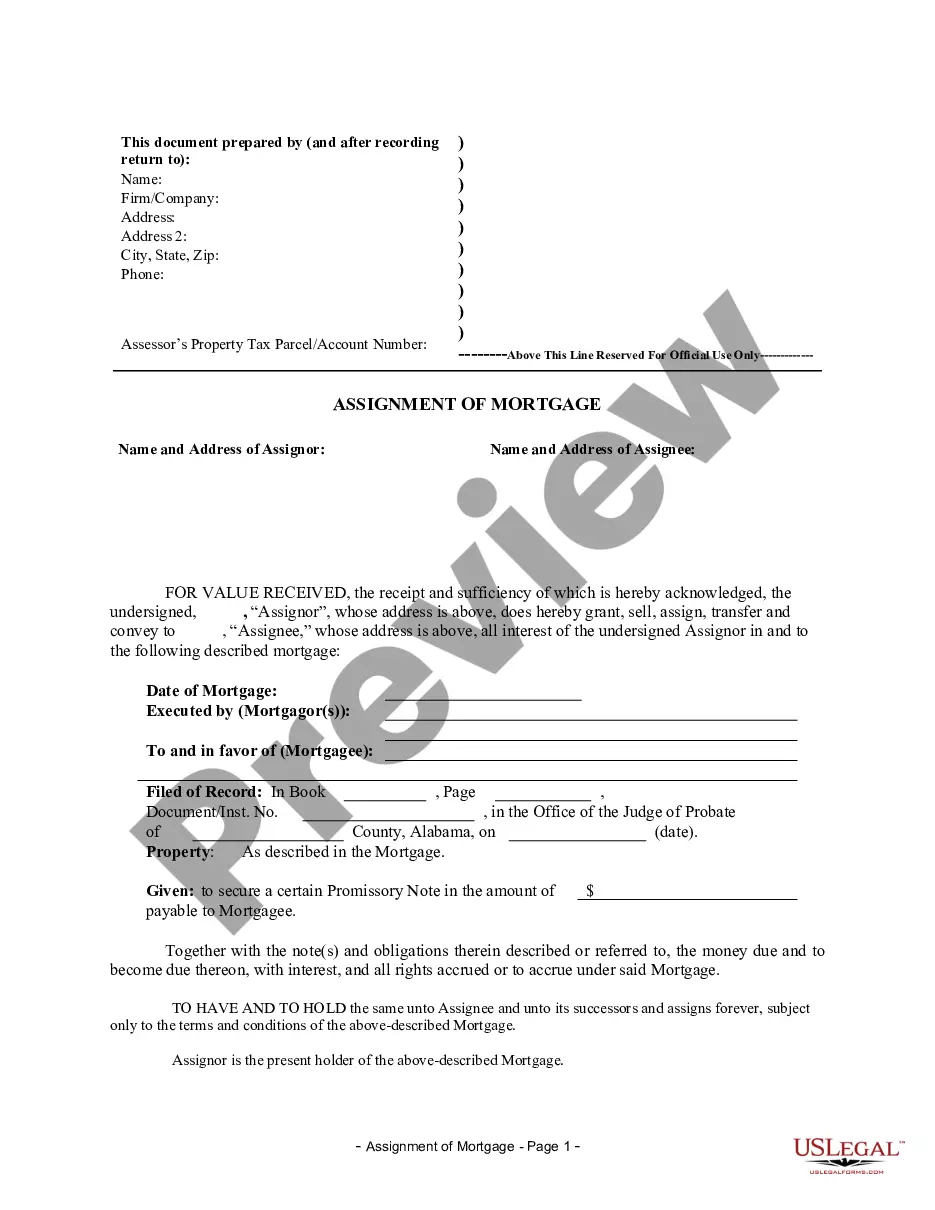

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Alabama Assignment of Mortgage by Corporate Mortgage Holder

