Llc Ltd

Description

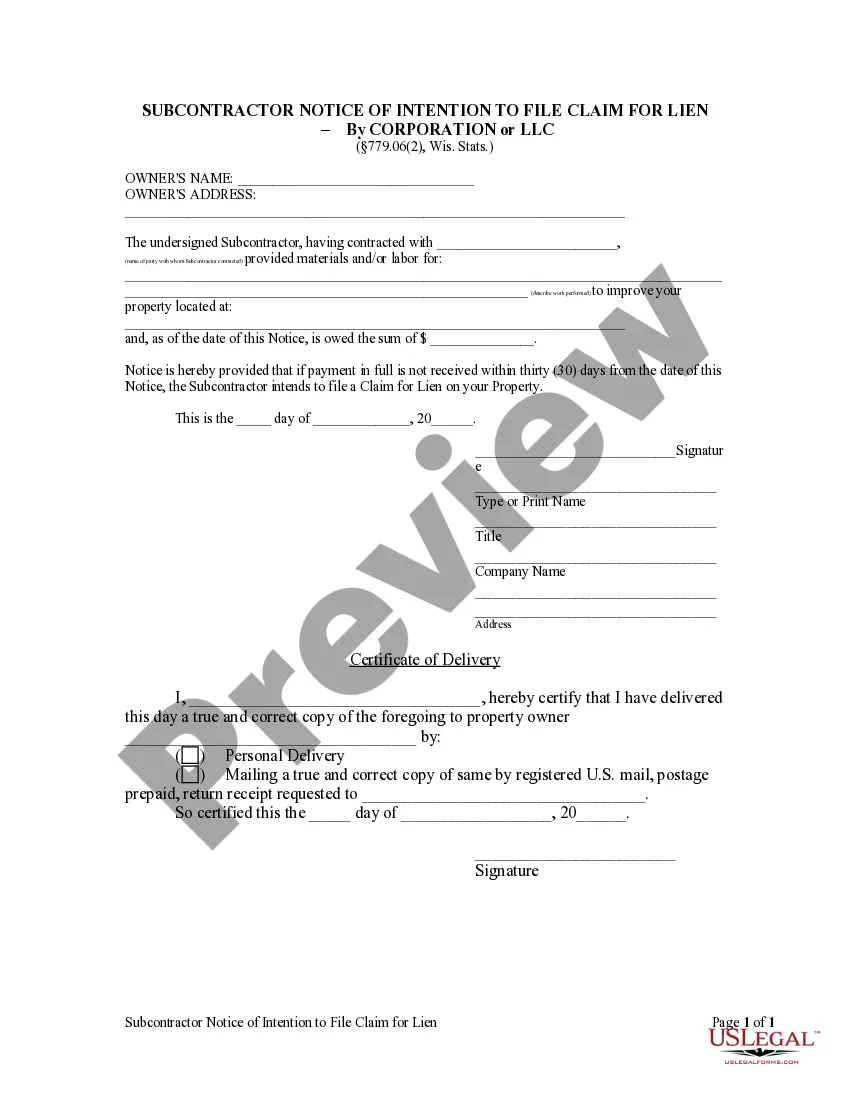

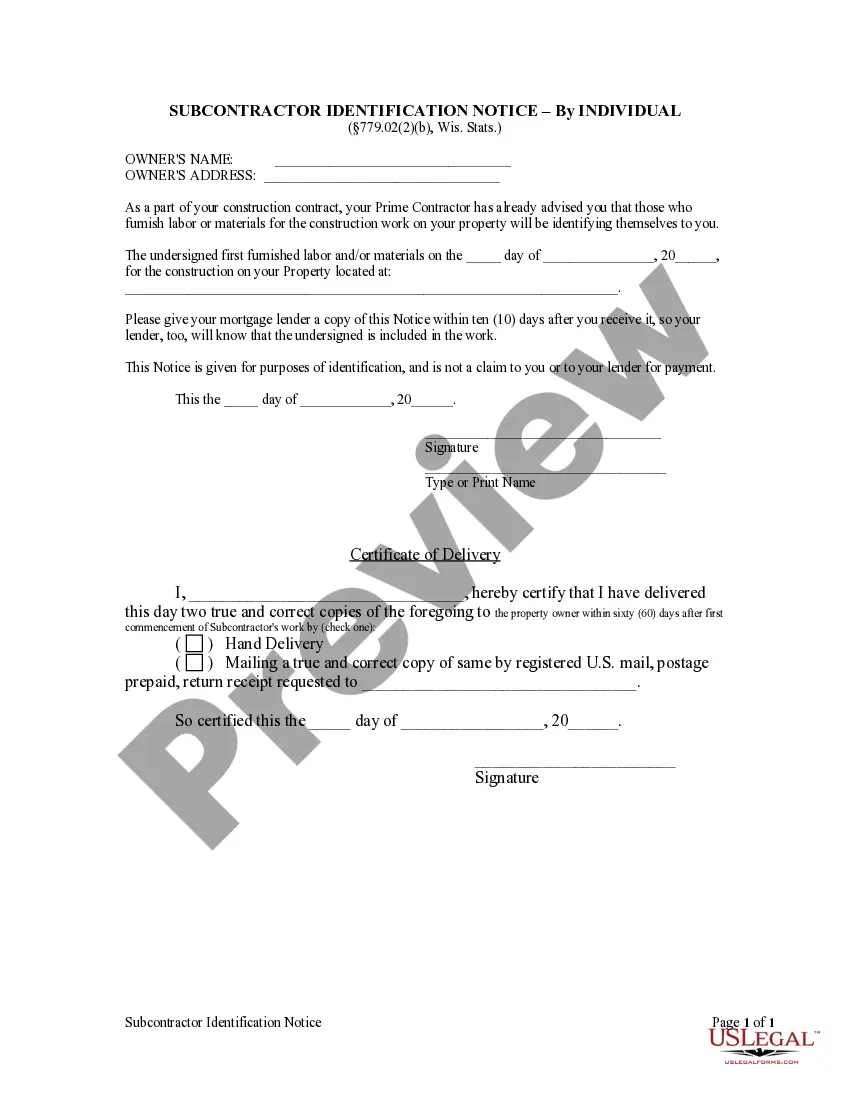

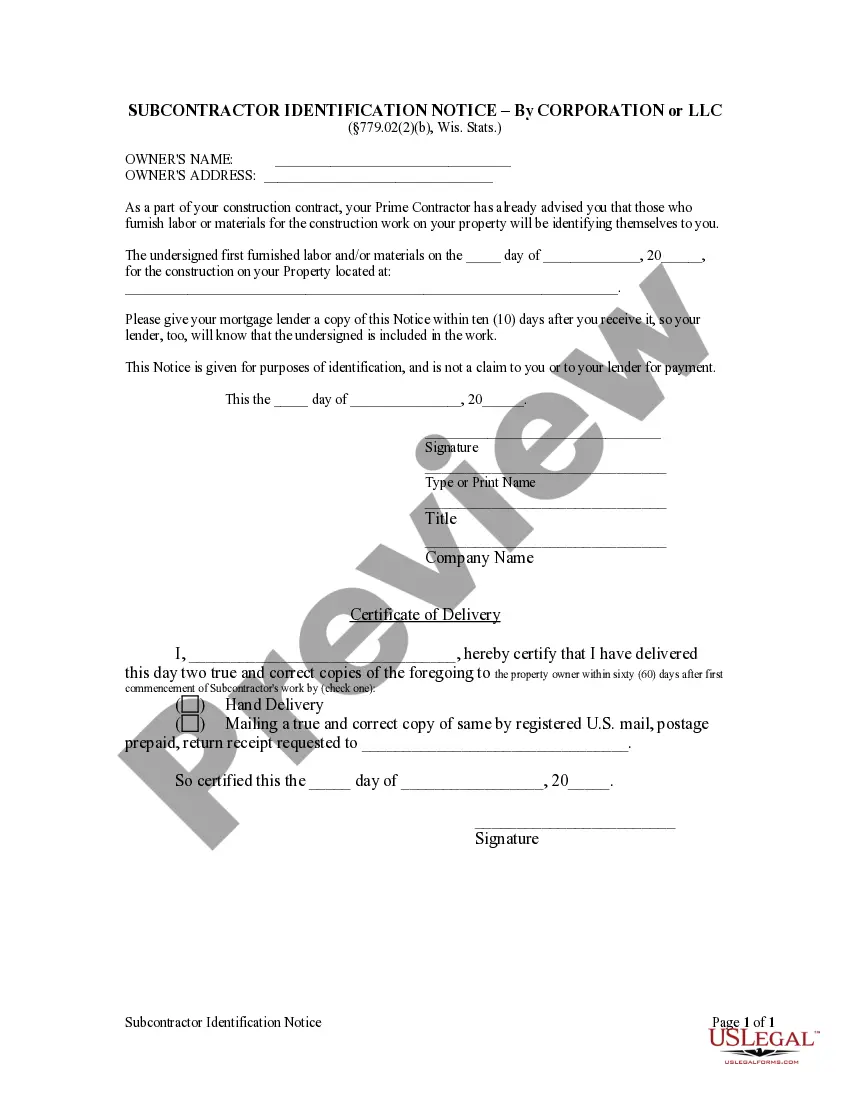

How to fill out Wisconsin Subcontractor's Identification Notice By Corporation?

- If you're a returning user, log in to your account to retrieve your form. Ensure your subscription is current; renew if necessary.

- For first-time users, start by checking the preview and description of your desired form. Confirm it is suitable for your requirements and aligns with local laws.

- If the selected form isn't a perfect match, use the search function to explore alternatives until you find the right template.

- To proceed, click the Buy Now button and select your preferred subscription plan. Registration will give you full access to the legal library.

- Finalize your purchase by entering your payment information via credit card or PayPal.

- Once completed, download your form to your device, and access it anytime through the My Forms section.

By leveraging US Legal Forms, users can benefit from an expansive collection of legal documents, significantly more than what competitors offer.

Start simplifying your legal needs today—unlock the potential of US Legal Forms and ensure your documents are expertly crafted!

Form popularity

FAQ

An LLC can choose to be taxed as either an S-Corporation or a C-Corporation. The choice depends on how the owners want to manage their tax obligations and the overall structure of their business. By default, an LLC is treated as a pass-through entity, meaning profits are not taxed at the business level. For tailored guidance related to LLC and Ltd tax classifications, consider using US Legal Forms for clarity and assistance.

