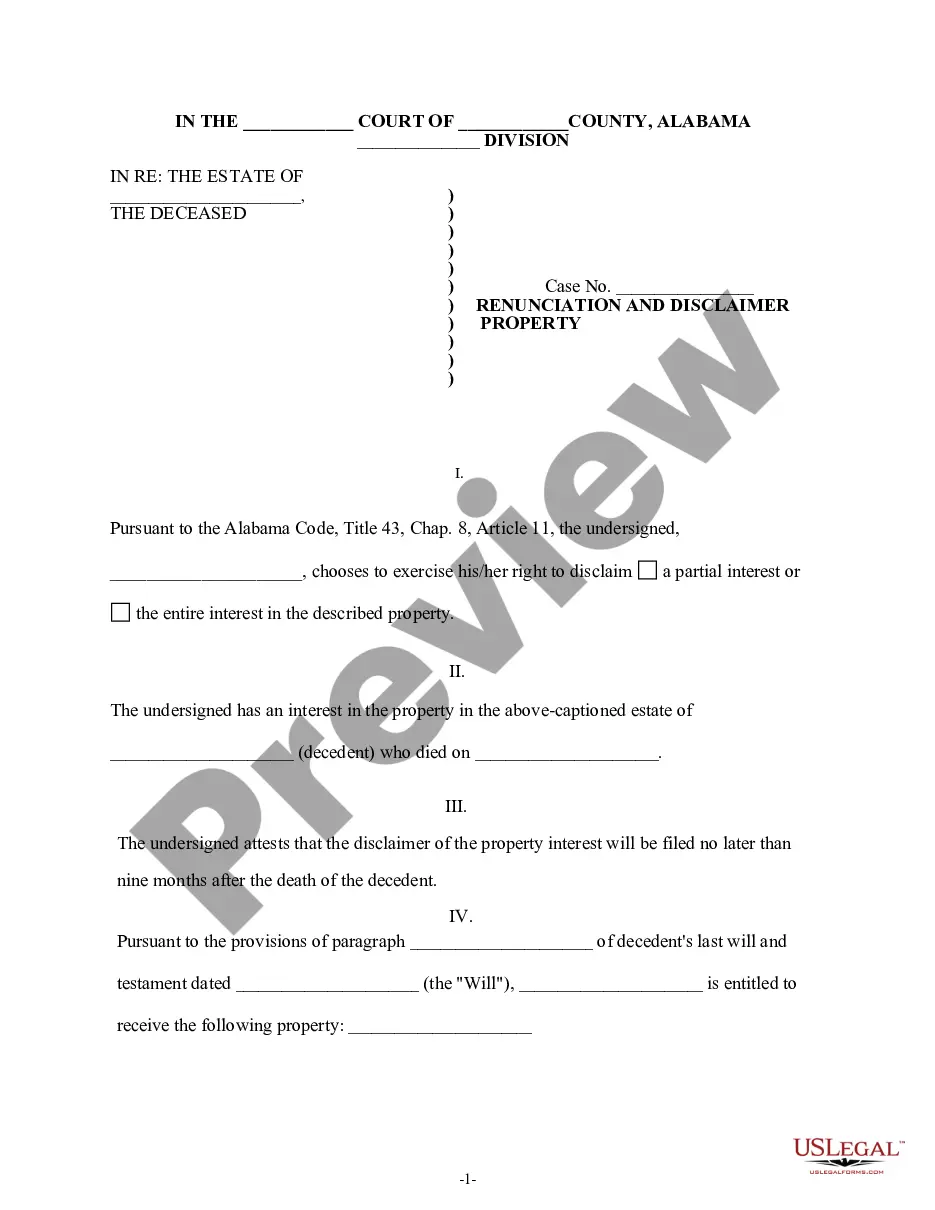

Alabama Renunciation and Disclaimer of Property from Will by Testate

Overview of this form

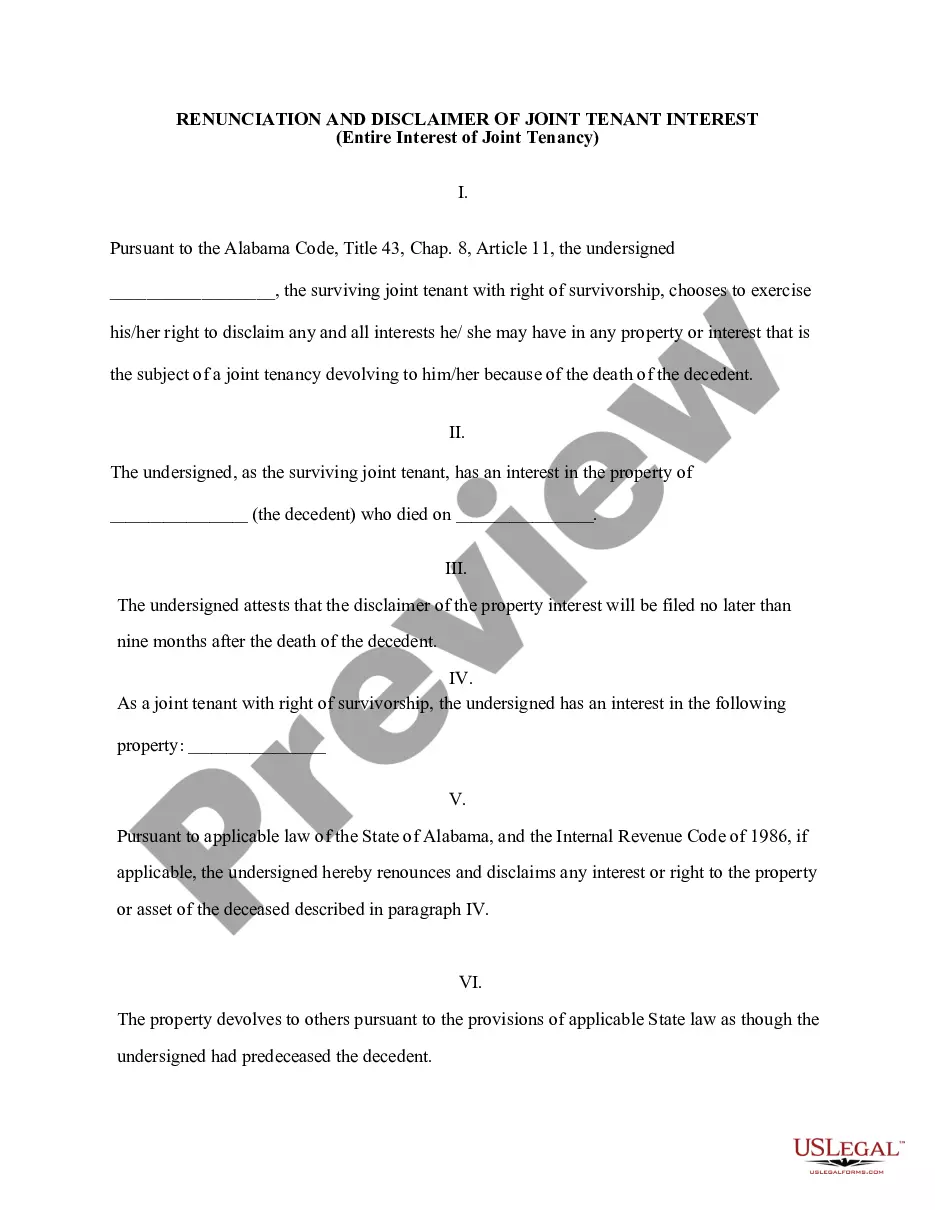

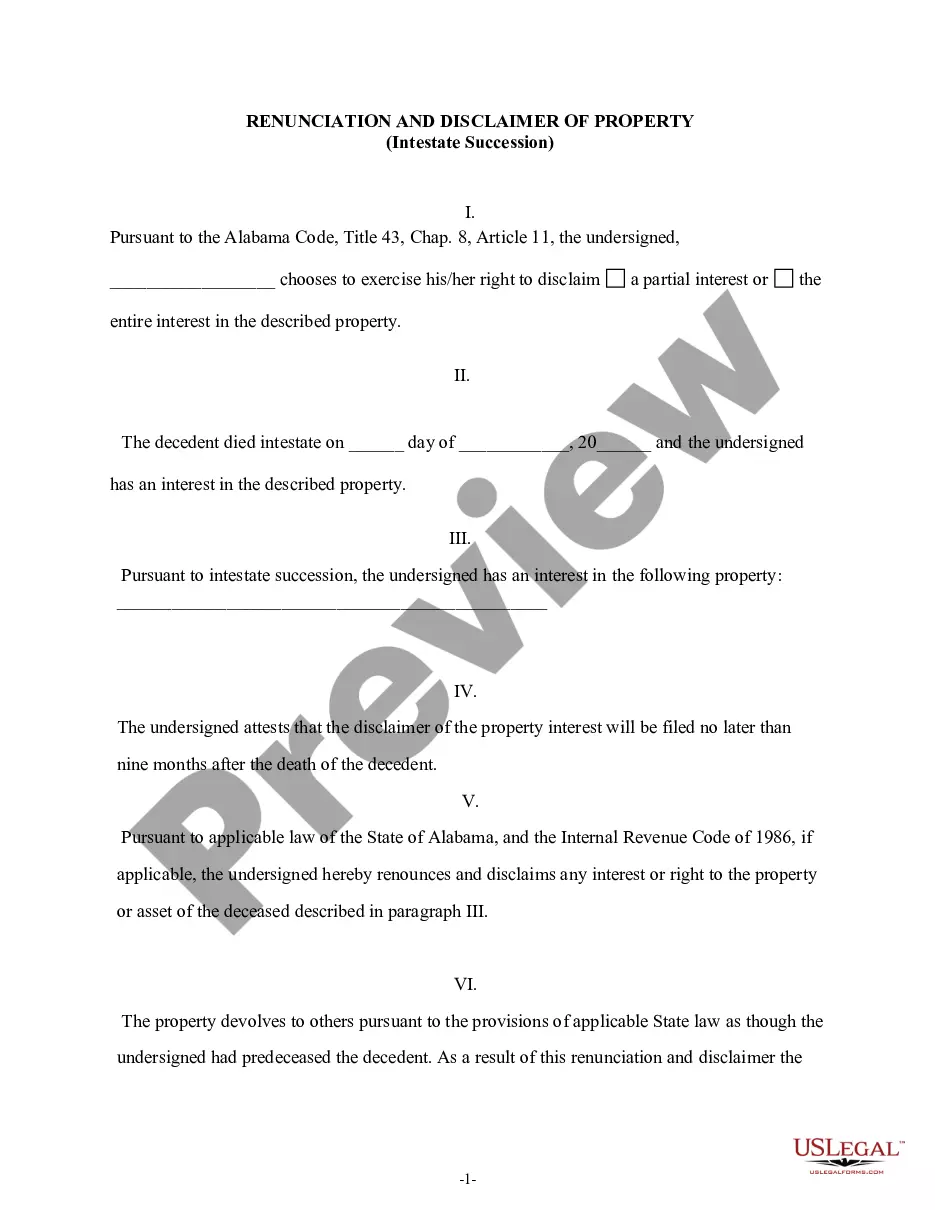

The Alabama Renunciation and Disclaimer of Property from Will by Testate is a legal document used by a beneficiary to formally renounce or disclaim an interest in property received through a will. This form allows beneficiaries in Alabama to relinquish their right to inherit property from a decedent, either fully or partially, as recognized under the Alabama Code, Title 43, Chap. 8, Article 11. It is crucial in ensuring that the property devolves according to Alabama law, as though the renouncing beneficiary had predeceased the decedent.

Key parts of this document

- Preamble stating the right to disclaim the interest in the property.

- Identification of the decedent and the date of their death.

- Statement affirming the timeline for filing the disclaimer.

- Details about the specific property being renounced.