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

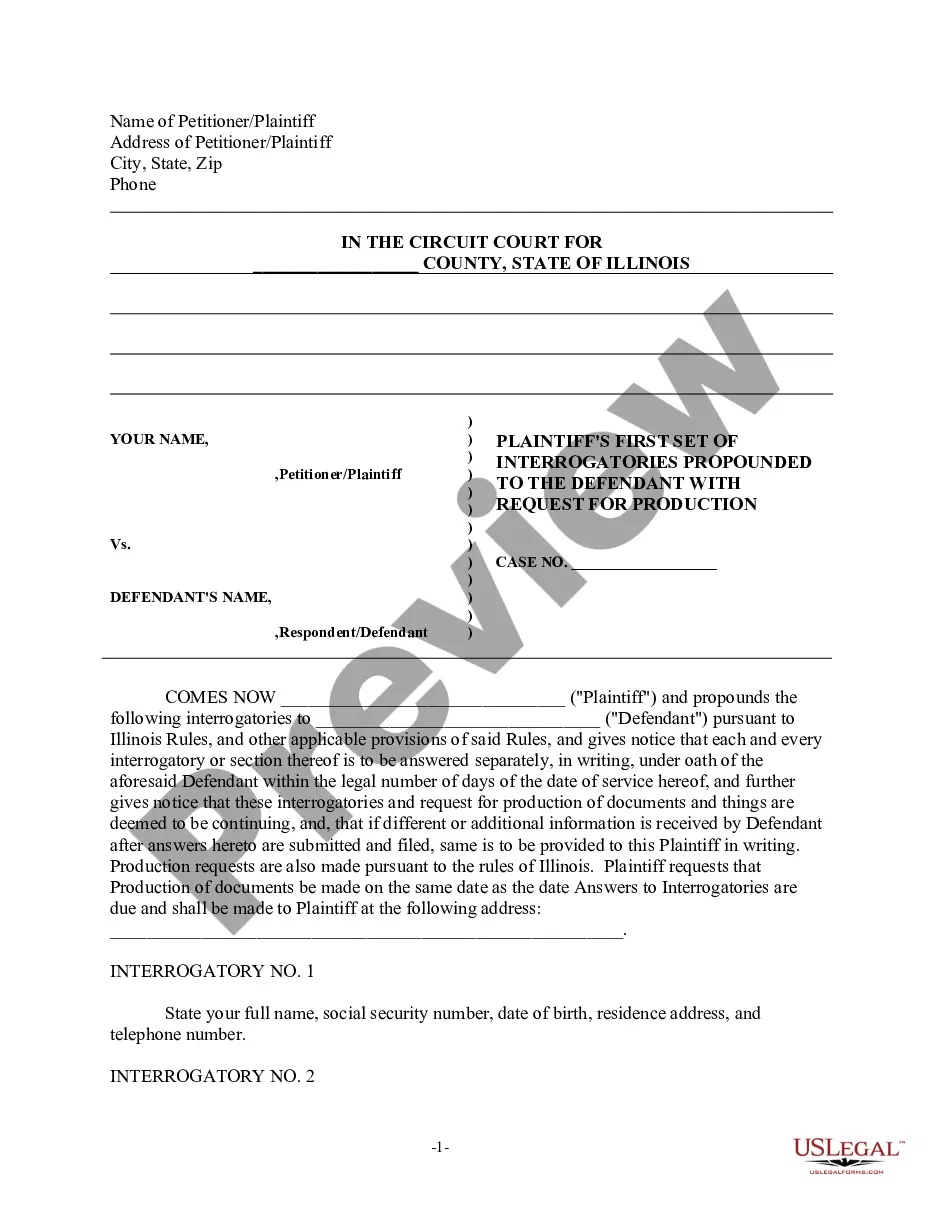

How to fill out Alabama Assignment Of Mortgage By Corporate Mortgage Holder?

Utilizing examples of Alabama Mortgage Assignment by Corporate Mortgage Holder created by experienced attorneys provides you the opportunity to avert stress when submitting paperwork.

Simply download the template from our site, complete it, and request a legal expert to review it.

By doing so, you can conserve significantly more time and effort than searching for legal advice to create a document from scratch to meet your requirements.

Minimize the time spent on document preparation with US Legal Forms!

- If you possess a subscription to US Legal Forms, simply Log In to your profile and return to the forms page.

- Locate the Download button next to the template you are examining.

- After downloading a template, you can access all your saved samples in the My documents section.

- If you lack a subscription, that's not an issue.

- Just adhere to the instructions below to register for an online account, obtain, and fill out your Alabama Mortgage Assignment by Corporate Mortgage Holder template.

- Verify and ensure that you’re downloading the correct state-specific form.

Form popularity

FAQ

If the assignment of mortgage is not recorded, it can lead to significant complications for the parties involved. Without proper documentation, the original mortgage holder may still be viewed as the legal lien holder, potentially jeopardizing your rights as a borrower. Moreover, the failure to record can invite disputes with subsequent purchasers or lenders. To avoid these issues, consider utilizing the Alabama Assignment of Mortgage by Corporate Mortgage Holder to ensure your transaction is properly documented and protected.

No, an assignment of mortgage does not imply foreclosure. It only signifies that the lender’s rights have transferred to another party. In fact, understanding the Alabama Assignment of Mortgage by Corporate Mortgage Holder can help prevent confusion between these two processes. Foreclosure occurs when a borrower defaults on payments, while an assignment merely changes who holds the mortgage rights.

