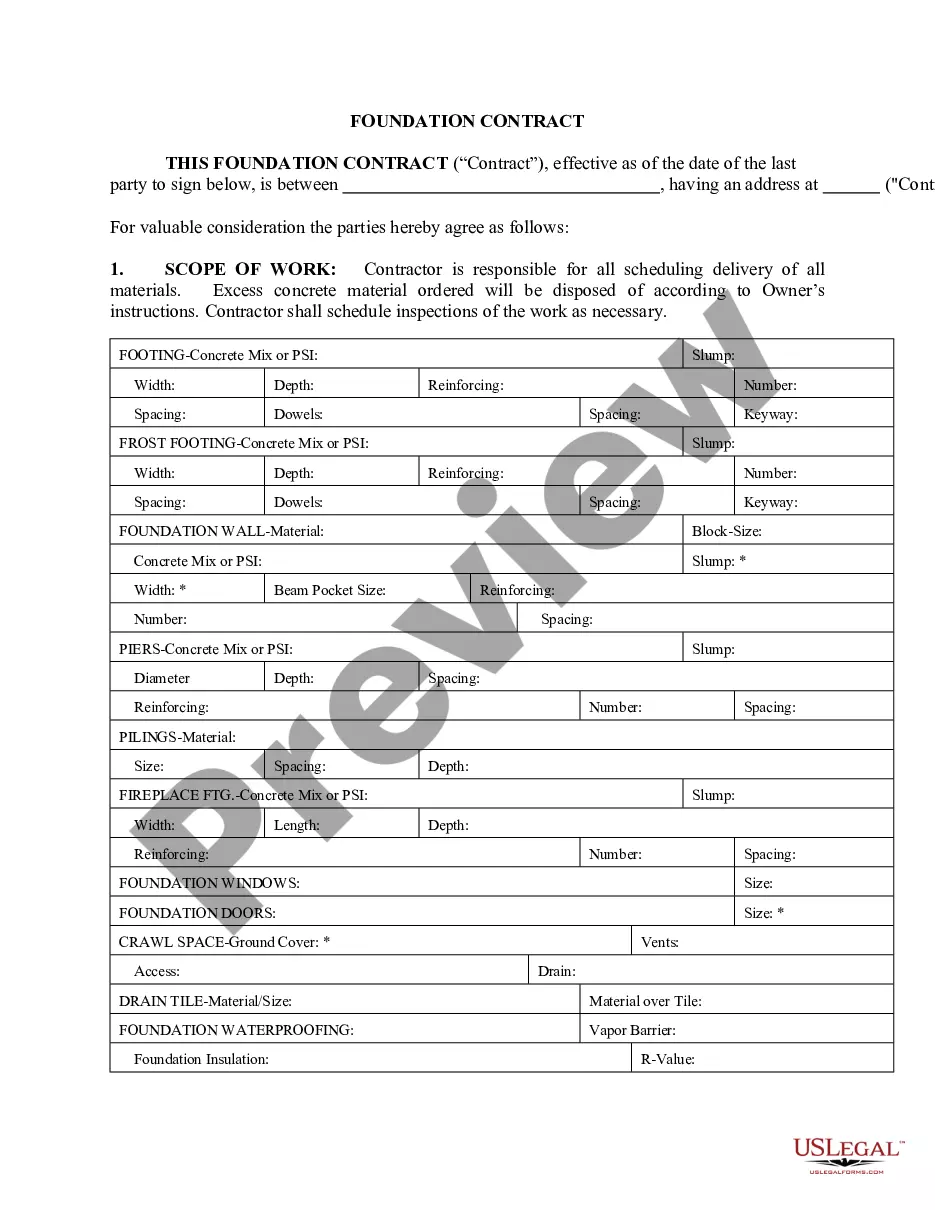

Form components explained

- Identification of the Grantor (the corporation) and Grantees (the two individuals).

- Legal description of the property being transferred, typically referenced in an attached Exhibit A.

