Alabama Vendor's Lien Deed

Definition and meaning

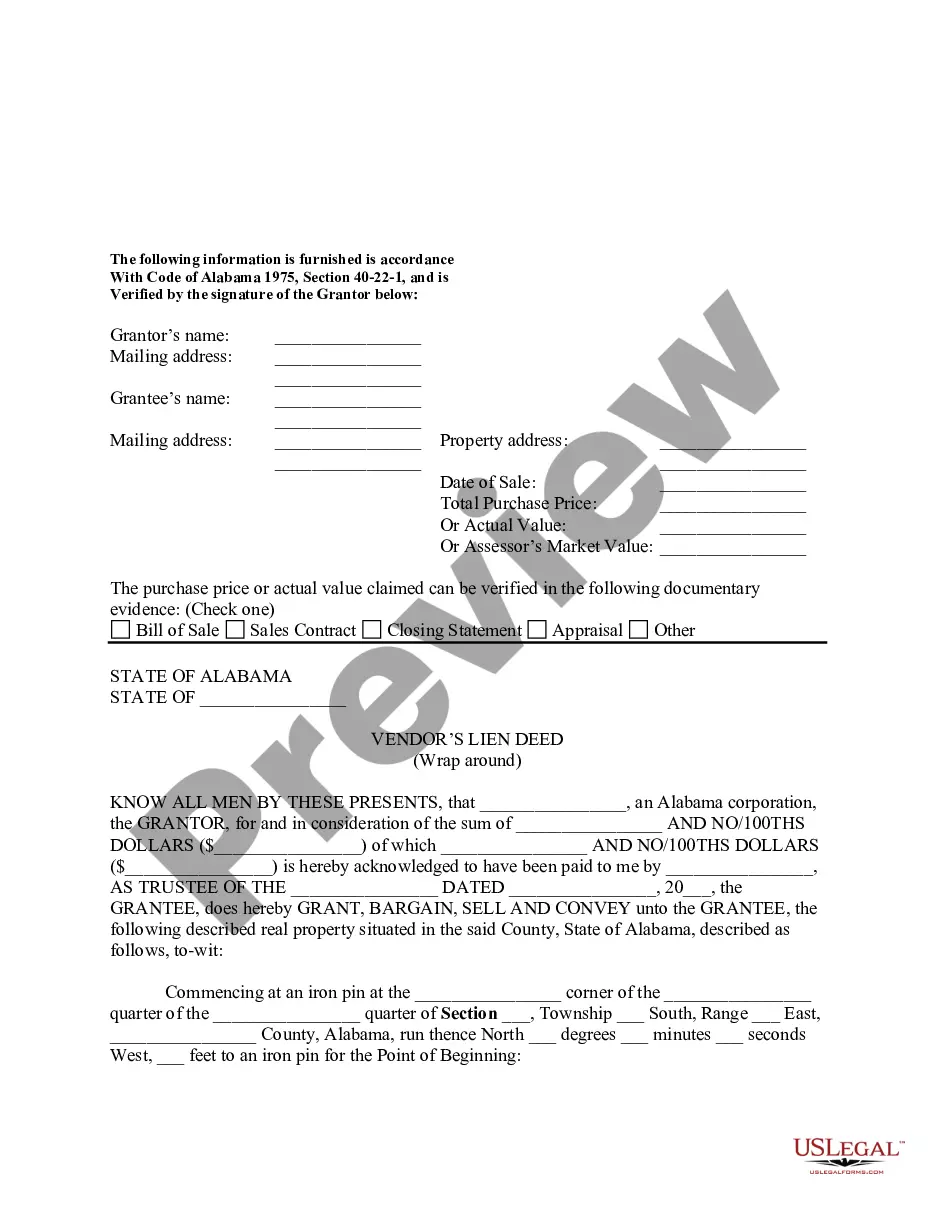

An Alabama Vendor's Lien Deed is a legal instrument used in transactions where a seller retains a lien on property sold until the purchase price is paid in full. This type of deed secures the seller's interest in the property, allowing them to reclaim it if the buyer defaults on payment. It is commonly used in real estate transactions in Alabama.

Who should use this form

This form is generally beneficial for individuals or entities involved in selling property with an installment payment plan. If you are a seller who wishes to secure your financial interest in the property until full payment is received, this form is for you. Additionally, buyers might use this form to understand their obligations when purchasing property through a vendor's lien arrangement.

How to complete a form

To properly fill out the Alabama Vendor's Lien Deed form, follow these steps:

- Enter the names and addresses of both the Grantor (seller) and Grantee (buyer).

- Provide the property address and its legal description.

- Specify the total purchase price or actual value of the property.

- Indicate the type of documentary evidence used to support the claim.