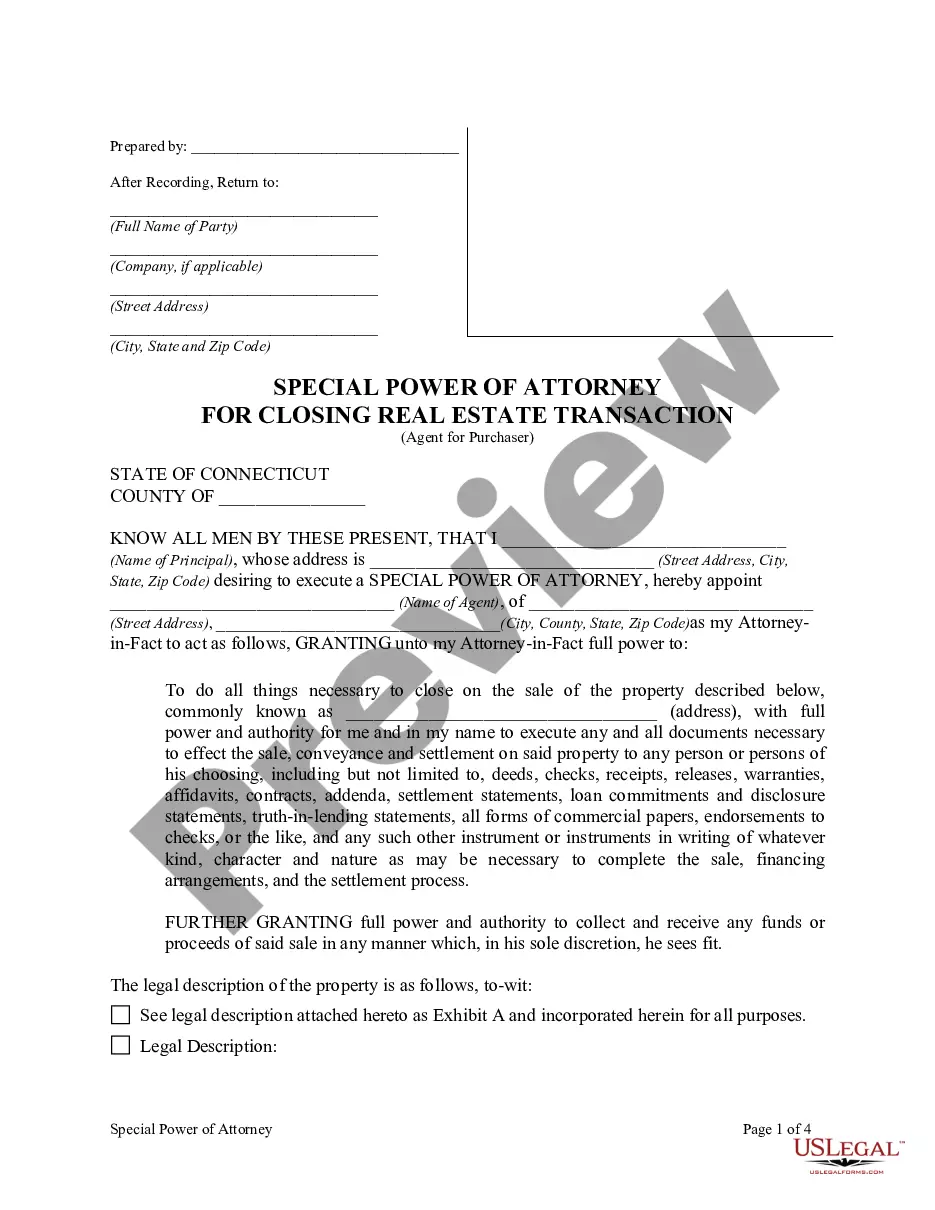

A corporate assignment of a mortgage is the legal transfer of the lender’s interest in a mortgage from one corporate entity to another. This assignment occurs in various circumstances, such as acquisitions or restructuring. An Alabama Assignment of Mortgage by Corporate Mortgage Holder often involves a company that specializes in managing multiple mortgages. Understanding this assignment helps borrowers recognize their rights and the responsibilities of their new lender.

