Alabama Tax Free Exchange Package

What is this form package?

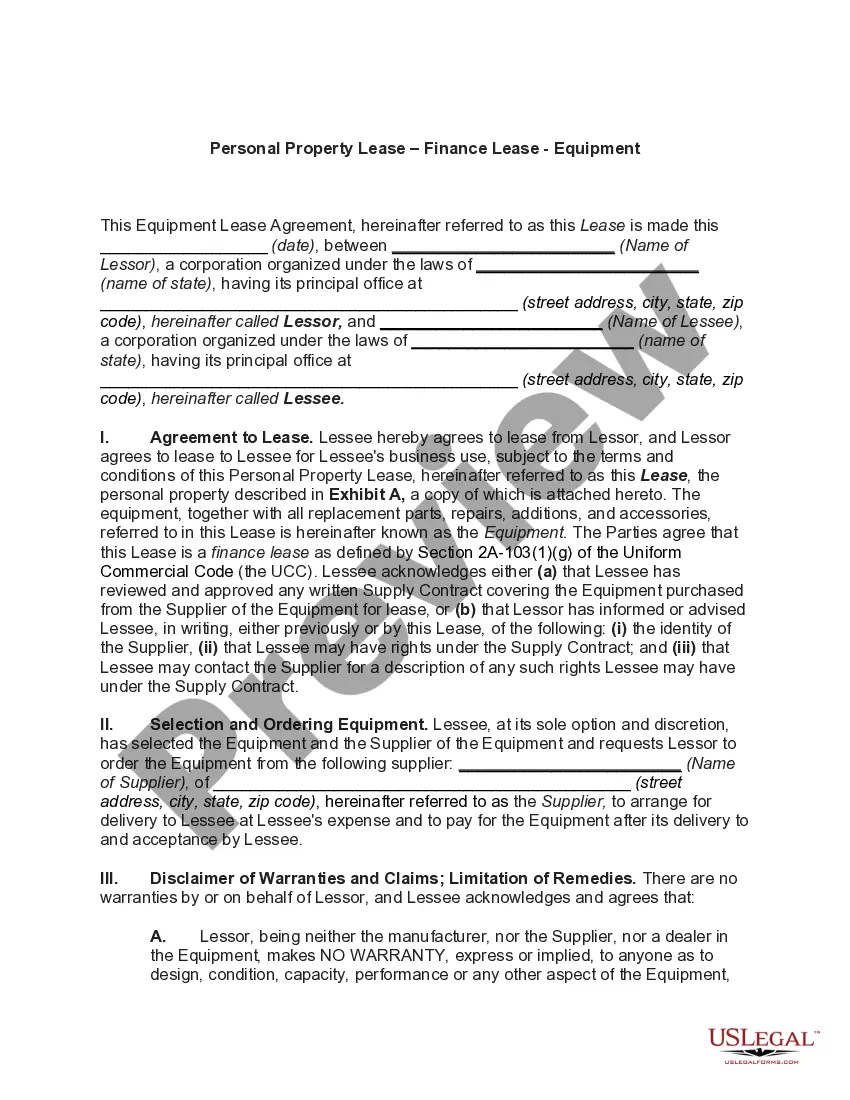

The Alabama Tax Free Exchange Package includes essential forms designed to facilitate the successful completion of a tax-free exchange of like-kind property. This package is unique in that it provides comprehensive documentation necessary for investors looking to defer capital gains tax through Section 1031 exchanges, setting it apart from generic real estate forms.

Forms included in this package

When to use this document

This form package is particularly useful in situations such as:

- When you wish to defer capital gains taxes on the sale of investment or business property.

- When exchanging real estate for other like-kind properties.

- When you require documentation to assist in structuring a real estate transaction under IRS rules.

Who can use this document

- Real estate investors looking to utilize tax deferments.

- Property owners seeking to exchange one investment property for another.

- Business owners selling or exchanging business property.

- Individuals who want to ensure compliance with IRS Section 1031 regulations.