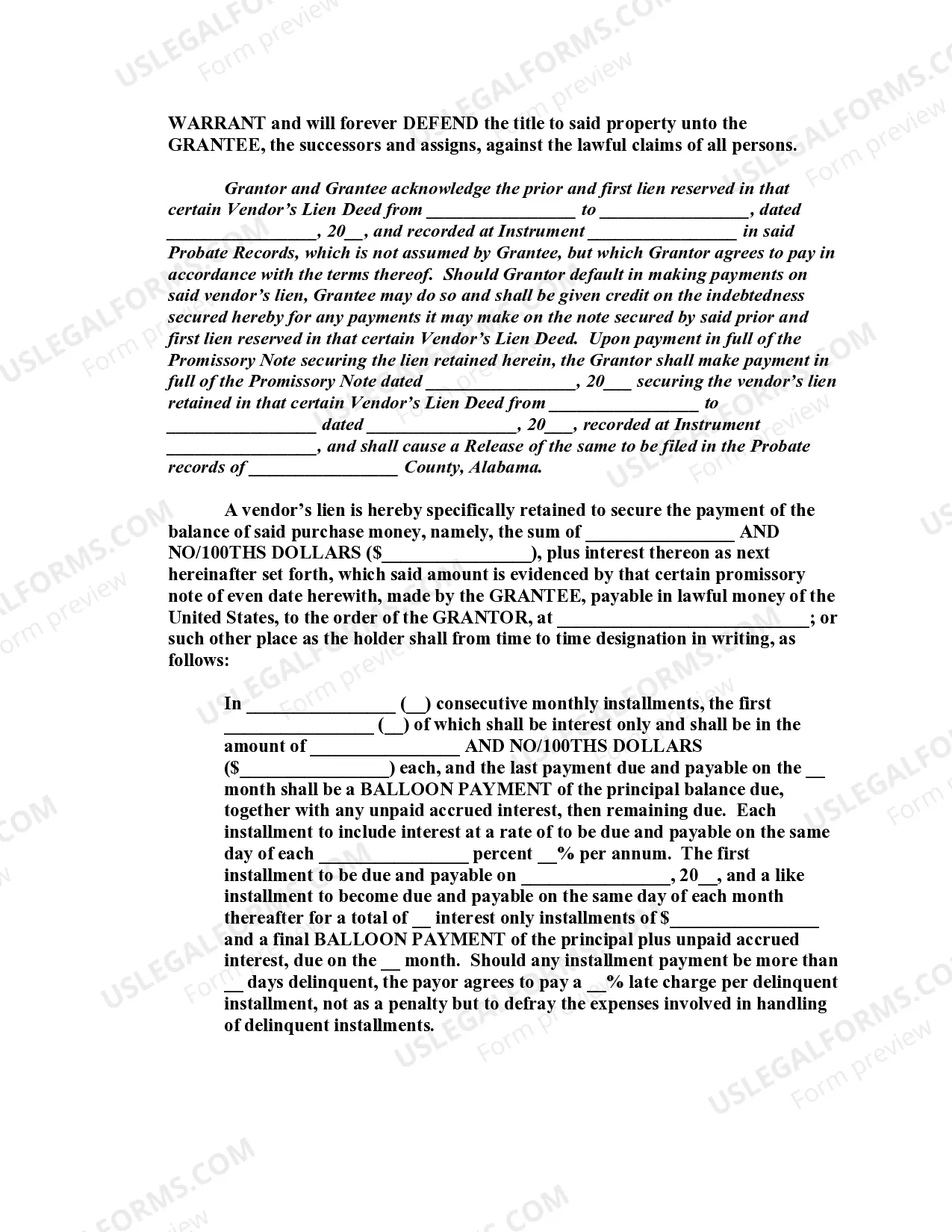

- Include the pertinent details of the payment terms, such as any installment amounts and payment schedule.

- Ensure the form is signed by both parties in the presence of a Notary Public.

Key components of the form

The Alabama Vendor's Lien Deed contains several crucial components, including:

- Grantor and Grantee Information: Identifies the seller and buyer.