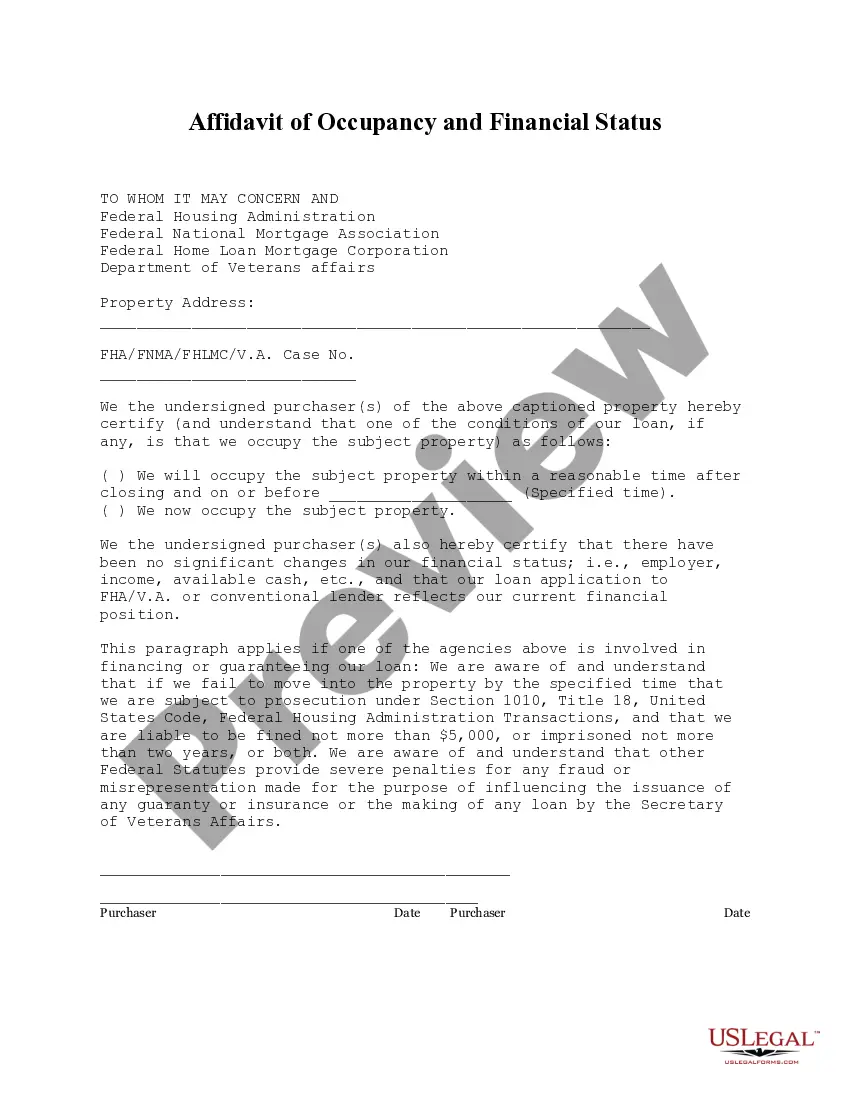

To complete an assignment of mortgage, the current lender must create a written document that clearly outlines the terms of the assignment. This document should include details about the property and the new lender. Once executed, the assignment needs filing with the appropriate county office to ensure public record. Using platforms like uslegalforms can simplify this process by providing templates and guidance tailored to an Alabama Assignment of Mortgage by Corporate Mortgage Holder.

A corporate assignment of a mortgage refers to the formal process where a corporate lender assigns its rights under a mortgage to another entity. This process is crucial in the case of an Alabama Assignment of Mortgage by Corporate Mortgage Holder, as it allows lenders to manage their portfolios effectively. It ensures that the new lender can collect payments and enforce rights on the mortgage. This assignment benefits borrowers by providing continuity in their mortgage agreements.

A mortgage assignment transfers the rights and responsibilities of a mortgage from one lender to another. In the case of an Alabama Assignment of Mortgage by Corporate Mortgage Holder, the corporate entity formally documents this transfer. The borrower should receive a notification, ensuring they know who their new lender is. This process maintains transparency and protects the interests of all parties involved.

A corporate assignment of a mortgage occurs when a corporation transfers its rights to receive mortgage payments to another entity. This process ensures that the new entity has the legal authority to collect payments and manage the mortgage. The corporate assignment plays a crucial role in the mortgage market, especially in Alabama, facilitating smoother transactions for the Alabama Assignment of Mortgage by Corporate Mortgage Holder.

When a mortgage is assigned to a purchaser, they typically receive two key legal documents: the Assignment of Mortgage and the Note. The Assignment of Mortgage officially transfers the rights and responsibilities from the original lender to the new holder, ensuring that the purchaser has a clear claim over the property. Meanwhile, the Note outlines the repayment details and terms, essential for understanding the financial obligations tied to the Alabama Assignment of Mortgage by Corporate Mortgage Holder.

