Washington Business Corporation Formation

Description

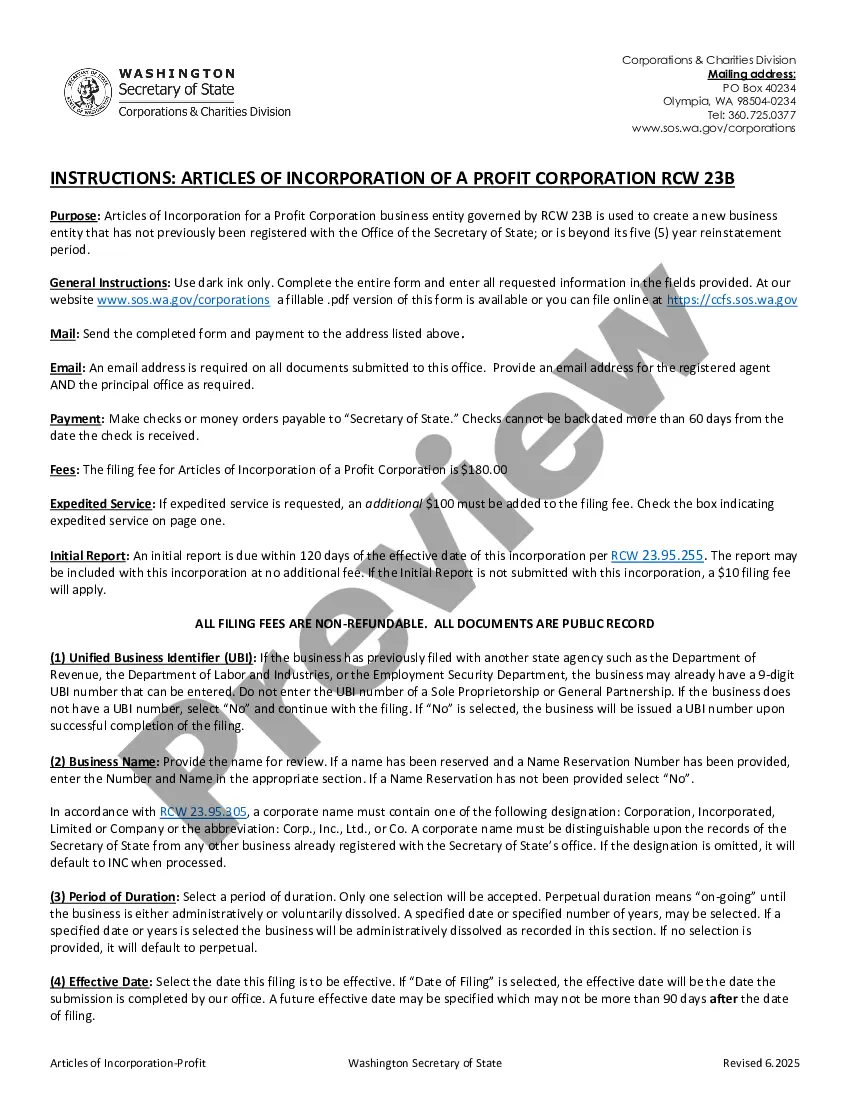

How to fill out Washington Business Incorporation Package To Incorporate Corporation?

Whether for commercial aims or personal issues, everyone must confront legal scenarios eventually in their life.

Completing legal documentation requires meticulous attention, starting from choosing the suitable form template.

Once it is saved, you can complete the form with the assistance of editing software or print it out and finalize it manually. With an extensive US Legal Forms catalog available, you do not need to waste time searching for the correct template online. Utilize the library’s easy navigation to find the appropriate form for any situation.

- For instance, if you select an incorrect version of the Washington Business Corporation Formation, it will be rejected upon submission.

- Thus, it is essential to find a trustworthy source of legal documents such as US Legal Forms.

- If you need to acquire a Washington Business Corporation Formation template, follow these simple steps.

- Locate the example you require using the search box or catalog browsing.

- Review the form’s details to ensure it corresponds with your situation, state, and locality.

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search function to locate the Washington Business Corporation Formation sample you need.

- Download the file once it meets your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can download the form by pressing Buy now.

- Choose the right pricing option.

- Fill out the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you desire and download the Washington Business Corporation Formation.

Form popularity

FAQ

Two Ways to Start A New Business in Washington Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the Washington Secretary of State. Get your business licenses. Set up a business bank account.

