Wisconsin Amendment to Living Trust

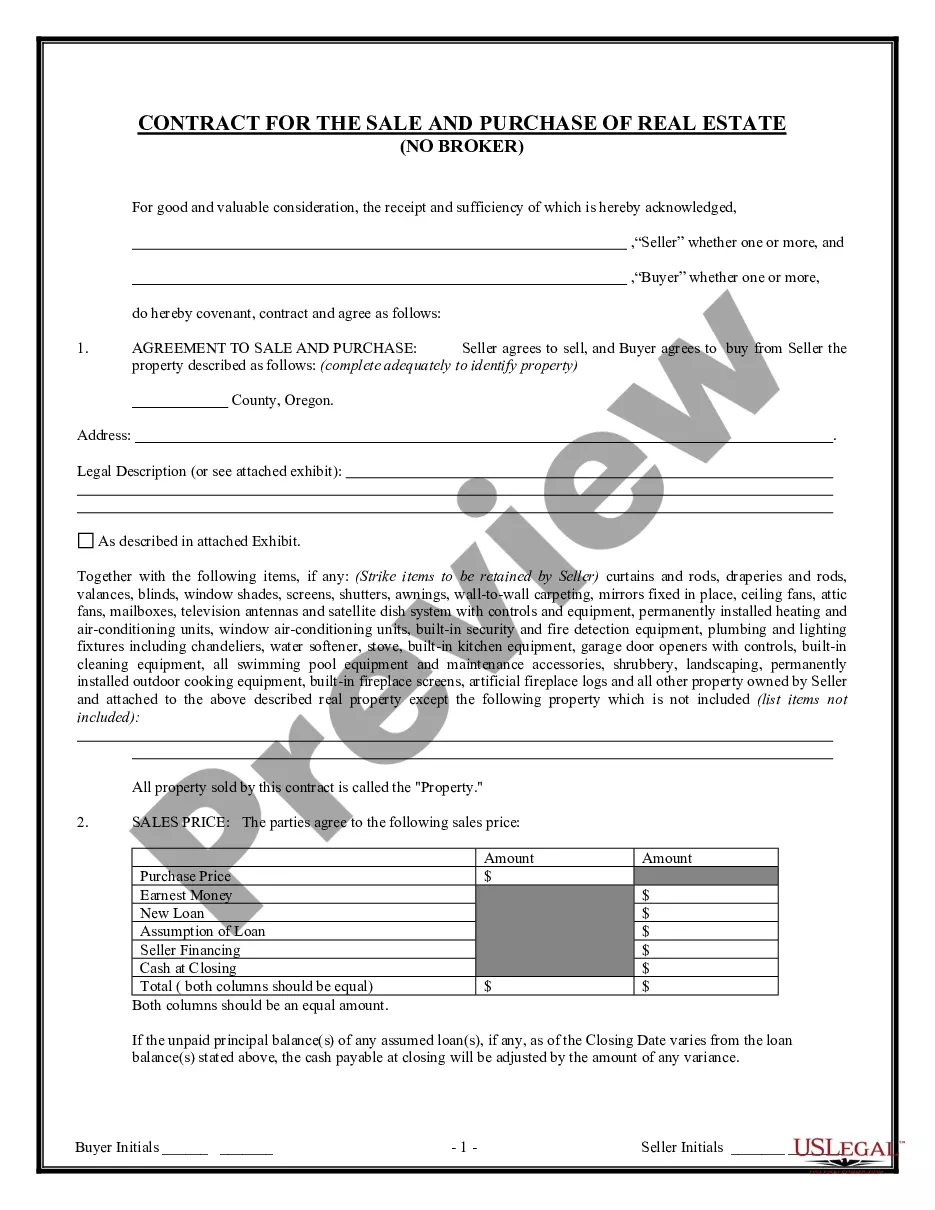

What is this form?