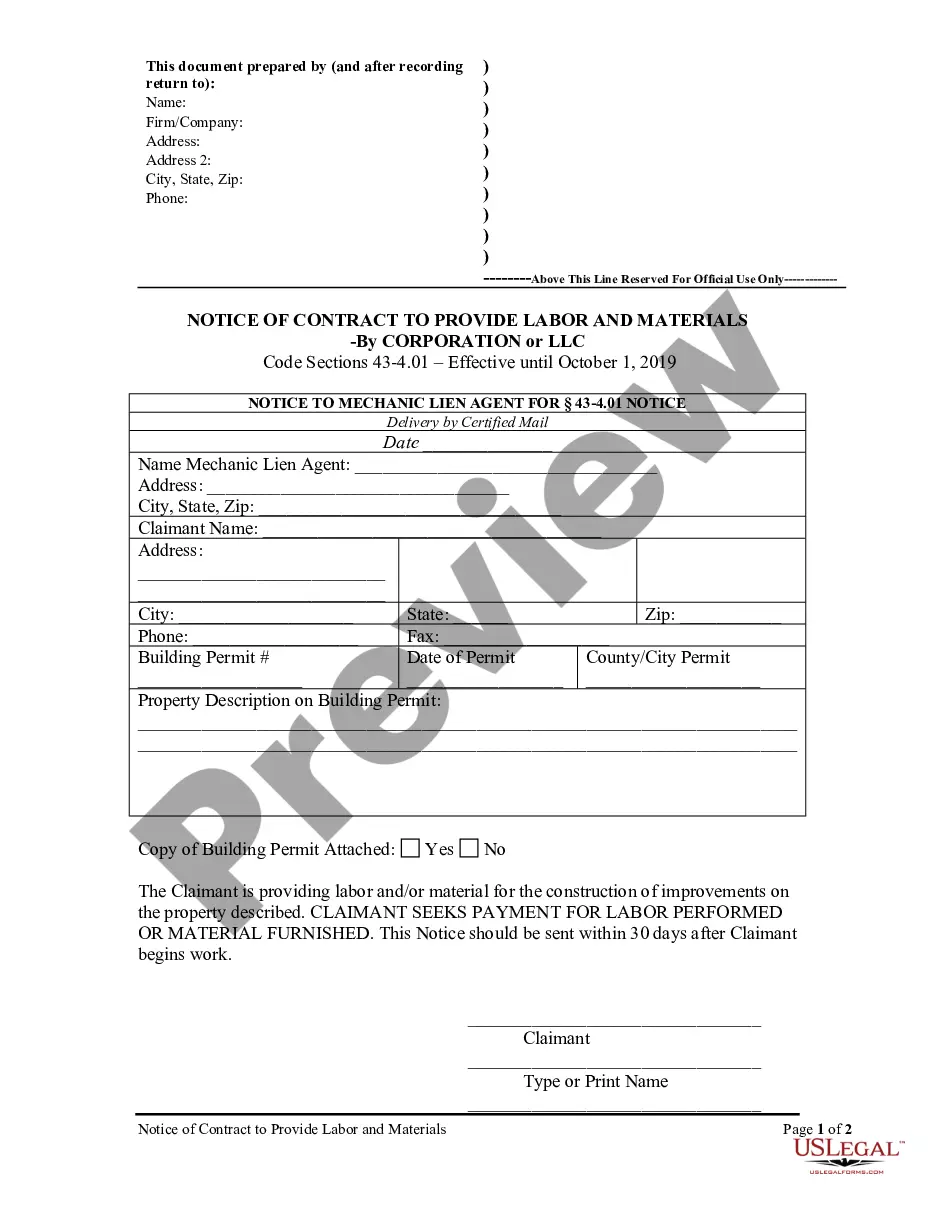

Instructions for completing these forms

- Review the included forms carefully to understand their purpose.

- Identify the parties involved in the exchange and their respective roles.

- Fill in the relevant details in each form, ensuring accuracy and completeness.

- Check for any needed signatures and ensure all parties sign the necessary documents.

- Store the completed forms securely for your records and future reference.

Do documents in this package require notarization?

Certain documents in this package must be notarized for legal effectiveness. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to properly identify like-kind properties.

- Not completing forms in accordance with IRS requirements.

- Missing signatures from key parties involved in the exchange.

- Neglecting to maintain accurate records of the transaction.

Benefits of using this package online

- Convenience of downloading forms instantly.

- Editability allows you to customize forms to fit your specific situation.

- Reliability of documents prepared by licensed attorneys.

Legal use & context

- Each form is designed to ensure compliance with Alabama's legal framework for tax-free exchanges.

- The package offers protection under IRS guidelines when used appropriately.

- Parties must understand the stipulations of Section 1031 to avoid unexpected tax liabilities.

Summary of main points

- The Alabama Tax Free Exchange Package is crucial for legally deferring taxes on property exchanges.

- Ensure accuracy and thoroughness when filling out forms to prevent mistakes.

- Review Alabama's specific laws regarding like-kind exchanges to stay compliant.

Looking for another form?

Form popularity

FAQ

In the state of Alabama, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Several examples of exceptions to this tax are items intended for use in agricultural pursuits or industry.

Services in Alabama are generally not taxable. But watch out if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Alabama , with a few exceptions for items used in agriculture or industry.

Alabama's 16th annual sales tax holiday for school-related items begins at a.m. Friday, July 16, 2021, and ends at midnight Sunday, July 18, 2021, giving shoppers the opportunity to purchase certain school supplies, computers, books and clothing free of the state's four percent sales or use tax.

Sales of Exempt Items: Some of the more common items which are exempt are: prescription drugs, gasoline and motor oil (kerosene and fuel oil are taxable), fertilizer/insecticides/fungicides when used for agricultural purposes, seeds for planting purposes, feed for livestock and poultry (not including prepared food for

(2) Sales or use tax applies to labor or service charges billed to customers in conjunction with sales of tangible personal property and repairs to tangible personal property as follows: (a) Labor or service charges, whether included in the total charge for the product or billed as a separate item, are taxable if the

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states.

The real estate transfer tax is paid to a local or state agency to transfer real property from one owner to another. The buyer cannot take ownership of the property until the transfer tax has been paid. In Alabama, the transfer tax is usually paid by the buyer.

A sales tax exemption releases a business or organization from having to pay state or local sales tax on at least some of the items that it purchases.A tax-exempt organization, such as an elementary or high school, makes a purchase for items needed for the school.