Alabama Last Will and Testament for Widow or Widower with Minor Children

What this document covers

The Last Will and Testament for Widow or Widower with Minor Children is a legal document designed specifically for individuals who are widows or widowers and have minor children. This form allows you to outline your wishes regarding the distribution of your assets, the appointment of a personal representative or executor, and the designation of guardians for your children. Unlike other wills, this form incorporates provisions for minor beneficiaries and trusts, ensuring that your children are cared for after your passing.

Main sections of this form

- Identification of the testator (the person making the will).

- Appointment of a personal representative or executor.

- Designation of guardians for minor children.

- Specific bequests of property and assets.

- Establishment of a trust for the benefit of minor children.

- Instructions for signing and witness requirements to ensure legal validity.

Legal requirements by state

This form is designed to comply with general legal standards but may require additional modifications based on state laws regarding wills and estates. It is advisable to check your specific state's regulations or seek legal advice to ensure compliance.

When this form is needed

You should use this form if you are a widow or widower with minor children and need to create a will that outlines your wishes for asset distribution and guardianship. This form is particularly important if you want to ensure that your children are taken care of and that your estate is managed responsibly. It is also essential if you wish to avoid complications for your heirs in the probate process.

Who this form is for

This form is intended for:

- Widows or widowers with minor children.

- Individuals wishing to specify how their assets should be distributed after death.

- Parents who want to appoint guardians for their minor children.

- Those looking for a straightforward way to establish a trust for beneficiaries under a certain age.

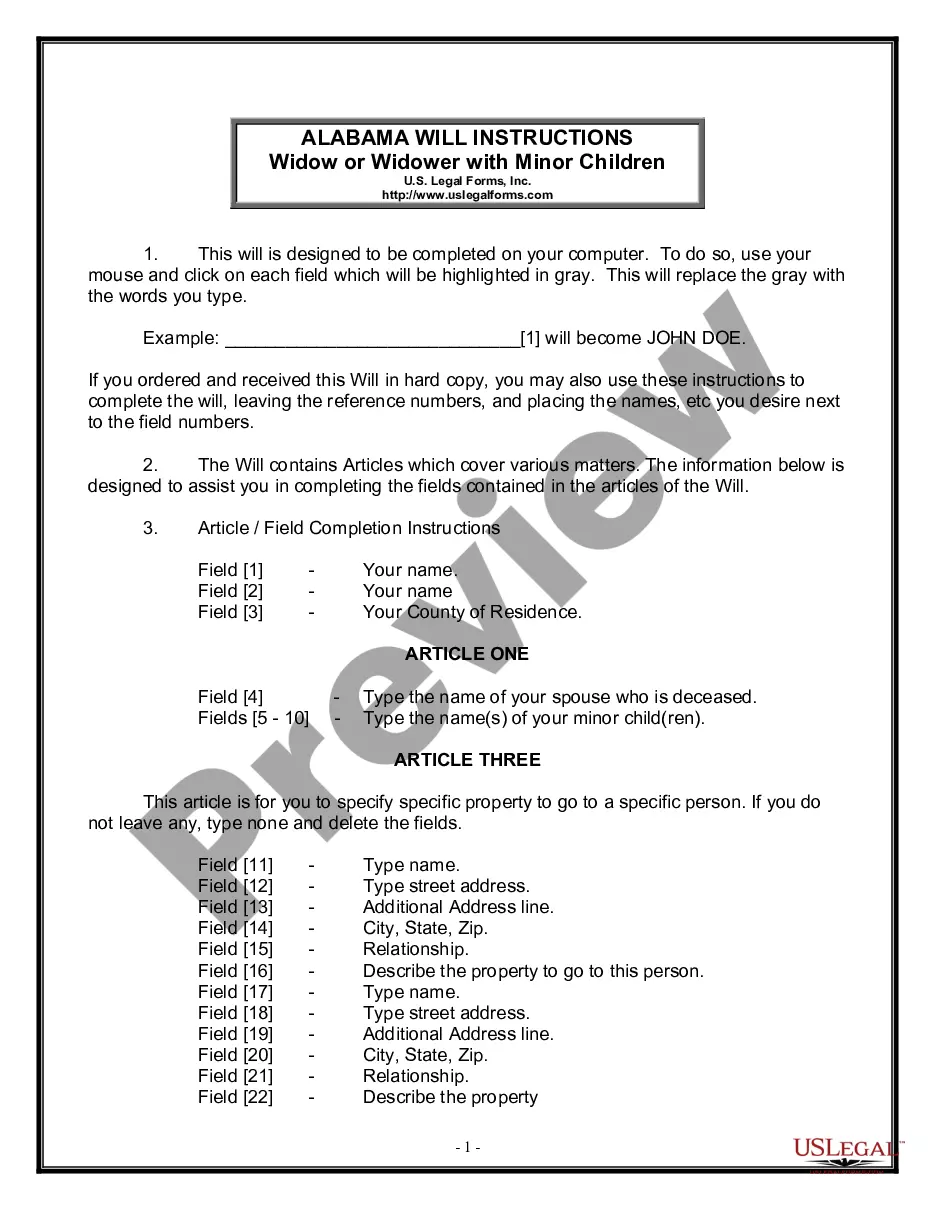

Instructions for completing this form

- Begin by entering your full name and county of residence at the designated fields.