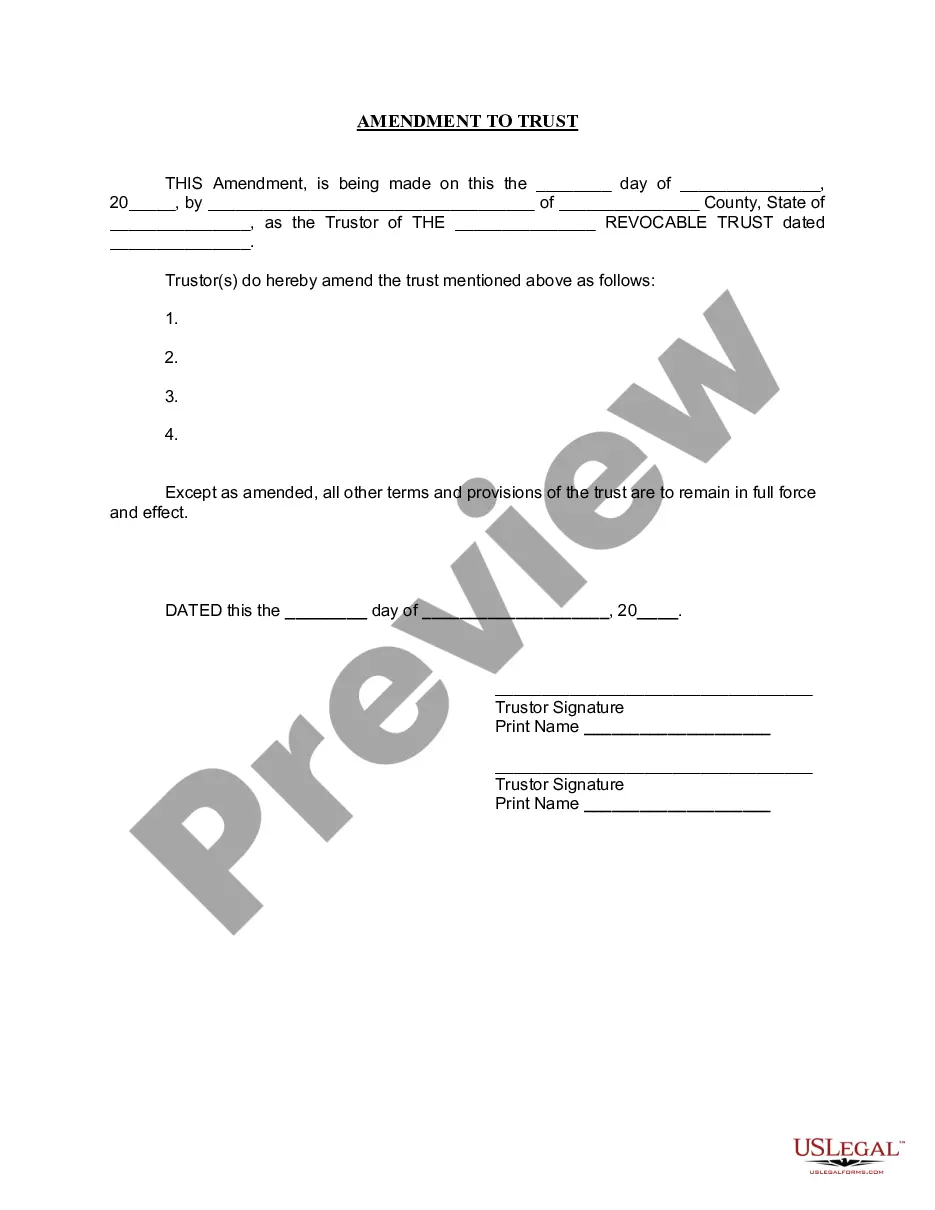

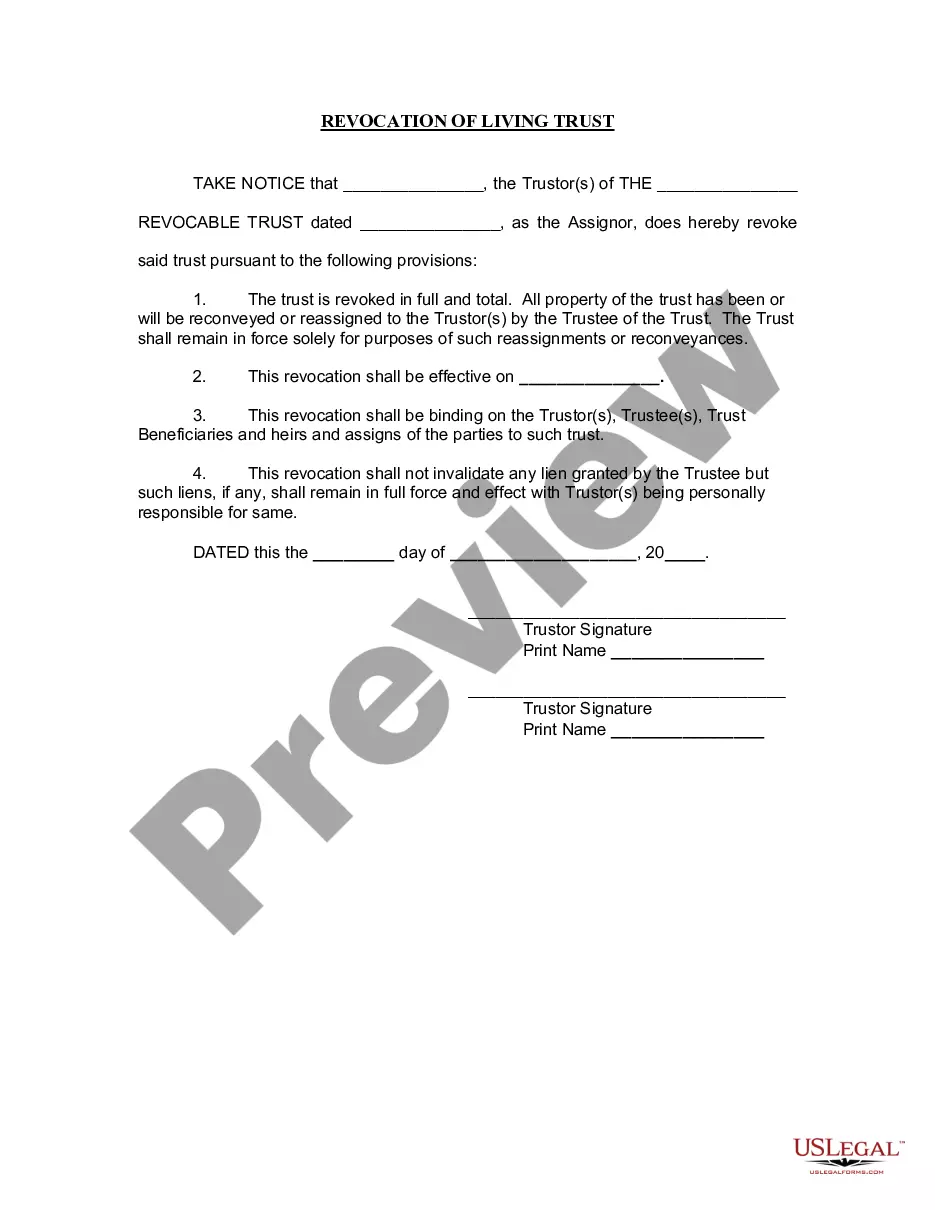

The Amendment to Living Trust form is designed for adjusting an existing living trust. A living trust holds a person's assets during their lifetime for estate planning purposes. This form allows the Trustor to amend specific provisions of the trust while ensuring that the overall purpose remains intact. Essentially, it provides a legal framework for modifications without invalidating the trust itself.

Form components explained

- Identification of the Trustor and the trust being amended.

- Specifications of the amendments to be made to the trust.

- Signature lines for the Trustor(s).

