Alabama Warranty Deed to Child Reserving a Life Estate in the Parents

Overview of this form

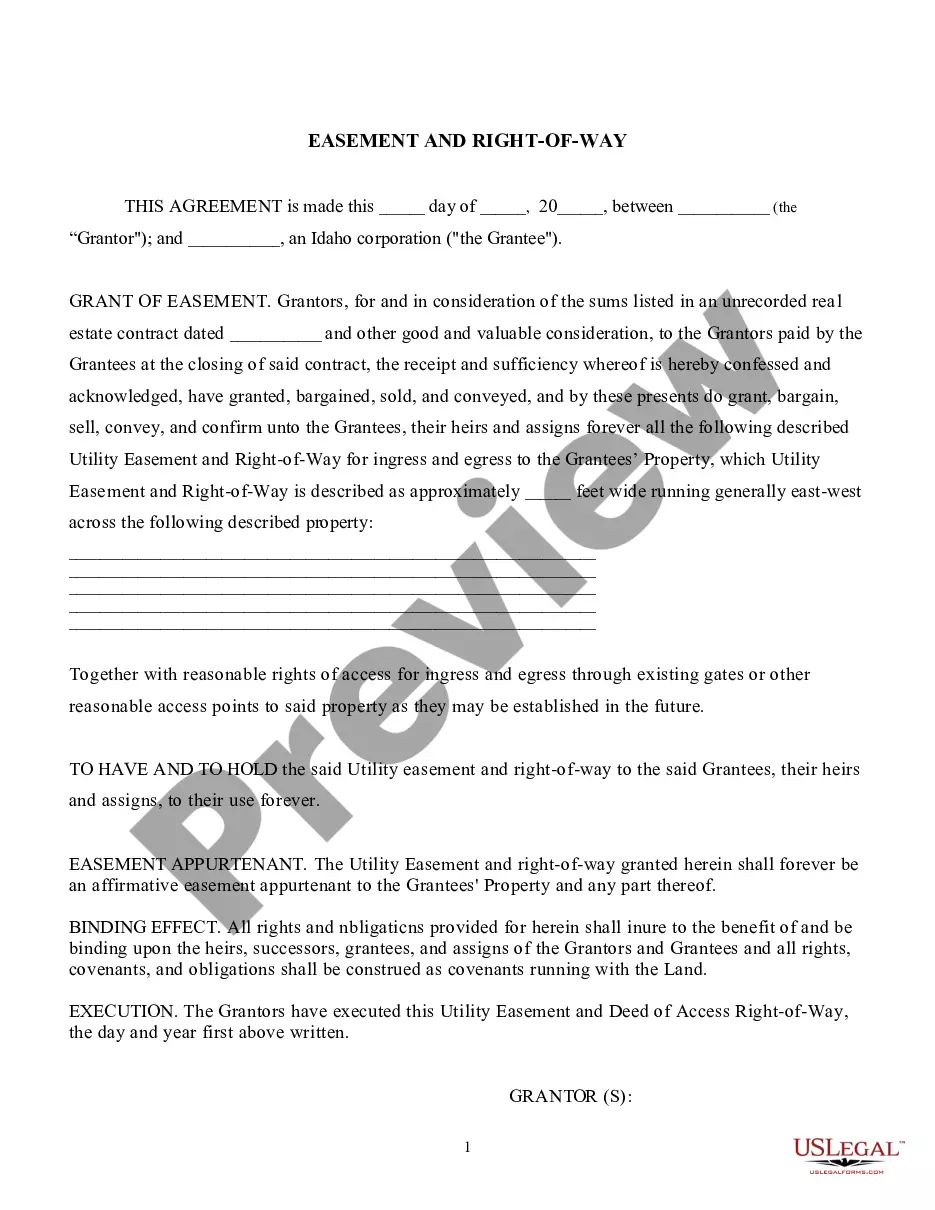

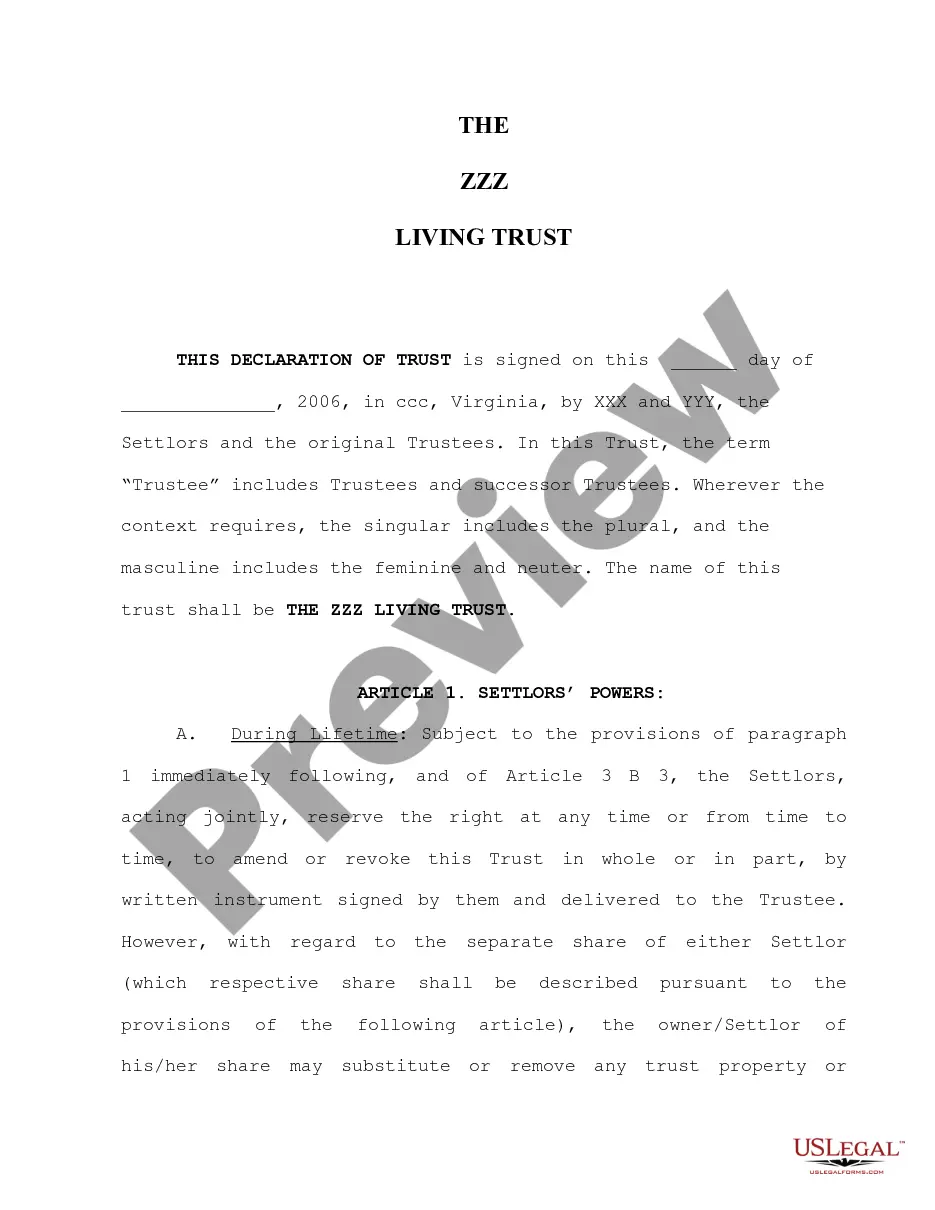

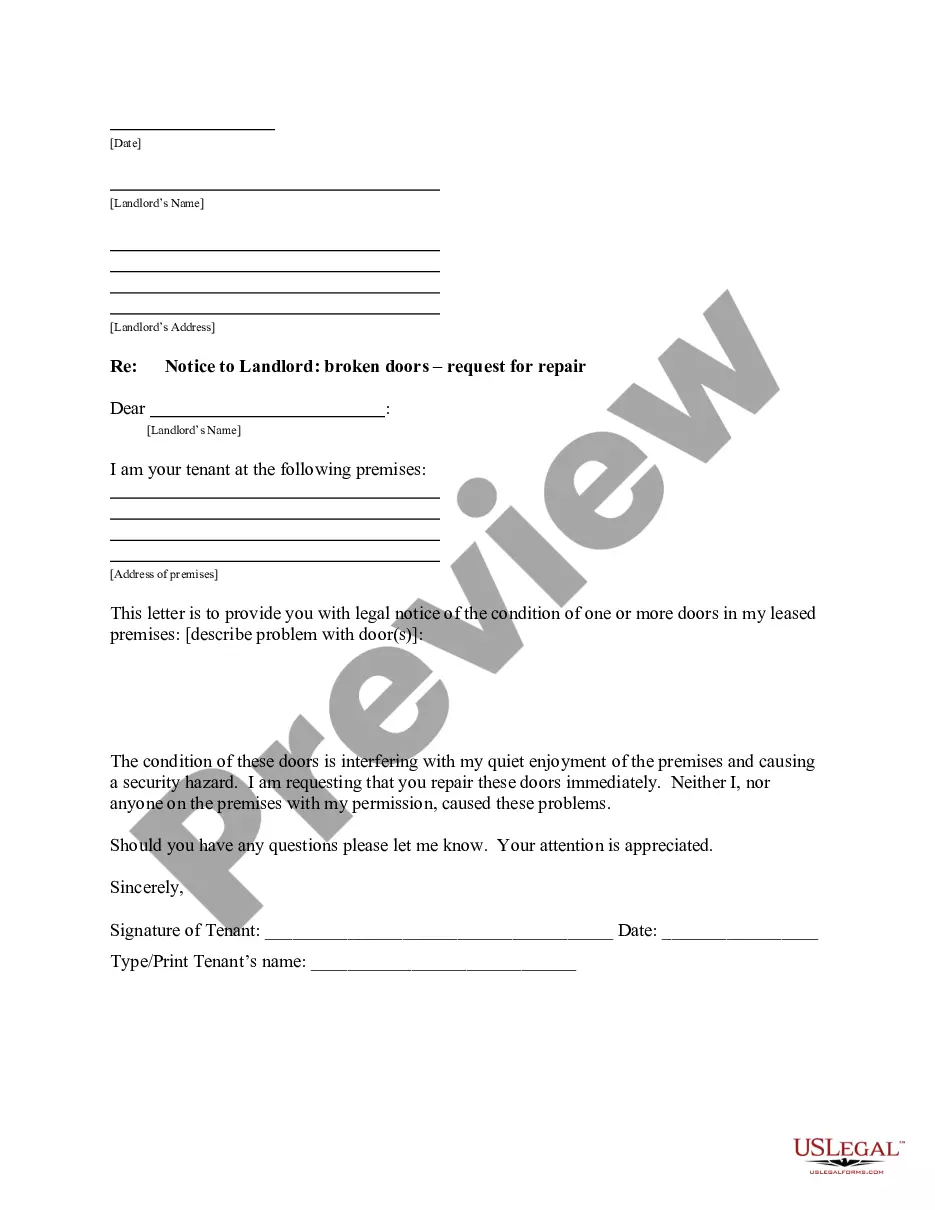

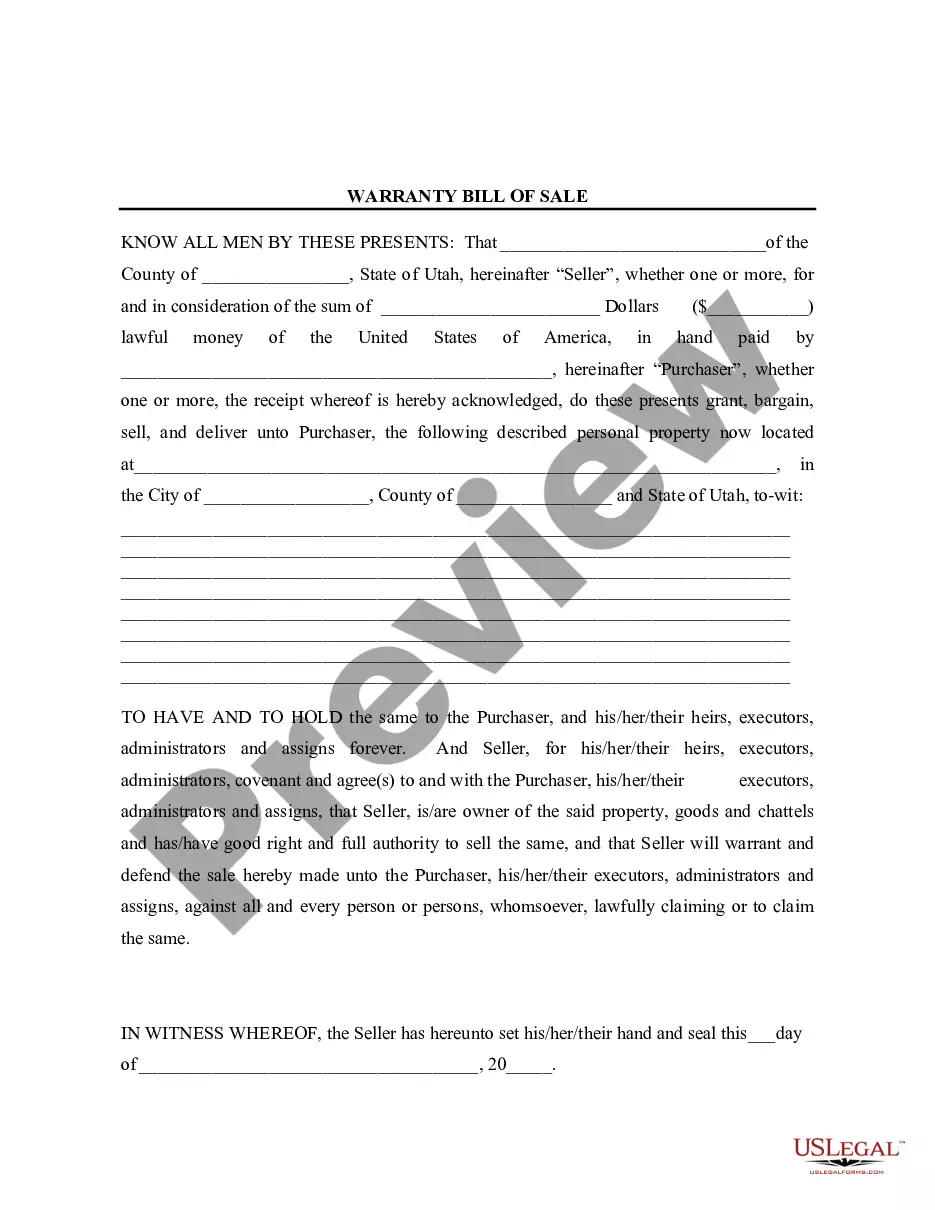

The Warranty Deed to Child Reserving a Life Estate in the Parents is a legal document that allows parents (grantors) to convey real property to their child (grantee) while retaining a life estate, meaning the parents can continue to live on or use the property until their passing. This form is particularly useful in estate planning as it enables parents to transfer ownership while maintaining control over the property during their lifetime, unlike a standard warranty deed where full ownership is transferred immediately.

