Vehicle Promissory Note With Collateral Template

Description

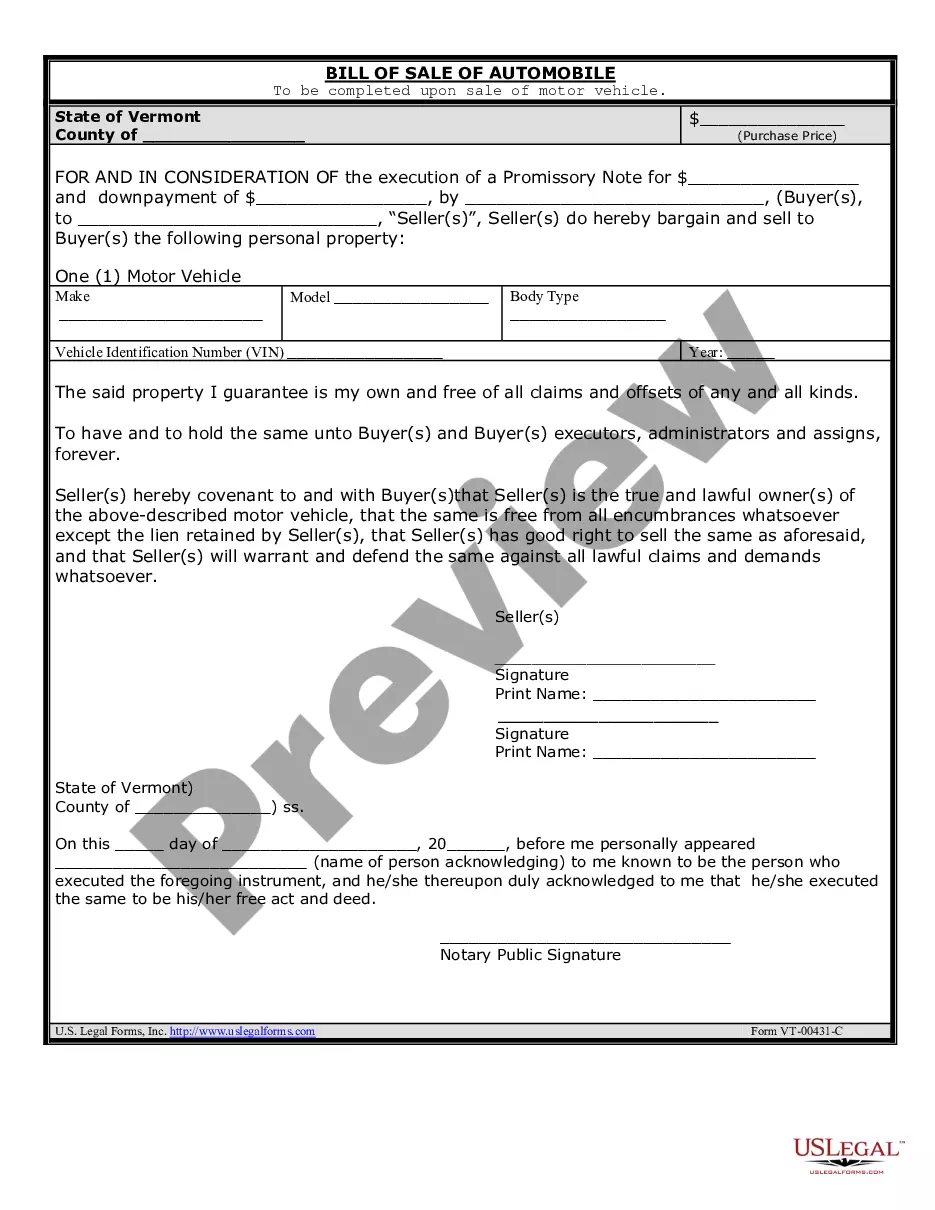

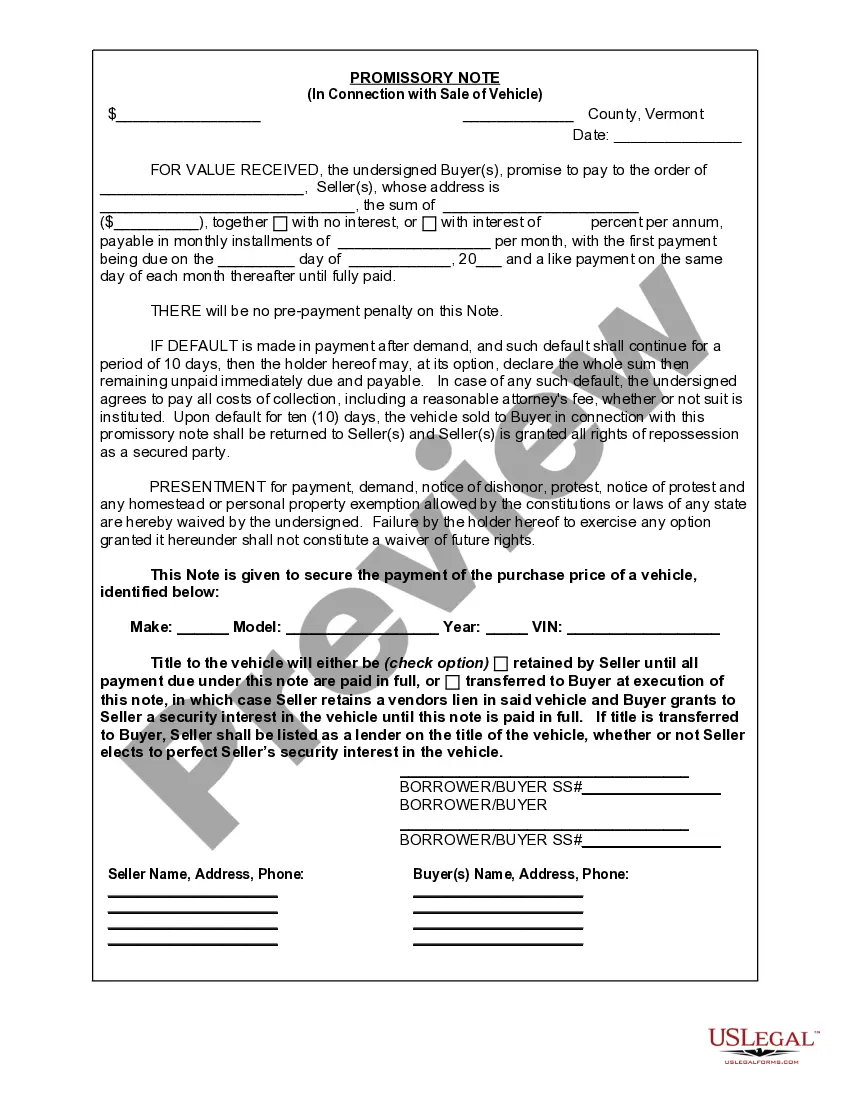

How to fill out Vermont Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Properly prepared official documents are one of the crucial assurances for preventing complications and legal disputes, but obtaining them without an attorney's assistance might require some time.

Whether you wish to swiftly locate a current Vehicle Promissory Note With Collateral Template or any other paperwork for work, family, or business events, US Legal Forms is consistently here to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen document. Additionally, you can access the Vehicle Promissory Note With Collateral Template anytime later, as all documents ever acquired on the platform are kept within the My documents section of your profile. Save time and expenses when preparing official documents. Experience US Legal Forms today!

- Ensure that the form aligns with your circumstances and locale by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar in the page header.

- Click on Buy Now when you find the suitable template.

- Choose the pricing option, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Opt for PDF or DOCX file format for your Vehicle Promissory Note With Collateral Template.

- Hit Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.