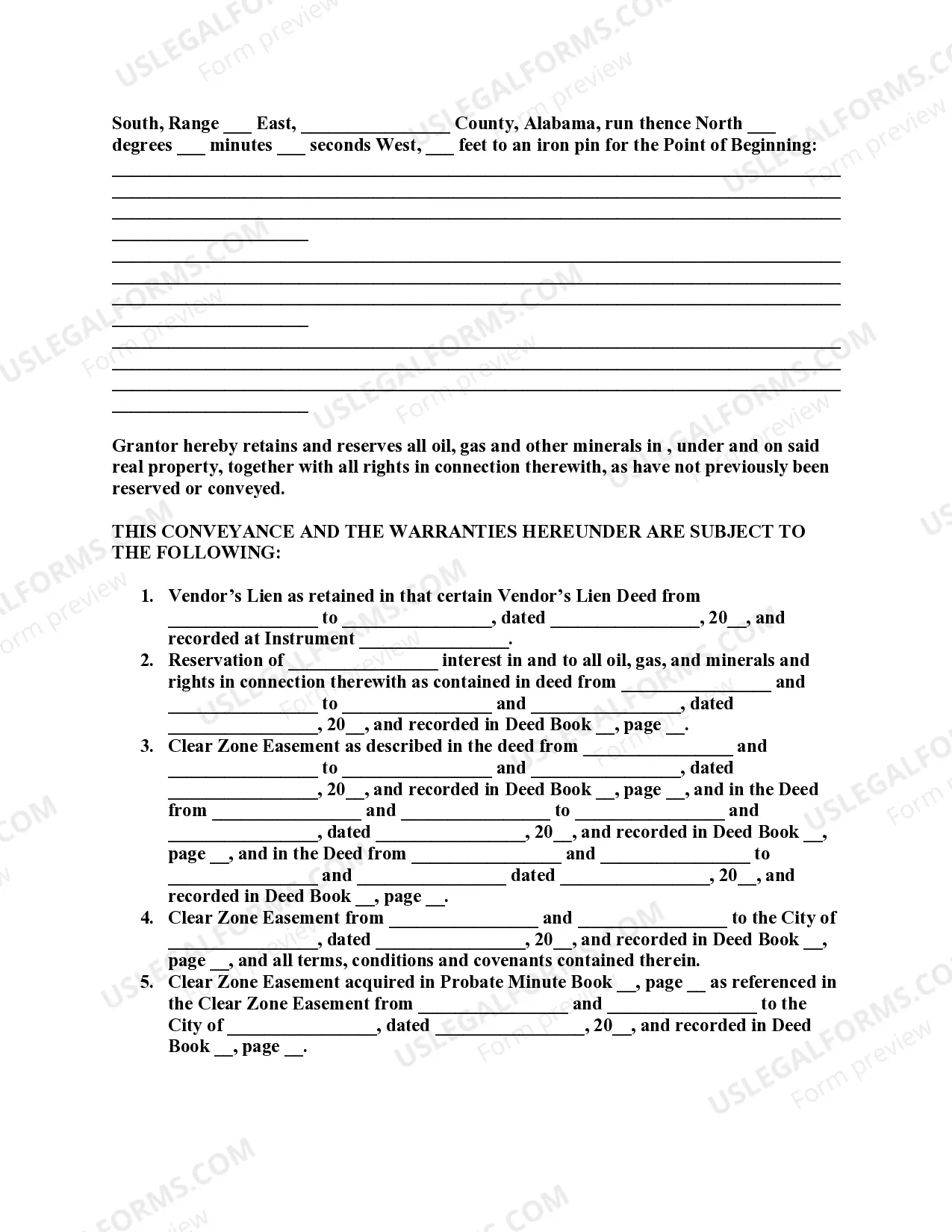

- Property Description: A detailed legal description of the property being sold.

- Purchase Price: States the total cost and how it will be paid.