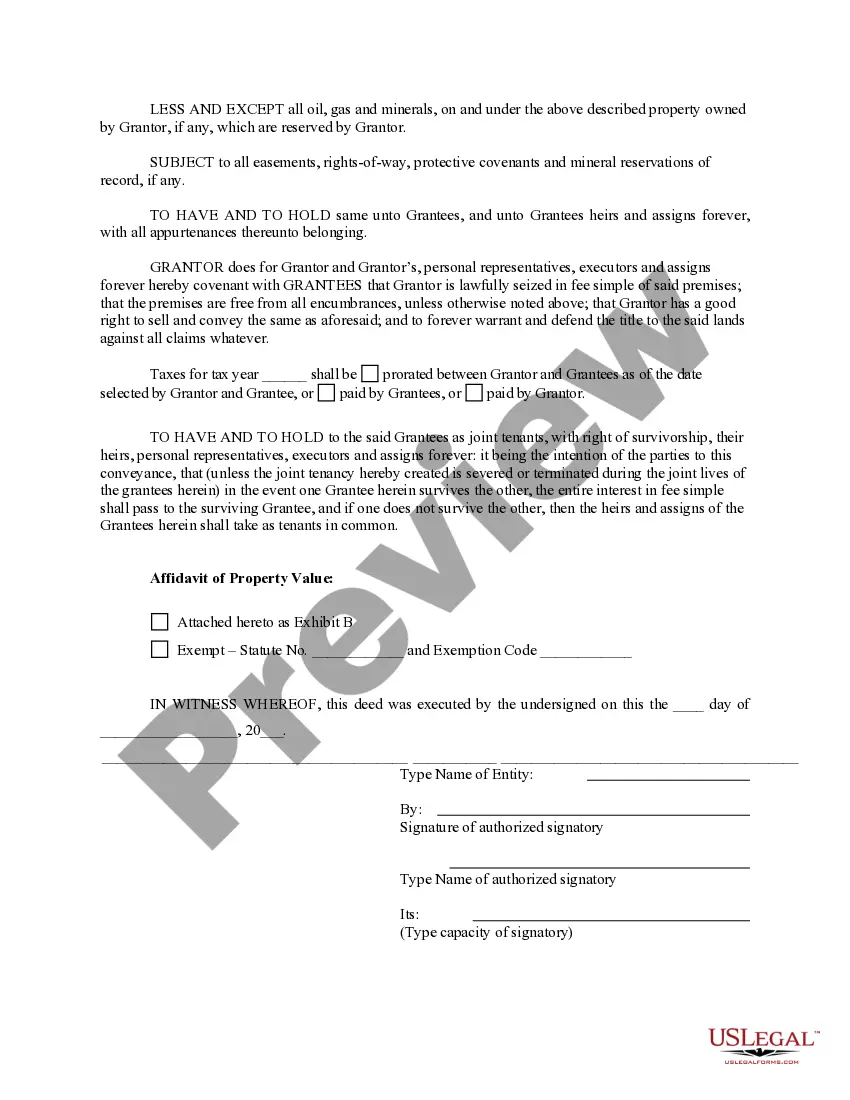

- Clarity on the reservation of oil, gas, and mineral rights by the Grantor.

- Assurances regarding the clear title and absence of encumbrances on the property.

- Provisions for apportioning property taxes between Grantor and Grantees.

- Space for notarization to validate the deed.