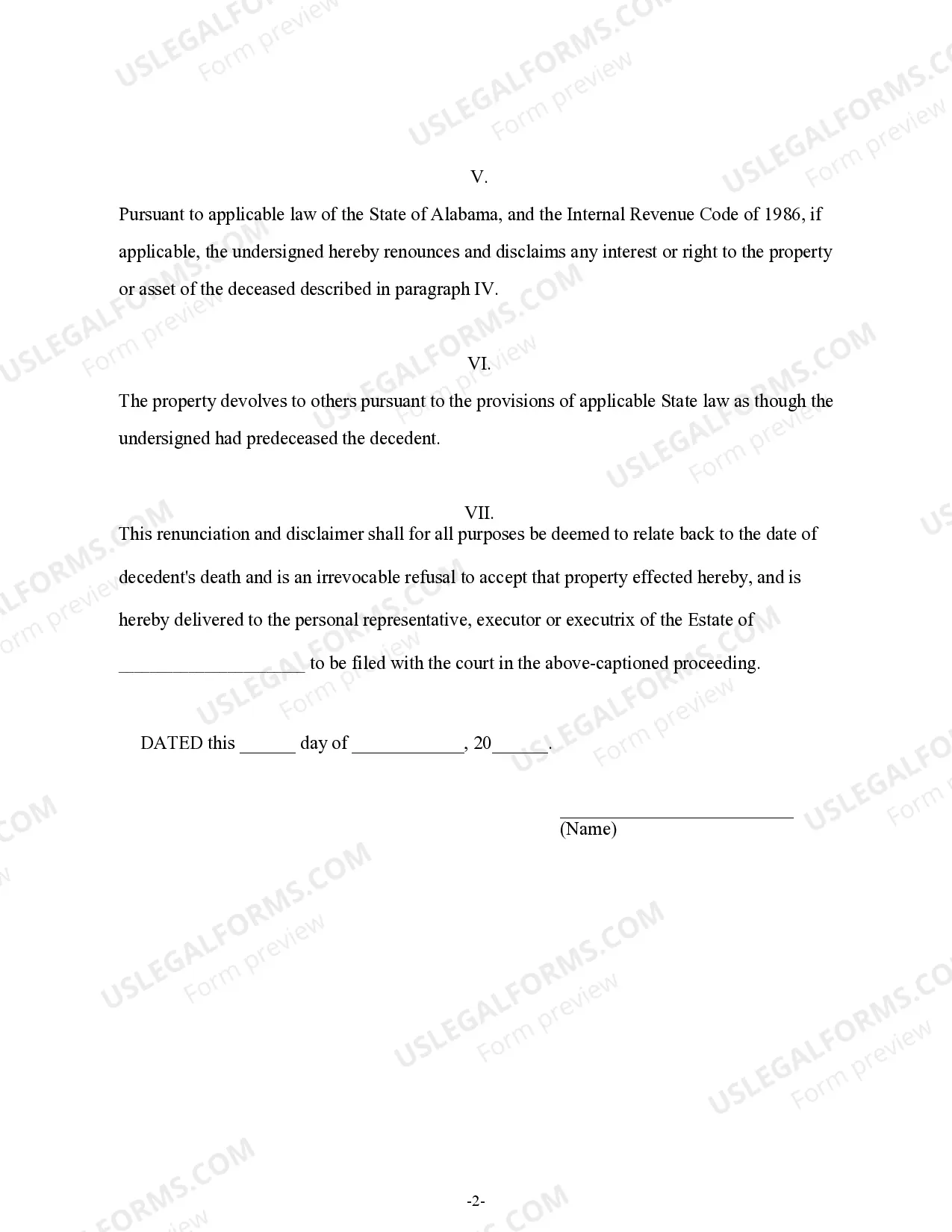

- Legal declaration of the disclaimer's effects on inheritance rights.

