Gift Real Estate With Salary

Description

How to fill out Virginia Deed Of Gift?

Creating legal documents from the ground up can occasionally feel a bit daunting. Certain situations may require extensive research and substantial financial investment. If you’re in search of a simpler and more economical method for generating Gift Real Estate With Salary or any other documents without unnecessary complications, US Legal Forms is always available.

Our digital repository of over 85,000 contemporary legal documents covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can quickly obtain state- and county-specific templates meticulously assembled for you by our legal professionals.

Utilize our platform whenever you require trustworthy and dependable services through which you can effortlessly find and download the Gift Real Estate With Salary. If you’re a returning user and have previously registered with us, simply Log In to your account, find the form and download it or re-download it at any time later in the My documents section.

Don’t have an account? No problem. It only takes a few minutes to sign up and navigate the library. However, before you begin downloading Gift Real Estate With Salary, consider these suggestions.

US Legal Forms prides itself on a flawless reputation and over 25 years of experience. Join us today and make document completion a simple and efficient process!

- Examine the document preview and descriptions to ensure you have located the document you need.

- Verify if the template you choose complies with the rules and regulations of your state and county.

- Select the most appropriate subscription plan to acquire the Gift Real Estate With Salary.

- Download the form. Then complete, validate, and print it out.

Form popularity

FAQ

Yes, you can transfer $50,000 to a family member, but be aware of gift tax regulations. The IRS allows for annual exclusions per recipient, so ensure your gift falls within these guidelines to avoid complications. If you wish to gift real estate with salary, it’s wise to discuss your plans with a financial advisor to navigate the potential tax consequences effectively.

To avoid capital gains tax on gifted property, consider holding the property for a longer period before transferring it. The recipient may also benefit from a step-up in basis, which can significantly reduce their taxable gain upon sale. Additionally, utilizing strategies such as gifting real estate with salary can help minimize tax implications. Consulting with a tax advisor can provide tailored guidance for your situation.

Giving your real estate agent a gift can be a thoughtful way to show appreciation for their hard work. However, consider the policies of your local real estate board and any ethical guidelines that may apply. It's important to ensure that your gesture remains compliant with industry standards. If you choose to gift real estate with salary, keep in mind that transparency is key.

Under current tax laws, not all gifts received in India are subject to tax. However, the Income Tax Act, 1962 includes key provisions which allow you to receive various tax-exempt gifts. For instance, if you receive gifts or cash of up to Rs. 50,000 in a financial year, you do not have to pay any gift tax on it.

From an income tax perspective, receipt of a gift from a relative does not trigger taxation, i.e., it is exempt in the hands of the receiver. However, it has to be disclosed as exempt income in Schedule EI of the ITR form.

Documentation Requirements Gifts must be evidenced by a letter signed by the donor, called a gift letter. When the gift is sourced by a trust established by an acceptable donor or an estate of an acceptable donor, the gift letter must be signed by the donor and list the name of the trust or the estate account.

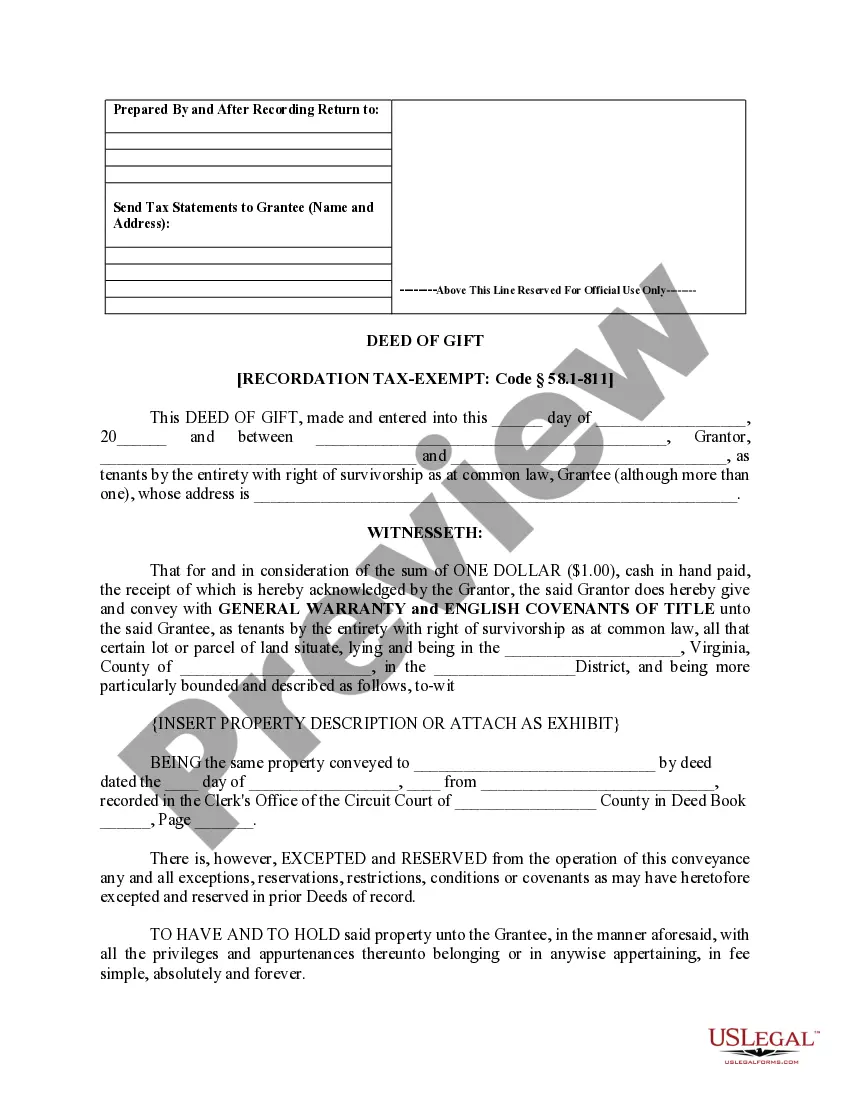

Draft of a gift deed must include the following details: Place and date on which the gift deed is to be executed. Relevant information on gift deed regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures.

Can my parents give me $100,000? Your parents can each give you up to $17,000 each in 2023 and it isn't taxed. However, any amount that exceeds that will need to be reported to the IRS by your parents and will count against their lifetime limit of $12.9 million.