When to use this form

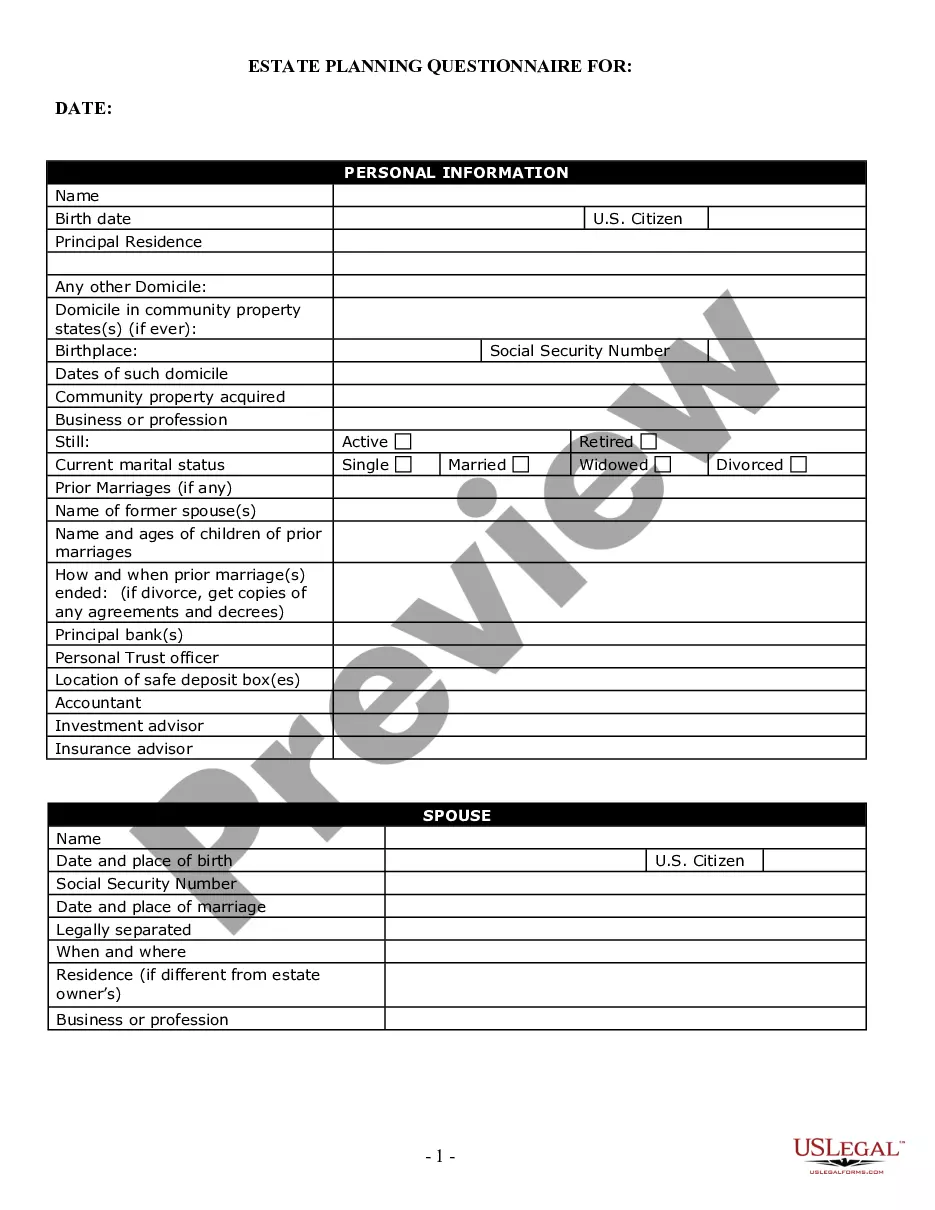

This form is used when a corporation wishes to transfer property ownership to two individuals while establishing a joint tenancy arrangement. It is ideal in situations such as forming a partnership between two individuals who want shared ownership of a property or when individuals inherit property from a corporation. This deed is often executed in real estate transactions, estate planning, or when consolidating ownership interests in a property.

Who needs this form

- Corporations transferring property to individual owners.

- Individuals wanting to co-own property under joint tenancy.

- Real estate professionals involved in property transfers and legal documentation.

- Estate planners seeking to document property transfers as part of a larger estate plan.

How to prepare this document

- Identify the parties involved, including the corporation as the Grantor and the two individuals as Grantees.

- Provide the legal description of the property in the designated section, often included as Exhibit A.

- Indicate any reserved rights regarding minerals or other resources beneath the property.

- Complete any provisions regarding tax responsibilities, including how they will be prorated.