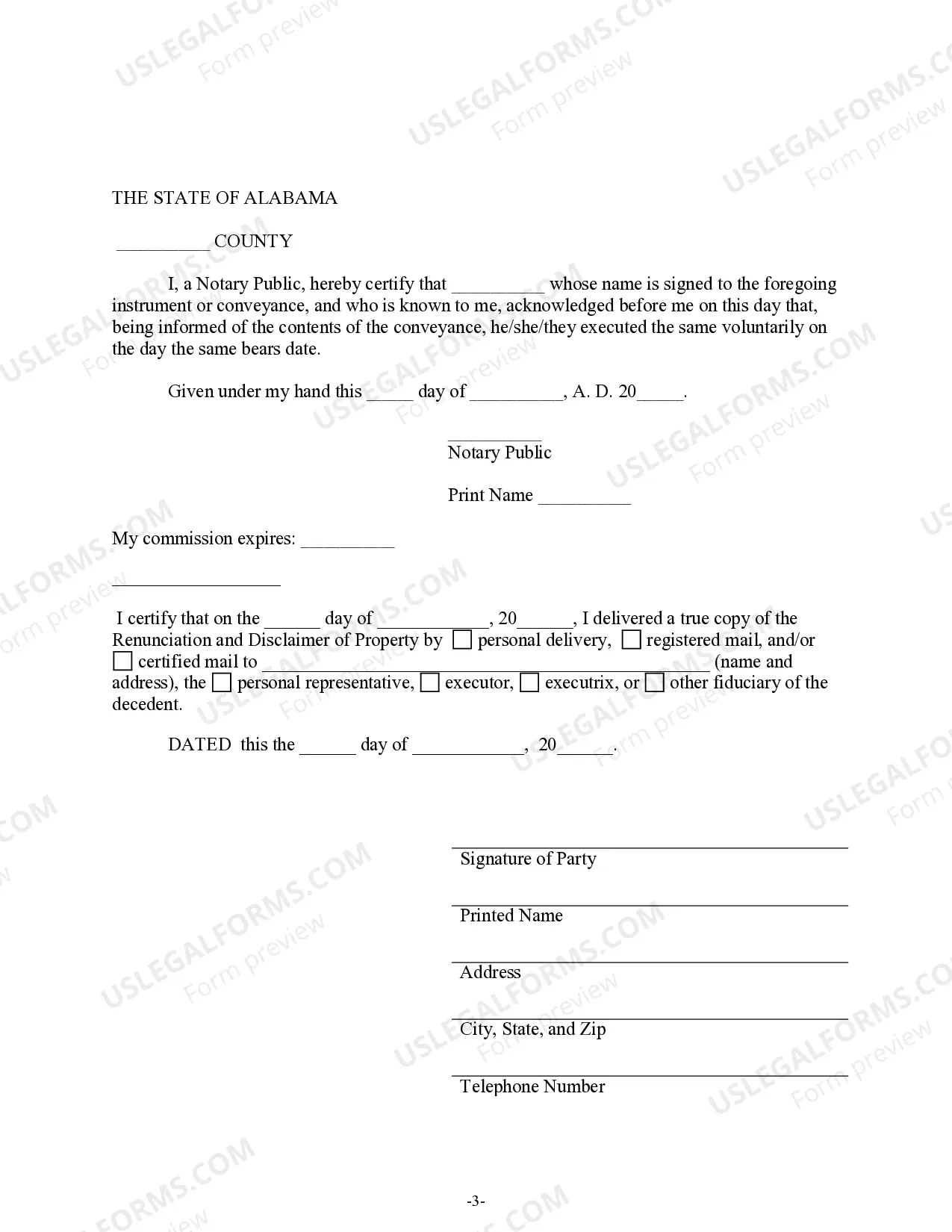

- Signature section for the beneficiary and notarization details.

Legal requirements by state

This form complies with Alabama law regarding the renunciation and disclaimer of property. It includes state-specific acknowledgments and requirements outlined in the Alabama Code, ensuring that the disclaimer will be legally recognized in Alabama.

When to use this document

This form should be used when a beneficiary of a will in Alabama decides to reject their share of the inherited property. It is appropriate in scenarios where the beneficiary may have personal, financial, or tax-related reasons for disclaiming the inheritance. Using this form helps to ensure that property is distributed according to the deceased's wishes and under Alabama law.

Intended users of this form

- Beneficiaries named in a will who wish to renounce their inheritance.

- Heirs considering the tax implications of accepting property.

- Individuals seeking to clarify property distribution after a decedent's death.

How to complete this form

- Identify the name of the beneficiary and the decedent.

- Specify whether you are disclaiming a partial or full interest in the property.

- Enter the date of the decedent's death.

- Fill out the details of the property being disclaimed as per the will.

- Sign the document and have it notarized to ensure legal validity.

- Deliver a copy of the signed form to the personal representative or executor of the estate.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Mistakes to watch out for

- Failing to file the disclaimer within nine months of the decedent's death.

- Not including all required property details as specified in the will.

- Neglecting to have the form properly notarized.

Why use this form online

- Convenient access to download and complete the form at your own pace.

- Ability to customize the form for specific situations based on your needs.

- Reliable templates drafted by licensed attorneys ensuring compliance with Alabama law.

Quick recap

- This form allows a beneficiary to renounce their interest in property under Alabama law.

- Timely filing within nine months after the decedent's death is essential.

- Proper notarization is required for the form to be valid.

Form popularity

FAQ

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

The length of time an executor has to distribute assets from a will varies by state, but generally falls between one and three years.

In Alabama, the estate executor is known as a "personal representative". Executors for Alabama estates are entitled to reasonable compensation of up to 2.5% of assets received, and 2.5% of disbursements.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

According to Alabama Probate Code, probate must be filed within five years after the death of the owner of the estate.

Signature: The will must be signed by the testator or by another person in the testator's name, under his direction and in his presence. Witnesses: At least two witnesses must sign an Alabama Last Will in order for it to be valid. Writing: An Alabama will must be written in order to be valid.

By law, the probate of an estate in Alabama will take at least six months. This period gives creditors and others with a claim on the estate time to receive notice that the estate is being probated and to submit a claim.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

A last will and testament in Alabama must be in writing and signed by the testator (the person writing the will), or at the testator's direction and in his or her presence. The will also has to be witnessed and signed by at least two people.