What’s included in this form

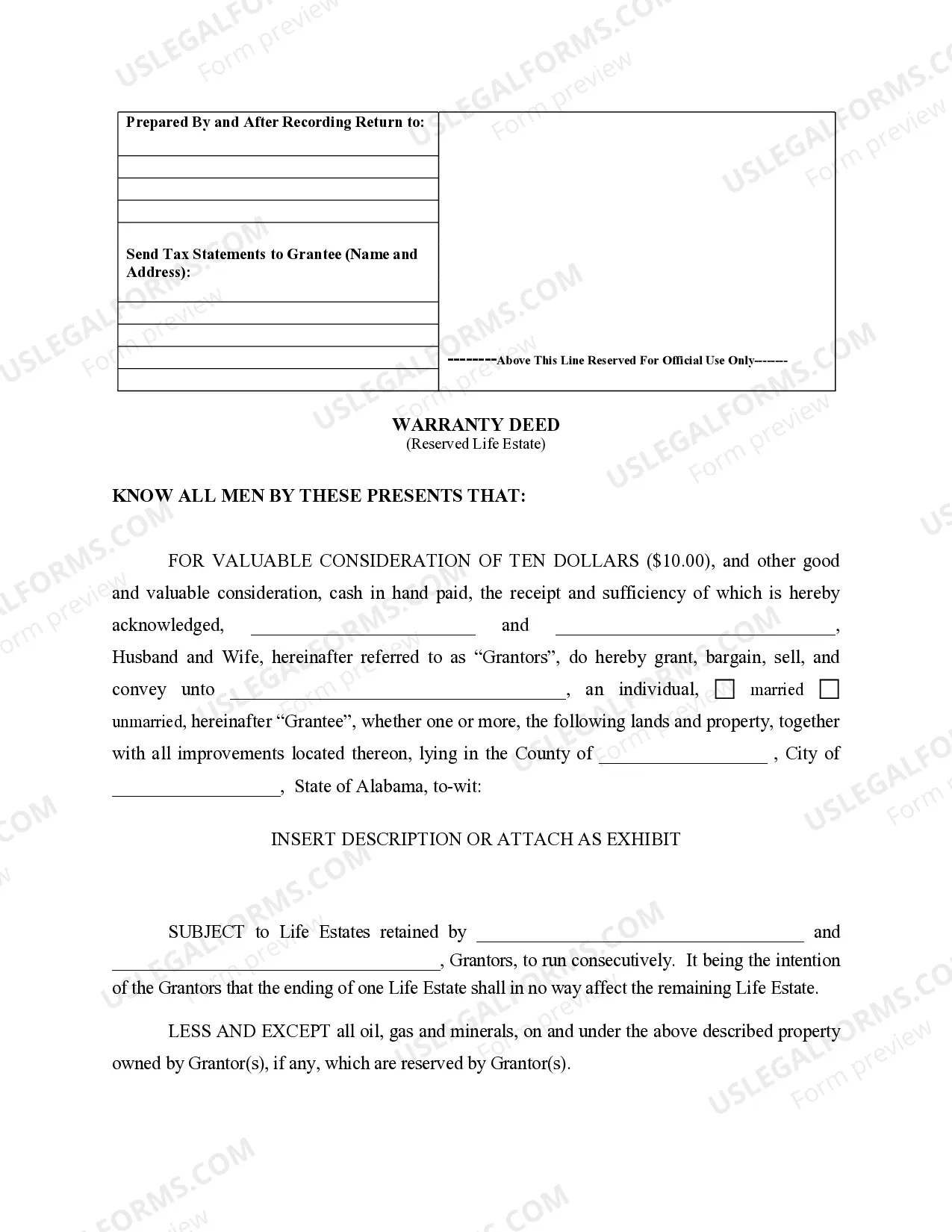

- Identification of grantors and grantee, including names and addresses.

- Description of the property being conveyed, including its legal description.

- Statement regarding the life estate reserved by the grantor(s), clarifying their rights during their lifetime.

