Revocation Living Trust For Foreigners

Description

How to fill out Virginia Revocation Of Living Trust?

- Log in to your account on the US Legal Forms website if you're an existing user, and ensure your subscription is up to date. If not, consider renewing it.

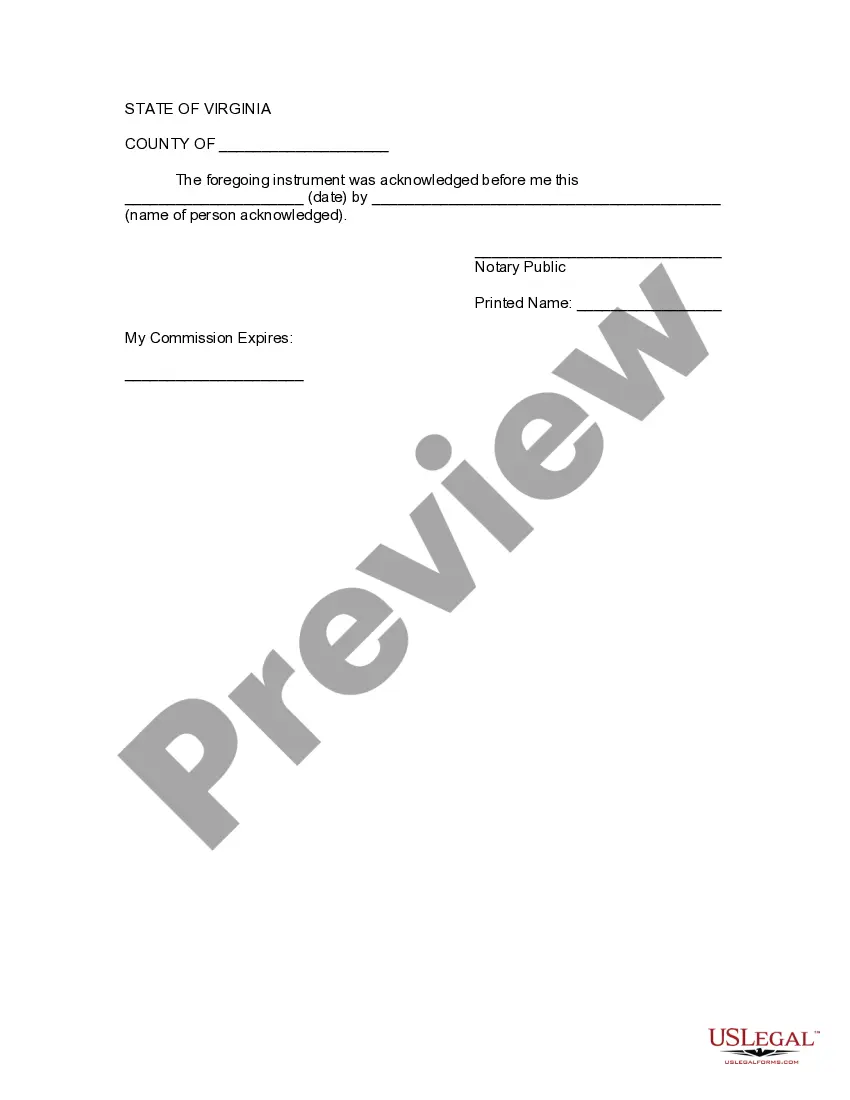

- Review the Preview mode for the revocation living trust template to ensure it aligns with your specific needs and local jurisdiction requirements.

- If necessary, search for other templates using the Search tab to find alternatives that might suit your needs better.

- Click the Buy Now button, choose your desired subscription plan, and create an account to gain access to over 85,000 legal forms.

- Input your payment information using a credit card or PayPal to finalize your purchase.

- Download the completed form to your device, and find it later in the My Forms menu within your profile.

With US Legal Forms, you gain access to robust resources that empower both individuals and attorneys to craft legal documents seamlessly.

Take control of your legal needs today by utilizing our extensive form library and expert assistance!

Form popularity

FAQ

Yes, a revocable living trust explicitly allows you the flexibility to revoke or dissolve it at any time during your lifetime. This feature is one of the main benefits, offering peace of mind and control over your assets. For foreigners engaged in estate planning, understanding this aspect of a revocation living trust for foreigners can be crucial in managing their affairs smoothly.

The form required to dissolve a revocable trust is typically called a revocation of trust form. This legal document states your decision to terminate the trust and outlines the assets involved. It is essential to utilize a reliable source, such as US Legal Forms, to obtain a properly structured form, especially for individuals managing a revocation living trust for foreigners.

To revoke a revocable living trust, you need to execute a revocation document that specifically cancels the trust's provisions. Once you sign this document, ensure you provide copies to all relevant parties, such as the trustee and beneficiaries. This process is vital for managing your assets, especially for those dealing with a revocation living trust for foreigners.

A trust revocation declaration is a formal statement indicating the termination of a revocable living trust. For instance, you might state, 'I hereby revoke my revocable living trust dated January 1, 2020.' This declaration clearly communicates your intention to dissolve the trust, particularly important for foreigners considering a revocation living trust for foreigners.

To invalidate a living trust, you must follow certain legal procedures, which often involve drafting a formal revocation document. This process is crucial when it comes to a revocation living trust for foreigners. Be sure to notify all parties involved and keep records of the revocation. Consulting with legal experts can help ensure that you meet all necessary requirements.

Yes, a non-US citizen can serve as a trustee of a US trust. This applies even if the trust is a revocation living trust for foreigners. However, it is important to select a trustee who understands both US laws and the terms of the trust. As you manage your trust, consider seeking legal advice to ensure compliance.

A trust can be declared null and void for several reasons, including lack of legal capacity, improper execution, or violation of laws. If the trust does not meet the specific criteria set forth by state law, it could also be invalidated. It's essential to draft your revocation living trust for foreigners carefully to avoid such issues. Review your trust with a legal expert to ensure its validity.

A nursing home cannot automatically take your revocable trust; however, they can seek payment from your assets if you require long-term care. It's vital to understand that the assets in a revocation living trust for foreigners might still be counted towards Medicaid eligibility. Planning ahead can help protect your assets. Consulting a financial advisor can provide clearer strategies.

To revoke a revocable trust, the trust document must include a clear procedure for termination. Generally, you can formally declare your intent to revoke by signing a revocation document or by writing a new trust that outlines the changes. A revocation living trust for foreigners allows you to manage your assets and adjust the trust as necessary. Always consider seeking legal guidance during this process.

Yes, a non-US citizen can be a trustee of a trust, including a revocation living trust for foreigners. This flexibility allows foreign nationals to manage their assets according to their wishes. However, it is essential to ensure that the trust complies with US laws. Consult with a legal expert to confirm specific requirements.