An Ltd can be classified under different tax categories, depending on how it is structured and operates. Typically, an Ltd is subject to corporate tax rates, which means profits are taxed at the corporate level. Owners may then face additional taxes when profits are distributed as dividends. It is essential to consult with a tax professional to understand your specific obligations and options.

LLC stands for Limited Liability Company, while Ltd stands for Limited Company. Both structures offer limited liability protection, meaning owners are not personally responsible for the company's debts. However, they differ in regulations and operational requirements. Understanding these differences can help you select the right structure for your specific business needs, making US Legal Forms a valuable resource.

An Ltd is typically classified as a private limited company. This classification indicates that the shares of the company are not available to the general public, which allows for more control over ownership. Owners of an Ltd benefit from limited liability, which means their financial exposure is limited to their investment in the company. This makes it a popular choice for small business owners who want to safeguard their personal assets.

The choice between an LLC and a PVT Ltd often depends on the specific needs of your business. An LLC offers flexibility in management and tax benefits, while a PVT Ltd provides a more formal structure and potentially broader ownership opportunities. Each option has its advantages, so you'll want to consider factors like liability protection, taxation, and growth goals. For clarity on these choices, platforms like US Legal Forms can guide you through the process.

An Ltd, or limited company, is a business structure that limits the liability of its owners. This means that the personal assets of the owners are usually protected from business debts. Generally, an Ltd is a separate legal entity from its owners, which offers flexibility in management and a clear structure for ownership. For those considering options like LLC or Ltd, understanding these distinctions is key.

LLC and Ltd are not the same. While both provide limited liability to their owners, they are designed for different legal contexts. An LLC is the preferred structure in the US, while Ltd is commonly found in other countries. Understanding the differences can help you choose the right structure for your business needs.

When naming your Limited Liability Company, you should include 'LLC' at the end of the business name. This clearly indicates its legal structure to the public. It’s important that the name is unique and complies with state guidelines. Platforms like Uslegalforms can guide you through the naming and registration process to ensure everything is in order for your LLC ltd.

Ltd stands for Limited, indicating limited liability for its shareholders. This means that the financial responsibility of the owners is limited to their investment in the company. In contrast, LLC, or Limited Liability Company, serves a similar purpose in the US. Understanding these terms will help you make better-informed decisions regarding your business structure.

The US equivalent of an Ltd is the LLC or Limited Liability Company. Both structures offer limited liability protection to their owners but differ in formation and management rules. If you are exploring options for your business, an LLC could provide the benefits you are looking for as it combines flexibility and protection. Uslegalforms can assist you in setting up your LLC.