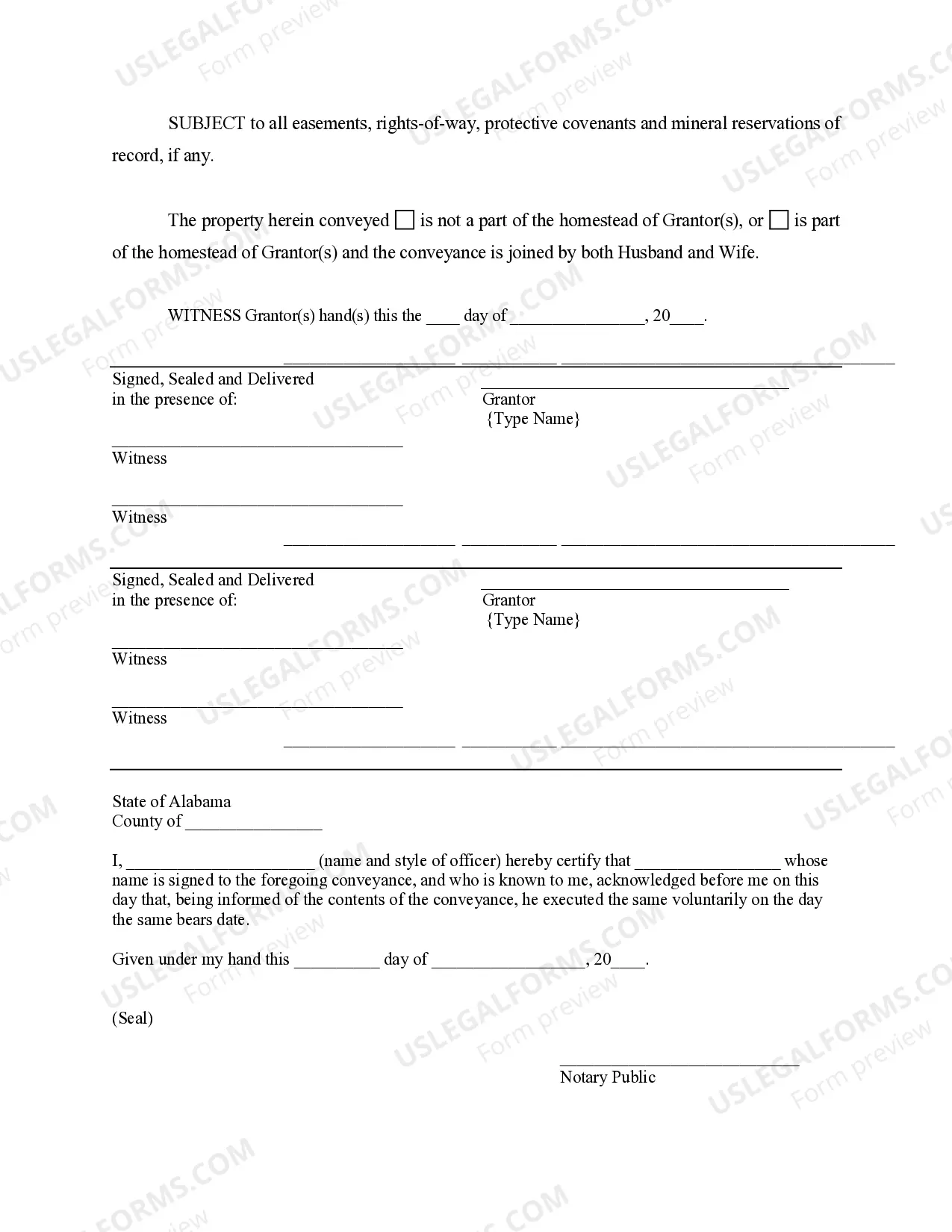

- Space for signatures of the grantor(s) and witnesses documenting the transfer.

- A notary section to validate the execution of the deed.

When to use this form

This form is beneficial in various situations, including when parents wish to pass on property to their child while still retaining the right to live in or use the property. It is commonly used in estate planning to help avoid probate, secure property for family members, and manage future inheritance without the immediate loss of residence for the parents.

Who this form is for

- Parents wishing to transfer property ownership to their child but retain a life estate.

- Individuals looking to simplify their estate planning and ensure their family receives property without lengthy legal processes.

- Those who want to provide for their child while continuing to reside in the family home.

