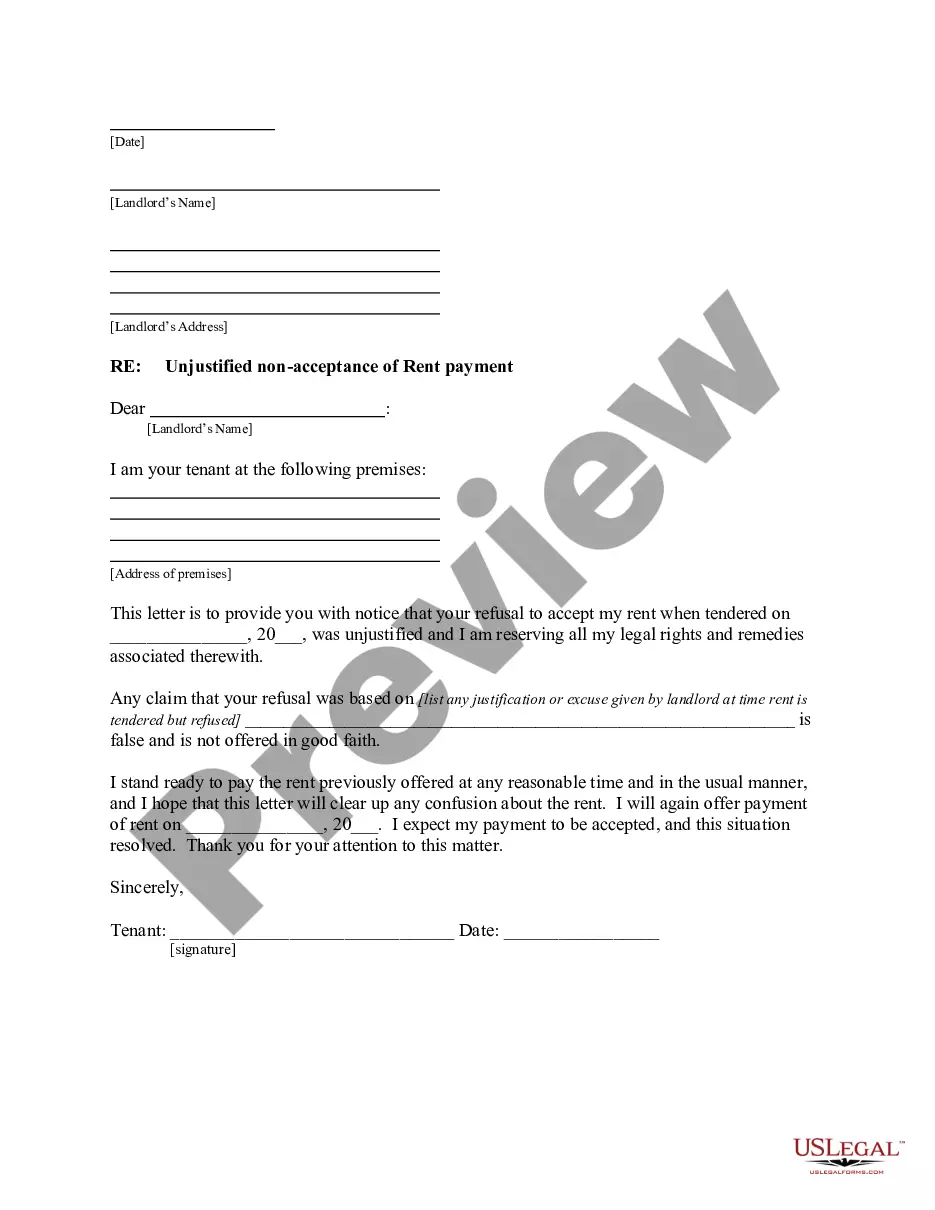

This form covers the subject matter described in the form's title for your State. This is a letter written by Tenant to Landlord claiming that Landlord's refusal to accept rent was unjustified. This puts Landlord on notice that Tenant is reserving all legal rights and remedies associated with Landlord's refusal.

Noc From Tenant For Mortgage

Description

Form popularity

FAQ

Securing a house with an eviction on your record can be challenging, but it is not impossible. Lenders view evictions as a risk factor, which may lead to stricter requirements or higher interest rates. It is beneficial to have a Noc from tenant for mortgage, as this document can help show that you have resolved past issues and are ready to move forward with a fresh start.

Yes, mortgage companies often check for evictions when assessing a borrower's application. They review the applicant's rental history as part of their risk assessment. If you have an eviction on your record, it might affect your chances of getting approved for a mortgage. To strengthen your application, consider obtaining a Noc from tenant for mortgage to demonstrate your commitment to responsible payments.

NOC is used to confirm acceptance of specific actions taken by landlords, including securing a mortgage. It is especially relevant in situations where landlords need to reassure lenders of tenant consent. By applying a Noc from tenant for mortgage, property owners can expedite their financial transactions while maintaining good relations with their tenants.

A NOC contract is an agreement that allows a tenant to grant permission for certain actions regarding a property, such as mortgages or renovations. This contract serves as an assurance for the landlord that the tenant is not opposed to these changes. Involving a Noc from tenant for mortgage within a NOC contract ensures everyone is working together and mitigates future conflicts.

To prepare a NOC letter, you should include your name, address, and the tenant's details, along with the specific purpose for the certificate. Clearly state that you grant permission for the landlord’s mortgage transaction. A well-crafted Noc from tenant for mortgage ensures that all parties understand their rights and obligations and can help avoid future miscommunications.

An NOC, or No Objection Certificate, in real estate is a document that confirms that a tenant has no objections to certain transactions involving the property they are renting. This may include the landlord's intention to refinance or sell the property. The Noc from tenant for mortgage is essential for lenders to ensure that the tenant is aware of and agrees to the mortgage arrangement.

Mortgage lenders do review eviction records as part of their evaluation of your financial history. This information provides insight into your previous rental practices, which influences their lending decisions. With a Noc from tenant for mortgage, you may be able to showcase your responsible rental behavior. Addressing any past issues up front can help you improve your chances of securing a mortgage.

In the context of a mortgage, Noc stands for a Notice of Consent from a tenant. This document indicates that a tenant agrees to the mortgage terms set by the property owner. Having a Noc from tenant for mortgage can protect tenants and promote a smoother relationship between landlords and lenders. It serves as an essential tool for all parties involved in the property financing process.

Yes, mortgage companies consider your rental history as part of their assessment. A stable rental history demonstrates reliability and can positively influence the lender's decision. If you have a strong Noc from tenant for mortgage, it can reflect your commitment to fulfilling lease obligations. This can enhance your attractiveness as a borrower to potential lenders.

Landlords typically find out about past evictions through background checks and rental history verification. They may review your credit report, which might include eviction records, or request rental history from previous landlords. If you have an Noc from tenant for mortgage, it can show landlords that you have been responsible, which might enhance your application. Transparency about your history can also build trust with potential landlords.