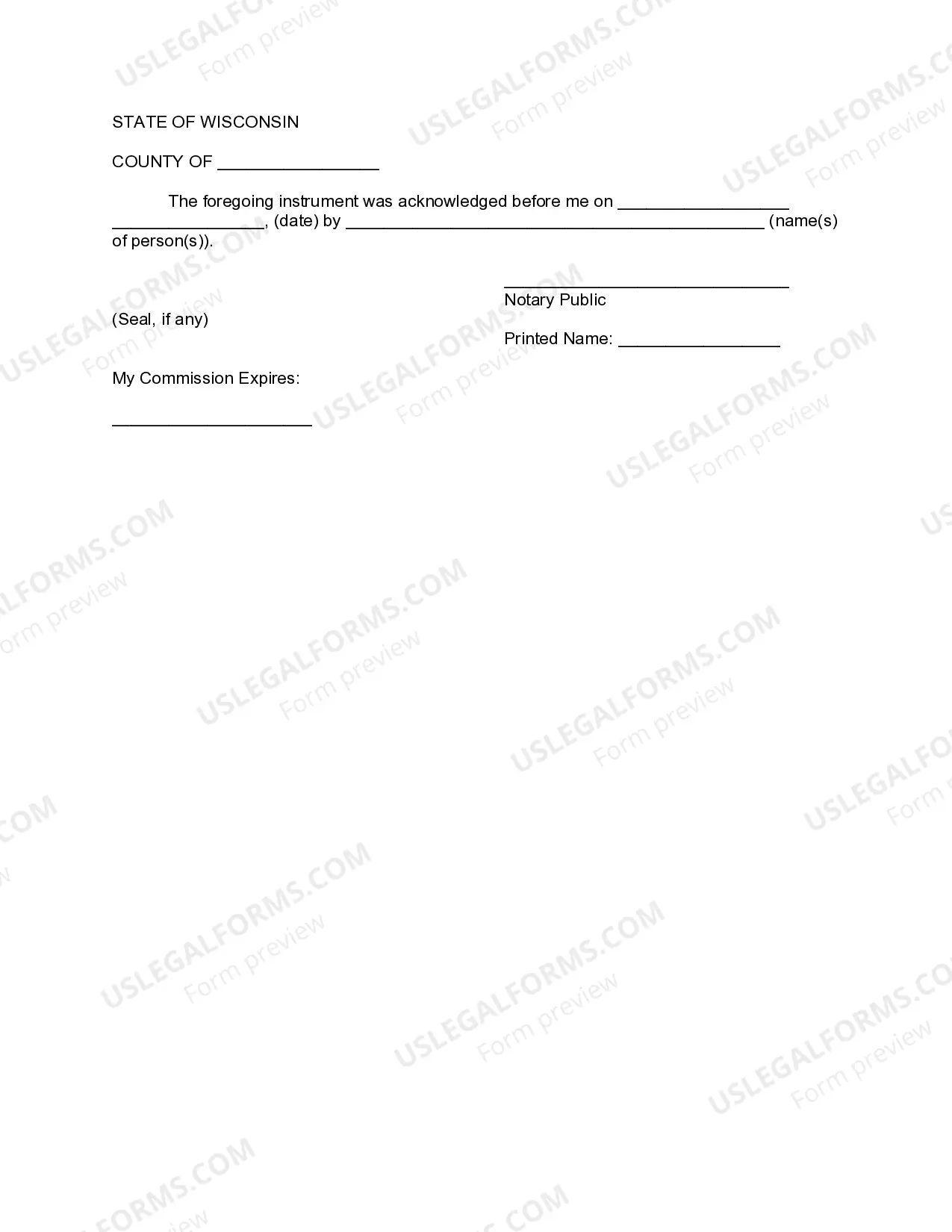

- Notary acknowledgment section to verify the authenticity of signatures.

Situations where this form applies

This form is needed when a Trustor wishes to modify certain aspects of their living trust. Common scenarios include adding or removing beneficiaries, changing trustees, or updating the distribution of assets. It provides a simple solution for maintaining an accurate and up-to-date estate plan without the need for creating a new trust from scratch.

Who needs this form

- Individuals who have established a living trust.

- Trustors who need to make changes to the terms of their trust.

- Estate planners looking for a straightforward solution to amend existing trusts.

How to complete this form

- Identify the date the amendment is being made.

- Enter your name as the Trustor and your county and state of residence.

- Specify the name of the living trust you are amending.

- Detail the specific amendments you are making to the trust.

- Sign the form in the presence of a notary public.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to properly identify the trust in question.

- Not specifying the amendments clearly.

- Omitting signatures or failing to have the document notarized.

Key takeaways

- The form allows Trustors to make specific changes to their living trust.

- Proper completion and notarization are essential for legal validity.

- This tool is useful for those looking to maintain updated estate plans efficiently.

Looking for another form?

Form popularity

FAQ

Wisconsin does not levy an inheritance tax or an estate tax. However, if you are inheriting property from another state, that state may have an estate tax that applies. You will also likely have to file some taxes on behalf of the deceased. If the estate is large enough, it might be subject to the federal estate tax.

You can make your own will in Wisconsin, using Nolo's do-it-yourself will software or online will programs. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.

Payment. Current beneficiaries have the right to distributions as set forth in the trust document. Right to information. Right to an accounting. Remove the trustee. Termination of the trust.

Figure out which type of trust you need. Take stock of your assets. Decide who will be your trustee. Draw up the trust document. Sign the trust document before a notary public. Put your property into the trust, a process known as funding the trust.