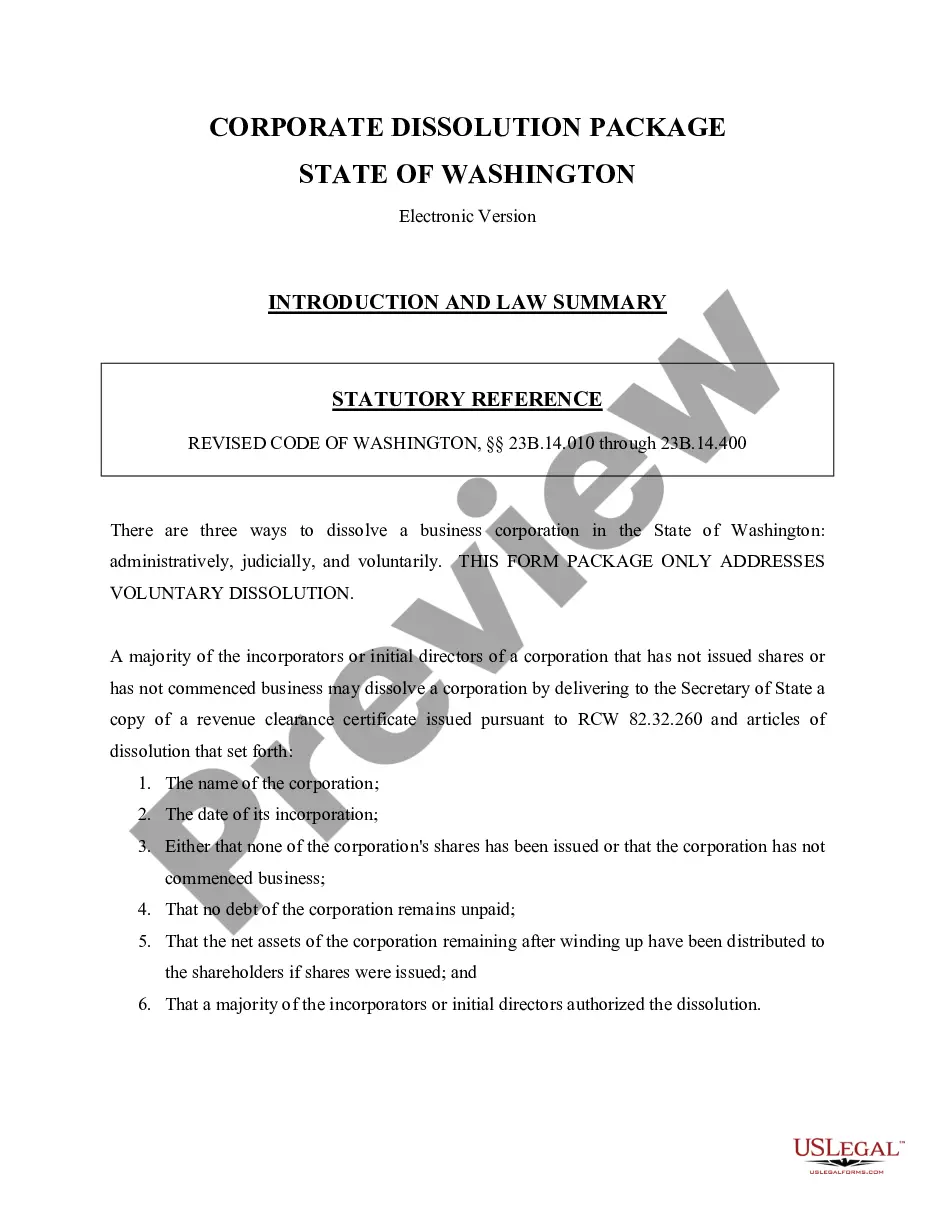

Limited liability companies are permitted to engage in any lawful, for-profit business or activity other than banking or insurance. Doing business as an LLC may yield tax or financial benefits. A Corporation* is a legal entity. A corporation has certain rights, privileges, and liabilities beyond those of an individual.

When you form a Washington LLC, you file a Certificate of Formation with the Secretary of State. This filing legally creates your limited liability company. A Washington Certificate of Formation is a fairly simple form, but it does require specific information about your company and its owners.

We walk you through the process step-by-step: Name Your Washington State LLC. First, select a name for your Washington State LLC. ... Appoint a Registered Agent. ... File a Certificate of Formation. ... Prepare an Operating Agreement. ... Comply with WA LLC Tax and Regulatory Requirements.

A Washington LLC (limited liability company) is a type of business with a flexible management structure, liability protection, and your choice of being taxed as a pass-through business or like a corporation.