Alabama Summary Administration for Estates Not More Than $37,050 - Small Estates

Description

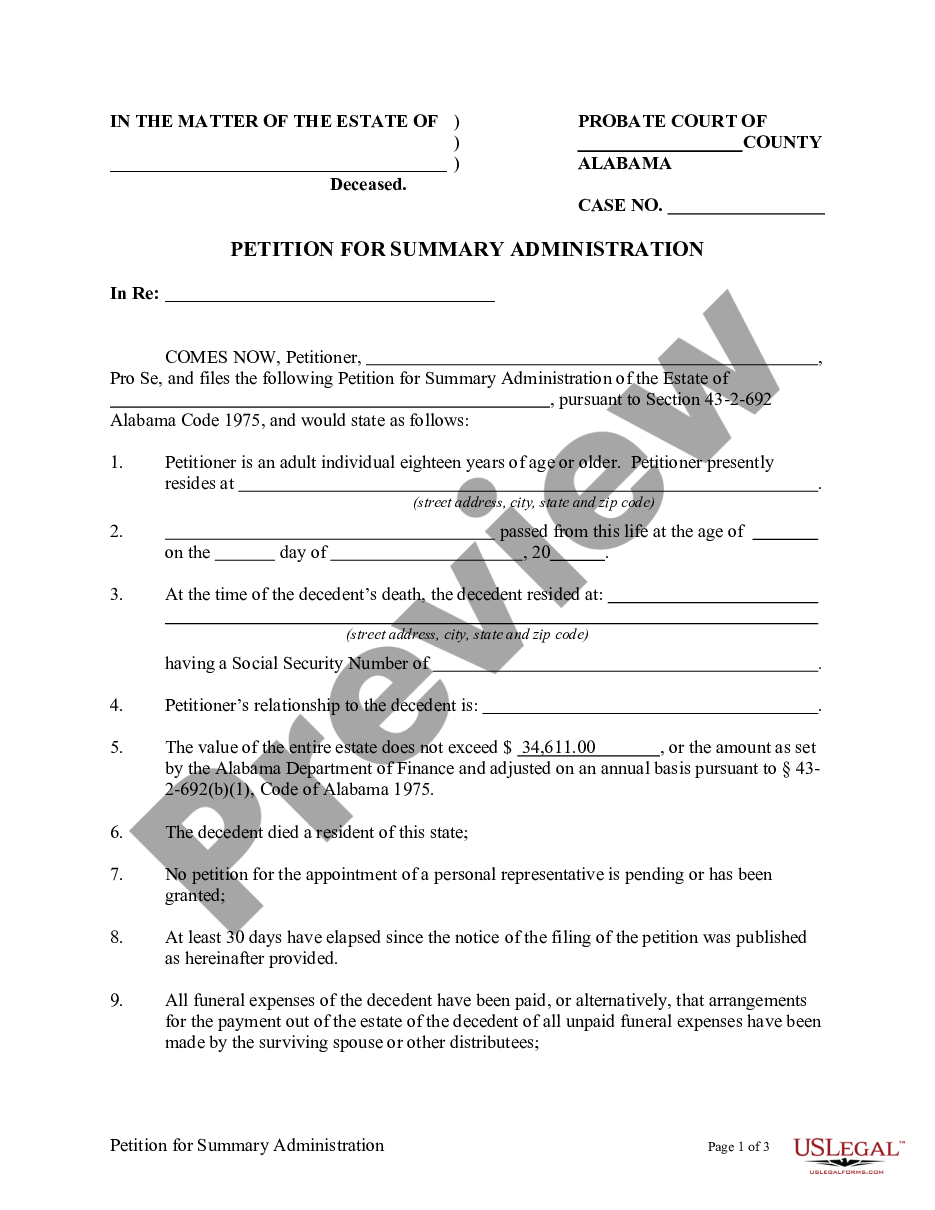

How to fill out Alabama Summary Administration For Estates Not More Than $37,050 - Small Estates?

Utilizing Alabama Summary Administration for Estates Not Exceeding $30,245.00- Minor Estates samples crafted by experienced attorneys allows you to evade difficulties when completing paperwork.

Merely download the form from our site, complete it, and ask a lawyer to review it.

By doing this, you will conserve significantly more time and effort than seeking a lawyer to generate a document entirely from the ground up for you.

Utilize the Preview feature and examine the description (if accessible) to determine if you need this specific template and if so, click Buy Now.

- If you possess a US Legal Forms subscription, simply Log In to your account and navigate back to the form page.

- Locate the Download button adjacent to the template you are examining.

- After downloading a file, you will find your saved examples in the My documents section.

- If you lack a subscription, it’s not an issue.

- Just adhere to the detailed instructions below to register for an account online, acquire, and complete your Alabama Summary Administration for Estates Not Exceeding $30,245.00- Minor Estates template.

- Thoroughly verify and ensure that you are obtaining the correct state-specific form.

Form popularity

FAQ

The threshold for probate in Alabama is currently set at $34,611.00 for small estates. If the total value of the estate exceeds this amount, a full probate process is necessary, which can be complex and time-consuming. However, for estates below this threshold, Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates provides a streamlined alternative, facilitating easier asset distribution.