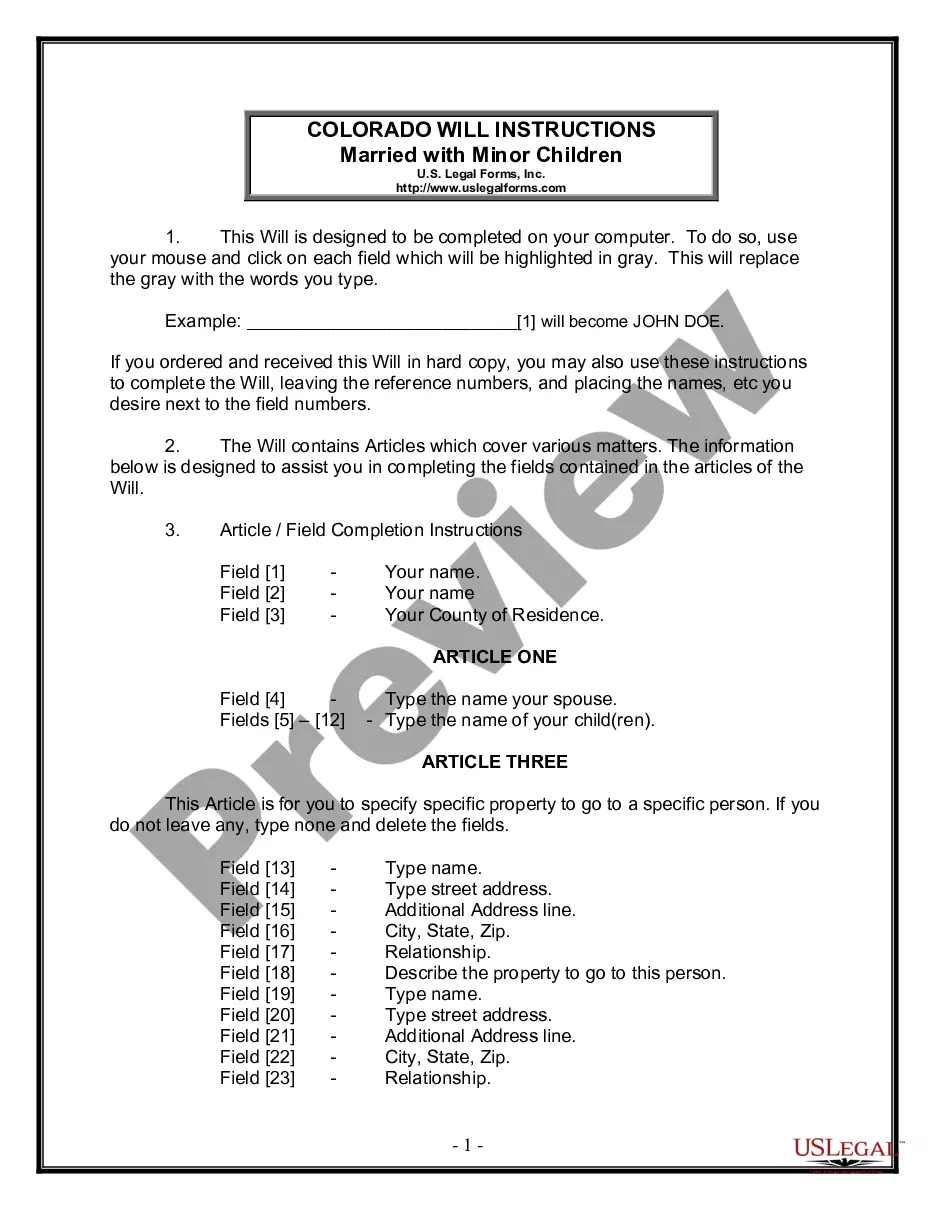

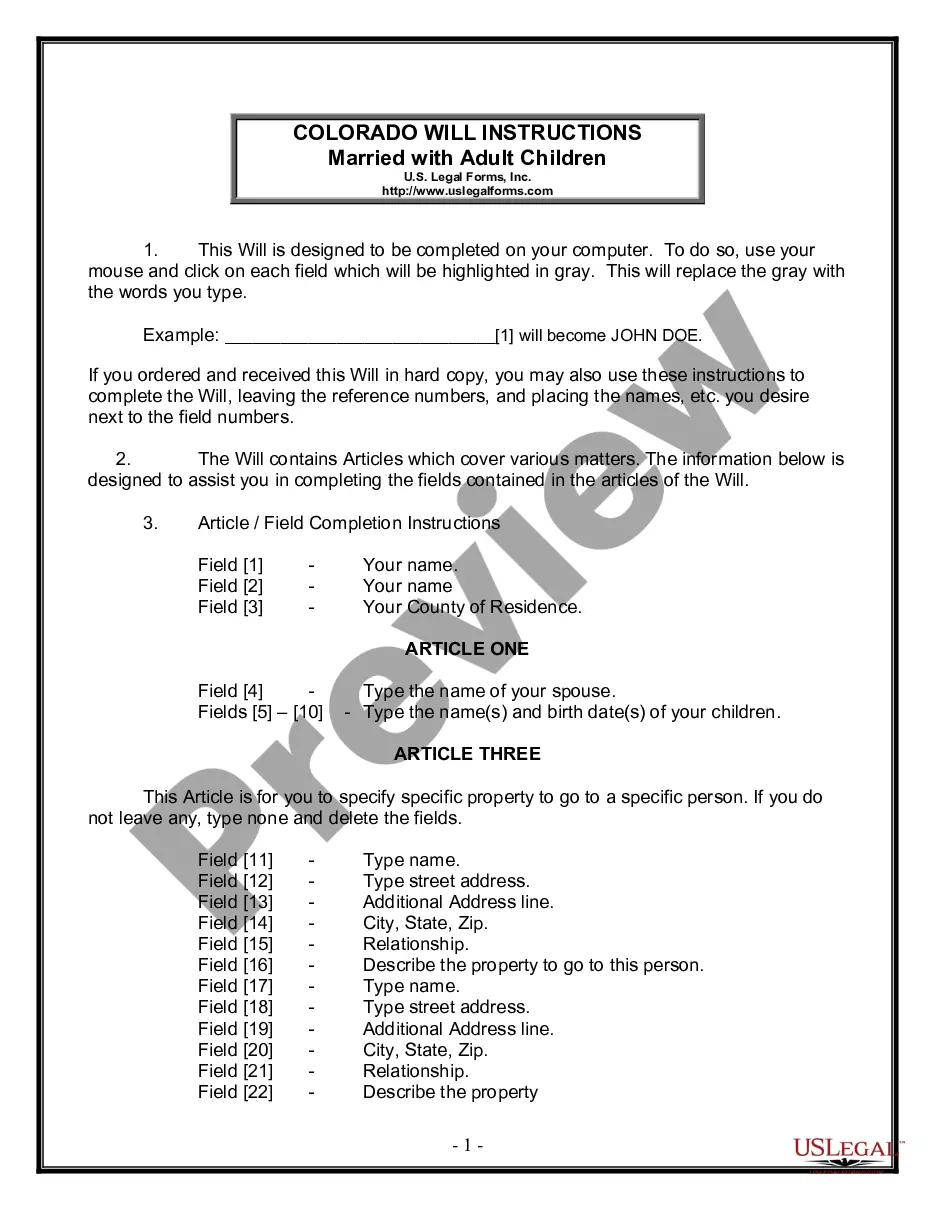

Instructions for completing this form

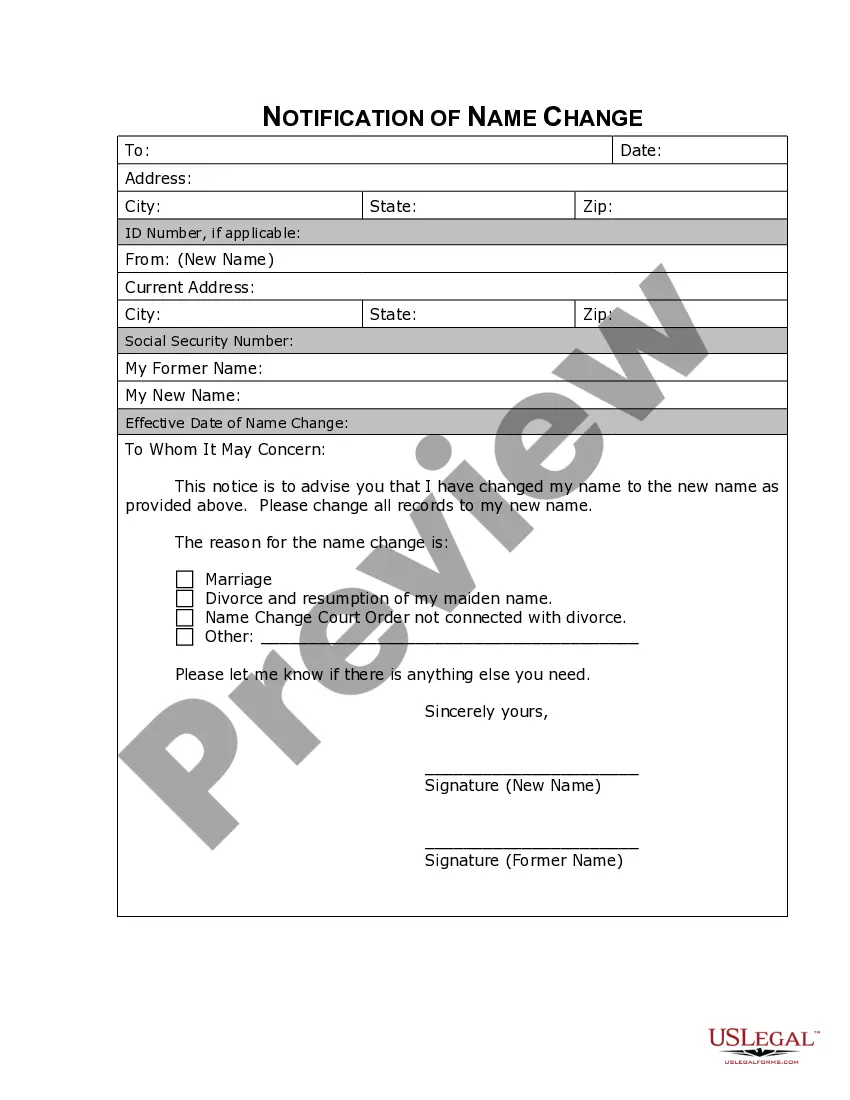

- Identify the grantors (parents) and the grantee (child) by entering their full names and addresses.

- Provide a detailed description of the property, including its legal description, to ensure clarity on what is being conveyed.

- Clearly specify the life estate reserved by the grantor(s) to retain their rights to the property during their lifetime.

- Ensure that all signatures of the grantor(s) and witnesses are obtained in the designated areas, including their printed names.

- Have the document notarized to validate the execution of the deed, ensuring it meets legal requirements.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide a complete legal description of the property, which can create confusion or disputes later.

- Not having the form notarized, which can render the deed invalid.

- Leaving out signatures or entries, which may lead to the deed being rejected or challenged.

- Not specifying the correct nature of the life estate reserved, leading to potential legal issues over property rights.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows for easy modifications based on your specific situation.

- Reliable legal wording drafted by licensed attorneys, ensuring compliance with relevant laws.

Looking for another form?

Form popularity

FAQ

The person holding the life estate -- the life tenant -- possesses the property during his or her life. The other owner -- the remainderman -- has a current ownership interest but cannot take possession until the death of the life estate holder.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A life estate deed allows you to transfer property while reserving an interest during your lifetime or during the lifetime of someone else. Once the person who holds the life estate passes away, the Grantee fully owns the property.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

At death, property is transferred from your name (ownership) in one of three ways: by title; by beneficiary designation; or by probate. The trick to avoiding probate is to make sure all of your assets are set up as transfers under either joint title or beneficiary designation.

A life estate is a form of co-ownership that allows owners to hold interests at different points in time. One ownercalled a life tenantcan hold title to the property for his or her life. At the life tenant's death, the property passes automatically to another owner called a remainderman or remainder beneficiary.