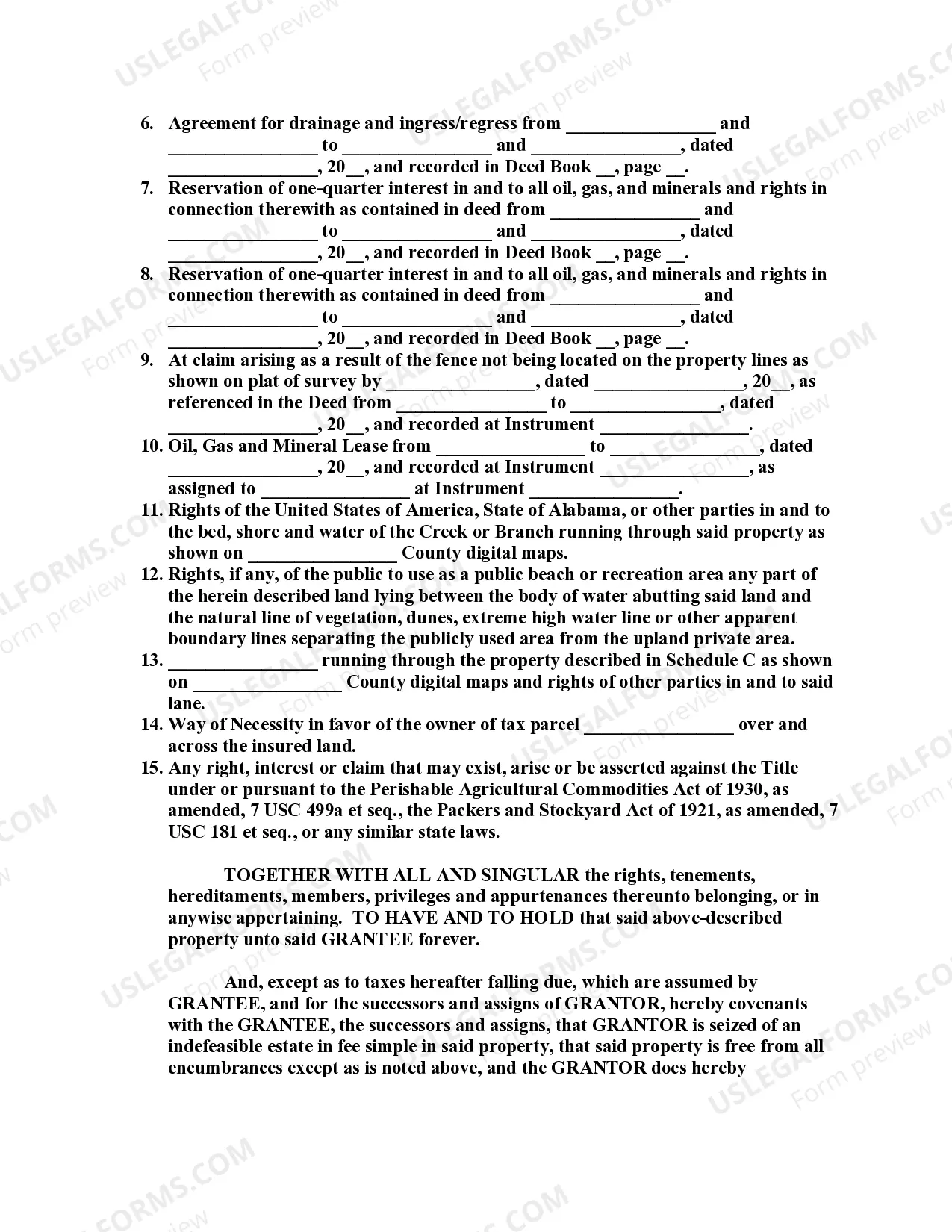

- Vendor's Lien Clause: Ensures the seller retains interest in the property until payment is completed.

Legal use and context

The Alabama Vendor's Lien Deed is primarily used in real estate transactions within Alabama where payments are made over time. It legally protects the seller’s right to the property until they receive full payment, making it an essential document for sellers engaged in financing property sales. This deed aligns with the state laws regarding liens and property rights.

Common mistakes to avoid when using this form

For a valid Alabama Vendor's Lien Deed, avoid these common errors:

- Failing to accurately describe the property.

- Leaving key fields, such as purchase price or payment terms, blank.

- Not having the document notarized, which is mandatory for it to be legally binding.

What to expect during notarization or witnessing

During the notarization of the Alabama Vendor's Lien Deed, both parties will need to present valid identification to the Notary Public. The Notary will verify identities, witness the signing of the document, and affix their seal. This process ensures the execution is legitimate and adds a layer of enforceability to the deed.

Form popularity

FAQ

Property liens are legal notices attached to a property title because of unpaid debts. This can make selling a home a lot more difficult, or at the very least a big hassle. Unfortunately, this hassle is not always revealed until late in the home buying processwhen you have already found the home of your dreams.

A vendor's lien is the right of a seller to repossess the property sold until the buyer makes all payments for the full purchase price. The property is the collateral given as security to the seller for the purchase price. It is sometimes used in connection with a purchase money mortgage on real estate.

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

When a borrower agrees to use the property as collateral to secure the loan, it places a voluntary lien on that property. Once it is recorded, it becomes public information. Great examples of voluntary liens is mortgages and trust deeds.

Vendor's lien. seller's right to reclaim property sold to a buyer if the purchaser falls behind in payments, for example, a seller's lien on real estate sold through a purchase money mortgage. Seller's liens are a carryover from common law and are relatively uncommon in the United States.

All liens stay with the property so if you buy a home with outstanding liens, you assume responsibility for those debts. Therefore, it's imperative that you (or one of the members of your team, such as a lawyer or notary public) search the local records for any liens on a home before you buy it.

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.When you call the lender, ask for the release of lien department.

When a warranty deed contains a vendor's lien, the buyer agrees to allow the seller to seize the property until the property is paid for in full. It's used in situations where the buyer is taking immediate possession of the property, but is paying the purchase price in installments or at some later date.

A lien does not convey ownership, with one exception A lienor generally has an equitable interest in the property, but not legal ownership.