- Provide the name of your deceased spouse and the names of your minor children.

- Specify any specific bequests of property you wish to allocate to individuals.

- Indicate who you would like to appoint as guardians for your minor children.

- Complete the signature section in front of two witnesses, ensuring they are not related to you or named in the will.

- If applicable, have the will notarized to fulfill self-proving affidavit requirements.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to have the will signed in the presence of two witnesses.

- Not specifying guardians for minor children.

- Overlooking the need for notarization if required by state law.

- Not reviewing or updating the will to reflect life changes (e.g., remarriage, new children).

- Using vague language that may lead to confusion over your intentions.

Why complete this form online

- Convenience of downloading and completing the document at your own pace.

- Editability allows you to make changes easily before finalizing.

- Access to attorney-drafted content ensures that legal requirements are met.

- Protection of your children's future by establishing clear guardianship and asset distribution.

Main things to remember

- The Last Will and Testament for Widow or Widower with Minor Children provides essential legal protections for both your estate and your children.

- Proper completion and execution of this form can save your heirs time and legal complications.

- Ensure to have the will witnessed and notarized, if required, to uphold its legality.

- Regularly review and update your will to reflect significant life changes.

Form popularity

FAQ

In Alabama, a will remains valid after your death as long as it is properly executed and meets state laws. Typically, a valid will must be probated within five years from the date of your death. This is crucial, especially when ensuring that your wishes, outlined in your Alabama Last Will and Testament for Widow or Widower with Minor Children, are honored. To simplify the process for your heirs, consider utilizing legal platforms like US Legal Forms, which help in filing and managing your will efficiently.

Yes, a hand-written will, also known as a holographic will, is legal in Alabama as long as it meets specific criteria. This type of will must be in your own handwriting and signed by you. Importantly, it should express your intentions clearly regarding the distribution of your assets, especially if you are creating an Alabama Last Will and Testament for Widow or Widower with Minor Children. However, using a formal will template can help ensure that all legal requirements are met, providing peace of mind for your loved ones.

Property does not automatically go to a spouse in Alabama unless specified in a will. If the deceased had minor children, the distribution may involve both the spouse and children in the estate's arrangement. By drafting an Alabama Last Will and Testament for Widow or Widower with Minor Children, you can clearly delineate ownership and ensure your loved ones are adequately provided for.

In Alabama, you do not need a lawyer to create a will, but having one can simplify the process and ensure compliance with legal requirements. Using an Alabama Last Will and Testament for Widow or Widower with Minor Children template can also help guide you through filling it out correctly. Nevertheless, consulting with a lawyer can provide valuable insight into protecting your assets and beneficiaries.

Alabama follows a specific order of inheritance when distributing assets without a will. First, the surviving spouse and children inherit jointly. If no spouse or children exist, parents and siblings may inherit next. Understanding this order highlights the importance of drafting an Alabama Last Will and Testament for Widow or Widower with Minor Children to customize how your assets will be divided.

In Alabama, a spouse is entitled to a portion of the deceased partner's estate, but specific entitlement varies based on whether there are surviving children. If there are minor children, the spouse inherits a statutory share, ensuring that both the spouse and children are cared for. Creating an Alabama Last Will and Testament for Widow or Widower with Minor Children can clarify these entitlements and protect your family’s future.

If there is no will in Alabama, the state's intestate succession laws dictate who inherits the estate. Generally, the surviving spouse and minor children share in the inheritance. Having an Alabama Last Will and Testament for Widow or Widower with Minor Children can help ensure your specific wishes are followed and your children’s needs are prioritized.

In Alabama, a spouse does not automatically inherit everything. The distribution of assets depends on whether a will exists. If there is an Alabama Last Will and Testament for Widow or Widower with Minor Children, the assets will be divided according to the terms of that will. Without a will, the spouse is entitled to a significant share, but it is not necessarily everything.

In Alabama, when a parent dies, their minor children are entitled to a share of the estate, even if the parent did not leave a will. Children typically inherit a portion of the estate, which may include all property if there is no surviving spouse. Establishing an Alabama Last Will and Testament for Widow or Widower with Minor Children can ensure that your children receive their rightful inheritance and that their future is secured. This legal document helps you outline your wishes clearly.

While it is possible to create a will without a lawyer in Alabama, consulting an attorney is advisable, especially when dealing with complex estates. A lawyer can help ensure your Alabama Last Will and Testament for Widow or Widower with Minor Children complies with state laws and effectively reflects your wishes. Additionally, a lawyer can provide guidance on potential tax implications and help safeguard your assets for your children.