- Have the document signed where indicated and ensure it is notarized for legal validity.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide a complete legal description of the property.

- Not properly notarizing the deed, which can invalidate the transfer.

- Omitting the reservation of rights concerning minerals or other subsurface resources.

- Neglecting to indicate how property taxes will be handled.

- Using outdated or incorrect forms that do not comply with current laws.

Why complete this form online

- Convenience of completing the form at your own pace.

- Ability to modify the form easily to fit your specific needs.

- Access to templates drafted by licensed attorneys, assuring compliance and legal validity.

- Secure downloading options that allow for easy storage and future access.

Looking for another form?

Form popularity

FAQ

Arizona law does not specify a maximum number of people who can be on a property deed. That said, it is important to ensure clear terms of ownership, especially when forming an Arizona Joint Tenancy Deed from Corporation to Two Individuals. As the number of owners increases, it is advisable to agree on how decisions about the property will be made to avoid potential conflicts.

Joint ownership of property in Arizona refers to a property ownership structure where two or more individuals hold title to the property together. This arrangement includes rights of survivorship, meaning if one owner passes away, their share of the property goes directly to the surviving owner. An Arizona Joint Tenancy Deed from Corporation to Two Individuals is a popular choice for couples or partners who want to ensure this seamless transfer of ownership.

In Arizona, there is no strict limit on the number of names that can be on a home title. However, when considering an Arizona Joint Tenancy Deed from Corporation to Two Individuals, it is common to see two or more individuals shared on a deed. Each co-owner can have equal rights to the property, but it is important to outline the specific arrangements as necessary.

To add someone to your property deed in Arizona, you will need to create an Arizona Joint Tenancy Deed from Corporation to Two Individuals. This involves drafting a new deed that includes both your name and the individual’s name. After signing the new deed, you must have it notarized and recorded at your local county recorder’s office. This process legally establishes joint ownership.

In Arizona, when dealing with an Arizona Joint Tenancy Deed from Corporation to Two Individuals, it is essential to follow specific legal requirements. First, the deed must be signed by the property owner and notarized. Additionally, you must file the deed with the county recorder’s office where the property is located. This ensures that the transfer is officially documented and publicly recognized.

Filling out a joint tenancy deed in Arizona involves several key steps. Start by clearly identifying the grantor, which is the corporation in this case, and the grantees, who are the two individuals receiving the property. Ensure that the deed states the intention to create a joint tenancy and includes the necessary legal descriptions of the property. Utilizing platforms like uslegalforms can simplify this process by providing templates and guidance tailored for an Arizona Joint Tenancy Deed from Corporation to Two Individuals.

To break a joint tenancy in Arizona, one joint tenant must take legal action, which may involve filing a partition lawsuit. This lawsuit allows for the court to assess and divide the property, or it can result in the sale of the property with proceeds distributed among the co-owners. Exploring options through an Arizona Joint Tenancy Deed from Corporation to Two Individuals can help clarify the ownership structure and any necessary steps for dissolution.

Yes, the right of survivorship is automatic in Arizona joint tenancies. When one of the joint tenants passes away, their share of the property transfers directly to the surviving tenant without requiring probate. This feature simplifies the transfer process and ensures that the property remains within the joint tenants, making the Arizona Joint Tenancy Deed from Corporation to Two Individuals a preferred choice for many.

To create a joint tenancy, all parties must share equal ownership, possess the same interest in the property, and acquire their interests through the same deed. In the case of an Arizona Joint Tenancy Deed from Corporation to Two Individuals, it is essential that both individuals explicitly agree to hold the property together. This agreement establishes the right of survivorship, allowing one owner to inherit the other's share automatically upon death.

A corporation cannot be a joint tenant because it does not have a natural person capacity to own property jointly in the same manner. Joint tenancy involves the notion of survivorship, which does not apply to a corporation as it does not expire or die. Therefore, using an Arizona Joint Tenancy Deed from Corporation to Two Individuals is advisable for individual co-ownership rather than including a corporate entity.