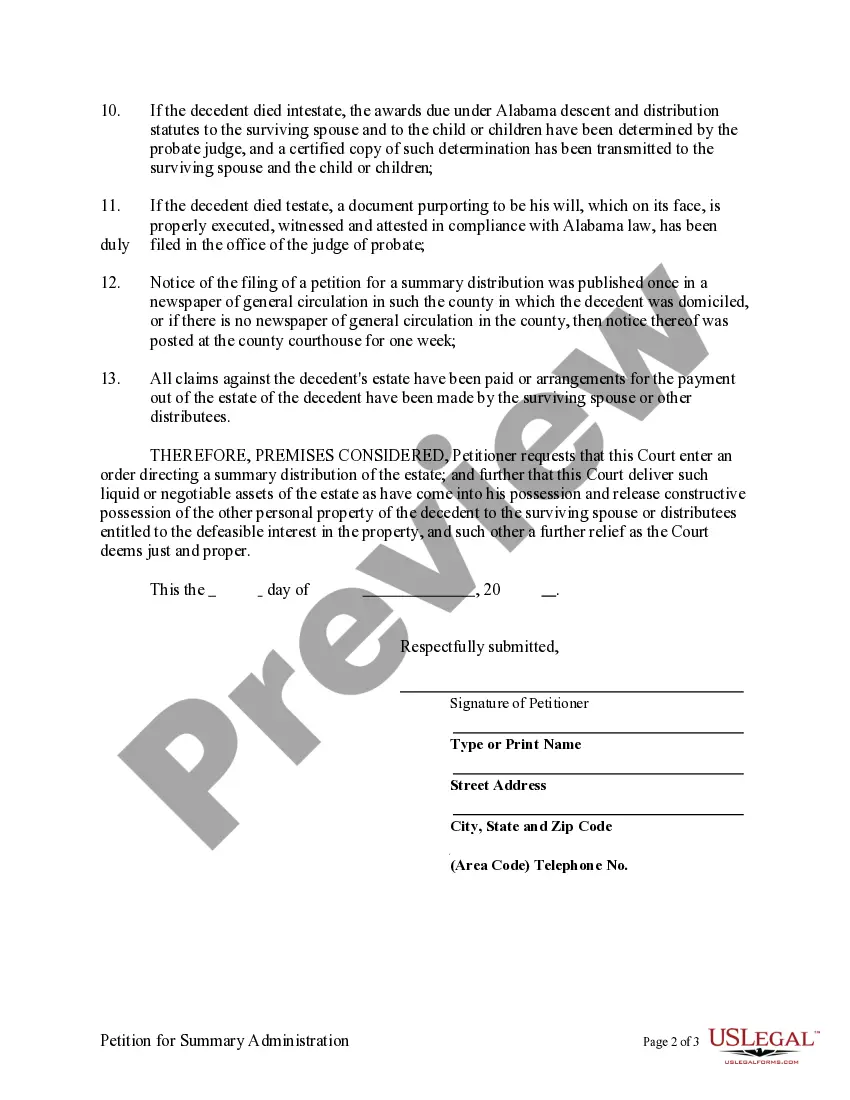

Yes, an estate can be settled without probate in Alabama if it qualifies as a small estate. By utilizing Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates, heirs can simplify the process and avoid lengthy court proceedings. This approach saves time and resources, allowing for a smoother transition of the deceased's assets to their rightful beneficiaries.

Probate in Alabama is typically initiated when a person dies leaving assets that exceed the allowable amount for a small estate. This includes real estate, bank accounts, and other valuable property held solely in their name. Additionally, if an estate does not qualify for Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates due to exceeding this threshold, probate proceedings become necessary.

To obtain a small estate affidavit in Alabama, start by gathering information about the deceased's assets and debts. You must ensure the total value of the estate does not exceed the $34,611.00 limit for Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates. Once you prepare the affidavit, present it to the probate court in your county, along with any required supporting documents.

In Alabama, certain assets do not require probate if they meet specific criteria. For example, jointly owned properties, life insurance policies with named beneficiaries, and retirement accounts can bypass the probate process. Additionally, Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates allows some exemptions, making the estate settlement process simpler and quicker.

To file your small estate affidavit in Alabama, prepare and sign the affidavit form to declare your status as the heir. After that, file it with the probate court where the deceased resided. Submitting the properly completed documents allows for a streamlined approach to settle the estate unimpeded by extensive probate, leveraging the Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates process.

Filling out a small estate affidavit involves providing specific details such as the deceased’s full name, date of death, and a description of the estate's assets and liabilities. Additionally, you'll need to state your relationship to the deceased and confirm that the total value does not exceed $34,611.00, qualifying for Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates. If you seek a simpler way to complete this process, consider using uslegalforms for comprehensive guidance and user-friendly templates.

To file a small estate affidavit in Alabama, start by preparing the affidavit form, which declares you are the rightful heir to the estate. You will need to include information about the deceased, the assets, and any debts. After completing the form, submit it to the court in the county where the deceased lived, allowing heirs to access the estate promptly.

In Alabama, the small estate limit is set at $34,611.00 for Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates. This means if the total value of the estate falls below this threshold, heirs can manage the estate without going through the lengthy probate process. Understanding this limit is crucial for heirs looking to settle affairs quickly and efficiently in Alabama.

To fill out an estate document, start by collecting all necessary information about the deceased's assets, debts, and beneficiaries. Make sure to obtain the correct forms, which can often be found through platforms like UsLegalForms. As you fill out each section, clarity is essential, particularly when working through Alabama Summary Administration for Estates Not More Than $34,611.00- Small Estates, as accurate documentation ensures a smoother process.