Setting Up A Trust In Wisconsin

Description

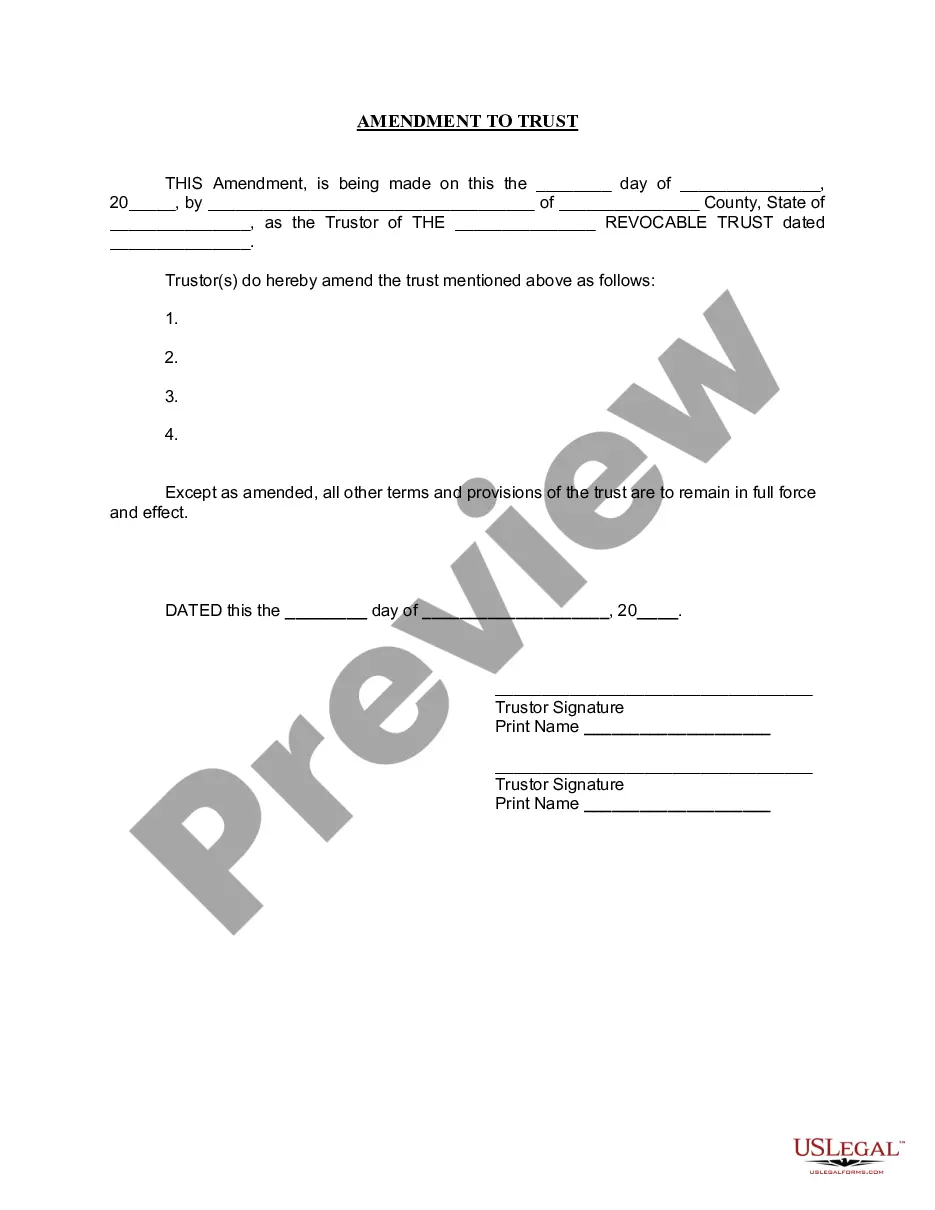

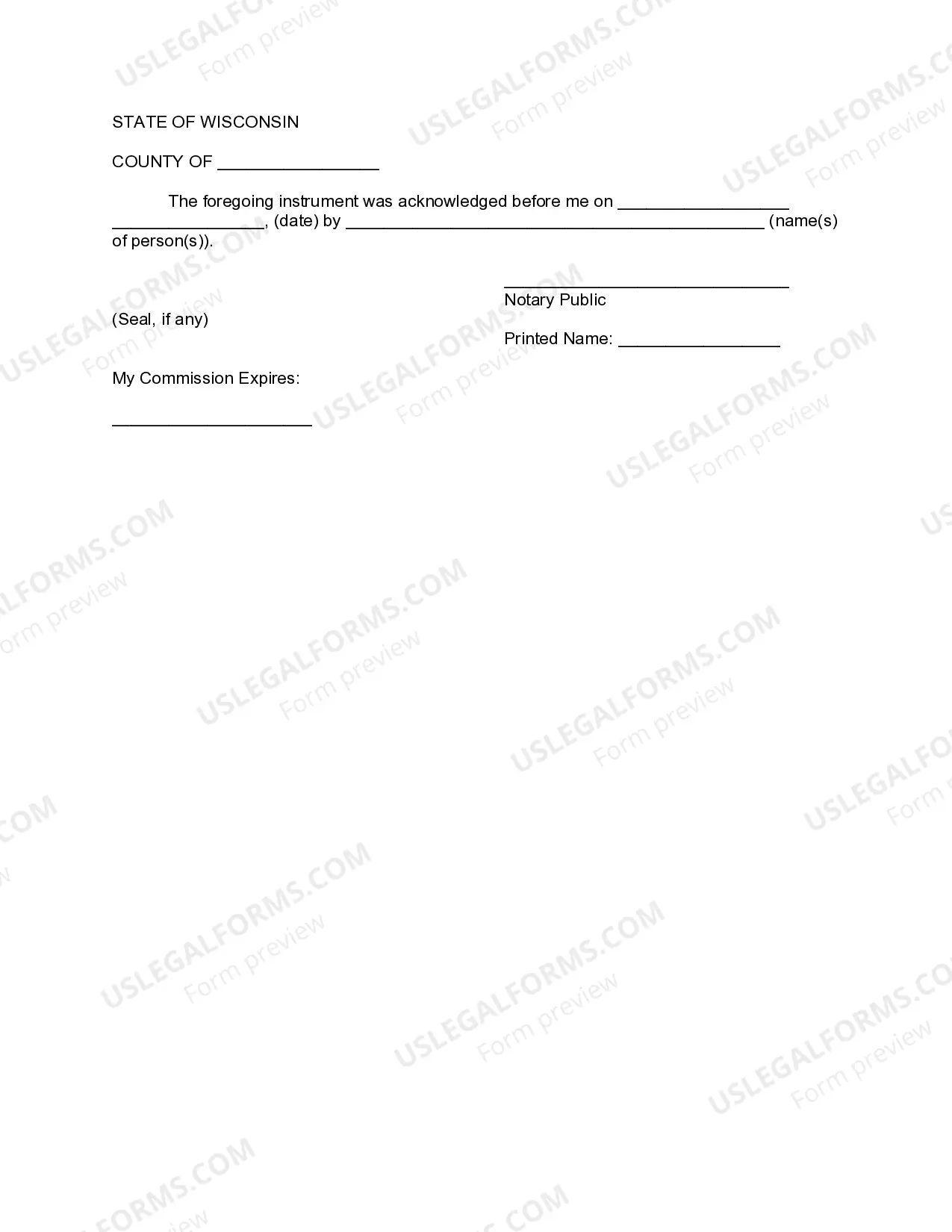

How to fill out Wisconsin Amendment To Living Trust?

Locating a reliable source for the most up-to-date and suitable legal templates constitutes a significant part of managing red tape.

Identifying the appropriate legal documents necessitates accuracy and meticulousness, which is why it is essential to obtain samples of Establishing A Trust In Wisconsin exclusively from reputable providers, such as US Legal Forms.

