Limited Business

Description

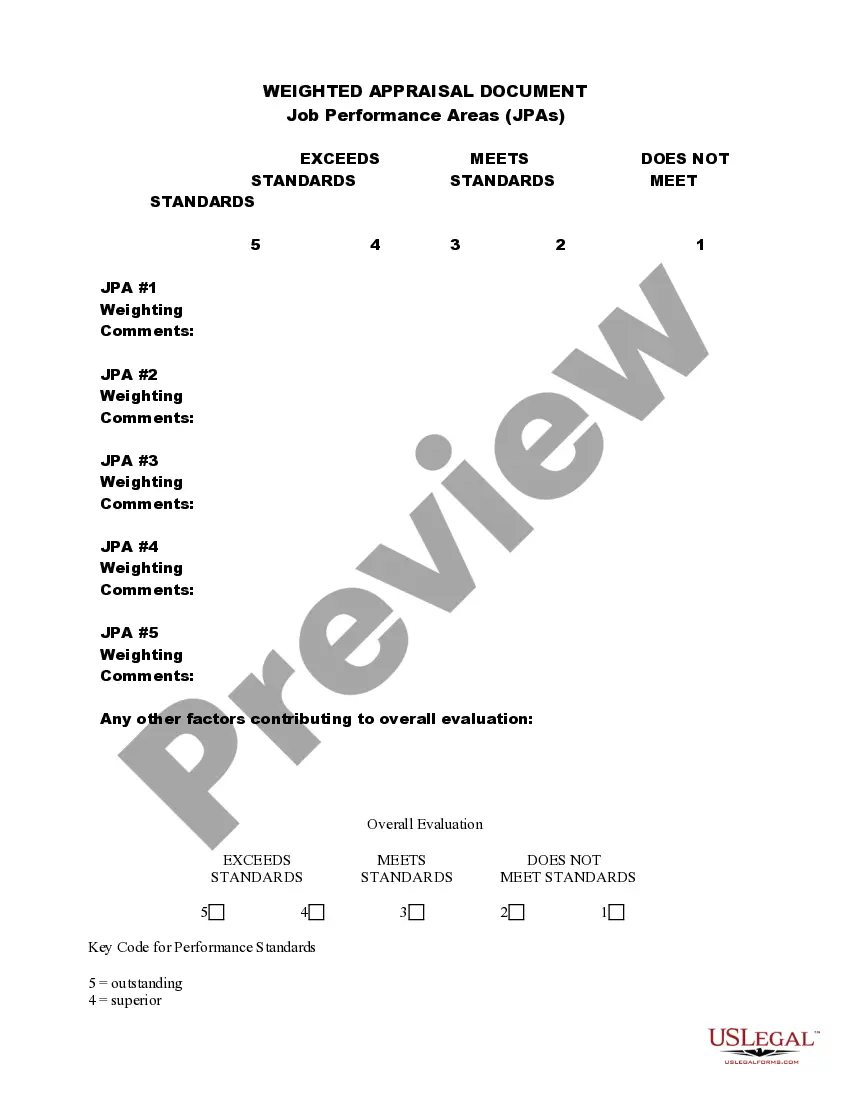

How to fill out Wisconsin Limited Liability Company LLC Formation Package?

- Log into your US Legal Forms account if you are a returning user. Click the Download button for the form template you need, ensuring your subscription is active. If it has expired, renew it based on your chosen payment plan.

- For new users, begin by reviewing the Preview mode and form description to select the right template that aligns with your requirements and meets local jurisdiction criteria.

- Should you find any discrepancy in the selected template, utilize the Search bar to locate the appropriate form. Only proceed once you've confirmed it suits your needs.

- Purchase the selected document by clicking the Buy Now button, choosing your preferred subscription plan, and creating an account for full access to the library.

- Complete your purchase by providing credit card details or opting for PayPal to finalize the subscription.

- Download your chosen form onto your device for completion. You can also access it later in the My Forms section of your profile.

In conclusion, US Legal Forms provides a robust collection of forms and expert assistance to empower you in setting up your limited business effortlessly. Accessing the extensive legal library ensures that you have the right documents delivered promptly.

Ready to get started? Visit US Legal Forms now for all your legal documentation needs!

Form popularity

FAQ

One common example of a limited business is a corporation, specifically a C corporation or an S corporation. These entities offer limited liability to their shareholders, meaning that the shareholders are only responsible for the company’s debts up to the amount they invested. This structure encourages investment and limits personal risk, making it appealing for many business owners. If you're considering this option, using platforms like USLegalForms can simplify the process of setting up your limited business.

A limited business typically refers to a company that limits the personal liability of its owners. This includes structures like limited liability companies and limited partnerships. These structures offer a layer of protection, ensuring that personal assets are separate from business obligations and risks. Choosing a limited business structure can be a strategic move for entrepreneurs looking to safeguard their personal finances.

A limited liability company (LLC) is a notable example of a limited business structure. It combines the flexibility of a partnership with the limited liability protection of a corporation. Business owners can benefit from this arrangement as it protects personal assets from business debts and liabilities. LLCs are popular among small businesses, as they provide a straightforward way to operate while preserving individual asset security.

A limited company qualifies as a distinct legal entity where the owners' liability is typically limited to the amount they invested. This structure helps protect personal assets from business debts. Understanding the requirements and benefits of forming a limited company is vital for your limited business success.

A private limited company shares similarities with an LLC, particularly in limiting liability for owners. However, legal definitions and regulations may vary by jurisdiction. Always consider consulting experts or using platforms like US Legal Forms to navigate your limited business structure effectively.

While you can use 'limited' in some contexts, it is critical to understand the distinctions between a limited company and an LLC. Each offers unique advantages and limitations regarding liability and taxation. For a successful limited business, clarity in naming and structure is imperative.

Choosing between an LTD and an LLC depends largely on your specific goals. An LTD, or limited company, is more common in certain countries and may involve different regulations than an LLC which is popular in the U.S. Assess your limited business needs carefully to determine which structure best meets your objectives.

Using a limited partnership may offer certain benefits over an LLC for your limited business. Limited partnerships allow for a mix of general and limited partners, providing flexibility in terms of liability and management roles. This structure can suit individuals looking to invest without active involvement while still taking advantage of limited liability.

Yes, you can use the term 'limited' in some contexts instead of LLC, but it's essential to be accurate. Generally, 'limited' refers to a type of company structure that may not carry all the legal protections of a limited liability company. Understanding the precise implications of using 'limited' is crucial for your limited business and its legal status.

There is no specific threshold for small businesses to file taxes; if you earn income, you must report it. Even a limited business with minimal earnings needs to file, as the IRS requires reporting of all business activity. Ensuring proper compliance protects you from potential penalties down the line. For assistance, consider resources such as uslegalforms to navigate your tax obligations.