To release an assignment of a mortgage, you need to file a release document that indicates the satisfaction of the mortgage obligations. This document should be properly signed and recorded in the county where the property is located. It is essential to ensure that all parties agree and that the release is legally binding to avoid any future confusion. For assistance, Uslegalforms can guide you through the process of properly managing the Alabama Assignment of Mortgage by Corporate Mortgage Holder.

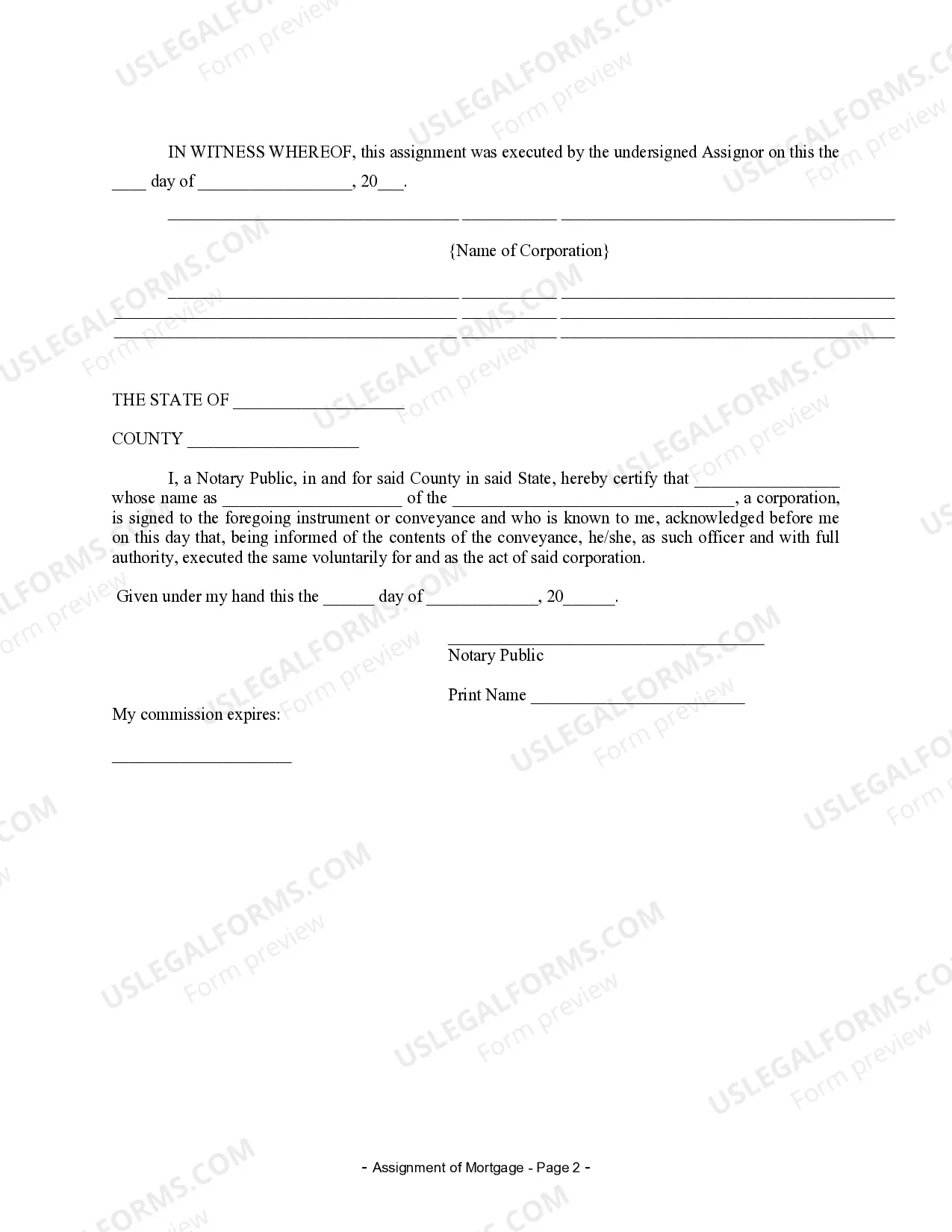

Typically, the assignment of a mortgage is signed by the current mortgage holder, which is often a corporate entity or bank. In some cases, authorized representatives from the company may also sign on its behalf. It is crucial for the assignment to be executed properly to ensure that the rights are effectively transferred. For detailed guidance on this process regarding the Alabama Assignment of Mortgage by Corporate Mortgage Holder, Uslegalforms can offer helpful solutions.