Eliminate the hassles associated with your legal paperwork. Explore the comprehensive US Legal Forms collection to discover legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search feature to locate your template.

- Review the form’s description to verify that it meets the criteria for your state and county.

- Preview the form, if available, to confirm that the template is indeed what you need.

- Continue searching and find the correct document if the Establishing A Trust In Wisconsin does not suit your requirements.

- If you are certain about the form’s applicability, proceed to download it.

- As a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you don’t have an account yet, click Buy now to purchase the template.

- Select the pricing plan that aligns with your preferences.

- Continue to the registration to finalize your purchase.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading Establishing A Trust In Wisconsin.

- Once the form is on your device, you can modify it using the editor or print it to fill out manually.

Form popularity

FAQ

To file a trust in Wisconsin, begin by preparing your trust document and signing it in front of witnesses. After you establish the trust, transfer any relevant assets into it. While the process can be straightforward, you might benefit from guidance to ensure compliance with local laws. Platforms like US Legal Forms provide valuable resources to help you effectively file a trust in Wisconsin.

Filing your own trust is achievable, especially when setting up a trust in Wisconsin. First, create and sign your trust document, ensuring it meets state requirements. Next, you may need to transfer ownership of assets into the trust. Consider using US Legal Forms, which offers templates to help simplify your filing process.

Forming a trust in Wisconsin involves several key steps, making it important to be informed. Start by determining the type of trust that suits your needs and drafting the trust document. You will need to identify the trustee and beneficiaries, then fund the trust with your assets. Resources like US Legal Forms can streamline your experience in setting up a trust in Wisconsin.

You do not necessarily need an attorney to file a trust when setting up a trust in Wisconsin. However, having legal guidance can help avoid potential pitfalls and ensure all legal requirements are met. An attorney can provide essential advice tailored to your situation. If you seek a more straightforward process, consider platforms like US Legal Forms for assistance.

Understanding the negatives of a trust can help you make an informed decision when setting up a trust in Wisconsin. One major downside is the possibility of misunderstanding or mismanagement by the trustee, which could lead to disputes among beneficiaries. Furthermore, trusts may also subject your assets to additional taxes that you might not face with other estate planning strategies. It's essential to weigh these factors and consider using a reliable platform like US Legal Forms to navigate the trust setup process effectively.

When setting up a trust in Wisconsin, you should consider three primary types: revocable trusts, irrevocable trusts, and testamentary trusts. A revocable trust allows you to maintain control over the assets during your lifetime, while an irrevocable trust often provides tax benefits and asset protection after it is set up. Testamentary trusts, on the other hand, are established through a will and come into effect after your passing. Understanding these options can help you decide which type aligns with your goals.

Setting up a trust in Wisconsin involves several key steps. First, decide what type of trust best suits your needs, then gather the necessary documents detailing your assets. Next, create the trust document, which outlines your wishes, and ensure all legal requirements are met. Engaging with a legal expert or using resources like USLegalForms can streamline this process, making it easier to establish a functional trust.

Yes, you can fill out your own trust when setting up a trust in Wisconsin, but it requires careful attention to detail. Using templates or forms can simplify the process, but you must ensure that the document complies with state laws. Many find it helpful to use a platform like USLegalForms, which provides accessible resources, to guide you through the creation of a legally binding trust.

When considering setting up a trust in Wisconsin, it is essential to evaluate your specific needs. While a will directs asset distribution after death, a trust can manage assets during your lifetime and can avoid probate. Trusts also offer a greater degree of control and privacy, making them a popular choice for many families. Ultimately, consulting with a knowledgeable professional can help you decide the best option.

The 2-year rule for trusts refers to the period that affects the validity of certain transfers. When setting up a trust in Wisconsin, be aware that any transfers made within two years of death can be scrutinized by the courts. This rule is designed to prevent individuals from evading creditors or altering estate tax rules. Always consider consulting with a professional to navigate these complexities.